The Accountant, the Avios, and the Lapland Winter | Or: How we saved him $21,285 in Cash

He’s not spending Thanksgiving in the Valley this year - he’s spending it under the Northern Lights. One accountant, 4 tickets, 143K Chase points turned into $21K in airfare. Parents in business, kids in economy and a 61.8% return on spend that turns math into magic.

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

This isn’t a Thanksgiving at home - it’s a winter wonderland.

An accountant from the San Fernando Valley (Greater LA) trades turkey and traffic for the Arctic Circle, taking his family to Finland for a “Winter Wonderland Week.”

They’ll fly from Los Angeles to Helsinki, then on to Lapland, where reindeer rides and frozen forests replace pumpkin pie. But behind the cozy holiday postcard lies a sharply engineered redemption - one that turns everyday spend into a five-figure flight experience.

The parents will fly one-way to Europe in business class, tickets priced at $20,710 cash for two. Instead, they redeem 125,000 Avios + $345 in fees, transferred from 97,000 Chase Ultimate Rewards during a 30% transfer bonus. That redemption yields a value of 21.3¢ per point, or a burn rate of 21.3% - the kind of number that redefines what points can do when deployed with precision.

The kids’ tickets tell a smaller but equally efficient story:

Each child’s one-way economy seat, retailing at $545, is booked for 30,000 Avios + $85, equivalent to 23,000 Chase points thanks to the same 30% bonus. That’s 1.99¢ per point, perfectly aligned with the rule of saving premium redemptions for premium cabins - while still stretching the family’s total travel value.

In total, the family used 143,000 Chase points + $515 in fees to unlock $21,800 worth of airfare. The accountant’s average earn rate across his business spend sits at 2.9%, and with this burn rate, his Return on Spend (RoS) climbed to 61.8%. That means for every $1 he spends on his business cards, he effectively generates $0.618 in flight value...

Proof that when points are optimized, even a CPA can make the numbers feel like magic.

Everything else you need to know is just below 👇🏻

In the San Fernando Valley (Greater LA), tax season never ends - it just changes form. By the time most accountants are thinking about year-end filings, one will be thinking about Finland.

This winter, while Los Angeles will sit under 68 degrees of beige sunshine, he’ll be stepping off a plane into minus 10 Celsius in Lapland, Finland - dragging two kids in snow boots and wondering how anyone could live somewhere this cold.

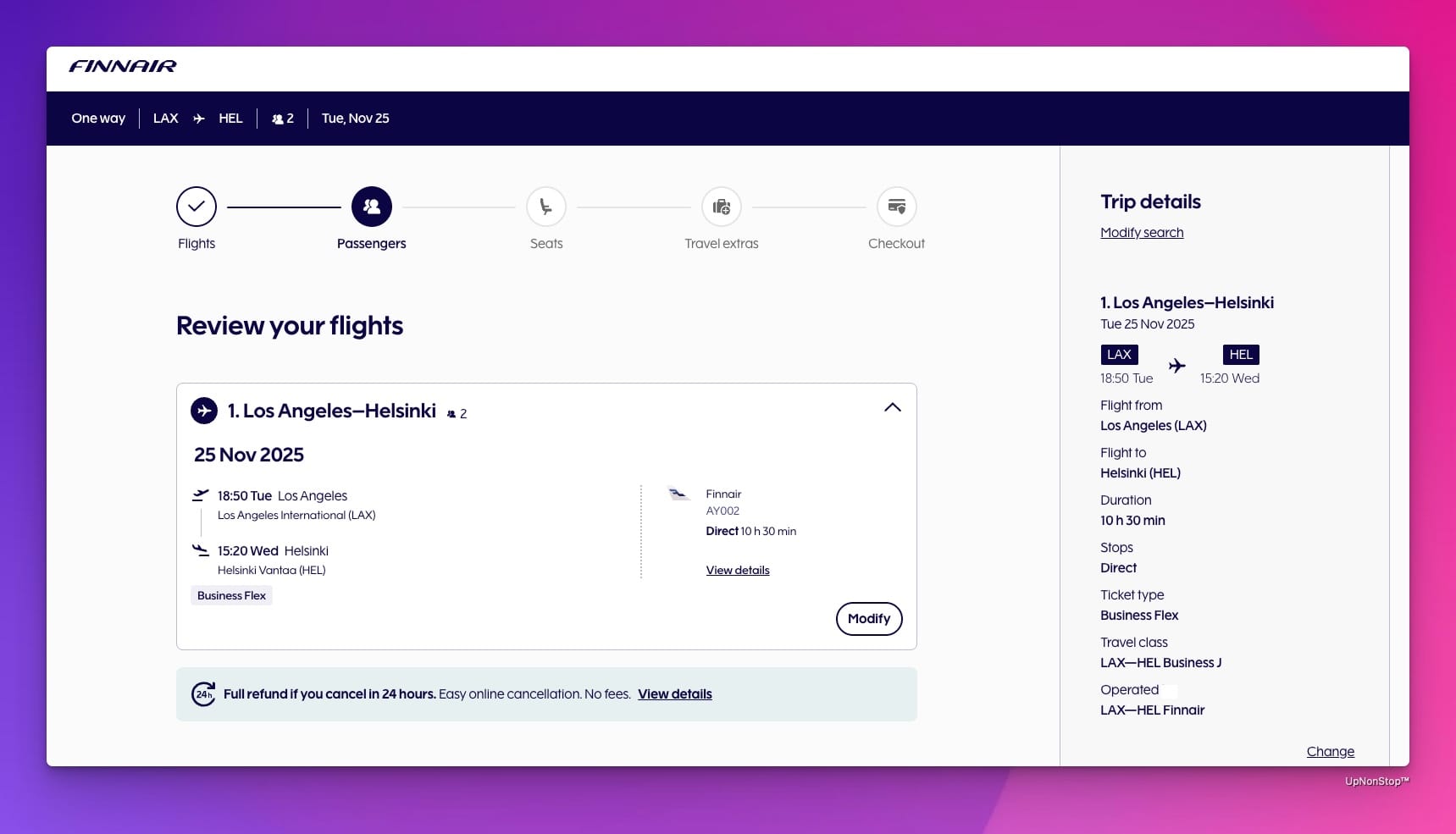

How we booked them: Him + Wife in business class, Kids in economy.

The Setup

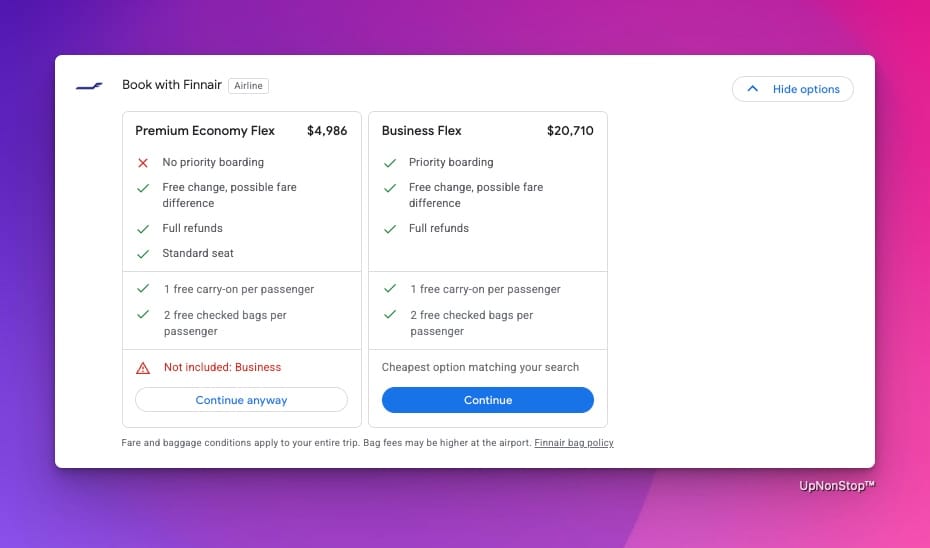

This will not be a budget trip. The flights alone (four passengers, LAX to Helsinki roundtrip, continuing on to Lapland) will price out at $21,800 in cash:

- $20,710 for two business class tickets for the parents (about $10,355 per seat)

- $1,090 for two economy seats for the kids (about $545 per seat)

He won’t pay that.

Instead, we've transferred 143,000 Chase Ultimate Rewards during a 30% transfer bonus to British Airways Avios, netting 185,000 Avios total.

That covered the full itinerary - 125,000 Avios + $345 for the parents, 60,000 Avios + $170 for the kids.

All in:

- 185,000 Avios + $515 in fees

- Worth $21,800 in cash fares avoided

The move won’t be random. It’ll be perfectly timed - executed during the bonus window, planned around real award space, and burned with surgical precision.

The Earn

This accountant doesn't earn so many points by accident. His firm runs a tight $200K–$300K monthly card spend: software licenses, continuing education, payroll processors, digital ads, even his accounting platforms.

Every dollar flows through the points engine, and his average earn rate sits at 2.9% - meaning, effectively, $2.90 in point value generated per $100 spent.

That number isn't a hypothetical. It's his real blended yield across the year - some 3x categories, some 1x categories, all optimized through UpNonStop.

The discipline is in how he holds those points: He sits on them, we wait for a transfer bonus, and only move when the math turns favorable.

When Chase announced the 30% transfer bonus to Avios, we strike.

In one clean move:

- 97,000 UR → 125,000 Avios (parents’ business class)

- 46,000 UR → 60,000 Avios (kids’ economy)

- Total: 143,000 UR → 185,000 Avios

That single 30% bump was the invisible edge. Without it, he’d need 185,000 UR instead of 143,000 - a 42,000 UR savings, the difference between a good redemption and a record-setting one.

The Burn

Now the math gets interesting.

Let’s quantify it.

If booked in cash:

- Parents’ tickets: $20,710 total

- Kids’ tickets: $1,090 total

Total cash price: $21,800

Since booking with points:

- 185,000 Avios + $515 in fees

- Transferred from 143,000 UR (thanks to the 30% Oct 2025 Chase to Avios bonus)

That means:

- Net travel value unlocked: $21,800 – $515 = $21,285

- Value per Avios: $21,285 ÷ 185,000 = 11.5¢ per Avios

- Value per UR: $21,285 ÷ 143,000 = 14.9¢ per UR

But averages lie...

Let’s separate the parents and the kids - because one half of this family will be flying in lie-flat beds worth spreadsheets of bragging rights, and the other half will be watching Frozen 3 in economy.

Parents’ Tickets: The Redemption Engine

- Cash fare: $20,710 total ($10,355 per seat)

- Award fare: 125,000 Avios + $345 in fees

- UR used: 97,000

So per seat:

- $10,355 cash avoided – $172.50 fees = $10,182.50 in net value

- 62,500 Avios (48,500 UR) per seat

- Value per Avios: 16.3¢

- Value per UR: 21¢

That’s the kind of number that makes a CFO’s eyebrow lift.

Each UR (normally “worth” 1¢ in cashback) produced a 21¢ of flight value here.

This is the burn multiple: 21x.

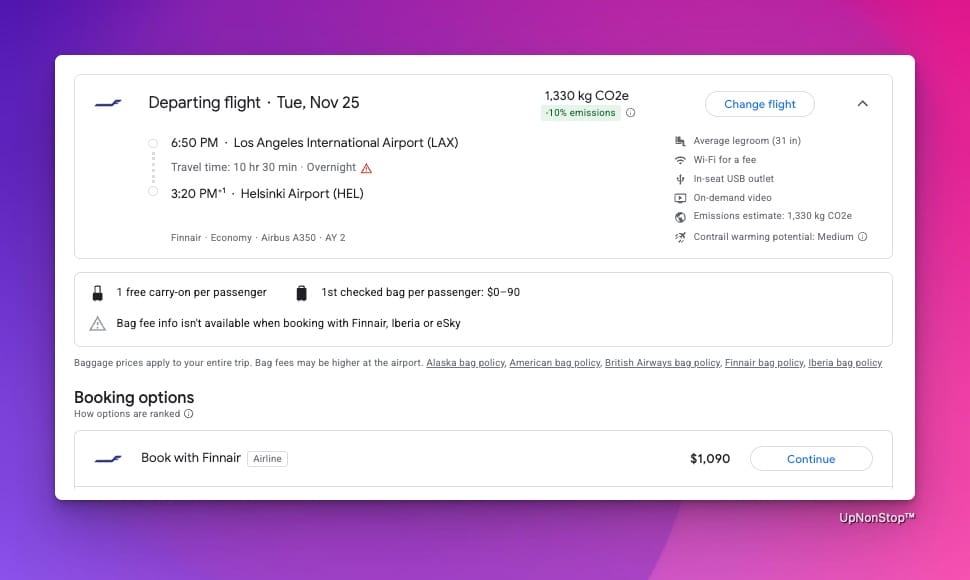

Kids’ Tickets: The Leak

- Cash fare: $545 each

- Award fare: 30,000 Avios (23,000 in Chase UR Points) + $85 in fees

Per seat:

- $545 – $85 = $460 in net value

- 30,000 Avios → 1.53¢/Avios

- 23,000 UR → 2¢/UR

Economy rarely wins the math. These are fine but unremarkable - a 2x burn multiple compared to the parents’ 21x.

Family Average

When you blend the two cabins:

- Total net value: $21,285

- Total UR burned: 143,000

- Average return: 14.9¢/UR

- Average burn multiple: 14.9x

That’s the number that matters at the household level.

Every Ultimate Reward point, on average, bought 14.9¢ of real travel value.

The Return: Turning Earn and Burn into RoS

This is where UpNonStop earns its name - turning raw earn and burn data into a business metric: Return on Spend (RoS).

RoS isn’t a gimmick. It’s the clean, CFO-friendly way to express the total yield on company spend - how much travel value a business gets for every dollar it runs through its optimized cards.

The formula is simple:

Earn Rate × Burn Multiple = Return on Spend (RoS)

That’s it...

Your earn rate tells you how efficiently you’re creating points.

Your burn multiple tells you how efficiently you’re converting them into travel.

Multiply the two, and you get the actual yield on spend - your travel return on every business dollar.

Parents’ Business Class Return-on-Spend (RoS)

- Earn rate: 2.9% (0.029)

- Burn multiple: 21x

- RoS = 0.029 × 21 = 0.609 → 60.9%

That means: every $1 the accountant’s firm spends to generate UR will ultimately deliver $0.61 in travel value when burned this way.

That’s a 60.9% return on spend.

If this were a cashback card at 1.5%, he’d get $1,500 on $100,000 of spend.

With this strategy, he’ll unlock roughly $60,900 in equivalent travel.

Kids’ Economy RoS

- Burn multiple: 2x

- RoS = 0.029 × 2 = 5.8%

That’s fine, but it’s not the kind of number UpNonStop brags about.

It’s what happens when redemptions are done for convenience, not optimization.

Family Average RoS

- Burn multiple: 14.9x

- RoS = 0.029 × 14.9 = 43.2%

That’s the blended return - still enormous by any normal measure.

A 43.2% Return on Spend on everyday business expenses.

No speculation. No crypto. Just credit card optimization and timing.

The Why: Timing, Leverage, and Intent

Two things make this work: transfer timing and cabin leverage.

1. The Transfer Window

Most people transfer points as soon as they see a trip they like. That’s how they lose. He waited. He built his UR balance until Chase ran the current 30% transfer bonus to Avios - a window that opens a few times a year for those paying attention.

When such window opened this month we moved only the points he needs. No leftovers, no stranded balances. That move alone increased his effective value by 30% overnight - a free $4,000+ in value, engineered by timing, not luck.

2. The Cabin Leverage

Avios redemptions shine in premium cabins, especially on partner airlines with distance-based pricing.

That’s why the parents will sit up front.

It’s not luxury for luxury’s sake - it’s efficiency. Business class redemptions often deliver 10-20¢ per point, while economy rarely clears 2¢.

We used points where they’re scarce and pay cash where they’re cheap.

That mix (points for leverage, cash for efficiency) creates a portfolio effect that maximizes the family’s Return-on-Spend over time.

The Business Case

Let’s put this in terms accountants appreciate:

If his firm will spend $1,000,000 this year, at a 2.9% earn rate, he’ll generate 290,000 ultimate rewards (UR) if we assume 1¢ baseline value.

At his Lapland burn rate of 14.9¢ per UR, that’s $43,210 of travel unlocked - from the same million in spend.

In a parallel world, running a 2% cashback card would earn him only $20,000.

The Discipline

Here’s what separates him from most points collectors:

- He doesn't hoard (we don't let him):

Points are treated as inventory, not trophies. Once they earn their keep, they’ll be burned. - We calculate before transfers:

If the cents-per-point doesn’t clear 5¢/UR, he’ll pay cash. - We record redemptions:

Burn rate, taxes paid, cash avoided - all logged. Because data compounds faster than points. - We audit his cards quarterly:

Merchant category codes change, bonus multipliers expire, and corporate software spend shifts - all things most people ignore. He won’t. - We separate business and personal:

The kids’ economy tickets will go on the family ledger; the business class fares will show up as a travel dividend of company spend.

This is not travel hacking. This is operational finance.

The Human Side

When the family boards that Finnair flight to Helsinki, the accountant won’t be thinking about Avios or transfer bonuses. He’ll be thinking about how he traded spreadsheets for snowflakes - and how the entire trip cost him $515 out of pocket.

He’ll spend the week sledding under polar skies, chasing the Northern Lights, teaching his kids how to pronounce “Rovaniemi.”

Then he’ll come home, open his QuickBooks, and log the win:

143,000 UR burned. $21,285 of value created. 43.2% RoS delivered.

He doesn't spend more. He spends smarter.

The Takeaway

This redemption won’t just be about a family trip. It’ll be a case study in what happens when precision meets patience.

The numbers tell the story:

| Passenger Type | Cash Price | Chase Ultimate Reward (UR) Points Used | Burn Rate (¢/UR) | Return-on-Spend (RoS) |

|---|---|---|---|---|

| Parents (Biz) | $20,710 | 97,000 | 21.0¢ | 60.9% |

| Kids (Econ) | $1,090 | 46,000 | 2.0¢ | 5.8% |

| Family Total | $21,800 | 143,000 | 14.9¢ | 43.2% |

That’s how UpNonStop serving as true Chief Points Officer in practice.

A business owner who doesn’t see “free flights” - he sees annualized returns on spend:

He doesn’t brag about upgrades - we track his RoS.

He doesn’t play the points game - we run it like an asset class.

Final Approach

So when that accountant will post his Lapland photos (Northern Lights, husky rides, glass igloos) remember: those aren’t sponsored moments. They’re audited outcomes.

Because this isn’t a travel story. It’s a financial one... This time written in Avios, calculated in Chase Ultimate Reward Points, and paid for by knowing exactly when to move.

The Lapland trip will be the result of one formula applied correctly:

Earn smart. Burn sharper. Calculate the Return-on-Spend.

That’s the UpNonStop way.