What 20,000 CapitalOne Miles Can Really Get You

20,000 Capital One miles aren’t just worth $200—they can unlock $300–$400+ in flights or hotel nights when transferred smartly. Think round-trip to Hawaii, multiple short-hauls, or even two hotel nights abroad. Don’t settle for the portal. Play it right, and 20k miles take you way further.

If You Only Had 60 Seconds to Read This Article (Click Here)

Don’t underestimate what 20,000 Capital One miles can do. While the baseline value is $200 when redeemed through the Capital One Travel portal or as a purchase eraser, the real magic happens when you transfer those miles to one of Capital One’s 15+ airline and hotel partners—most at a 1:1 ratio. That same 20k, if used wisely, can unlock travel experiences worth $300, $400, or more. A standout example: Turkish Airlines’ Miles&Smiles program lets you book a round-trip United flight from the mainland U.S. to Hawaii for just 20,000 miles total, a flight that often retails for $500+. That’s 2.5 cents per mile in value—more than double the default.

And you don’t have to fly to paradise to squeeze value. Short-haul flights across North America offer another route to maximizing 20k miles. With Air Canada’s Aeroplan, one-way flights under 500 miles cost just 6,000 points—so you could book three separate legs with a single 20k stash. British Airways Avios, another Capital One partner, charges as little as 7,500 miles for nonstop flights under 650 miles on American or Alaska Airlines. Flights like New York to Boston or L.A. to Vegas can go for $200+ last-minute, meaning your redemption could return 2.5–3.3 cents per mile in real cash value.

If you’re not in the air, you can still come out ahead on the ground. Transferring Capital One miles to hotel programs like Wyndham or Choice Privileges can easily cover 1–3 free nights. Wyndham’s award chart offers plenty of options at 7,500–15,000 points per night, including all-inclusives in Mexico and the Caribbean. That means your 20k could offset a $300 stay at a beachfront resort or buy two nights in a decent city hotel. Choice is even more flexible globally, with high-value options in places like Scandinavia and Japan—again yielding well over 1 cent per mile in savings if used strategically.

And yes, if you’d rather keep it simple, the 1:1 fixed-value route is still there—use 20k miles for $200 off any flight, hotel, or rental car. You’ll get flexibility, avoid transfer headaches, and even double-dip if you use your card to book travel and erase the charge later (earning miles on the spend). But if you’re aiming to stretch every point, look to airline and hotel transfer sweet spots. Whether you’re planning a trip to Hawaii, stringing together regional getaways, or covering hotels in high-cost cities, 20,000 Capital One miles—redeemed smartly—can punch well above their weight.

Everything else you need to know is just below 👇🏻

The Power of 20,000 Miles

Twenty thousand Capital One miles might not sound like a life-changing sum at first. After all, if you simply redeem through Capital One’s travel portal or use miles to “erase” travel purchases, 20,000 miles is equivalent to $200 in travel value. Yet in the world of points and miles, even a balance of 20k can unlock exciting travel experiences. The key is knowing how to maximize those miles.

Imagine you've earned 20,000 miles from the Capital One VentureOne card’s sign-up bonus or after a few months of spending on your Venture card. You’re probably wondering: What can I do with 20k miles? The answer: potentially a lot more than $200 worth of travel. By leveraging Capital One’s extensive airline and hotel transfer partners, you can squeeze much higher value out of these miles – sometimes double or even triple the cents-per-mile value compared to basic travel redemptions.

In this guide, we’ll explore the best ways to spend 20,000 Capital One miles, focusing on high-value travel redemptions. We’ll walk through real examples – from free flights to hotel stays – that demonstrate how even a modest mileage balance can cover an entire trip. We’ll also highlight some pitfalls to avoid so you don’t inadvertently waste those hard-earned rewards. Let’s dive in and see how far 20,000 miles can take you!

Understanding the Value of 20,000 Capital One Miles

Before jumping into specific redemptions, it’s important to understand what 20,000 Capital One miles represent in value. Capital One miles are worth a fixed 1 cent each when redeemed for travel through the Capital One Travel portal or as a statement credit toward recent travel purchases. That means your 20k miles can function like a $200 travel voucher – usable for flights, hotels, rental cars or other travel expenses booked on your card (which you then “erase” by redeeming miles).

On the surface, $200 might cover a domestic flight, a night or two in a hotel, or a weekend car rental. For example, if you find a round-trip flight from New York to Chicago for $180, you could charge it to your Venture card and then redeem 18,000 miles to wipe the charge (covering the fare entirely). You’d even have 2,000 miles left over. This straightforward use through the portal or purchase eraser is reliable and easy, guaranteeing 1 cent per mile of value.

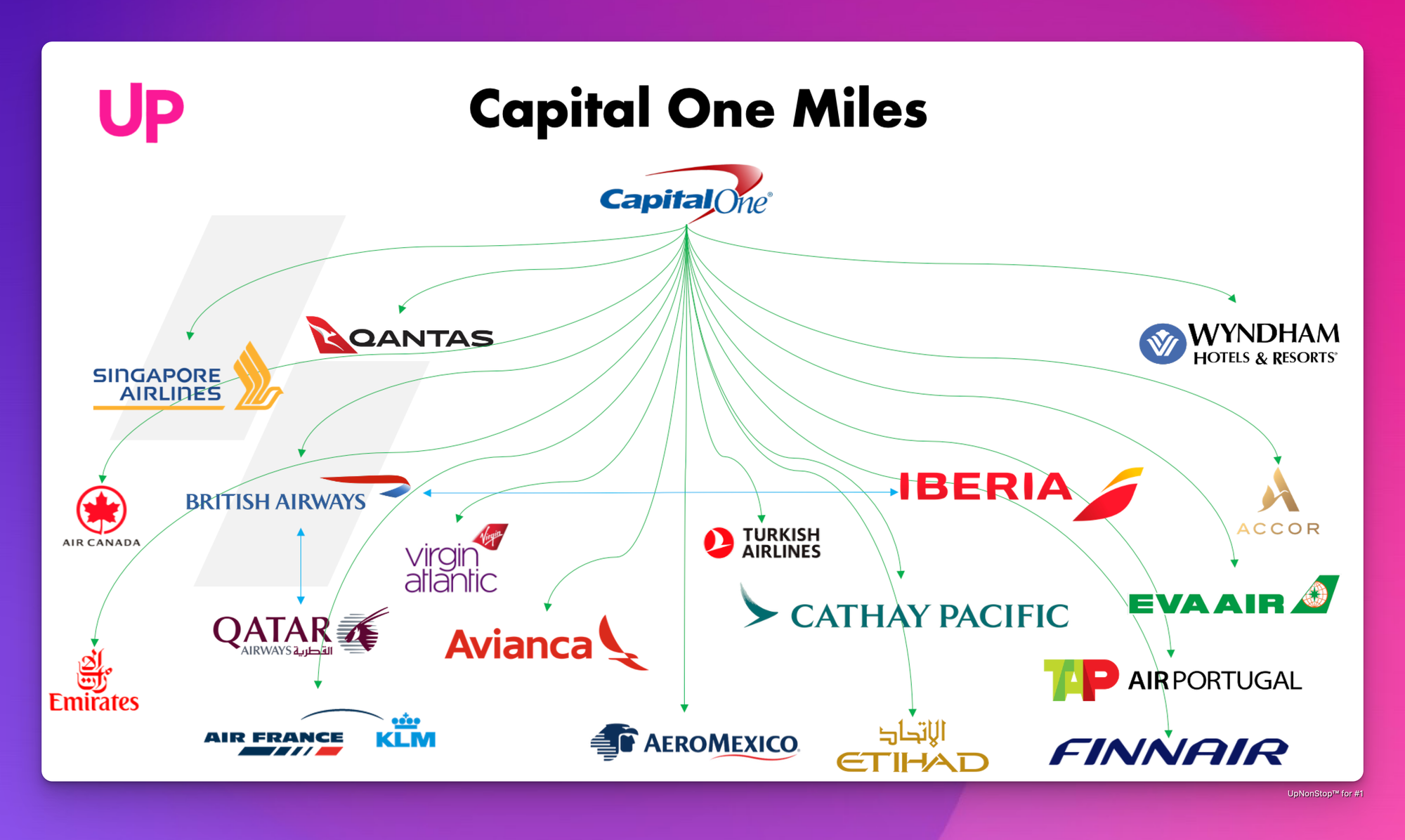

However, 1 cent per mile is just a baseline. The real power of Capital One miles lies in their flexibility: you can transfer miles to over 15 airline partners and 3 hotel partners. Most of these transfers are at a 1:1 rate (meaning 1 Capital One mile becomes 1 partner point/mile in the other program). By transferring and then redeeming within an airline or hotel loyalty program, you can often get far more than 1 cent of value per mile.

For instance, airline miles can have “sweet spots” – specific routes or cabins where the award price in miles is low relative to the cash cost. A flight that costs $300 might cost only 10,000 airline miles via a partner program, effectively giving you 3 cents per mile of value if you transferred Capital One miles for that booking. That’s the kind of leverage we want with our 20k balance.

It’s also worth noting how achievable 20,000 miles can be. If you opened a no-annual-fee VentureOne Rewards card, you might have received a bonus around this size (e.g. 20,000 miles for spending $500 in three months). Or maybe you’ve accumulated 20k miles by using a Capital One Venture card (2x miles on every purchase) for a while. In either case, you have a nice stash to play with. And importantly, Capital One miles don’t expire as long as your account is open and in good standing. There’s no rush to burn them for a subpar redemption – you can take the time to plan for a high-value use.

To summarize the value context:

- Cash value (baseline): 20,000 miles = $200 toward travel if used via Capital One’s travel redemption options.

- Potential value via transfers: Often $300–$400 (or more) worth of travel, if you capitalize on the right partner award bookings.

- Perspective: 20k miles could fund a short vacation’s flight or hotel, especially if maximized.

Now, let’s explore some concrete ways to turn 20,000 Capital One miles into memorable travel.

Maximizing 20,000 Miles: Top Redemption Options

With 20,000 miles at your disposal, you won’t be booking round-the-world luxury trips (save that for when you have a six-figure miles balance), but you absolutely can get a fantastic reward. Here are some of the best redemptions and ideasfor a 20k Capital One miles balance:

1. Round-Trip Flight to Hawaii or Anywhere in the US (via Turkish Airlines Miles&Smiles)

One of the most outstanding uses of a small chunk of miles is a round-trip ticket to Hawaii. It might surprise you, but you can fly from the mainland U.S. to Hawaii and back for just 15,000 miles round-trip in economy using Turkish Airlines’ Miles&Smiles program. Turkish is a 1:1 transfer partner of Capital One. This is possible because Turkish’s award chart (for United Airlines flights, since United is a Star Alliance partner) prices any domestic U.S. flight at 10,000 miles one-way in economy – and that includes flights to Hawaii, which are technically domestic.

How it works: You transfer 20,000 Capital One miles to Turkish Miles&Smiles. Then you book a round-trip United Airlines flight from, say, Newark to Honolulu. It will cost 10k each way (20k total) plus minimal taxes (around $11 round-trip). Even flights from the East Coast to Hawaii (which are 10+ hour journeys often costing $500 or more) are just 20k miles round-trip. Essentially, your 20,000 Capital One miles can become a Hawaii vacation flight for one person. That’s incredible value – effectively getting ~2.5 cents per mile if the cash ticket would’ve been $500.

This sweet spot isn’t limited to Hawaii. Turkish Miles&Smiles charges 10k each way for any domestic US flight on United. Los Angeles to New York? 20k round-trip. A 3-stop cross-country itinerary? Still 20k. If you only have 20k miles, you could use them for a coast-to-coast round-trip flight in economy for one person. Considering many cross-country flights cost $300+, you’re beating the standard 1 cpp value by a wide margin.

2. Multiple Short-Haul Flights in North America (via Air Canada Aeroplan or British Airways Avios)

Instead of one long trip, you could get several shorter flights out of 20k miles by exploiting distance-based award charts. Capital One has transfer partners like Air Canada Aeroplan and British Airways Avios (Executive Club) that offer excellent deals on short-haul flights.

- Air Canada Aeroplan’s 6,000-point flights: Aeroplan (1:1 transfer from Capital One) has a partner award chart where flights under 500 miles cost just 6,000 points one-way in economy. This means for 20,000 miles, you could book three one-way flights (6k + 6k + 6k = 18k) under 500 miles each, or a couple of round-trips on very short routes. For example, Toronto to New York is ~6,000 points each way. Chicago to Washington D.C., or L.A. to San Francisco – all can fall near or under that 500-mile threshold. If you have a series of weekend getaways or family visits on short routes, your 20k miles could cover multiple tickets.

- British Airways Avios for short hops: British Airways Avios (also 1:1 transfer) uses a distance-based pricing system on partner American Airlines and Alaska Airlines flights. A flight under 650 miles (like New York to Boston, or L.A. to Las Vegas) can cost as low as 7,500 Avios one-way in economy (off-peak). Slightly longer flights (651–1150 miles) cost 9,000–10,000 Avios. So with 20k, you could do perhaps two round-trip flights of moderate distance, or a handful of one-ways regionally. For instance, 20k Avios could fly you round-trip from Miami to Turks and Caicos (short Caribbean route on American) with points to spare. Or maybe Dallas to New Orleans round-trip (at ~7.5k each way = 15k total).

These short-haul redemptions shine when cash prices are high relative to distance – think last-minute flights or popular weekend routes that might cost $200-$300 each way. Paying 6k or 7.5k miles for a ticket that would be $250 yields around 3 to 4 cents per mile of value, an excellent return.

3. Hotel Stays via Wyndham or Choice (1–3 Free Nights)

Capital One’s transfer partners aren’t just airlines; they include two major hotel programs: Wyndham Rewards and Choice Privileges (both at a 1:1 transfer rate). If you’re more interested in offsetting lodging costs for an upcoming trip, 20,000 miles transferred to these programs can secure some free nights.

- Wyndham Rewards (1:1): Wyndham has a simple award structure where many hotels cost 15,000 points per night (standard award at their top tier; some go for 7,500 or 30,000, but a large number of properties including nice resorts are 15k). With 20k miles -> 20k Wyndham points, you could book one free night at a top-tier Wyndham property (15k) and still have 5k left. For example, Wyndham all-inclusive resorts in the Caribbean or Mexico often run 15k points per night – a room that could cost $250-$400 cash easily. You’d effectively use 15k miles to save say $300, which is 2 cents per mile value. Alternatively, you could choose a lower-tier property for 7,500 points a night (many Wyndham hotels in smaller cities or along highways are 7.5k or 15k). In that case, 20k Wyndham points might get you two free nights (2×7,500 = 15k, with 5k left over). That could cover a weekend getaway hotel bill.

- Choice Privileges (1:1): Choice hotels range from budget inns to upscale partner hotels. They price awards per hotel and date, typically from 8,000 to 35,000 points per night in the U.S. (and up to 50k+ at certain luxury all-inclusive affiliates). With 20k, you can snag two or even three nights at mid-range Choice hotels. For example, many Comfort Inn or Cambria suites in smaller cities might be 10k points a night, so 20k covers two nights. Internationally, Choice has some great partners; for instance, in Japan or Scandinavia, high-end hotels like the Clarion Collection or Ascend properties might run ~16,000 points/night. One strategy some savvy travelers use is transferring to Choice and redeeming for nice hotels in expensive cities (like Stockholm or Tokyo) where Choice points have fixed value – often yielding upwards of 1.5 cents per mile in savings.

The advantage of using miles for hotels is that it can cover lodging where airline programs don’t help. If you find yourself with a modest miles stash and rising hotel rates, converting to Wyndham or Choice can be a lifesaver. Twenty thousand miles could easily save you $200-$300 on hotels if used at the right properties. And importantly, Wyndham and Choice have no blackout dates for award nights (if a standard room is available, you can book with points), so it can be simpler than dealing with airline award seat availability.

4. $200 Worth of Travel Through Capital One Travel Portal

While the focus here is on outsized value, it’s worth mentioning the default, easy route: redeeming your miles through Capital One’s travel portal or as a statement credit for travel purchases. If you have a small trip planned and don’t want to fuss with airline programs, you can always use 20,000 miles to cover up to $200 of travel expenses.

For example:

- Book a round-trip flight on the Capital One Travel site for $180 — use 18,000 miles to pay for it at checkout (you can pay with miles like you would with cash in their portal).

- Or, buy a $200 Amtrak train ticket or pay for a hotel on your card, then go to your rewards and “Cover Travel Purchase” to get $200 credited back to your statement (for 20k miles).

The upside of this method is simplicity and flexibility: no need to find award availability or deal with transferring points. You also continue to earn airline miles or hotel points on bookings made with cash (even if you erase them later with miles). The downside is you’re capped at 1 cent per mile value. So this is best used when you can’t find a better-than-1cpp option or if you just want to quickly use the miles to save cash.

One scenario: Say you find a domestic flight for only $120 round-trip during a sale. Instead of transferring to an airline, you might just book it and wipe $120 with 12k miles. That’s fine – you still have 8k miles for another purchase. There’s no shame in using the purchase eraser for cheap travel if it makes sense; just try not to do it for expensive trips where an award could yield higher value.

5. Save or Combine for a Bigger Award (If Not Urgent)

Finally, one could argue the best use of 20k miles is to hold onto them until you have more miles and can book something bigger. This might not be a popular answer for someone itching to travel now, but consider that Capital One lets you pool miles from multiple cards and even transfer miles to other Capital One cardholders. If you’re close to a milestone award, it can pay to be patient.

For example, 20k miles on its own might get one person to Hawaii in economy (as we saw). But if you and your partner each have 20k, that’s 40k total – enough to get two round-trip tickets to Hawaii (20k each). You can combine your Capital One miles by simply sending miles to one another’s rewards accounts (Capital One allows free transfers between cardholders). Thus, sometimes the “best” use is to increase your balance and aim higher.

Similarly, you might hang onto 20k now because you’re working towards the next transfer bonus or a specific award. If you know you’ll earn another 20k in a few months through spending, you could target a 40k business class flight somewhere by combining. The key here is not letting the miles sit unused forever (don’t hoard for no reason) but strategically saving to unlock a better redemption threshold.

Pitfalls to Avoid When Redeeming 20k Miles

Redeeming 20,000 miles can be extremely satisfying, but there are a few pitfalls and common mistakes to be aware of:

- Don’t Settle for Gift Cards or Cash Back: Capital One allows you to redeem miles for things like gift cards or non-travel cash back, but at a poor rate (often only 0.5 to 0.8 cents per mile). For example, 20k miles might only net you a $100 Amazon gift card (0.5 cpp). This is a terrible value next to the travel options we discussed. Unless you have miles you absolutely can’t use for travel, avoid using them for cash, statement credits on non-travel, or shopping portals like PayPal/Amazon.

- Avoid High-Fee Redemptions: Some airline transfers can lead to big cash surcharges that kill the value. For instance, British Airways Avios are great for short flights, but if you tried to book a London to New York flight on British Airways with Avios, you’d pay maybe $200+ in taxes/fees along with the miles — not worth it for a $200 value of miles. With only 20k miles, you likely won’t venture into those high surcharge scenarios, but it’s good practice to check fees on any award booking. The options we highlighted (United via Turkish, AA via Avios, etc.) generally have low fees (just standard security taxes of $5-$50).

- Double-Check Award Availability Before Transferring: Transfers from Capital One to partners are irreversible. So make sure the flight or hotel night you want is actually available for booking with points before you move your miles. For example, don’t transfer to Turkish Miles&Smiles speculatively without confirming that United has saver seats open on your dates. If you transfer 20k to an airline and then can’t find an award, you might be stuck with orphaned miles in that program.

- Don’t Let Miles Go Unused (but no rush): While Capital One miles do not expire as long as your account is open, be mindful if you decide to close a card. If you earned a one-time bonus on a no-annual-fee card and think of closing it, use or move your miles first (you could transfer them to a partner or even to another Capital One card account you have). If the account is closed, any unused miles could be forfeited. Also, if you find you’re not using the miles, consider redeeming for some travel value rather than hoarding until devaluation hits. Points currencies occasionally get devalued (partners might raise award prices), so using 20k for a solid trip now is better than holding until it’s worth less.

- Overlooking Simplicity: On the flip side, don’t get too caught up chasing the perfect value if it complicates your life. For example, if you only have a weekend off and a specific flight in mind, using 15k miles to erase a $150 ticket you need is fine, even if theoretically you could have gotten 2x value elsewhere. The goal is to travel and enjoy the reward — sometimes the straightforward redemption that actually gets you on your way is the right call.

Final Thoughts on Spending 20,000 Capital One Miles

Having 20,000 Capital One miles opens the door to a surprising variety of travel experiences. With smart planning, you could be sipping a mai tai on Waikiki Beach thanks to an essentially free flight, or enjoying a weekend road trip where your hotel nights didn’t cost a dime. The flexibility of Capital One’s program – allowing both fixed-value redemptions and transfers to valuable airline/hotel partners – means you can tailor your strategy to your travel goals and get the most bang for your buck (or rather, bang for your mile).

To recap, the best uses of 20k miles include:

- A round-trip economy flight to Hawaii or anywhere in the US (via Turkish/United) – an outsize value for long flights.

- Several short-haul flights or a couple of domestic hops (via Aeroplan or Avios) – great for regional travel.

- One to three free hotel nights (via Wyndham or Choice) – turning a small points stash into real savings on lodging.

- Or simply $200 of whatever travel you want, if flexibility is paramount – an easy win.

By avoiding low-value redemptions and targeting sweet spots, you ensure your 20,000 miles deliver memories and meaningful savings. Even at this entry-level mileage amount, Capital One’s “miles” can function as a powerful travel tool. Use them wisely, and you’ll quickly see why no amount of miles is “too small” to matter.

So go ahead – plan that getaway, book that flight, or surprise your significant other with a hotel stay on points. With the strategies outlined here, your 20k miles can take you further than you imagined. Happy Travels!