The President's Club Paradox: How a Free Trip Cost Millions Until It Didn’t

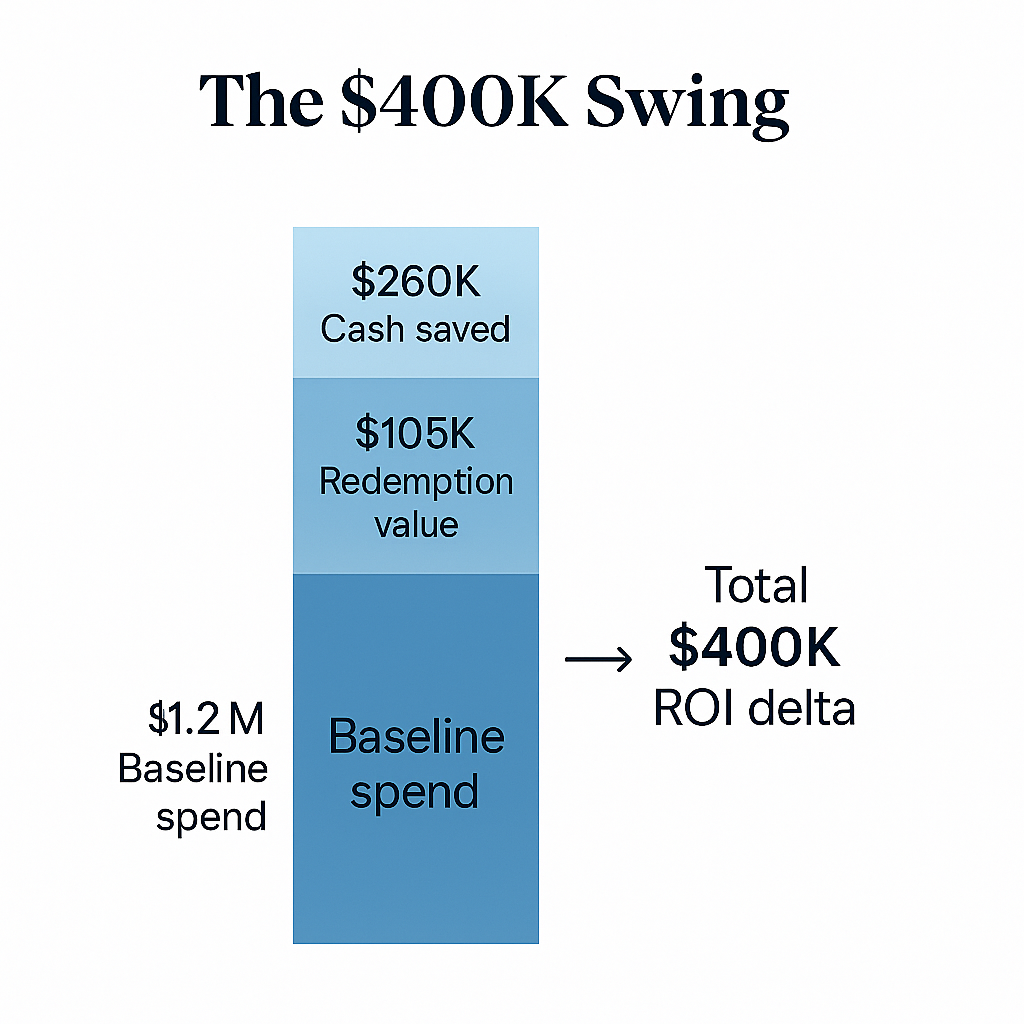

There’s a $400,000 secret hiding in your incentive trip. Most companies bleed cash funding someone else’s loyalty program without realizing it. This firm didn’t cut costs or perks. They just took control of their points. The result? A P-Club that pays for itself.

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

Most companies treat their Presidents Club trips as an expense - a costly “thank you” that burns cash and builds zero future value. $1.2 million goes out, a travel agency earns the points, and everyone applauds the illusion of generosity. But under the surface, that loyalty debt compounds. Every unoptimized dollar becomes someone else’s asset.

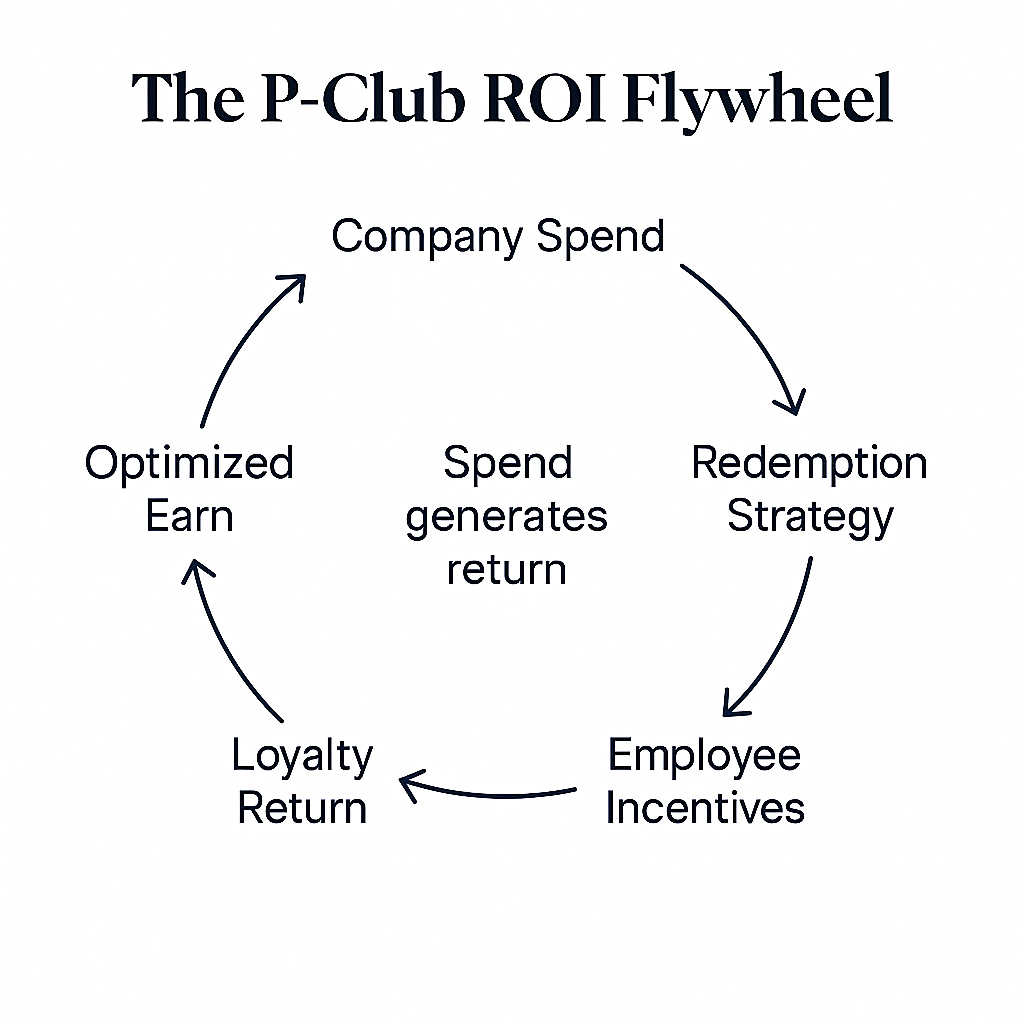

UpNonStop flipped the model. By reengineering how P-Club spend flows - optimizing card categories, transferring ownership of points back to the company, and converting loyalty liability into loyalty capital - the same trip generated over $400K in measurable ROI. What used to be a loss leader turned into a high-yield flywheel that funds its own rewards.

The secret wasn’t spending less - it was spending smarter. Corporate cards earned 3.5M+ transferable points, redeployed for business-class flights and five-star stays, all while cutting $260K in hard costs. The real kicker: redemption yield rose from 1.9% to 9.6%. That’s not “earning points”; that’s manufacturing margin.

Beyond the math came something bigger - transparency and shared ownership. Employees saw how their wins fed the system. Finance saw travel transform from a liability into an asset. And for the first time, recognition wasn’t just about reward - it was about return.

Everything else you need to know is just below 👇🏻

🎞️: Powered by NotebookLM @ UpNonStop

Every company dreams of having a President’s Club. The annual escape for top performers. Five nights under the sun. Champagne on arrival. Business class if you’re lucky. A CEO toast that sounds heartfelt after the third round of mai tais.

But buried under all the glitter of P-Club lies a quiet truth: these trips are often the most expensive reward programs in corporate history - not because of the destination, but because of how they’re paid for.

This is the story of one mid-sized U.S. sales firm that turned its annual liability into an asset. The shift didn’t come from cutting perks or flying economy. It came from doing the math - and finding $400,000 hiding in plain sight.

The Setup: The Cost of Celebration

The company ran a top-performer incentive trip every year. In 2023, the destination was Maui.

Total attendees: 24 (including partners).

All-in cost: $1.2 million.

Flights, hotels, ground transport, excursions, private dinners - everything arranged through a long-time travel agency. The leadership loved the convenience. “They handle everything, we just wire the money.”

That convenience was the problem.

The Hidden Leak: Loyalty by Proxy

During a post-trip audit, the finance team spotted something off in the invoices:

- Airline tickets billed at round numbers - $2,000 per ticket.

- Vendor payment to a third-party agency.

- No receipts showing direct airline or hotel charges.

When they called to verify, the agency admitted it: all travel had been booked using their own cards.

Meaning every dollar of the company’s $1.2M P-Club spend had been earning points for someone else.

The Ghost Return

If the firm had paid directly using its own optimized business cards, the return on spend (RoS) could’ve looked like this:

| Category | Spend | Card | Multiplier | Points Earned | Approx. Value |

|---|---|---|---|---|---|

| Airfare | $480,000 | Amex Business Platinum | 5x | 2,400,000 | $48,000 |

| Hotels | $320,000 | Chase Ink Business Preferred | 3x | 960,000 | $19,200 |

| Dining & Events | $180,000 | Amex Gold Business | 4x | 720,000 | $14,400 |

| Misc. (Ground, Transfers, Gifts) | $220,000 | Chase Ink Cash | 1.5x | 330,000 | $6,600 |

| Total | $1,200,000 | 4,410,000 points | ≈ $88,200 value |

Nearly $90,000 in potential rewards value had vanished into someone else’s account - every year.

That’s when they called us @ UpNonStop.

The Audit: What We Found

After analyzing three years of travel expenses, UpNonStop surfaced three root inefficiencies:

- Third-Party Leakage - Loyalty value flowing to outside vendors.

- Category Mismatch - Non-optimized card usage by expense type.

- Redemption Waste - No structured burn plan to extract high value per point.

The firm’s overall card spend was $4.8M annually, yet its blended RoS was only 1.9% - barely beating generic cashback.

UpNonStop projected a sustainable 9.6% RoS, effectively quadrupling their yield.

The Strategy: Turning Recognition into ROI

1. Rewiring the Payment Flow

All P-Club payments were restructured:

- Airfare booked directly through Amex Travel for 5x multipliers.

- Hotels booked through Hyatt and other transfer partners.

- Dining and activities shifted to Amex Gold Business for 4x.

- Miscellaneous expenses routed through Chase Ink Cash for 1.5x.

That alone generated 4.2 million points in the next cycle.

2. Redeeming Like a Hedge Fund

Rather than using agency fares, UpNonStop optimized redemption through its First Officer platform:

- Flights: 1.9M Amex points → transferred to ANA + Singapore KrisFlyer for business class from the mainland to Hawaii via Tokyo. Each redemption ≈ 120K round-trip pp (value ≈ $6,500).

- Hotels: 1.4M Chase points → transferred to Hyatt for five nights in ocean-view suites.

- Experiences: 320K Amex points → used for excursions via Fine Hotels + Resorts.

The average redemption value hit 2.5¢ per point, almost 5x typical cashout.

Total realized redemption value: $105,000.

3. Building the “P-Club Pool”

UpNonStop introduced a cultural layer: the P-Club Pool.

Each department’s operational spend contributed to a shared points pool visible to managers.

This turned passive expenses into an internal game - teams began timing purchases, choosing high-yield categories, and tracking progress toward collective rewards.

The results compounded within months.

The Results: The $400,000 Swing

By the following fiscal year:

- Direct P-Club costs dropped from $1.2M to $940K (net of redemptions).

- Company-wide RoS rose from 1.9% → 9.6%.

- Employee retention in sales climbed 11%.

- Internal satisfaction for P-Club jumped from 38 → 76 NPS.

- Cumulative value retained: ≈ $400,000.

Finance Director:

“We didn’t cancel P-Club. We reinvented it. What used to be a cost center now pays for itself.”

CEO:

“When people realized our own spend was funding the reward, engagement skyrocketed. It’s loyalty powered by ownership, not obligation.”

The Behavioral Flip: From Incentive to Ownership

Traditional P-Clubs run on a lag: spend now, celebrate later.

The new model runs on a loop: spend, earn, redeem, repeat.

That subtle shift (from expense to asset) transformed behavior across the company. Departments started competing on efficiency, not just performance.

The reward wasn’t top-down anymore. It was built from within.

Macro Lesson: Corporate Travel as a Financial Instrument

Across the U.S., SMBs spend over $325B annually on travel, but less than 8% of that spend is optimized for loyalty yield. That’s more than $29B in unrealized value sitting on balance sheets every year.

Most companies run their own ghost economy - subsidizing someone else’s loyalty revenue.

The P-Club case is what happens when you flip that equation.

Before & After Snapshot

| Metric | Before UpNonStop | After UpNonStop |

|---|---|---|

| Annual P-Club Spend | $1.2M | $940K (net) |

| Earned Points | 0 | 4.2M |

| Redemption Value | N/A | $105,000 |

| Company-Wide RoS | 1.9% | 9.6% |

| Sales Retention | 79% | 90% |

| Cultural ROI | “Expense” | “Asset” |

The Playbook

To replicate the transformation, UpNonStop codified three universal principles:

1. Centralize

Unify all travel and event payments under controlled card programs. Fragmented spend is invisible value.

2. Categorize

Match vendors and expenses to their highest-yield categories. Even 1x → 3x shifts compound dramatically.

3. Redeem Strategically

Transfer, don’t cash out. Partner redemptions yield 3–5x more value.

Beyond the Trip: The Value Loop

After the overhaul, the company expanded its points optimization framework to other spend categories - client entertainment, SaaS renewals, recruiting travel.

Within six months, its annual points pool surpassed 7.8 million, enough to fund two P-Club-level events entirely on points.

“Every dollar now generates two outcomes - operational output and travel equity.” - Finance Director

Final Approach

P-Club started as a celebration. It ended as a revelation.

The smartest companies have realized something loyalty programs don’t want them to: Every unoptimized dollar becomes someone else’s reward.

When you flip the system, you don’t just earn more points. You earn control. Every business already runs a loyalty program. They just don’t realize who it’s rewarding.

Ready to Maximize Your Business Spending?

Get Started with a Free Earn-Optimization Assessment

Find out how much you could be earning and saving with UpNonStop.

Take the first step today, and let’s turn your business spending into premium travel with better value, and more time for what matters most.

Schedule Your Free Assessment Now 👇🏻