Capital One Miles in 2025: A Strategic Traveler’s Guide

The travel rewards program has matured into the most practical, consistent, and powerful ecosystems in the credit card landscape. While it doesn’t offer the aspirational hotel partners of Chase or the luxury polish of Amex, it makes up for that with broad flexibility, fast earning, and low friction.

If You Only Have 60 Seconds to Read This Article (Click Here)

Capital One’s travel rewards ecosystem offers fixed-value redemptions at 1 cent per mile through its Travel Portal and Purchase Eraser, while unlocking significantly higher value - often 2 to 7 cents per mile - via 1:1 airline and hotel transfer partners. With over 15 transfer options across all major alliances (including Aeroplan, Flying Blue, British Airways, LifeMiles, and Turkish Miles & Smiles), the program supports both premium international flights and economy sweet spots. Hotel partners like Wyndham and Choice add optionality, with redemptions like Vacasa vacation rentals for ~15,000 points per night presenting high-value alternatives to cash.

Earning is fast and predictable: Venture X and Spark Miles cards yield 2× on all purchases, plus 5× on flights and 10× on hotels/rentals booked through Capital One Travel. The Venture X also includes a $300 annual travel credit and 10,000 bonus miles each card anniversary - effectively offsetting the $395 annual fee and bringing the card’s net cost close to $0. Unlike Chase or Amex, Capital One’s flat-rate multipliers work well for uncategorized or high volume spend, especially for business owners using Spark cards. All Capital One miles pool together, regardless of product, with no need for conversions or household merges.

Portal bookings allow users to book any flight with no blackout dates and still earn frequent flyer miles. Meanwhile, the Purchase Eraser gives users the ability to wipe travel expenses (including Airbnbs, boutique hotels, and train tickets) off their statement at 1¢ per mile - key for elite status seekers who prefer to book direct. The main redemption tradeoff: no access to premium hotel programs like Hyatt or Fine Hotels & Resorts, and fewer transfer bonuses compared to Amex or Chase. But the simplicity, speed, and flexibility are unmatched for hands-off travelers.

Capital One’s travel model in 2025 is built for efficient execution, not promotional theatrics. There are no rotating categories, no quarterly activations, no complex point conversions. Instead, users earn fast, redeem freely, and access high-end travel when engaging strategically with partners. With transfer redemptions enabling first-class tickets for under 90,000 miles one-way and economy redemptions as low as 7,500, the Capital One Miles program continues to deliver reliable, transferable value across both casual and experienced users.

Everything else you need to know is just below 👇🏻

In 2025, the Capital One Miles program is best thought of as a no-nonsense travel engine for both personal and business cardholders who want results over ritual. If you’re optimizing for ease of use, international optionality, or cash-equivalent flexibility, Capital One deserves a central role in your travel strategy.

This guide breaks down how to strategically earn, redeem, and maximize Capital One miles-without overcomplicating your wallet or daily routine.

The Capital One Philosophy: Efficiency First

Capital One’s ecosystem centers on simplicity and predictability. There are no rotating categories, no opt-ins, no need to combine points between products, and no artificial currency segmentation between personal and business cards. You earn Capital One miles, and they’re yours to use-at a minimum of 1 cent per mile toward travel, with far more potential if you engage transfer partners strategically.

That’s a marked contrast from the layered, gamified reward systems elsewhere. And it’s deliberate.

At a high level, CapitalOne’s program breaks down into three primary components:

- Flat-Rate Earning on Every Purchase

- 1:1 Airline and Hotel Transfer Partners

- Simple Portal and Purchase Eraser Redemptions

There are no “tiered portals,” no blackout date headaches, and no need to carry five different cards to make it work. That’s the draw.

Earning: Reliable and Rapid

The foundation of CapitalOne’s miles program is predictable earning, especially on premium products like the Venture X, Venture, and Spark Miles lines.

- Venture X: 2× on everything, 5× on flights and 10× on hotels and rental cars booked through Capital One Travel

- Venture: 2× on everything

- Spark Miles: 2× on everything for business spend

- Spark Miles Select: 1.5× on everything

Unlike programs that split purchases into categories and subcategories, Capital One treats most purchases equally. That’s especially valuable for business owners and freelancers who don’t want to spend time dissecting bonus tiers or wondering if a charge codes as “online advertising” or “professional services.”

This is also one of the few ecosystems where all cards earn miles in the same pool. There’s no need to convert cashback, merge accounts, or game bonus structures. Every mile counts equally.

Redemption Route One: Transfer Partners for Premium Value

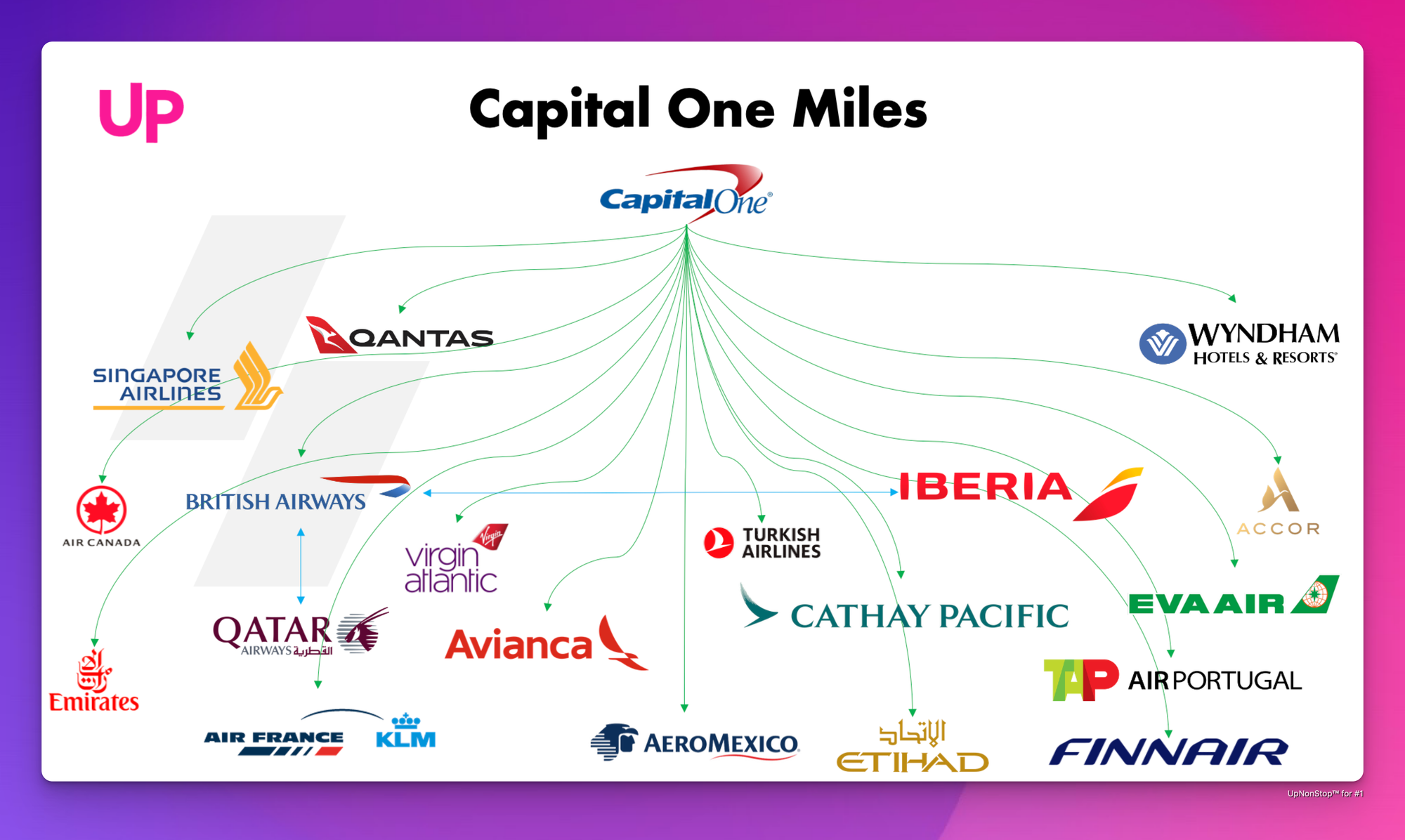

The real strength of Capital One’s program lies in its growing network of airline and hotel transfer partners, most at a 1:1 ratio. As of mid-2025, Capital One supports over 15 partners across all major alliances, including:

- Star Alliance: Air Canada Aeroplan, Avianca LifeMiles, TAP Air Portugal

- OneWorld: British Airways Avios, Cathay Pacific Asia Miles, Qatar Privilege Club

- SkyTeam: Flying Blue (Air France/KLM), Aeromexico

- Other Valuable Partners: Emirates Skywards, Turkish Airlines Miles & Smiles, Singapore KrisFlyer

On the hotel side:

- Wyndham (1:1)

- Choice Privileges (1:1)

- Accor Live Limitless (ALL) (2:1)

The value in transferring miles is not theoretical - it’s often the difference between getting 1 cent per mile through the portal and 4–10 cents per mile on aspirational international redemptions.

Example Use Cases:

- Transfer to Virgin Atlantic to book ANA First Class to Tokyo for ~55k one-way

- Use Turkish Miles & Smiles to fly United economy to Hawaii for 15k round-trip

- Fly Lufthansa First Class via Avianca LifeMiles or Aeroplan for ~87k one-way

- Redeem Avios for short-haul flights within Europe for under 10k miles

Redemption Route Two: Portal and Purchase Eraser

When partner redemptions aren’t practical - last-minute bookings, low-cost carriers, or tightly scheduled itineraries - Capital One’s Travel Portal becomes an excellent fallback. Every mile is worth 1 cent, with no blackout dates or seat restrictions.

Key advantages:

- Book any flight, hotel, or rental car at cash price

- Earn frequent flyer miles on flights (unlike with many award tickets)

- Use Venture X’s $300 annual travel credit through the portal

- Access competitive pricing via Capital One’s partnership with Hopper

An alternative to the portal is the Purchase Eraser, which allows you to wipe eligible travel purchases (flights, hotels, Airbnbs, trains) from your statement retroactively - still at 1 cent per mile. This can be particularly helpful when booking directly with a hotel or airline to secure elite benefits, upgrades, or specific rates.

Venture X as the Flagship Product

Capital One Venture X remains the anchor card in the ecosystem. At a $395 annual fee, it undercuts both the Chase Sapphire Reserve and Amex Platinum while offering real-world value:

- $300 annual travel credit through Capital One Travel

- 10,000 bonus miles annually, starting year two (worth $100)

- Priority Pass + Capital One Lounge access

- 2× miles on everything, 5× on flights, 10× on hotels/rentals through portal

This makes the effective net cost $-5 per year, assuming you use the travel credit and annual bonus. And with minimal activation effort, it's nearly frictionless to engage.

What’s notable is how little management is required. There’s no need to activate monthly perks, track rotating categories, or navigate limited transfer bonuses. You earn, you book, and you move.

Business Cards: Streamlined Earning for High-Volume Spend

For business owners, Capital One’s Spark Miles suite offers straightforward earning and a shared redemption pool with personal cards.

- Spark Miles for Business: 2× on everything

- Spark Miles Select: 1.5×, no annual fee

With no bonus categories to manage, these cards shine for ad spend, contractor payments, software subscriptions, and other uncategorized business purchases.

Crucially, Spark Miles earned can be combined with Venture/Venture X miles for consolidated redemptions. That means a business earning setup can feed your personal travel lifestyle seamlessly.

Hotel Strategy: Flexible but Imperfect

Unlike Chase (which partners with Hyatt) or Amex (which offers exclusive Fine Hotels & Resorts), Capital One’s hotel strategy revolves around either portal bookings or transfers to Choice, Wyndham, and Accor.

These hotel programs don’t always inspire premium-redemption excitement - but they do offer surprising opportunities:

- Use Wyndham to book Vacasa vacation rentals at ~15k points per night

- Transfer to Choice for Scandinavian or Japanese hotels in high season

- Convert to Accor (2:1) for high-end redemptions in France and Asia

Additionally, Venture X’s portal booking benefits - especially the $300 travel credit - can make up for the loyalty trade-off when chain elite status doesn’t apply.

What Capital One Doesn’t Do

Capital One’s program is deliberately lean. That works well for efficiency-minded travelers, but there are trade-offs:

- No transfer to Hyatt or Hilton (high-value redemptions lost to Chase/Amex)

- No luxury hotel ecosystem akin to Amex’s Fine Hotels & Resorts

- No points pooling across households (each account is standalone)

- Fewer ongoing transfer bonuses than competitors like Amex

Still, these gaps are less significant for travelers who prioritize flights, flexibility, and frictionless redemption over luxury concierge programs or high-end hotel affiliations.

The Capital One Advantage in 2025

When comparing against Chase Ultimate Rewards or Amex Membership Rewards, the Capital One value proposition rests on three core strengths:

- Faster baseline earning through flat-rate multipliers

- Lower annual fees for premium cards

- Simpler engagement model with no opt-ins, portals-within-portals, or category gymnastics

It’s not designed to be aspirational in the traditional sense. It’s designed to work - and for a growing number of travelers and small business owners, that’s the real aspiration.

Final Thoughts: Simple on the Surface, Strategic in Practice

Capital One doesn’t try to dazzle with flash or overwhelm with complexity. That’s its edge. It plays the long game, offering strong travel tools that deliver high value with low maintenance. For anyone who doesn’t want to juggle half a dozen cards, track 19 different credits, or read loyalty program footnotes for fun, it’s a welcome alternative.

But simple doesn’t mean basic. Underneath its streamlined design is a world of strategic potential for those willing to explore its transfer partners, take advantage of premium redemptions, and intelligently pair personal and business spend.

Capital One miles may not always win the award chart game - but they quietly win the flexibility game. And in 2025, that’s the currency most travelers need.

July 2025 CapitalOne Redemption Series: