Unlock Big Travel: How to Make 50,000 CapitalOne Miles Stretch Beyond $500

Unlock amazing travel with 50,000 CapitalOne miles! Use them for two economy flights abroad, a one-way business class treat, or several hotel nights. Transfer wisely to partners for max value, avoid low-value redemptions, and mix flights and hotels to stretch your miles into unforgettable trips.

If You Only Had 60 Seconds to Read This Article (Click Here)

Hitting 50,000 CapitalOne miles opens up a world of travel possibilities beyond the simple $500 baseline you get by redeeming through the portal or statement credit. This amount of miles can cover two economy tickets to popular international destinations like Europe or South America, or even one-way business class flights if you time transfers and promotions right. Whether you’re aiming for a couple’s getaway, a business-class treat, or a multi-night hotel stay, 50k miles is a sweet spot offering real flexibility and value.

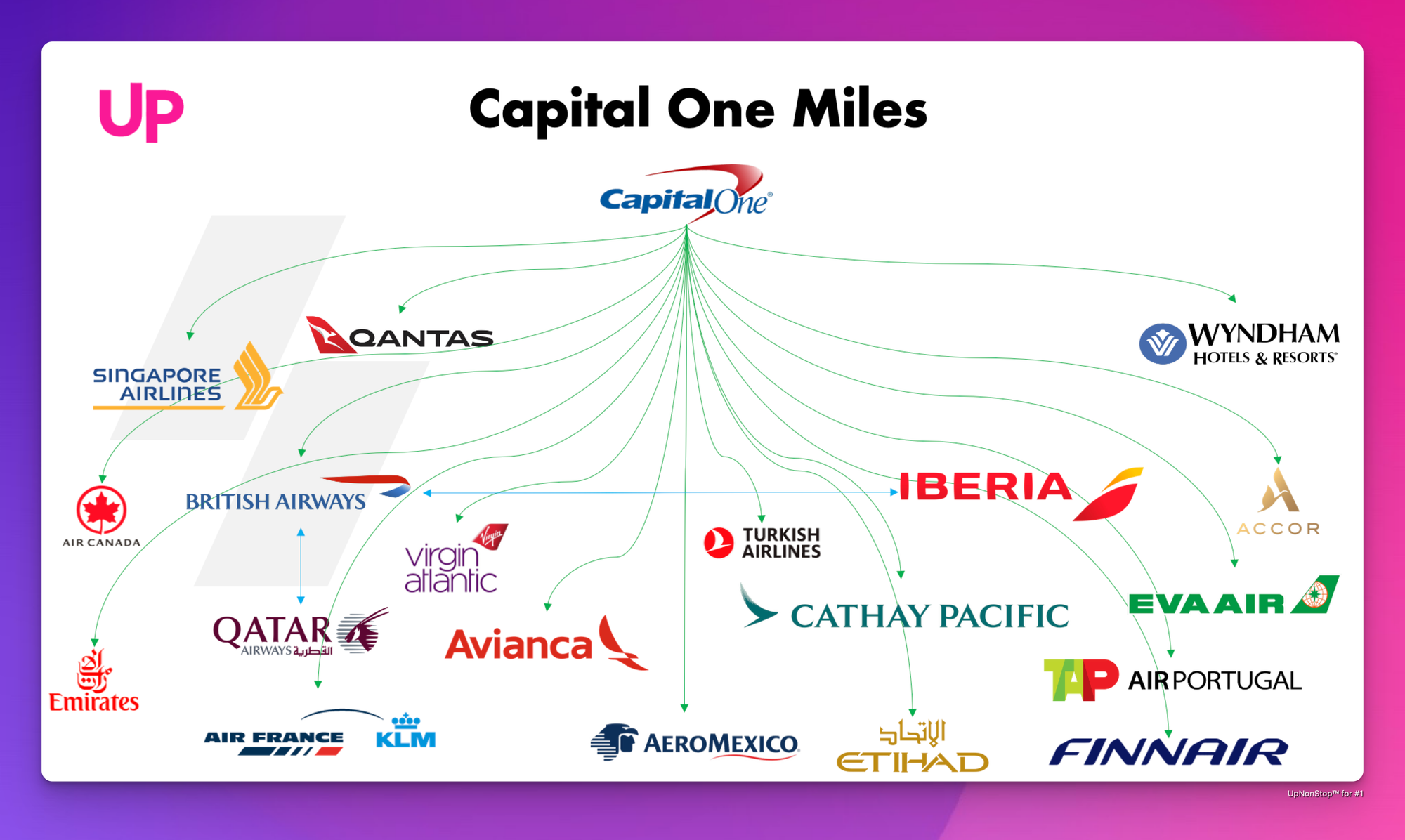

By transferring your miles to airline partners like Aeroplan, Flying Blue, or Avianca LifeMiles, you can unlock award flights that often cost significantly fewer points than the baseline redemption. For instance, two round-trip economy flights to Europe might require a bit more than 50k, but with creative planning—like booking one passenger’s ticket with miles and paying cash for the other—you can drastically cut your costs. You can also combine miles with a travel partner to double your power and book flights for two without breaking the bank.

Hotels are another great way to stretch 50k miles. Transferring to hotel partners such as Choice Privileges or Wyndham can secure multiple nights in comfortable or even all-inclusive resorts, sometimes covering a full week depending on location and category. Plus, mixing and matching your miles between flights and hotels can create a complete trip package, where you cover the big expenses with points and pay out of pocket for the extras, maximizing your overall savings.

Avoid common pitfalls like low-value redemptions (e.g., cash back or merchandise), transferring all miles prematurely without availability, or overlooking surcharges and fees that can diminish value. The key is strategic planning: match your miles to the travel experience you value most, monitor transfer bonuses, and consider your overall points portfolio. With careful moves, your 50,000 CapitalOne miles can transform from a number in your account to real, memorable adventures.

Everything else you need to know is just below 👇🏻

Turning 50k Miles into Big Travel

Hitting the 50,000 miles mark with CapitalOne is an exciting milestone. Whether you earned these miles from a generous sign-up bonus (50k is a common bonus on cards like the Venture Rewards) or through steady spending and maybe a referral or two, you now have a significant travel currency at your fingertips. The question is: how to deploy those 50,000 CapitalOne miles for maximum enjoyment and value?

At a bare minimum, 50,000 miles equals $500 in travel when redeemed through CapitalOne’s portal or as a travel statement credit. That’s nothing to scoff at – $500 could cover a domestic flight for two, a nice weekend hotel stay, or a chunk of an international ticket. But just like with 20k miles, the true power of those 50k comes from leveraging transfer partners and hunting down high-value redemptions that outperform the 1 cent-per-mile baseline. In other words, you can stretch 50,000 miles to unlock travel experiences worth $750, $1,000 or more with some savvy planning.

This article will delve into the best ways to spend 50,000 CapitalOne miles, focusing on travel redemptions that are particularly attractive at this point level. With 50k, you’ve moved into a range where business class flights enter the realm of possibility, longer international trips can be booked in economy, and multi-night hotel stays or even an entire vacation can be covered on points. It’s a sweet spot where you have a lot of options, but you’ll want to choose wisely to get the most joy out of every mile.

We’ll look at specific examples, from flying to Europe or Asia on points to taking a couple of big trips within the US, and even combining flights and hotels for one comprehensive getaway. Along the way, we’ll share pro tips on avoiding pitfalls (like low-value redemptions or unnecessary fees) and making the most of CapitalOne’s unique program features. The tone here is personal and exploratory – think of it as if we’re planning some awesome trips together, fueled by that stack of 50k miles.

Ready to see what 50,000 miles can do? Let’s explore the possibilities.

50,000 Miles in Context: Baseline Value and Potential

First, frame the value: 50,000 CapitalOne miles = $500 toward travel if used at the basic rate. That could mean:

- Wiping out a $500 airfare or hotel bill using Purchase Eraser.

- Booking a $500 trip through the CapitalOne Travel site for “free.”

- Getting $500 in travel gift cards (though, as we’ll discuss, there are often better options than gift cards or cash-like redemptions).

However, as we’ve learned, transferring to partners can amplify that value. With 50k miles, you’re in a position to consider awards like flights that cost 40k-60k miles round-trip in economy or 50k+ for one-way in business class. Many international economy awards fall in the 30k-50k range one-way, and some business class awards start around 50k-75k one-way. You might not have enough for a round-trip in business class to every destination, but you could potentially snag one premium cabin flight and really treat yourself, or cover round-trip economy flights for two people to certain regions.

It’s also a handy amount for hotel points: 50k transferred to a hotel program can cover multiple nights, especially with Choice or Wyndham (for example, 50k Choice points might book 3-6 nights depending on the hotel category).

To visualize the possibilities:

- $500 in travel (baseline) – maybe a domestic flight for two, like two $250 tickets, basically covered by 50k miles.

- One-way business class flight internationally – e.g., ~50k to 60k can often get a one-way business class to Europe or South America via certain partners.

- Round-trip economy for two to Europe – often ~60k per person round-trip to Europe in economy, so 50k is slightly short for two, but perhaps two round-trips to the Caribbean or Central America for two people is doable (those can be ~40k each person round-trip).

- Multiple domestic flights – 50k could fund several domestic round-trips in economy on partner award charts.

- Hotels – up to 4 nights at 12.5k/night (Choice), or 3 nights at 15k (Wyndham) with some points spare, etc.

Every traveler’s priorities differ. Some might want to use 50k for one grand experience (like a lie-flat seat on a long flight), others might want to maximize the number of trips or people it covers (like flights for the whole family on a shorter route). The good news is, with 50,000 miles, you have enough to make a variety of plans feasible.

Let’s dive into some of the top ways to redeem this chunk of CapitalOne miles for outsized value.

Top Redemption Options for 50,000 CapitalOne Miles

1. Fly to Europe (or South America) in Economy – Two Tickets

One of the most enticing uses of 50k miles is to get an international trip for two in economy class. While business class is nice (we’ll cover that next), the ability to cover both you and a companion’s airfare for a big trip is huge. With careful partner selection, 50,000 miles can nearly achieve this for certain destinations:

- Europe for ~60k round-trip per person: Typical round-trip economy awards to Europe run around 60,000 miles per person on many airline programs (like 30k each way). With 50k, you’re a bit short for two round-trips. However, there are some cases where you can get economy seats for fewer miles. For example, Air France/KLM Flying Blue (1:1 transfer) often has promotional rewards or off-peak pricing where a one-way transatlantic flight can be 15,000-20,000 miles. If you catch a Flying Blue Promo Reward sale, you might see round-trip economy from the East Coast to Europe around 35k-40k per person. Two of those would be ~80k total, still above 50k. But what if you just cover one person with miles and pay for the companion’s ticket? 50k could cover one round-trip (say 40k) and you pay cash for the other – effectively halving the cost for the pair.

- CapitalOne + Partner combo: If you and your travel buddy both have CapitalOne miles, combining forces could easily hit ~100k, enough for two round-trip tickets to Europe. For instance, you have 50k and they have 50k; you could each transfer to Aeroplan or British Airways and book each person’s flight separately on points.

- South America or Central America: Don’t forget South America: Avianca LifeMiles (another 1:1 partner) and Aeromexico (1:1) have decent economy award rates to Latin America. For example, LifeMiles might charge ~30k round-trip to northern South America (Colombia, etc.) in economy, or ~40k-50k to the southern part (Argentina/Chile). With 50k, you could possibly get two round-trips to the Caribbean, Mexico, or Central America. Aeromexico Club Premier (also 1:1) uses a kilometer-based currency, but roughly, you could get Mexico or the Caribbean for both of you in economy with 50k miles if you navigate their chart (they partner with Delta too).

As a concrete scenario: 50k miles to Aeroplan – You find flights from Montreal to Paris at 35k Aeroplan points round-trip per person (Air Canada has some lower bands for closer distances or off-peak). You transfer 35k for yourself, book your round-trip. Now 15k miles remain, which you could use to offset part of your companion’s ticket or save for a future trip. Alternatively, maybe you transfer the full 50k to Aeroplan and book both of you one-way to Europe (25k each in economy one-way). Then pay cash or use other miles for the return. This split strategy still cuts your total trip cost significantly.

The key is that 50k miles can substantially dent the cost of an international vacation for two. By using miles for one direction or one person, you reduce the cash outlay. It’s a flexible chunk – you decide how to apply it. If your goal is to see more of the world with someone, this is a great use.

2. Experience Business Class – One-Way in Style

If you’ve amassed 50,000 miles, you might be daydreaming about trying a lie-flat business class seat on a long flight. While 50k usually isn’t enough for a round-trip in business, it can often cover a one-way business class ticket to certain regions. This can be a great way to treat yourself to comfort on either the outbound or return leg of a journey.

A few examples of what ~50k miles can do in business class:

- Transcontinental U.S. in Business: Air Canada’s Aeroplan charges as low as 25k points one-way for business class on a transcontinental route (like New York to Los Angeles) if it’s under a certain distance. Specifically, flights around 2,000-3,000 miles can be 25k-30k in business if you use Aeroplan on a partner like United. That means 50k could book a nice round-trip business class ticket across the country. United’s lie-flat p.s. business class from Newark to LAX, for example, could be booked via Aeroplan for ~25k each way at saver levels. Instead of paying perhaps $700-$1,000 cash for a round-trip flat-bed seat coast-to-coast, you spend 50k miles – a solid deal (~1.4-2 cents per mile).

- One-way to Europe in Business: Many programs charge between 60k and 70k miles one-way for business class to Europe. You’re slightly short of that with 50k. However, there are a couple of wrinkles: Flying Blue (Air France/KLM) sometimes has Promo awards, e.g. business class from certain U.S. cities to Europe for ~45k one-way. Or consider Turkish Miles&Smiles – before their devaluation, it was 45k one-way in business to Europe on Star Alliance. Post-devaluation, it’s higher (85k). But Avianca LifeMiles often charges 63k one-way business to Europe on Star Alliance. 50k isn’t enough alone, but what if you catch a transfer bonus to LifeMiles? If CapitalOne offers, say, a 30% bonus to LifeMiles, you could transfer 50k and receive 65k LifeMiles – just enough for a one-way business class on, for instance, United or Lufthansa to Europe. It requires a bit of timing luck, but it illustrates that 50k can be on the cusp of such an award.

- One-way to Asia in Business (via a sweet spot): Asia is generally pricier, but there are gems. As we saw earlier, Virgin Atlantic’s partnership with ANA (All Nippon Airways) has business class from the U.S. west coast to Tokyo for 52,500 Virgin points one-way (and 60k from the East Coast). If you have 50k, you’re just shy, but perhaps you could transfer 50k CapitalOne to Virgin and top up 2,500 points from a different source or using CapitalOne’s purchase eraser for a small points purchase. Alternatively, Qatar Airways Qsuites (one of the best business classes) can be booked via British Airways/Qatar Avios for around 70k Avios one-way from the U.S. to Doha (off-peak). 50k doesn’t reach that, but again if a transfer bonus comes (like a 40% bonus to Avios, which has happened), 50k would become 70k – bingo, Qsuite time.

Maybe those exact scenarios require extra luck, but consider South America: some northern South America destinations have biz class awards around 35k-50k one-way. For example, Avianca LifeMiles might charge ~45k for business to Lima, Peru from Miami. That’s within your budget. Or even domestic first class for the entire family – 50k could seat two people round-trip in domestic first on a 2-3 hour flight if you use Avios (e.g., 25k Avios each round-trip for a mid-distance domestic flight in first on American). The “wow” factor of first or business class, even if just for one leg of a trip, can greatly enhance your travel experience.

3. Two Round-Trip Flights to Hawaii or Mexico for a Couple

In the 20k miles article, we highlighted using 20k for one round-trip to Hawaii. With 50k, you can take your companion along or even cover two separate trips. Specifically:

- Hawaii for Two: Turkish Miles&Smiles at 20k per round-trip economy to Hawaii means 40k miles covers two round-trips. You and your partner could jet off to Honolulu from anywhere in the continental U.S., all covered by points. You’d have 10k miles left over (from your 50k total) which could be used for inter-island flights (those can be bought for around $100 or 6-7k miles if needed) or perhaps a hotel night via Wyndham/Choice. This is one of the highest value uses for a pair of travelers – flights to Hawaii are often $400 each, so 40k miles yielding ~$800 in value (2 tickets) is a big win.

- Mainland U.S. flights for a family: Alternatively, you could use 50k to book several domestic flights for your family. At 10k each way on Turkish (United) domestically, 50k miles equates to five one-way tickets in the U.S. For example, a family of four could do a one-way trip and you pay cash coming back, or vice versa. Or two round-trips and an extra one-way for someone. If you have kids off at college or family in different cities, 50k in this sweet spot can really reduce holiday travel costs by covering multiple segments.

- Mexico, Central America or Caribbean: Many airline programs have separate award pricing for nearby international destinations. For instance, Aeroplan might charge 40k round-trip per person for U.S. to Central America in economy (so 80k for two, a bit high for 50k budget). But British Airways Avios is great for the Caribbean if departing from the East Coast (short distances). E.g., Miami to Grand Cayman is ~7,500 Avios one-way per person; two people round-trip = 30k Avios. Miami to Cancun might be ~9k Avios each way per person (36k for two RT). These fall well within 50k. So you can treat yourself and a friend to a beach vacation in the Caribbean or Mexico with your miles. Even factoring in taxes (which might be $100 or less each), it’s an excellent deal. If you paid cash, flights to these destinations can be $300-$500 each round-trip, so using ~30-40k miles for two could be 1.5-2 cents per mile.

Think of 50k as enough to plan a vacation for two. For example: 50k transfers to British Airways Avios. You book two round-trip flights from Dallas to Cancun (requiring ~40k Avios total). You then have ~10k left which you transfer to Wyndham for one free hotel night at a Wyndham All-Inclusive resort in Cancun (15k needed – maybe you had a few leftover miles from card spend to reach 15k, or you choose a mid-tier resort at 15k and cover the 5k shortfall with a little cash or by earning more miles by the time of booking). Suddenly, flights are free and one night of your resort is free – you’ve drastically reduced the cost of the trip with 50k miles.

4. A Week-Long Hotel Stay (or More) via Transfer Partners

If free flights aren’t your priority or you have other points for flights, 50,000 CapitalOne miles can create a hotel-heavy redemption, possibly covering a week’s lodging on vacation:

- Choice Privileges: 50k Choice points can go a long way. Many Choice hotels in, say, Southeast Asia or parts of Europe can be 8,000-12,000 points per night. For instance, a Comfort Hotel in Tokyo or a Quality Inn in Stockholm might be 8k-12k points. If you averaged ~10k a night, 50k yields 5 nights. In some cases, Choice runs promos where if you book 4 nights on points, the 5th night is free (this has been a feature of some hotel programs). If applicable, 50k could potentially stretch to 5 nights with a 4+1 deal if you plan correctly. That’s almost a full vacation’s accommodations for zero cash.In the U.S., Choice hotels in tourist areas can be closer to 16k-20k points per night (for nicer Ascend Collection properties for example). Even then, 50k gives you 2 or 3 nights free. You might pair that with flights covered by other means, and suddenly a long weekend trip’s main costs are gone.

- Wyndham Rewards: With 50k Wyndham points, you have a few interesting options. Wyndham’s award cost is often a flat 15,000 per night for their best hotels. So 50k covers 3 nights at a top-tier resort (45k for 3 nights, leaving 5k). For example, the Wyndham Alltra Cancun (an all-inclusive resort) is 15k points per person, per night (all-inclusive often charge per guest on points). So 50k might get two people one all-inclusive night (since it'd be 30k per night for two, which is steep). However, a better use: some Wyndham condo-style resorts (Club Wyndham or Vacasa vacation rentals via Wyndham) can be booked for 15k per bedroom per night. You could do a 3-night stay in a condo that sleeps 4 or 6, for 45k total – great for a family trip to e.g. Orlando or ski resort condos that are in Wyndham’s network.Also, Wyndham has some properties at 7,500 points per night (often lower-end Days Inn, Super 8 types – not glamorous, but if you’re road-tripping, 50k could get you 6 or 7 nights at motels along your route, completely free). Or consider Wyndham’s partnership with Caesar’s in Las Vegas: certain Caesar’s hotels can be booked with Wyndham points; 15k might get you a night at a Vegas hotel that could cost $150-$200.

In short, 50k miles turned into hotel points can take a big bite out of lodging costs. The value proposition is: if a hotel night costs $150 cash but 10k points, you’re getting 1.5 cents per mile. If it’s $250 cash or 15k points, that’s ~1.67 cents per mile. These are good returns, plus the psychological win of not paying cash for your stay.

5. Split Your Miles: Flights + Hotels Combo

Why not do a bit of everything? With 50k, you can mix and match redemptions to cover a full trip’s major components. For example:

- Fly and Stay package: Transfer 30k miles to an airline for flights, and 20k to a hotel program for stays. Suppose you transfer 30k to Avianca LifeMiles and book a round-trip flight from Miami to Costa Rica for one person (around 30k in economy). Then transfer 20k to Choice and book 2 nights at a boutique hotel in Costa Rica at 10k/night. If you’re traveling with someone, you might pay for their flight, but you got one ticket and two nights free, cutting your vacation cost significantly.

- Another scenario: Use 40k for flights (20k each for two domestic round-trips via Turkish for Hawaii or similar) and 10k for a hotel (one night via Choice/Wyndham). If you and a partner are doing a three-night getaway, you could get both flights covered and one of the hotel nights free using 50k. You’d only pay out-of-pocket for two hotel nights and maybe some meals – very budget-friendly way to vacation.

The combo approach is highly personal – it depends on where you’re going and what the big expenses are. The beauty of CapitalOne miles is that you’re not locked in: you can decide to allocate part of your miles to one travel need and part to another. This can sometimes produce the highest overall satisfaction if, say, flights are cheap but hotels are expensive (use miles for hotels), or vice versa.

In many cases flights are the best target (as they can be pricey and fully coverable by miles), but don’t ignore situations where hotels might be more burdensome (e.g., NYC or SF hotel rates vs a cheap flight there).

Pitfalls to Avoid with 50k Miles

With more miles to play with comes more temptation to use them in suboptimal ways. Steer clear of these pitfalls:

- Low-Value Redemptions (Again): The advice from 20k holds – avoid using 50,000 miles for non-travel redemptions like cash back (which would only be $250 at 0.5¢ per mile) or merchandise. $250 in statement credit for 50k is a poor trade when you can get $500 in travel, or potentially $750+ in value via strategic transfers. Similarly, don’t blow them on overinflated “Pay with Miles” options like Amazon shopping (which gives 0.8¢ per mile at best). Keep your eye on travel to get the full cent or more per mile.

- Transferring All to One Partner Prematurely: With 50k, you might think “I’ll just dump all of it into X airline” because you have enough for something big there. But make sure that’s the redemption you want and it’s available. Nothing’s worse than moving 50,000 miles to an airline, then plans change or you find no award seats. For example, transferring all to Emirates Skywards aiming for a business seat, then discovering no availability on the dates you need – now your points are stuck in Skywards (where other uses might not be as valuable). Always verify the award and consider keeping some miles back if not needed. You don’t have to transfer the full 50k if, say, a flight only costs 40k – transfer exactly what’s needed.

- Ignoring Surcharges and Fees: As you venture into bigger trips (especially international, business class, etc.), pay attention to additional fees. Some programs (like British Airways Avios, Emirates Skywards for certain routes, etc.) can impose large fuel surcharges. Those can eat into the value of your redemption or negate the appeal. For instance, using 50k Avios for a British Airways premium economy flight to London might sound nice, but if it comes with $300 in fees, yikes – maybe better to use a different partner (like Aeroplan on the same route with no fuel surcharges). Check blogs or the airline program’s information on fees before committing miles.

- Not Considering Opportunity Cost: This is a subtle one – if you have 50k CapitalOne miles, also think of what other points you have and the best use across them. Don’t use your CapitalOne miles at 1cpp for something if you have, say, some airline miles that could have covered it while you could have transferred CapitalOne to another need. For example, if you have 50k Delta SkyMiles sitting around and you want to book a domestic flight, maybe use the Delta miles for that, and save CapitalOne miles for a partner that Delta can’t cover (like a hotel or another airline). Essentially, coordinate your point currencies to maximize each – CapitalOne’s strength is flexibility, so use it where flexibility is needed or where other points can’t reach.

- Overpaying in Miles: Sometimes using miles for convenience can lead to spending a ton for a small return. One such trap: CapitalOne’s partnership with PayPal or Amazon at 0.8 cents value. 50k miles would give you $400 in buying power via PayPal, which might seem easier than dealing with travel booking, but you’re giving up $100 of value compared to travel usage (since $500 vs $400). That’s like paying a 20% premium just for convenience. Resist this unless you’re in a bind – if you truly can’t travel, maybe, but otherwise it’s a loss. Also, through the travel portal, check prices: if a flight costs $300 through CapitalOne Travel but you find it for $250 directly with the airline, it’s better to buy direct and use miles to erase (since you’d only use 25k vs 30k in the portal). Always compare to ensure you’re not overspending miles.

- Cancelling Cards Prematurely: If those 50k came from a sign-up bonus and you’re thinking of closing the card after a year, remember you’d lose the miles if you close without using them. Either use them or downgrade/transfer them to another CapitalOne card that earns miles (e.g., if you have Venture X and VentureOne, and decide to close one, move miles to the other account first). Just a housekeeping note to preserve your rewards.

Final Thoughts on Maximizing 50,000 Miles

With 50,000 CapitalOne miles, you’re holding a travel treasure trove that can be shaped into many different adventures. The key is to align your redemption with your travel aspirations and get as much personal value out of those miles as possible. You might opt to elevate one trip to luxury by flying business class, or multiply the number of trips by covering multiple flights in economy for you and loved ones. There’s no one “right” way – the right way is what brings you the most happiness and memories for those 50k points.

To recap some of the standout ways to spend 50k:

- Fly two people somewhere special (Europe, Hawaii, Caribbean) in economy – making a vacation possible or much cheaper.

- Sample the good life in a business class seat, perhaps on a flight you’d never pay cash for – a bucket list experience.

- Cover a week’s worth of hotel nights on points – removing a huge chunk of vacation expense.

- Mix flights and hotels to cover an entire trip’s core costs – stretching your miles across multiple needs.

- Or even keep it simple: $500 in random travel purchases wiped off your credit card statement – zero out a couple weekend getaways’ costs.

By avoiding common mistakes like low-value redemptions and planning out your transfers carefully, you ensure every one of those 50,000 miles works hard for you. It’s a wonderful feeling to see a trip come together and realize “I only paid taxes and fees for this” because your miles took care of the rest.

So, dream a little. Where have you always wanted to go? What’s next on your travel list? With 50k CapitalOne miles in your pocket, you might be closer to that goal than you think. Happy travels, and enjoy turning those miles into memories!