What Would You Do With $5,000 in Free Travel? Here’s How to Make 250,000 Capital One Miles Work Like Cash (But Better)

250,000 Capital One miles can unlock $5,000+ in travel value—think first class flights to Japan, family trips to Europe, or luxury hotels in Asia. With smart transfers and timing, you can stretch this stash across multiple premium experiences or one unforgettable round-the-world adventure.

If You Only Have 60 Seconds to Read This Article (Click Here)

With 250,000 Capital One miles, you’re holding a travel asset worth anywhere from $2,500 to over $5,000 depending on how you redeem. Used through the Capital One portal, you’ll get 1¢ per mile ($2,500 in value). But transferring to partners can stretch that to 2¢ per mile or more. For instance, 170k miles can cover two ANA business class seats to Japan via Virgin Atlantic (a $10,000+ flight in cash). The remaining 80k can go toward hotels or a return trip. In the right hands, this isn’t just a free trip—it’s multiple aspirational experiences.

Family travelers can turn 250k miles into 4 round-trip flights to Europe in economy (~60k each via Flying Blue or Aeroplan) or take a family of 5 to Hawaii using Turkish Miles&Smiles at 15k round-trip per person on United—just 75k total. Combine that with a few free hotel nights via Choice (20k/night) or Wyndham (15k/30k/night), and you could easily cover two full family vacations. The key is flexible planning and booking early, especially when securing 4–5 award seats.

Looking to go big? 250k unlocks a round-the-world business class trip for two by piecing together smart sweet spots. Think 95k for two one-way ANA biz class seats to Japan, 150k for two Qatar Qsuite tickets to Europe, and 50k for two economy tickets home—just under 300k, or tweak a leg to stay under budget. Or go all-in on luxury: two first class tickets on Emirates (85k each JFK–MXP), and use remaining points for high-end hotel nights in Tokyo or Milan. The ultra-premium is now within reach.

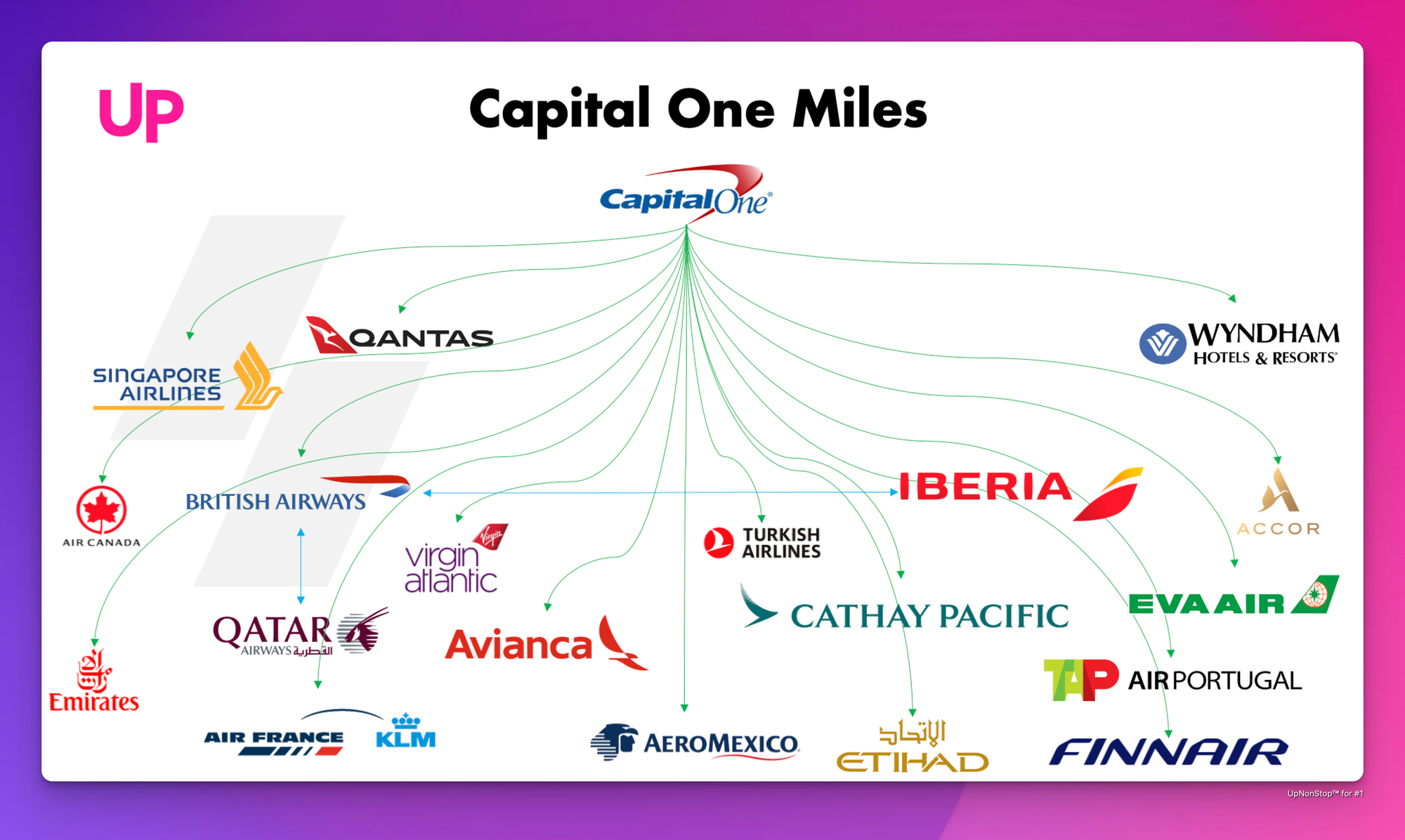

The smartest play? Mix and match. Use 50k for a domestic trip, 120k for a beach getaway (flights + hotel), and 80k for one leg of a future business class trip. Capital One allows transfers to over 15 partners—giving you flexibility, and even more value when timed with transfer bonuses. But don’t hoard: devaluations are real. Plan to redeem strategically over the next 1–2 years, and make sure every mile brings real-world joy.

Everything else you need to know is just below 👇🏻

A Quarter-Million Miles – What Would You Do?

Take a moment to appreciate the magnitude: 250,000 Capital One miles. A quarter-million miles is a milestone that puts you in an elite league of point savers and savvy spenders. It represents at least $2,500 of travel at minimum, but in the right hands, it could unlock $5,000+ worth of first-class flights, luxury hotel stays, or multiple vacations. If 100k was exciting, 250k is downright game-changing.

Maybe you’ve reached this level by pooling miles across multiple Capital One cards (Venture X, Venture, Spark Miles – since you can combine miles from all your accounts). Or perhaps you and a partner merged your miles into one account for a big travel goal. You might even be a small business owner who’s accumulated tons of miles through spending on your business. However you got here, you now have an incredible reservoir of travel currency.

The challenge (and joy) now is figuring out how to best spend 250k miles. With this amount, almost anything in the realm of travel is on the table:

- First class flights for two, round-trip, to almost anywhere.

- A complete round-the-world trip in business class with multiple stops.

- Several premium cabin trips or a dozen economy trips – basically, you could travel frequently for a couple of years without paying for flights.

- Combinations of flights, hotels, and other redemptions to cover entire vacations end-to-end.

- Or one over-the-top experience like a private villa via the travel portal (if that’s your thing).

This piece will break down how you can utilize 250k miles effectively. We’ll examine strategies like:

- Planning family vacations (with 250k, a family of four’s flights to many places can be fully covered).

- Doing something extravagant like a round-the-world in business or first for a couple.

- Using miles for both flights and hotels, creating nearly free vacations.

- Pitfalls unique to managing such a large balance (e.g., devaluation concerns, etc.).

- Ensuring you extract maximum value – but also enjoyment – from your quarter-million miles.

The tone remains personal: imagine yourself in these scenarios, because with 250k, you can turn travel dreams into reality with minimal compromise. Let’s dive into the possibilities, from practical to lavish.

250k Miles Basics: Value and Flexibility

First, a quick value check: 250,000 miles used at a flat rate of 1¢ each = $2,500 in travel. That alone could pay for:

- A pretty fancy cruise or all-inclusive resort booking via Capital One Travel.

- A couple of international economy trips for a small group.

- A business class ticket or two purchased directly (like using “Pay With Miles” style on the portal).

But of course, we aim higher. At 1.5¢ per mile, 250k is $3,750 value; at 2¢, it’s $5,000. And with certain first-class redemptions, you could even push beyond that (though you might not need to convert all 250k into one hyper-value redemption – spreading out might give more enjoyment).

Flexibility: With this many miles, you can think of multiple uses in parallel. You could allocate 100k to one trip, 100k to another, and still have 50k in reserve. Or go all-in on one massive trip. It’s like having a loaded travel wallet – and fortunately, Capital One’s ecosystem is flexible enough that you don’t have to make that decision until you see what you want to book. You can transfer miles to partners as needed in chunks, or use some via the portal and some via transfers, etc.

One great aspect of having such a large balance is you can capitalize on premium cabin sweet spots for multiple people. For example, at 250k, you could book two passengers in business or first whereas at 100k you might only do one. So think in terms of pairs or groups now:

- Want to fly two people in First Class on ANA to Japan? ~170k miles total via Virgin Atlantic – easily within your budget, with plenty left over.

- How about taking your family of four in business class to Europe? Roughly 4 × 120k = 480k needed for round-trip, which is beyond 250k. But one-way in biz for four (4 × ~60k = 240k) you can do, and maybe fly economy back or use more points later. Or perhaps two family members in biz and two in economy and then swap next time (some families do this to split comfort).

- Or simply four economy round-trips to Europe (4 × ~60k = 240k) – voila, the whole family’s flights to Europe for a big vacation, covered.

Given these opportunities, let’s outline some prime ways to use 250k miles.

Best Ways to Redeem 250,000 Capital One Miles

1. Business Class Around-the-World Trip for Two

If you’ve ever fantasized about doing a grand tour across multiple continents in style, 250k miles can make it happen in business class (and possibly even first for some segments). Here’s how you could approach a round-the-world (RTW) itinerary:

- Star Alliance with Aeroplan: Aeroplan’s distance-based chart for RTW-ish bookings (one stopover allowed per one-way) can be leveraged. One idea:

- Fly from North America to Asia in business (let’s say New York -> Singapore via Air Canada or United to Tokyo, stopover in Tokyo, then Tokyo -> Singapore on ANA, all on one award). Aeroplan might price that at ~85k (roughly, for distance covering NA to Asia with a stop).

- Then Asia to Europe in business (maybe Singapore -> Frankfurt on Singapore Airlines, stopover, then Frankfurt -> Paris as continuation, or skip stopover here if you used one already; roughly another 85k).

- Then Europe back to North America in business (maybe 60k if short distance from Western Europe to East Coast).

- Total could be around 230k points + a few minor add-ons for stopovers. With 250k you cover it. This is schematic; actual pricing would depend on distance and routing, but many people have done 3-continent trips using Aeroplan in the ~200-250k range in business class.

- OneWorld with Asia Miles: Cathay Pacific’s Asia Miles multi-carrier award chart is ideal for RTW. For example, 220k Asia Miles per person can get a RTW in business up to 35,000 miles distance (which is plenty to circle the globe). For two people, that’d be 440k – too high. But what if you do a slightly shorter RTW or only one person uses Asia Miles and the other uses a different currency? That gets messy. Instead, consider splitting into two awards:

- OneWorld ticket 1: North America -> Europe -> Asia (with stopovers) using maybe 150k Asia Miles per person in business.

- OneWorld ticket 2: Asia -> North America (transpacific) at maybe 85k per person in business via another program (like AA miles or Alaska or something if you have those).

- If focusing purely on Capital One miles, better stick to one program like Aeroplan or maybe multiple partner transfers.

- Mix and match: Since Capital One points can go to any partner, you don’t have to book all segments with one program. You could do:

- 100k miles to Virgin Atlantic for two ANA business class tickets from US to Japan (47.5k each one-way * 2 = 95k, sweet spot).

- Then 100k miles to Qatar Avios (or British Avios) to fly Qsuites business for two from Tokyo to Doha to, say, Paris (Avios pricing might be around 75k each one-way Tokyo-Doha-Paris, which for two is 150k, so might need a bit more than 100k, maybe catch a transfer bonus to Avios to help).

- Then from Europe back to US, use 50k via Aeroplan or LifeMiles for two economy tickets (because maybe you splurged on the first two legs and are okay ending in economy).

- This cobbles a RTW: US -> Asia (biz), Asia -> MidEast/Europe (biz), Europe -> US (econ) for roughly 95k + 150k + 50k = ~295k (a tad over 250k, but if you adjust one leg to economy or find a cheaper routing, it fits).

That was a lot, but the takeaway: 250k allows two people to circumnavigate the globe in a good level of comfort by carefully utilizing partner awards. Even if not fully RTW, you could do a multi-stop trip:

E.g., “Circle the Pacific”: US -> Tokyo (stop) -> Southeast Asia (stop) -> Australia (stop) -> back to US. With 250k for two in business, you might do some legs business, some economy to stretch it. Perhaps:

- US to Japan in biz (via Virgin/ANA, 95k for two).

- Japan to Singapore in biz (maybe 2× KrisFlyer 30k = 60k).

- Singapore to Sydney in economy (5-7 hour overnight, maybe fine in economy, 2×25k = 50k).

- Sydney to US in biz (Qantas via Alaska or AA miles ~2×, but those aren’t CapOne partners. Alternatively, Air Canada Aeroplan for partner like Air New Zealand or United from SYD to US ~ 2×85k = 170k, too high).

Alternatively, do North America -> Europe -> Asia -> North America (three legs).

The key is, at 250k you and your travel companion can see multiple countries on one big journey, mostly in premium cabins, by tactically deploying miles where each partner program is strongest.

One more angle: Star Alliance RTW tickets used to be bookable via ANA or Aeroplan as a separate thing, but nowadays simpler to piece it manually as above. If this is intimidating, a simpler approach with 250k for two:

- Do one big trip to an area (like Asia) using maybe 160k of the miles in biz (80k each for RT).

- Then do another big trip to Europe using 90k in biz (45k each one-way maybe, then pay cash one-way or use remaining points).

- That’s two major trips for two people in biz on 250k total. Not global in one go, but covers globe over two trips.

2. Multiple Family Vacations – Fly the Whole Crew

250k miles is a dream for planning family travel, especially if you have 3-5 family members to account for. Here’s how you could allocate:

- Trip to Europe for a family of four: Economy tickets to Europe can be 60k each round-trip (some less, some more). Four of those = 240k. So your 250k can nearly cover four round-trip economy flights to Europe. For example, transfer to Aeroplan or Flying Blue and book four seats from, say, Chicago to Rome. This takes a lot of hunting for 4 award seats on the same flight, but not impossible if you book early or travel off-peak. You’d pay minimal taxes (maybe ~$100 each). Suddenly, a Europe vacation’s biggest cost (flights) is mostly handled. Your remaining 10k miles you could use toward a hotel night or two (transfer to Wyndham for one free night at 15k, you have 10k so not quite, but after some spending you’d get there).

- You could also split classes: maybe 2 of you fly business (2×120k = 240k) and 2 fly on cheaper economy tickets out of pocket. Then next time swap who gets to fly biz. Families sometimes do that if they can’t get enough miles for everyone in biz. But using all points to put everyone in economy ensures all get to go for free.

- Hawaii for a family of five: Using Turkish Miles&Smiles (1:1 transfer) at 7.5k one-way per person economy on United, it’s 15k round-trip each. For five people, round-trip = 75k. For all five to Hawaii, that’s just 75k! 250k could do that three times over. So you could take three separate Hawaii vacations for your family of five (assuming vacation time and hotel costs allow!). Or more likely, use one Hawaii trip (75k), one Europe trip (let’s say 4 people, 240k as above), and you still have miles left? That example would be 75k + 240k = 315k, so a bit over; maybe adjust:

- Family of five to Hawaii (75k)

- Family of five to Caribbean or Mexico (maybe use British Airways Avios on American flights, which could be ~10-15k each RT depending on route from US – say 15k average, for five that’s 75k again)

- Family of five on one domestic US trip to Disney or national parks (maybe 25k each RT if coast-to-coast, 5×25 = 125k, too high combined with above).

- Actually, two major trips of 75k each = 150k, plus you have 100k remaining for other flights. Possibly four domestic round-trips (25k each) for one person, or however.

- If your family is smaller (say 3 people), 250k goes even further. You could do:

- Three business class to Europe (3×120k = 360k, a bit high, maybe 3×90k for one-way biz, then economy home or vice versa).

- Three economy to Asia (3×80k RT = 240k).

- Or multiple closer trips. For example, 250k might fund a multi-destination summer: 3 people to Europe (180k total), plus 3 people to Caribbean over winter break (maybe 60k total), total 240k.

- Don’t forget hotels: if flights are mostly covered, you can use part of 250k for lodging. E.g., transfer 50k to Choice Hotels – could get 3-5 nights in two rooms (because with family you might need 2 hotel rooms). Or transfer to Wyndham: 45k for 3 nights in one room (you might need two rooms, so 90k for 3 nights if splitting family into two rooms).

With 250k, you could allocate say 150k for flights and 100k for hotels. That could yield $1,500 in free flights and $1,000 in free hotel stays, for instance. - All-inclusive resort: Wyndham has some all-inclusives at 30k points per room per night (for up to 2 guests, kids maybe free depending on age, or might need additional). If you had 120k in Wyndham (transfer from CapOne), you could get 4 nights at an all-inclusive in Cancun for 2 people per room. Two rooms (for larger family) for 4 nights = 240k. That’s the whole balance, but then flights maybe cheap or separate. Or maybe use some miles for flights to Cancun and pay the resort cash. 250k gives ability to pick what to comp – flights or hotel.

The bottom line: 250k can significantly reduce the cost of family travels:

- Pitfall to watch: availability for multiple award seats. Plan early and be flexible with dates/routes. You might even need to split your family onto two different flights same day if seats on one flight are limited (especially in peak times).

- Also, consider using your miles for the typically expensive parts of family travel. For instance, school summer break flights to Europe are pricey in cash – great time to use miles (even though award availability can be tough, but if you book 11 months out you have a chance). Off-peak might be cheaper cash, so you can save miles if a fare sale happens.

3. Luxury for Two: First Class Extravaganza + 5-Star Hotels

Let’s say it’s just you and a partner, and you want to blow the roof off with 250k, going all-in on luxury. Here’s a potential dream trip scenario:

- Flights: Book two first-class tickets to a destination that truly showcases first class. For example, redeem:

- 170k miles total (85k each) for two first class seats on Emirates A380 from New York to Milan (via Emirates Skywards, 85k each one-way). You’ll enjoy the shower spa, onboard lounge, etc., together. Or do 170k for Tokyo via ANA first (85k each through Virgin Atlantic). Either way ~170k used.

- Then maybe fly business or economy back to conserve (or if you have more miles from somewhere else, do first back too).

- Alternatively, use 200k for a pair of round-trip business class tickets to somewhere far like South Africa or Australia (for ultimate value, but first class is limited on those routes nowadays).

- Hotels: Now allocate maybe 50k-70k of remaining miles to hotels:

- Transfer 60k to Choice Privileges. If you’re going to, say, Japan or Southeast Asia, 60k Choice could get you ~4 nights at an upscale hotel (some Choice partner hotels in Asia are 16k-20k a night, like high-end ones in Tokyo might be 20k/night – 3 nights = 60k). In Europe, 60k might get 2-3 nights in city centers depending on rates.

- Or transfer 45k to Wyndham for 3 nights at a Wyndham Grand or all-inclusive (if your destination has a good Wyndham).

- Or even 50k to Accor (since they are 2:1, 50k yields 25k Accor points, which is €500 value towards Accor hotels – maybe 2 nights at a Fairmont or Sofitel).

- Experience splurges: Capital One has the portal for things like rental cars or activities, but you don’t get great value (1¢ each). Instead, maybe use miles to erase some pricey dinners or tours if coded as travel (though tours likely not). Rental car can be via portal at 1¢, which might be fine if you have some orphan miles left.

- If you don’t want hotels with points, you could put all 250k into flying first class multiple segments:

- Example: 120k for two in Lufthansa first from USA to Europe (like ~60k each via LifeMiles or Aeroplan if available close-in).

- Another 120k for two in ANA first from Europe to Japan (since ANA flies London to Tokyo via Virgin Atlantic, 120k each RT or ~60k one-way, so two one-ways = 120k).

- That’s exactly 240k, and you just hopped from US to Europe in first, then Europe to Japan in first, effectively around the world in first class segments (you’d then need to get home from Japan, maybe pay economy or use any remaining 10k toward that).

- Consider non-flight luxury too: for instance, transfer some miles to Emirates and redeem for a fancy Emirates luxury hotel or experience via Skywards (they have something called Skywards Exclusives). But those are niche; better to stick to flights/hotels.

This approach is all about maximizing personal enjoyment per mile rather than distance. You might only go to one or two destinations, but you’ll do it in extreme comfort. For a special occasion (honeymoon, anniversary, etc.), that quarter-million miles can gift you and your partner a platinum-level experience.

4. Mix & Match: The Balanced Travel Portfolio

You don’t have to choose one style of redemption; with 250k, you can diversify:

Imagine you plan out the next 2 years of trips, for example:

- Trip 1: A domestic U.S. trip (or two). Use 50k miles to cover a couple of domestic round-trips for two people. Example: 2 tickets from New York to San Francisco (25k each round-trip on United via Turkish = 50k total for two). This covers a California vacation flights.

- Trip 2: A week in the Caribbean. Use 70k miles to cover flights for two (maybe 35k each round-trip via Avianca LifeMiles on United or AA via British Airways Avios depending on distance). Then use 50k miles for 3 hotel nights (Choice or Wyndham as above). Total ~120k on this trip. Add some cash or credit card free night certificates for extra hotel nights. You’ve got a mostly free beach getaway.

- Trip 3: A European jaunt. Spend 100k miles for one person’s business class round-trip to Europe (say 100k on Flying Blue for one RT in biz if promo, or maybe 120k Aeroplan), and pay cash for companion or use any remaining miles to partially cover companion in economy, etc. Alternatively, 100k could put both of you in economy to Europe and maybe one leg in premium economy.

- Trip 4: Keep 30k in reserve for spontaneity or topping off an emergency trip home etc.

This is just an illustrative breakdown: 50k + 120k + 100k = 270k (slightly over), so maybe trim a bit. Or if not doing business class at all, 250k could cover multiple economy-class vacations in full:

Say you want to take five trips in 2 years (some solo work trips, some couple trips). Allocate an average of 50k per trip:

- Solo work conference – use 30k for flights, 20k for 2 hotel nights.

- Couple weekend city break – use 40k for flights (2 domestic), 10k for one free hotel night.

- Family Thanksgiving travel – 50k covers 4 tickets domestic to get everyone home.

- Beach vacation – 70k covers flights for two and a couple hotel nights.

- Bucket list concert in London – 60k covers one person’s flight in biz, partner pays own way.

The specifics don’t matter as much as the idea: treat miles like a bank account you can draw from to subsidize every trip. This is often what long-time points collectors do. 250k allows you to commit to “I will not pay for a flight under X price, I’ll use miles instead” for a good while.

Additionally, don’t forget about transfer bonuses and promotions. With so many miles, moving them during a bonus yields a lot extra. For example, if Capital One offers a 25% bonus to Flying Blue and you shift 100k then, you get 125k FB – which might save you 25k that you can use elsewhere. Over multiple transfers, these bonuses can effectively increase your total point “budget”.

5. Pitfalls and Planning for 250k (Avoiding Devaluation & Over-Reliance)

While not a specific redemption, it’s worth discussing strategy for managing a quarter-million miles:

- Diversify usage: It can be risky holding all 250k for one far-future goal (point devaluations, partner changes can occur). It’s often wiser to use them steadily across a few years. Capital One’s mileage program is fairly stable, but partner programs can devalue overnight (increasing award costs). If, say, you were saving exactly 230k for a RTW in 2025 and Aeroplan raises prices so it costs 280k, you’re stuck. Better to either book earlier or have a cushion. Or diversify by splitting between a couple of different airline programs earlier (book some awards in advance and have those miles locked in value).

- Watch out for taxes and fees: When redeeming a lot of miles, people sometimes overlook that first class flights often carry big surcharges, or that booking four tickets yields four sets of airport taxes. Example: redeem 240k Avios for four people to London in economy – you still must pay maybe $250 each in UK Air Passenger Duty + carrier fees, so $1,000 out of pocket. Factor that into the plan. Sometimes using a different routing (like via Dublin to avoid high UK fees) or different program (one that doesn’t pass fuel surcharges) is better, even if miles cost is higher.

- Companion tickets & upgrades: At this level, consider if cash+companion certificate might beat using miles. E.g., British Airways Travel Together Ticket (earned from BA card) allows you to redeem Avios 2-for-1 in their premium cabins (but you pay fees). Or Alaska’s companion fare can get two tickets for cash of one plus $99 – might be cheaper than using miles for both. Leverage these to save miles for when they’re more valuable.

- Don’t forget to ENJOY: Analysis paralysis can happen – so many miles, so many options. Some people hoard waiting for the absolute perfect use. While being strategic is good, don’t let great opportunities for wonderful trips slip by because you’re saving miles for an ideal scenario that never comes. 250k used for “very good” trips now is better than 250k devalued to 200k worth because you waited five years for “ultimate” trip and then points lost value. Aim to redeem within a timeframe where you’ll actually enjoy the benefits (travel while you’re healthy, while destinations are open, etc.).

- Combining with other programs: If you have other point stashes (Amex, Chase, etc.), coordinate them. For instance, you could use Capital One miles for flights and Chase points for Hyatt hotels. Or vice versa. Don’t use CapOne miles at 1¢ for a hotel if you have hotel points that could cover it at a higher value, etc. Think of 250k CapOne as one tool in your big toolbox.

- Fees for booking through some partners: A minor pitfall – some transfer partners may charge booking fees (e.g., last-minute close-in booking fees by some programs, or phone booking fees). These are usually small but be aware. Capital One itself doesn’t charge to transfer, but once in the airline program, normal rules apply.

Final Thoughts on Spending 250,000 Miles

Having 250,000 Capital One miles puts you in an enviable position: you have the means to dramatically reduce the cost of travel for yourself and others, and to elevate your travel experiences to levels that might otherwise be out of reach. It’s like an all-access pass to premium cabins, exotic destinations, and frequent getaways – if you use it wisely.

We’ve explored various angles:

- Epic round-the-world adventures in business class for two – maximizing the experience and scope of travel.

- Family travel made affordable, turning big trips with kids into manageable expenses (or nearly free).

- Ultra-luxury splurges, sampling first class flights and high-end hotels with your significant other, crafting memories you’ll talk about for a lifetime.

- A balanced approach, sprinkling the miles across several trips to make multiple dreams come true over time.

There’s no single “best” use for everyone; the beauty of 250k miles is that you can tailor it to your travel style and goals. The common thread, however, is value: each mile should bring you joy or savings that you appreciate. That might be monetary value (saving hundreds on airfare) or experiential value (sipping Champagne at 35,000 feet in a private suite). Ideally, it’s both.

As you deploy these miles, keep an eye on the future. Earning and burning is a cycle – after using a chunk, you can always build up again with new bonuses or spending. Capital One continues to add partners and offers (and occasionally promos), so the landscape might evolve. Stay informed on new sweet spots or rate changes (for example, the addition of new partners like Turkish or Emirates in recent years opened more doors – which we took advantage of in scenarios above).

With 250,000 miles, you’ve essentially pre-paid for a lot of travel freedom. So make sure to actually use that freedom. Fill up your calendar with those trips. Take your parents somewhere as a thank-you (250k could fly your folks in business class to visit you or go on a trip with you). See that remote part of the world you’ve always wanted, without worrying about the $5,000 business class ticket price tag – it’s covered.

And as always, take photos, soak in the moments, and share the stories. Because at the end of the day, the goal of all these miles and points is not to accumulate them for bragging rights, but to convert them into experiences and memories. You have a quarter-million reasons (and ways) to do just that. Happy travels, and enjoy every mile of the journey!