What Would You Do with 500,000 CapitalOne Miles? (Here’s What You Should Do)

500,000 Capital One miles isn’t just a number—it’s a travel game-changer. Fly first class, take the whole family, or turn every trip into a luxury escape. Whether you want bucket-list experiences or years of free travel, this balance lets you dream big—and actually book it.

If You Only Have 60 Seconds to Read This Article (Click Here)

Half a million Capital One miles isn’t just a balance—it’s a passport to an entirely different kind of travel life. At a bare minimum, you’ve got $5,000 to burn through the portal, but if you play your cards right with airline and hotel transfer partners, that number can easily jump to $10,000–$15,000 or more in real-world travel value. You could fly first class across continents multiple times, stay in five-star hotels or overwater bungalows, or take care of both flights and hotels for several luxury getaways. Whether you want to see the world in style, treat your family to unforgettable vacations, or travel more often without dipping into your bank account, 500,000 miles gives you the flexibility to do it all—and then some.

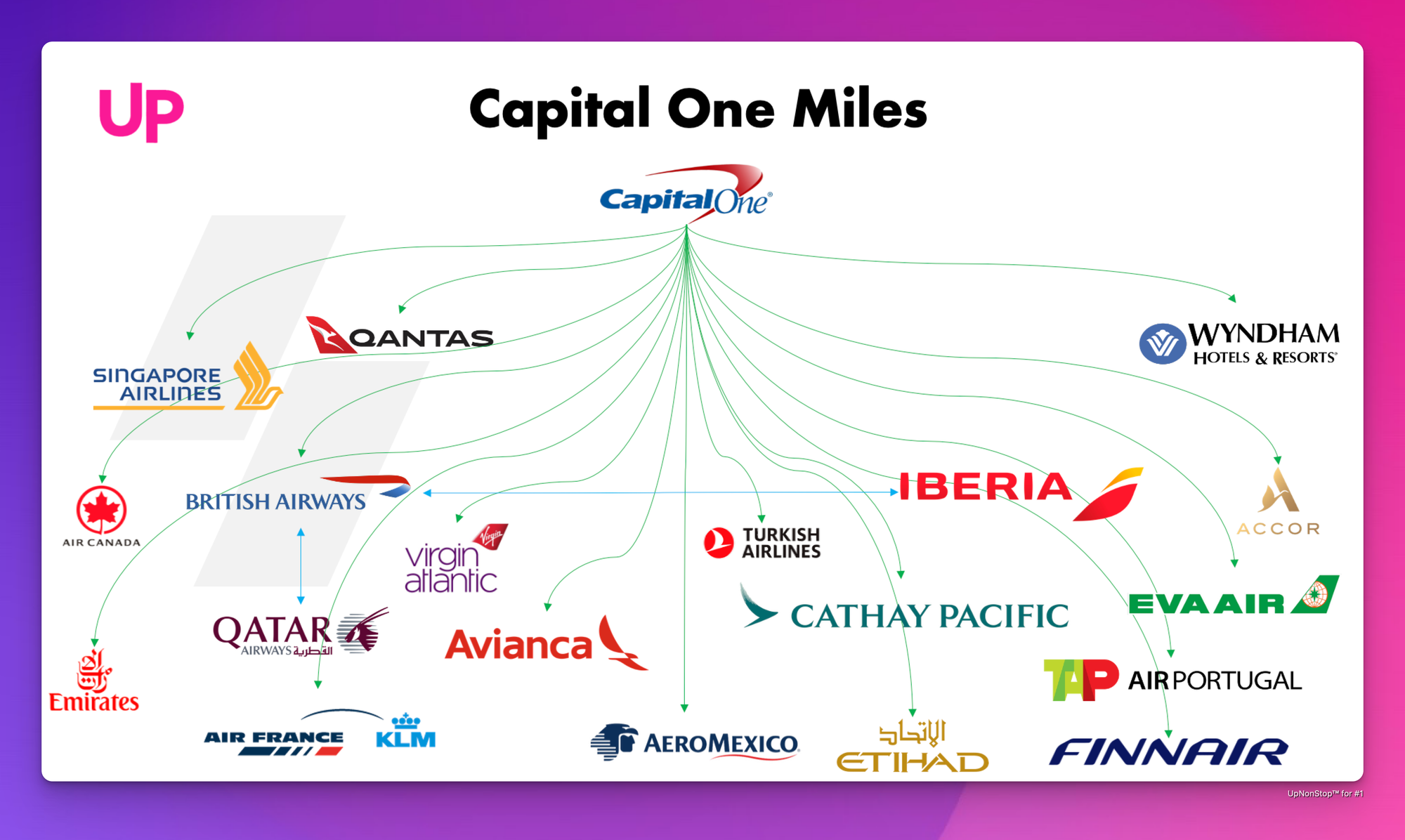

One powerful approach is to concentrate your points into a year or two of ultra-premium travel. Think Emirates A380 First Class, Singapore Suites, ANA or JAL First to Tokyo, or Lufthansa First to Europe. With a smart redemption strategy using partners like Virgin Atlantic, Avianca LifeMiles, or Air Canada Aeroplan, you could hit several of these experiences in a single round-the-world trip—or stretch them out over three or four separate journeys. Hotel redemptions, while trickier with Capital One due to partner limitations, can still provide excellent value through cash offsets, boutique options with programs like Wyndham or Choice, or even statement credits. In other words: if you want to travel like royalty, these miles will more than cover the crown.

But maybe your goal isn’t personal indulgence—it’s sharing the wealth. With 500k miles, you can fly ten friends to a reunion, gift your parents their dream business class trip to Europe, or cover the flights for a ski trip with your crew. Many programs allow booking for others without any hassle, and splitting your miles across multiple loyalty ecosystems lets you piece together award availability even for large groups. This kind of redemptive generosity is often the most fulfilling use of points. These miles aren’t just about where you can go—they’re about who you can bring with you.

And finally, maybe you want a long-lasting lifestyle shift: never flying economy again, always using miles for premium cabins, or setting up a “points budget” to fund all your upcoming travel. A stash like this allows you to treat every trip like a special occasion, knowing you’ve already prepaid for your freedom. You can book luxury cruises, guided tours, or high-end rail journeys through the portal if that’s your style. The key is to avoid procrastination, diversify your redemptions, and don’t be afraid to spend down—because every unused mile is a missed adventure. The smartest travelers use points not just for maximum cents-per-mile, but for maximum joy.

Everything else you need to know is just below 👇🏻

Half a Million Miles – Travel without Limits?

If 250k seemed like a lot, 500,000 Capital One miles is truly staggering. It’s an amount that can feel almost “too much” to spend – but don’t worry, we’re going to dream big. With half a million miles at your disposal, you can realistically travel for free for years, or embark on ultra-premium trips that would cost tens of thousands of dollars if paying cash. You’ve basically created your own travel endowment.

Let’s take a second to appreciate the baseline: 500k miles = $5,000 worth of travel minimum (at 1¢ each). But we’re not here to spend it at face value. With savvy redemptions, you could be looking at $10,000–$15,000 worth of first class flights and luxury hotels, possibly more if you orchestrate everything perfectly. The possibilities are immense:

- You could fly an entire group of friends or extended family somewhere for a reunion.

- Book multiple round-the-world tickets.

- Live it up in first class repeatedly.

- Cover both airfare and lodging on trip after trip, barely touching your wallet.

- Perhaps even take an around-the-world cruise by redeeming via the portal (though cent-per-mile might be low, it’s an option if bucket list calls).

However, with great power comes great responsibility (and planning). Managing 500k miles means thinking about strategy: how to avoid devaluation, how to maximize enjoyment without burning out on too much travel (is that possible?), and how not to inadvertently waste miles simply because you have a lot.

This article will guide you through leveraging 500k miles for maximum benefit. We’ll discuss:

- Orchestrating “once-in-a-lifetime” experiences (first class, private suites, five-star resorts) multiple times.

- Creating a multi-year travel plan where nearly every flight is covered.

- Combining redemptions for flights, hotels, and even creative uses like transferring to partners for unique experiences.

- Special considerations like business travel, gift of travel (you can use your miles to book for others), and charitable ideas.

- Pitfalls, like complacency (letting them sit unused) or putting all eggs in one basket.

Think of this as your blueprint to turn a half-million miles into unforgettable value. Let’s explore some top-tier ways to spend them.

A 500k Miles Game Plan: Diversify and Conquer

With 500k miles, you have enough to diversify your approach:

Some people in this situation actually break their points into “budgets” – e.g., “X for family travel, Y for luxury travel, Z reserved for spontaneous trip opportunities.” That’s one way to ensure you hit all your goals.

Strategy 1: Ultimate Luxury Year (or Two)

One approach: dedicate your half-million to ultra-luxury travel over a concentrated period. For instance:

- First Class All The Way: Set a goal to fly first class on the top products:

- Emirates A380 First Class, Singapore Suites, ANA First, Cathay Pacific First, maybe even Etihad Apartments if back in service, and Lufthansa First. You have the miles to sample them all.

- A possible “world tour” could be: New York -> Dubai (Emirates First, 136k miles round-trip or 85k one-way per person; let’s assume you go one-way for 85k), stay few days, Dubai -> Singapore (Emirates or Singapore First, ~100k per person one-way; two people ~200k if partner with you, but maybe you go solo for these experiences to stretch miles further? Up to you). Then Singapore -> Tokyo (ANA or Singapore First ~80-100k), Tokyo -> Europe (ANA First or JAL via Alaska/AA but assume using CapOne only: Virgin Atlantic for ANA first 90k round-trip per person, but you just need one-way maybe 45k each). Then Europe -> US (Lufthansa First via LifeMiles 87k per person or BA First via Avios 68k + fees).

- We could easily burn 400k+ on that one mega-trip in first for two people. But maybe you target doing it single or just a couple of segments.

- Perhaps better: plan 3 separate trips, each featuring one amazing first class:

- Trip to Asia: 2 tickets ANA First (170k via Virgin Atlantic).

- Trip to Europe: 2 tickets Lufthansa or BA First (say ~140k via LifeMiles or Avios).

- Trip to Middle East: 2 tickets Emirates First (170k via Skywards).

That’s about 480k total; the remainder can cover some hotels.

- 5-Star Hotels and Overwater Bungalows: Don’t neglect hotels. While Capital One doesn’t directly transfer to Marriott or Hyatt, you can use miles to cover charges or transfer to Choice/Wyndham for boutique options.

- Example: in Dubai, transfer 100k CapOne to Accor (2:1) to get 50k ALL points (~€1,000 value) – enough for 2 nights at Raffles The Palm or Burj al Arab (if bookable via ALL? Burj might not be, but Raffles yes).

- In Singapore, you might use cash or other points for the Marina Bay Sands, but you could also just pay $600/night cash since flights were free – you have that flexibility because you saved elsewhere.

- Overwater bungalow in Maldives? Capital One -> ALL won’t help there, but maybe use 1¢ per mile via portal to book a $1,000/night resort – 100k miles = $1,000, one night, pricey but hey.

- Alternatively, use miles to fly to Maldives in Qatar Qsuites (140k for two RT via Avios if off-peak with a transfer bonus possibly), and pay the resort with cash you saved on flights.

- The point is, 500k can let you say “Yes” to luxury at every turn for a series of trips.

Strategy 2: Family and Friends – Share the Wealth

Another fulfilling way: use your miles to bring others along or arrange gatherings:

- Family Reunion Trip: Fly 10 family members to a vacation villa in Hawaii. If each ticket averages 40k (from various US points of origin to Hawaii RT in economy can be 35-45k via United, Delta etc, but you use Turkish to reduce to 15k each RT ideally).

- With Turkish: 15k RT per person, 10 people = 150k. Wait, 10 people on the same flights might be tough with partner availability. Possibly split group flights or use multiple airlines.

- Even if you had to do 40k each using easier programs, 10×40k = 400k – still doable with 500k.

- Then use remaining 100k to offset lodging (e.g., pay for rental houses via Capital One eraser or book some hotel rooms on points).

- Gifting Travel: Have your parents always wanted to go to Europe but wouldn’t splurge on business class? Use ~200k to send them on a business class trip (say 100k each RT to Europe in biz via Aeroplan/LifeMiles). Still have 300k left for you.

- Friends Trip: Cover flights for 5 friends to go skiing in Colorado (maybe 25k each, 5×25 =125k) and use another 100k for accommodations (e.g., book ski resort condos through portal or transfer to Wyndham for Vacasa vacation rentals near slopes).

- Doing this, you derive joy from enabling experiences for others – arguably some of the best value (in a non-monetary sense) your miles can provide.

- Note: Redeeming for others is easy – you can typically book anyone’s name from your airline miles account (few exceptions like Singapore require nominee listing). Capital One miles you’d transfer to an airline in your name and just book others as passengers on the award ticket.

Strategy 3: No-Fear Travel Budget – Every Trip First Class

Maybe you’re a frequent traveler normally flying economy; now you can upgrade your travel lifestyle for a long time:

- Essentially, 500k could upgrade roughly 10 long-haul round-trips from economy to business (if ~50k extra needed each time for upgrade or award).

- Or just outright book business class for any flight over, say, 5 hours for the next several years. For example, if you take 3 international trips per year, each ~100k for biz RT, that’s 300k/year for two of you; 500k covers ~1.5 years. Not that long, but 3 major trips per year is quite a lot.

- If you mix in economy for shorter trips or use miles for domestic occasionally, you can extend it.

- It might be helpful to set aside miles for particular planned destinations: e.g., “Asia tour in Fall – 180k for 2 in biz + 60k hotels”, “South America trip next spring – 150k flights + etc.”

- With this approach, you’re basically saying: my next X trips, I won’t pay for flights at all. That’s huge peace of mind for a travel lover.

Strategy 4: Around the World Cruise or Tour via Portal

For those who prefer a fully packaged adventure, like a cruise or guided tour, sometimes paying cash (or with points via portal) is the way:

- For instance, around-the-world cruises can cost $10k+ per person. You have $5k equivalent in points; maybe combine with a partner’s points or accept covering partial.

- If you redeem 500k through the portal, you get $5,000 off such a purchase. Not the best “points value” but it’s a legitimate use if that’s your dream and you can’t easily cover that cost otherwise.

- Or perhaps a luxury train tour (like the Orient Express or private jet tour by NatGeo). Many can’t be directly booked with points transfers, but you can use miles as statement credits for travel purchases (if it codes as travel).

- Just ensure the portal has that product; if not, you could charge it and then try to use Purchase Eraser if it qualifies.

Strategy 5: Ensure You Don’t Lose Value

500k is great, but be aware of:

- Airline program changes: Having so many points in CapOne, not tied up until transfer, is somewhat safe. But once transferred, you want to use them rather than hold in airline accounts long-term. Maybe transfer as needed for booking (instant or near).

- CapOne transfer partner stability: Partners can change, but likely just additions. Still, keep an eye out if any partner ratio devaluation rumors.

- Expiration: CapOne miles don’t expire, but once moved to airlines, those might (e.g., Flying Blue miles expire if no activity 2 years, etc.). If you transfer a huge chunk, either use them or have a plan to keep alive.

- Booking logistics: Booking complex trips or many tickets can be time-consuming. With so many miles, you might consider using a points travel agency or award booking service for a tough itinerary; the fee (~$100-$200 per ticket) could be worth saving the hassle when you’re managing such high stakes travel. Or dedicate time to learning the ins and outs – which can be part of the fun for enthusiasts.

One more idea:

- Keep some miles unspent as a buffer: Perhaps you don’t need all 500k immediately. Keeping ~100k for spontaneity or emergencies is not a bad idea (e.g., last-minute flight to a relative’s wedding when cash price is high – you can always grab an award seat if available or transfer to use with a partner that doesn’t gouge last-minute, like Avios on AA). That still leaves 400k for planned fun.

Final Thoughts on Spending 500,000 Miles

Half a million miles opens doors that most travelers never see open. It is an opportunity to create a treasure trove of travel memories:

- You can go further, more often, and more comfortably – and bring loved ones along for the ride.

- You can relieve financial barriers for meaningful trips (like family reunions or visiting ancestral homelands).

- You can indulge in luxury that might have felt financially irresponsible if paying cash, but with points, it feels almost guilt-free.

- You also carry the responsibility to use these miles well – which means planning and actually taking the trips (procrastinating would be the biggest waste).

To get the most from 500k:

- Have a rough travel plan or bucket list and allocate miles to those priorities. It’s okay if plans change, but this ensures you’re using miles intentionally.

- Mix high-value redemptions (to feel proud of your “points prowess”) with emotionally fulfilling ones (like helping others travel, or making an anniversary extra special). The balance means you maximize value not just in cents but in happiness.

- Monitor your balance over time. It’s fine to spend down to near-zero – that’s what they’re for – as long as you have plans for more earning if needed (sign-up bonuses, etc.). But with 500k, even aggressive use might take a while, so revisit how many remain after each big trip and adjust future plans accordingly.

Consider keeping a little journal of what 500k miles “bought” you: e.g., “Summer 2025: First class to Tokyo (ANA), saved ~$20k. Winter 2025: Ski trip flights for family, saved $2k. Spring 2026: Paris in business, saved $5k.” It’s satisfying and helps justify the effort you put into accumulating these miles in the first place.

Finally, remember to savor it. Sometimes, people who travel on points a lot may start to take it for granted – a half-million miles can make luxury feel “normal”. Keep perspective: each time you sip champagne in a lie-flat seat or each time your whole family is together on a vacation flight, take a mental snapshot and appreciate that this was all made possible by your smart use of credit card rewards. That gratitude will make the experiences even richer.

You’ve earned these miles; now go out and earn the memories. With 500,000 Capital One miles at your command, the world is truly yours to explore. Happy travels, and enjoy turning that mountain of miles into a lifetime of stories!