Stop Settling for $1,000: How to Turn 100,000 Capital One Miles Into Jaw-Dropping Luxury and Multiple Trips

With 100,000 CapitalOne miles, you can cover $1,000 in travel at base value—but smart transfers to partners like Aeroplan or Etihad can unlock $1,500 to $4,000+ in premium flights. Use miles strategically for business class, economy round-trips, multi-stop journeys, or luxury first-class adventures!

If You Only Have 60 Seconds to Read This Article (Click Here)

With 100,000 Capital One miles, you hold a travel currency worth roughly $1,000 at baseline, but strategic transfers to airline partners can unlock $1,500–$4,000+ in value. Transferring miles 1:1 to partners like Aeroplan, Flying Blue, or Etihad Guest opens up business class round-trips to Europe or South America, premium cabins with lie-flat seats, and multi-city itineraries that maximize your spend.

Two economy round-trip tickets to many global destinations are also feasible with 100k miles. Programs like Aeroplan or Flying Blue occasionally offer promos reducing the miles needed for long-haul economy flights, enabling couples to fly round-trip internationally within this balance. Additionally, 100k miles can cover multiple smaller trips domestically or internationally, offsetting travel costs across a year for frequent travelers.

For aspirational travelers, 100k miles can fund ultra-luxury one-way first-class experiences like ANA’s “The Suite” or Emirates A380 First Class, yielding incredible value (sometimes 15–17 cents per mile). These bookings require planning and flexibility but can transform your travel with a once-in-a-lifetime journey while leaving some miles left over for other trips.

The key to maximizing 100,000 miles is thoughtful planning: balancing splurges with practicality, leveraging transfer bonuses, avoiding low-value redemptions, and considering multi-stop or open-jaw itineraries. With this approach, your 100k miles can either unlock premium travel or fund multiple adventures, turning your miles into unforgettable experiences instead of mere statement credits.

Everything else you need to know is just below 👇🏻

A Fortune of Miles Awaits

One hundred thousand miles – just say it out loud. It has a nice ring, doesn’t it? 100,000 Capital One miles is a hefty sum that can unlock truly extraordinary travel experiences. Perhaps you earned this windfall from the Capital One Venture X’s sign-up bonus (historically around 100k at launch) or you combined points from multiple Capital One cards. Maybe it’s the fruit of a couple years’ worth of spending and savvy budgeting. However you got here, congrats! You’re now sitting on a balance that many travelers only dream of.

To put it in perspective, 100k miles equates to $1,000 in travel when redeemed at the base value through Capital One (1 cent per mile). A thousand dollars can get you quite far on its own – a domestic round-trip for a family, or one person’s flight to Europe plus some hotel nights, for example. But as loyal readers know by now, we can often do far better than 1¢ per mile by leveraging transfer partners and strategic redemptions.

With 100,000 miles, the game changes: premium cabin awards, round-trip business class flights, or multiple economy trips for multiple people all become feasible. You have enough miles to plan a big international vacation or several smaller ones. Want to fly lie-flat business class to Europe and back? You can. Want to take your family of four on a domestic trip using miles for flights? You can likely do that too. How about a luxurious first-class one-way to Asia as a bucket list item? That’s within reach with 100k (especially if you top up just a bit or catch a transfer bonus).

This article will explore the best uses of 100,000 Capital One miles, blending data-driven value calculations with the personal, exploratory tone of trip-planning excitement. We’ll consider scenarios like:

- Business class to various parts of the world (and how to maximize those redemptions).

- Round-trip travel for two (or more) in economy or premium economy.

- Combining flights and hotels for one epic journey.

- Potentially using a portion of these miles for multiple different trips if you prefer quantity over one big quality blowout.

- Pitfalls to avoid (even with a lot of miles, you want to use them wisely).

By the end, you should have a clear picture of just how far 100k miles can take you – and some concrete ideas to turn those points into your next adventure. Let’s dive in and dream big!

The Baseline: 100k Miles = $1,000 (But We Can Do More)

It’s worth reiterating: if you did nothing fancy, 100,000 Capital One miles can pay for $1,000 of travel through the simple methods:

- Booking travel via Capital One Travel portal and using miles to pay (flights, hotels, car rentals – whatever).

- Using Purchase Eraser to wipe $1,000 of travel expenses off your statement.

That alone could fund, say, two round-trip tickets to Europe in economy during an off-peak sale (many Europe flights can be found for ~$500 each off-season). Or it could cover a week at an all-inclusive resort in the Caribbean if you find a $1,000 package deal. It’s a substantial chunk of value.

However, when transferred to the right partners, 100k miles can sometimes fetch 1.5 to 2 cents or more per mile in value – meaning potentially $1,500-$2,000 worth of travel if you maximize things. This is not hypothetical; many real-world redemptions achieve those figures:

- A business class flight that would cost $3,000 for 75k miles = 4¢ per mile, which would value 100k at $4,000 (extreme case, but possible in first class or biz).

- More commonly, maybe $1,500 in flights for 100k (1.5¢ each) or $2,000 for 100k (2¢ each) with smart usage.

The flexible nature of Capital One miles also means you can slice that 100k into different uses. You could allocate 60k for one big flight and 40k for other travel, for instance. With a balance this high, you have the luxury of mixing strategies:

- Splurge on one segment of a trip (like business class on the long-haul leg) and go economy on the way back to stretch miles.

- Or do one major trip entirely on miles and still have enough left for a domestic flight later.

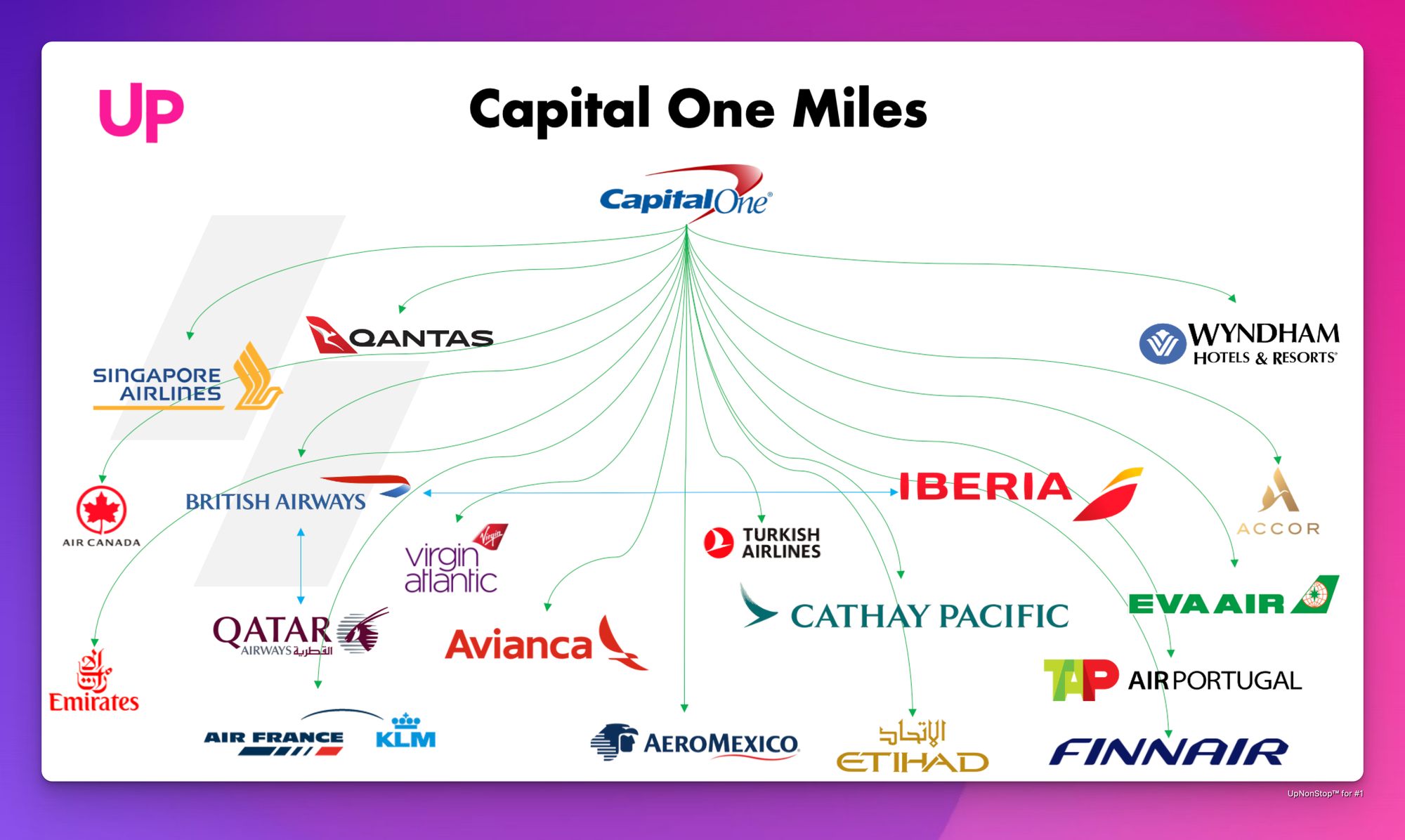

Keep in mind, too, that Capital One transfer partners largely operate at 1:1 (with a couple exceptions like JetBlue, but most are 1:1). So 100k Capital One = 100k miles in programs like Aeroplan, Avianca LifeMiles, Flying Blue, British Airways, etc. That’s a significant balance in any of those programs — enough to redeem for some of their top awards.

Let’s break down some prime ways to deploy 100k miles for maximum travel enjoyment.

Best Ways to Redeem 100,000 Capital One Miles

1. Round-Trip Business Class to Europe or South America

Flying business class on a long flight is a game-changer – lie-flat beds, better food and service, lounge access, the works. With 100k miles, you can almost cover a round-trip in business class to many destinations. Depending on the program and route, business class awards round-trip are typically:

- Europe: ~120k to 140k miles round-trip per person in many programs (e.g., 60-70k each way).

- South America (deep South like Argentina/Chile): similar to Europe, often 100k-130k round-trip.

- Closer regions (like U.S. to Northern South America or the Caribbean): sometimes less, maybe 70k-100k round-trip.

While 100k might not always fully cover one person’s business RT in some programs, it goes a long way. And if you have the ability to top off slightly or catch a transfer bonus, you’re there. Or consider one person on points, another on cash or economy, etc. But let’s focus on the scenario of using points:

Air Canada Aeroplan (1:1 transfer): Aeroplan has a distance-based chart. For example, a flight from the US East Coast to Western Europe might be 60k points one-way in business if under 4,000 miles distance (Newark to London just squeaks in, or Montreal to Paris, etc.). West Coast to Europe could be 70k-75k one-way if farther. So a round-trip per person is maybe 120k-140k. If you have 100k, you could do:

- One person’s round-trip business class to Europe with a 20-40k point shortfall. You could cover one way fully (60k) and the other way 40k of 60k needed, then perhaps use 20k from a different source or economy on the way back. Alternatively, if you and a companion both have 100k each, then 100k from each = 200k, enough for two round-trips in business to Europe (approx 120k-130k each, it fits).

- Another approach: Aeroplan allows one stopover on a one-way for +5k points. With 100k, you could book a one-way in business to Europe with a stopover (say, New York -> Frankfurt (stop 5 days) -> Istanbul, all in business for maybe 70k + 5k = 75k). Then you still have 25k left to get home in economy on another program or to use elsewhere. This way, you turned 100k into a mini Euro-trip with two destinations in business class.

Avianca LifeMiles (1:1): LifeMiles has competitive Star Alliance rates and no fuel surcharges. Typically ~63k one-way business to Europe on partners. So 126k round-trip. 100k covers most of it. If you catch a frequent LifeMiles sale or redemption discount, sometimes they run “spend X fewer miles” deals. For example, they’ve had promos like Europe for 55k one-way in biz. If that happened, 110k round-trip, now we’re talking – 100k almost covers, maybe use 10k from card spend to top off.

Etihad Guest (for American Airlines flights): There’s an interesting angle: Etihad is a 1:1 partner of Capital One, and Etihad’s award chart for American Airlines flights (a partner of Etihad) still has some fixed pricing gems. For instance, AA business class from U.S. to Europe is 50k Etihad Guest miles each way (so 100k round-trip) if saver space is available. This is amazing because American would charge you 57.5k each way in their own program. So with 100k Capital One transferred to Etihad, you could exactly book a round-trip business class on American Airlines metal to Europe (assuming you find saver award space on AA flights). No fuel surcharges either, just taxes (~$100 or less). This is a sweet spot: two segments in AA lie-flat business (perhaps on their 777 or 787) for only 100k. It could be New York to London, or Miami to Madrid, etc. The challenge is finding the saver availability on AA, but if you do, that’s one person’s entire biz trip covered by your points.

Similarly, Etihad’s chart for AA to South America is 50k each way in business to “Southern South America” (e.g., Chile, Argentina), and cheaper to Northern SA (like 30k each way business to Colombia). So actually, with 100k via Etihad Guest, you could do two one-way business class tickets on AA: for example, one to Europe (50k) and one to Chile (50k). Not that you’d necessarily split like that, but it shows what’s possible.

Air France/KLM Flying Blue (1:1): Usually around 55-70k one-way biz depending on city and date, but they run monthly Promo Rewards. Perhaps you might see something like 25% off business class to Europe from certain cities – occasionally popping up at ~50k one-way. If you nab that, 100k = round-trip business for one. If not, maybe 100k can get you a one-way for two people (e.g., 53k each one-way, ~106k total needed, very close – maybe you have a few extra miles from spending to round it).

South America via other programs: United’s old rates were 60k each way to deep S.A., LifeMiles matches that at ~60-63k. There might be opportunities to use fewer miles on partner programs like Copa’s ConnectMiles or using Avios on Iberia to fly to South America via Spain (Iberia has decent business rates to Spain, but beyond that not sure). But the standout is the Etihad-for-AA trick again: AA to Brazil/Argentina for 50k each way business via Etihad miles.

Imagine sitting in a lie-flat seat, sipping champagne as you cross the Atlantic or cruise down to Patagonia, knowing that you paid next to nothing out of pocket. That’s the magic of 100k miles redemption done right.

Transfer bonuses: Capital One has offered bonuses like 20% to Flying Blue, 15% to Aeroplan, etc. If you wait for a 25% bonus to Aeroplan, 100k CapOne becomes 125k Aeroplan – now you definitely have a round-trip business in range.

Partner quirks: Some frequent flyer programs allow something called “open jaws” (flying into one city and out of another on a round-trip) or stopovers. You could use that to visit two places. For example, with Aeroplan’s stopover rule: 100k (plus maybe a bit more) could possibly get you a round-trip with a stopover: e.g., fly New York -> Paris (stop 5 days) -> Rome, return Rome -> New York, all in business. That’s multiple cities for one award price plus 5k for the stop. It’s an advanced move, but with 100k+ you have latitude to explore those possibilities.

2. Two Economy Round-Trips to Asia (or Other Far-Flung Locales)

What if instead of one person in business, you want two people in economy on a long-haul adventure? 100k miles can absolutely cover round-trip economy for two to many parts of the world:

- Europe for two: Many programs charge 60k per person round-trip economy to Europe. That’s 120k for two, which is above 100k. But some have cheaper, especially from East Coast or off-peak: Aeroplan might charge 70k per person RT if it’s distance-based and you’re West Coast which is longer distance, not great. But Flying Blueoccasionally has round-trip economy for ~45k per person during promos from East Coast (rare but possible). If you can find ~50k each, that’d be 100k for two – perfect. British Airways Avios could do it if you fly via partner Aer Lingus from Boston to Dublin (Avios needed might be around 26k each way per person off-peak, which is 52k RT each = 104k for two; slightly over, but maybe manageable if off-peak).

- Asia for two: Depending on which part of Asia:

- Japan: All Nippon Airways (ANA) has a partnership via Virgin Atlantic (like we discussed in earlier article) where 90k Virgin points = round-trip business from West Coast on ANA, but for economy it’s even less: only 55k Virgin points round-trip in economy from West Coast (and ~65k from East Coast) on ANA. That means 110k Virgin points could book two economy round-trips on ANA to Japan. 100k is just shy; but if you go one West, one East coast departure maybe average 60k each = 120k, still over. However, if you had a small transfer bonus or a bit extra from card spend, you could hit that. Or one person uses miles, one person buys a cash ticket – not ideal, but 100k could at least cover one fully and partly the other.

- Alternatively, Aeroplan: They charge around 75k per person round-trip to Japan in economy (depending on routing). So two would be ~150k; too high for our budget.

- Turkish Miles&Smiles: They have (or had) great economy prices: 47k round-trip to the Middle East, 60k to Asia etc (though need to confirm post-devaluation, likely higher now). If it were still ~70-80k per person to East Asia, that’s ~160k for two, too high.

- Asia Miles (Cathay Pacific): Asia Miles (also 1:1 transfer) might offer around 70k per person round-trip from US to Asia in economy on Cathay or partners. Two is 140k, still above.

- Consider a combination: 100k could cover one person in economy to Asia and the other person in economy to Europe on one trip (like if you did around-the-world style, one person’s Asia ticket and one person’s Europe ticket).

- Australia or Africa: These are farther and pricey:

- Australia usually ~80k-100k per person RT economy (on Qantas or others). So 100k might only cover one fully and part of another.

- Africa similar, often 80k+. But there was a sweet spot: Etihad Guest for American Airlines has economy to Africa for 37.5k each way (75k RT on AA metal via Etihad chart). Two would be 150k, again beyond 100k.

But what about South America or other medium-haul international?

- South America (Northern part, e.g., Peru, Colombia): Can be as low as 40k RT per person in economy with some programs. Two would be 80k total, which 100k easily covers. Even deep South (Brazil/Argentina) might be ~60k each, 120k for two (need a bit extra).

- South Pacific islands via Qantas or Fiji Airways? Might be too high.

Instead of pure pairs, you could use 100k for four round-trip domestic tickets or similar:

- For example, a family of four to Hawaii: at 20k each round-trip (Turkish on United), that’s 80k total. 100k covers all four and you have 20k leftover for maybe two hotel nights via Wyndham or for activities. A huge win for a family trip.

- Or four to anywhere domestic (maybe 50k leftover in that case if domestic flights are like 15k RT each short-haul).

However, for this section, let's stick to the exciting idea of two people to a far destination in economy:

Case study: You want to go to Thailand with your spouse. Cash tickets are maybe $1,000 each ($2,000 total). Instead, you transfer 100k Capital One to Air France/KLM Flying Blue during a 25% bonus promo (just hypothetical). You get 125k Flying Blue. You find availability from New York to Bangkok for 37,500 miles each way per person (75k round-trip each, which sometimes is around what Flying Blue charges via their partner network). That would be 150k for two, you have 125k (from your 100k). You’re short 25k; maybe you already had some miles in Flying Blue or you generate them from another card, etc. Not perfect yet.

Alternatively, you could do one person fully on miles, one person paid (makes one free essentially). But we want to maximize using exactly 100k:

Better example: British Airways Avios + Companion Fare. BA Avios has an infamous feature if you hold their credit card in US you get a companion ticket after big spending, but let’s avoid that.

What about 100k to United MileagePlus via points.com? Actually, CapOne doesn’t transfer to United directly. But CapOne does to Aeroplan (Air Canada) which can book United flights. If United has a sale in miles (like dynamic pricing could drop economy to Europe for 45k RT in off-peak), you could use Aeroplan points to book Star Alliance if they open saver seats.

Realistically, to cover two long-haul round-trips in economy entirely with 100k, you either target a sweet spot (like AA via Etihad, or a transfer bonus scenario, or perhaps an overlooked routing). Another trick: Open jaw and multi-city. For instance, you could do:

- Fly both of you to Europe (maybe low points cost or cash if cheap), then use 100k to get from Europe to Asia for both, then find a way back to US. That’s very ambitious though – a kind of mini round-the-world.

However, for an article structure, simply stating that two economy round-trips to many places can be done with 100k is fine, highlighting that it often covers a couple’s trip.

3. Around-the-World or Multi-Stop Trip in Economy (or Mixed Cabin)

If you’re an intrepid traveler, 100k miles can be parlayed into a multi-destination journey. One way is to leverage alliances and partner booking rules to string together stopovers:

- Star Alliance via Aeroplan: Air Canada’s Aeroplan allows one stopover on a one-way for +5k miles. So with 100k, you could attempt something like a one-way from US to Asia with a stopover in Europe. For example: USA -> Paris (stopover) -> Tokyo for 62.5k (one-way business might be too high, but economy could be say 40k + 5k = 45k one-way with that stopover). Then use another 45k to come back via a different route: Tokyo -> (stop in, say, Hawaii for a few days) -> USA, another 45k. That’s a total of ~90k. You just visited Europe, Asia, and Hawaii on one trip for 90k (in economy). This is just conceptual but Aeroplan’s global reach and stopover option makes creative routing possible.

- Oneworld via Asia Miles (Cathay): Cathay Pacific’s Asia Miles has a oneworld multi-carrier award chart. If you fly two oneworld airlines and include a stopover, you can actually have up to 5 stopovers on a round-the-world ticket using Asia Miles. The pricing is distance-based. For example, a journey up to 25,000 miles in total distance in economy costs 130k Asia Miles. 100k is short of that, but perhaps a smaller RTW (under 20,000 miles) could be maybe ~100k in economy (we’d need the exact chart). In business it’s more, but in economy possibly. If you had 100k Asia Miles (which you could get from CapOne with a transfer bonus or combining with other points), you could do something crazy like: New York – London – Hong Kong – Los Angeles – New York (a full loop) with multiple stops for around that many miles. This requires deep knowledge and planning, but hey, some travelers use exactly this technique to see multiple continents on one award.

- Using multiple programs: You could break your trip into segments using different point currencies. 100k CapOne miles could fuel one major segment (like US to Asia one-way in business ~75k, then Asia to Europe one-way in economy 25k using some other low-cost budget airline or cheap cash, then Europe back to US on separate points). With 100k, maybe it’s better to concentrate it in one or two chunks, though.

Pitfall alert: This is advanced and easy to mess up if you’re not used to award rules. It’s likely too much for a beginner, but it shows the flexibility – 100k can be spread across a long journey.

For writing purposes, perhaps we position it as: If you’re feeling adventurous, you can stretch 100k to cover multiple stops around the world in economy by utilizing stopovers:

For example, a single 100k Aeroplan booking (with a bit extra) could allow you to stop in two cities en route to a final destination. Or using Asia Miles for a multi-city itinerary. These more complex redemptions yield huge travel but require planning.

4. Luxury First Class One-Way (Emirates, ANA, etc.)

So far we focused on maximizing trips or business class. Another angle: blow a big portion of 100k on one ultra-luxurious first class experience, and use the rest for something else. Why would you do this? Because some first class redemptions are within reach of 100k and deliver a truly once-in-a-lifetime experience, often worth thousands of dollars.

- ANA First Class via Virgin Atlantic: We touched on ANA business via Virgin, but first class on ANA using Virgin Atlantic miles is 85k one-way from the US East Coast to Japan (or 90k round-trip in biz which we covered). So 85k gets you the famous ANA “The Suite” first class from, say, New York to Tokyo (one-way). That’s a $15,000 ticket if paying cash in some cases. For 85k points + maybe $300 in taxes, that’s insane value (~17¢ per mile!). With 100k, you could book that and have 15k left (maybe for a domestic flight later). Or if you have a partner with another 85k, you both could go one-way in first to Japan, then come home in business or economy. Many enthusiasts consider this one of the best redemptions in the game for luxury.

- Emirates First Class: Emirates Skywards charges around 136k miles round-trip or 85k miles one-way for first class between the US and Europe (e.g., New York to Milan route) on their A380 (with shower spa, etc.). 85k one-way NYC-Milan in first, plus ~$500 in fees. 100k CapOne could cover the 85k if you transfer to Emirates (1:1) and you’d pay fees out of pocket. Or via Aeroplan, you could book Emirates now too, but costs are similar. Emirates first from US to Dubai is more (about 136k one-way). But maybe US to Europe with Emirates, or to Middle East via some program, could be in the under-100k range one-way.

- Lufthansa First Class: If you want that LH First Class terminal experience (Frankfurt), it’s pricey in miles (usually ~110k United miles one-way or 87k Aeroplan one-way plus fuel surcharges, or 50k LifeMiles one-way but they rarely open seats early). Possibly too high unless you find a sweet spot. LifeMiles sometimes is 87k one-way first to Europe on LH, not worth it given surcharges. Probably skip Lufthansa due to complexity unless LifeMiles availability shows up.

- Singapore Airlines Suites: Via Singapore KrisFlyer (1:1 transfer), New York to Frankfurt is ~86k KrisFlyer miles one-way in the A380 Suites first class. That’s within 100k. You’d need to transfer to KrisFlyer (which is an option with CapOne). There would be maybe ~$200 in fees. It’s another aspirational one-way. 100k could also almost cover one-way Suites from US to Singapore (that’s like 132k, so too high).

- Qatar Airways Qsuite First (well, Qatar doesn’t really have first class except on A380 limited routes like Doha-Paris or Doha-London). That’s probably not easy to book with Avios unless you have Qatar’s own miles. Possibly skip.

- Etihad First Apartment: New York to Abu Dhabi in Etihad’s Apartments (A380) used to be 115k AA miles one-way. Not sure if it’s still around because Etihad grounded A380s for a while, but they’re bringing them back in 2023/24 on London route. You could transfer to Etihad Guest but their own pricing for first is high. Possibly not feasible with 100k unless something changes.

If you’ve never flown international first class, using about 80-100k of your points for a one-way indulgence can be worth it. You could pair it with an award in business or economy coming back using any remaining points or cash. For instance, use 85k for ANA first to Japan, then maybe pay for your flight home (or a cheaper miles booking home). You get the amazing experience in one direction and keep the overall trip cost low.

Additionally, note that transferring to Virgin Atlantic or Singapore KrisFlyer often has transfer times (not always instant, sometimes ~1 day for Virgin from CapOne, KrisFlyer maybe a day or two), so plan that into your booking strategy.

5. Cover a Year’s Worth of Getaways and Travel Expenses

Another approach to 100k is to think of it as your travel budget for the year – parceled out across multiple smaller trips. Not every redemption has to be a max cpm (cents per mile) blockbuster. You might prefer to travel more frequently in economy and use miles to save money on each trip. 100k can do a lot in pieces:

- Domestic long weekends: Perhaps you do four round-trip domestic flights at ~25k each (maybe coast-to-coast flights cost ~25k miles apiece if not found cheaper). That’s four trips in a year – e.g., one ski trip to Colorado, one beach trip to Florida, one visit to family for Thanksgiving, one spring break getaway – all flights covered by your miles.

- Combination of redemption types: Use 50k for one international trip’s flights, use 30k to cover hotels on another trip, keep 20k for spontaneous airfare sales (book with cash then erase with miles).

- Offsetting family visits or emergency travel: If family is spread out, 100k could guarantee you can get home for the holidays and a couple other occasions without worrying about high fares. It’s peace of mind – not necessarily maximizing value per mile, but value in life.

- Upgrades: If you travel for work and your company pays economy, some programs allow using miles for upgrades. 100k could potentially upgrade several long flights. However, Capital One miles themselves can’t directly upgrade on an airline; you’d have to transfer to the airline’s program and have an upgradeable ticket. That gets tricky but it’s an idea.

The point is, 100k miles can cover a lot of little things that add up. Maybe you redeem 10k here, 15k there, always targeting at least 1¢ value or better, and effectively save yourself $1,000+ in travel costs over the year.

This approach is more holistic: treat the miles like a travel savings account that you dip into whenever you have a trip. As long as you avoid the traps (like sub-1¢ uses), you’re still coming out ahead.

Pitfalls to Avoid When Using 100k Miles

With a larger balance, there’s a bit more cushion, but also potential to waste miles if not careful. Keep these pitfalls in mind:

- Blowing it all in one place without research: Just because you have 100k doesn’t mean you should throw 100k at the first itinerary that comes to mind. For instance, avoid redeeming 100k via the portal on a $1,000 economy ticket to London that you could have gotten for 60k via a transfer partner. Do a little research on partner options for big redemptions. It’s worth the time when so many miles are at stake.

- Overvaluing aspirational awards: Wait, didn’t we just sing praises of first class? Yes, but know thyself. If you burn 85k on a first class flight and then find yourself short of miles for a trip that really matters (like visiting family or a long-planned vacation), you might regret it. Balance bucket-list splurges with practical needs. In other words, ensure that using a chunk of miles for pure luxury won’t prevent you from taking another trip you’d otherwise do. Ideally, earn enough or have a plan to cover both.

- Letting points sit too long: Holding 100k indefinitely might expose you to devaluation (programs raising award prices). Capital One’s miles themselves don’t devalue unless partner ratios change (which they did improve in the past from 2:1 to 1:1, etc., but could go the other way too). It’s fine to save for a big goal, but have that goal in sight. Don’t hoard 100k for 5 years for no reason; something could change. Use them within a reasonable timeframe for maximum enjoyment.

- Mixing cash and points poorly: If you have 100k, you may consider mixing cash and point bookings for a trip (like pay for one ticket, use miles for another). That’s fine. But avoid scenarios where, say, you use miles for one person’s expensive ticket and pay cash for another’s expensive ticket when you could have instead both flown economy and saved a ton of miles or something. Evaluate the whole trip cost. For example, don’t use 100k miles for one first class seat and then have to pay $1,200 for your travel companion in economy out of pocket – unless that’s what you both want. Perhaps better would have been both in business for a bit more miles or both in economy and save miles for hotels, etc. Essentially, use miles to alleviate your biggest pain points in the budget, and consider both travelers if it’s a joint trip.

- Not leveraging companion tickets or card benefits: At 100k, you likely have a Venture X or multiple cards. The Venture X offers a $300 travel credit on the portal yearly and 10k bonus miles each anniversary. Don’t forget those perks in trip planning. They can complement your 100k miles. For example, use the $300 credit to book part of a trip (earning 5-10x miles on that booking too), then use miles to cover the rest. Also, some airline cards or programs have companion fares (Alaska’s Famous Companion Fare, BA’s Travel Together Ticket, etc.). If you have access to those, coordinate them with your miles usage to maximize overall value.

Final Thoughts on Spending 100,000 Miles

When you’ve accumulated 100,000 Capital One miles, you’ve earned yourself a world of possibilities. It’s a gratifying position to be in – this stash can unlock premium experiences or simply make travel much more affordable for you and your loved ones. The key is thoughtful planning: decide what your travel priorities are and let the miles serve those goals.

Are you chasing luxury? Then maybe that once-in-a-lifetime first class flight or a five-star hotel stay should be on the agenda. Do you prefer more trips over one fancy trip? Then stretch those miles over multiple vacations – perhaps a couple’s getaway to Europe in economy and a family trip domestically, all covered by the same pot of points. Want to share the love? Use the miles to take a friend or partner along somewhere they wouldn’t otherwise go – 100k provides a lot of cushion to be generous.

We’ve seen how 100k can:

- Fly you round-trip in business class to far-off destinations like Europe or South America, nearly free.

- Cover two passengers’ flights on major international routes in economy, bringing travel dreams to life for a pair.

- Even dip a toe into the ultra-luxe world of international first class for a truly special journey.

- Or simply remove the financial barriers from several trips throughout the year, making spontaneous travel a reality.

By avoiding common pitfalls (like low-value redemptions or letting points languish unused), you can ensure your 100,000 miles deliver maximum impact. Every mile is a tool to enhance your travel, and at 100k you have a well-stocked toolbox.

One more thing: as you use these miles and save money on travel, consider “reinvesting” in your travel hobby. The money you didn’t spend on flights could perhaps go towards a nice meal on the trip, or maybe paying the annual fee on a card that will give you another big bonus for the next trip. In that way, the cycle continues – your 100k miles unlock amazing experiences, and those experiences fuel you to earn and learn more in the points game.

Now it’s over to you. Sketch out that itinerary, price out those awards, and don’t be afraid to get creative with routings and partners. With 100,000 miles ready to deploy, you’re well on your way to an unforgettable journey or two (or three!). Enjoy the travels, and safe flying!