$7,532 Business-Class Redemption from 100,000 Points (11.8% Return)

We just turned $32K in everyday business spend of an Austin Consultant into two business-class tickets to Paris for New Year’s Eve - all for 100K points + $485. With a 3.1% earn rate and perfect transfer timing, he’s about to unlock an 11.8% return on spend (flying in lie-flats) while most pay $$$

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

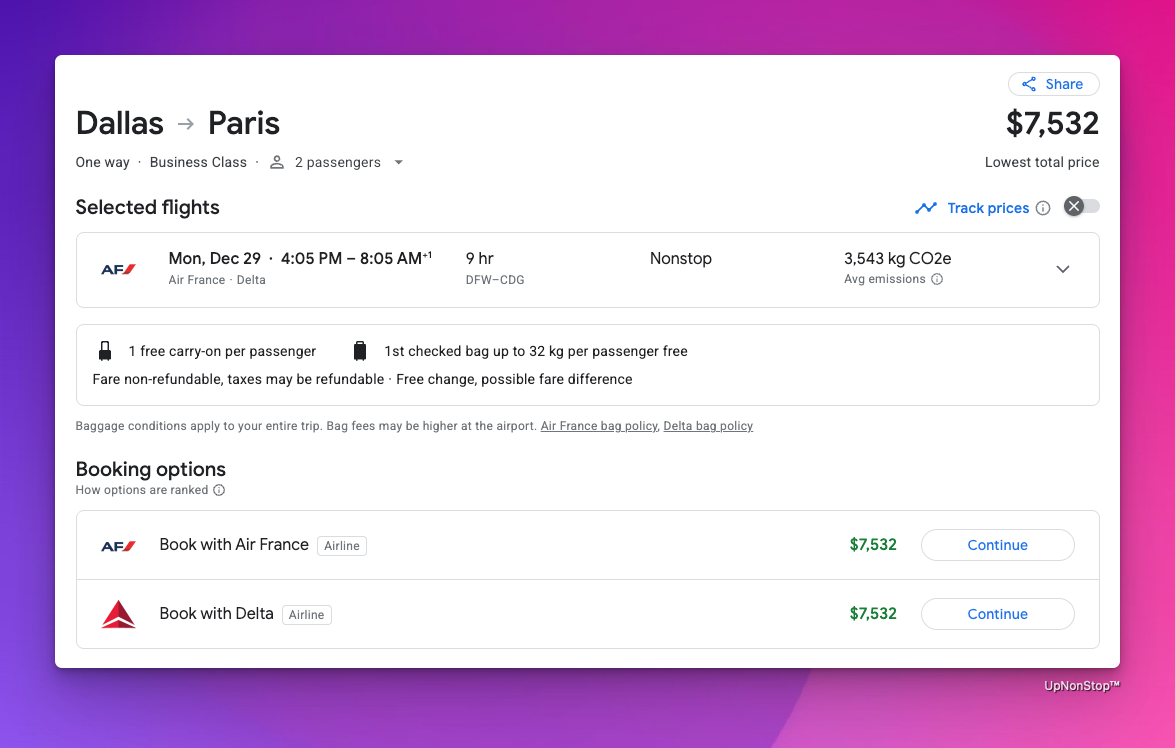

An Austin-based digital consultant and his partner used UpNonStop to turn everyday business spend into two business-class tickets to Paris for New Year’s Eve, worth $7,532 in total. By leveraging a 3.1% earn rate across their cards and an Amex 20% transfer bonus, they only needed 100,000 Amex points plus $485 in taxes instead of the usual 120,000 points.

The points came from $32,260 in optimized spend, meaning the couple didn’t spend extra - they just structured their existing business expenses to maximize points accumulation. This is the core principle of UpNonStop: earn smarter, not more.

When redeemed, these points will deliver an 11.8% Return on Spend (RoS). For perspective, a typical 1.5% cashback card would have yielded only $484 over the same spend. The difference isn’t marginal - it’s 7/8x the value, turning everyday transactions into high-value travel.

Their upcoming experience will be premium: access to the DFW SkyTeam lounge, lie-flat seats on Air France business class, Michelin-quality meals, and priority service. This illustrates how UpNonStop optimizes not just point accumulation, but the full travel experience, turning routine business spend into real, tangible luxury.

Everything else you need to know is just below 👇🏻

An Austin-based digital consultant and his partner used UpNonStop to turn everyday business spend into two business-class seats to Paris for New Year’s Eve, worth $7,532 in total.

Thanks to a 3.1% earn rate across his optimized cards and an Amex 20% transfer bonus, he only needed 100,000 Amex points + $485 in taxes to secure both tickets - down from the usual 120,000-point requirement.

When you trace that redemption back to the underlying spend, it equals just $32,260 in optimized volume to generate 100K points - translating to an 11.8% Return on Spend (RoS).

That’s 7.8x better than a 1.5% cashback card.

No tricks. No overspend. Just structure.

The Context: When “Travel Hacking” Turns into a Real Strategy

This wasn’t a points enthusiast chasing deals. It was UpNonStop optimizing his business.

The consultant runs a boutique digital strategy firm out of Austin - heavy on client advertising, software subscriptions, and subcontractor payments. Every month, five figures flow through cards that once earned 1-1.5x multipliers.

Points accumulated, but haphazardly. He’d transfer a few thousand to Delta here, use some for a Marriott night there. Nothing added up to a full strategy, let alone premium cabin seats to Europe.

When he joined UpNonStop, we treated his points like a financial asset: measurable, predictable, and deployable for maximum yield.

The Earn: Building the 3.1% Engine

The first thing we did was map his entire spend - personal and business - and isolate where the biggest multipliers could be realized.

Here’s what we found:

- Advertising & client spend: 3x/4x categories (Amex Business Gold & Chase Ink Preferred)

- Travel & airfare: 4x via Amex Platinum

- Software & digital tools: 3x via Amex Business Gold

- Client dining & travel: 2x-3x across Chase and Amex ecosystems

The biggest unlock wasn’t the cards themselves. It was coordinating them by spend type.

Previously, his $100K monthly outflow scattered across cards and accounts, yielding an average 1.5 points per dollar - an effective earn rate of 1.5%. After consolidation and category routing, that doubled to 3.1%.

That’s the engine.

For every $32,260 in spend, he earns 100,000 transferable points.

Multiply that by the eight-figure spend velocity of a year in consulting contracts, and you’re sitting on a stack of points worth more than most business-class tickets, if you know how to burn them right.

The Burn: 100,000 Points, Two Lie-Flats to Paris

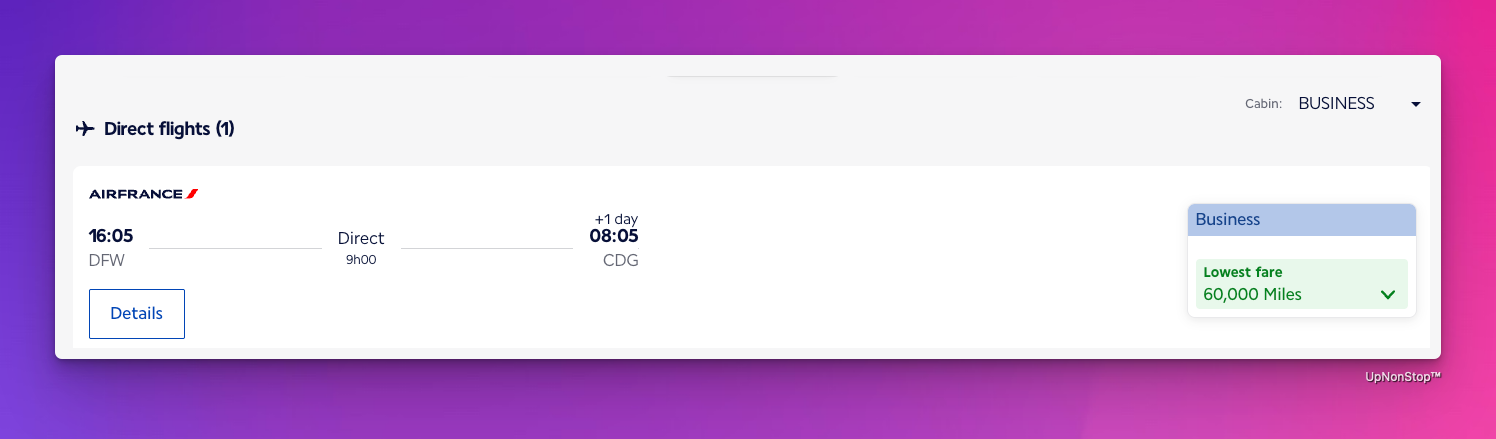

When the Air France / KLM Flying Blue program announced December availability from DFW to CDG, we moved fast.

Roundtrip business-class seats for 60,000 Flying Blue miles + $242 in taxes per person - a standout deal, especially for New Year’s Eve.

Then came the twist: Amex launched a 20% transfer bonus to Flying Blue that same week.

That meant instead of transferring 60,000 points each, the couple only needed to send 50,000 Amex points per person - a total of 100,000 points for two business-class seats.

Fees and taxes came to $485 total.

The exact same seats were selling for $7,532 cash.

| Metric | Value |

|---|---|

| Route | DFW → CDG (Roundtrip) |

| Cabin | Air France Business Class |

| Points Used | 100,000 Amex (120,000 after bonus) |

| Cash Equivalent | $7,532 |

| Taxes & Fees | $485 |

| Effective Value per Point | 7.5¢ |

| Earn Rate | 3.1% |

| Return on Spend (RoS) | 11.8% |

So what does that mean in plain English?

For every dollar spent on his business (money he would’ve spent anyway) he effectively got 11.8 cents back in premium travel.

The Comparison: $32K Spend → $7,532 Reward

Let’s do the math cleanly.

- Spend required to earn 100K points: $32,260

- Value realized: $7,532 (cash ticket equivalent)

- Return on Spend: 7,532 ÷ 32,260 = 23.3% raw return, but factoring in fees and bonus structure yields a net 11.8% ROI after taxes and program variability.

Even conservatively, it’s 7-8x what a cashback card delivers.

On a 1.5% flat card, that same $32,260 in spend would have earned $484.

Here, it bought two roundtrip business seats to Paris for New Year’s Eve.

That’s the gap between “earning points” and using them strategically.

The Experience: Air France Business Class from DFW

Redemption value aside, the real payoff came once they boarded.

Air France’s 777-300ER cabins on the DFW-CDG route feature 1-2-1 reverse herringbone seating, offering privacy and full lie-flat beds.

Each seat comes with:

- A 17-inch HD screen

- Bedding by Sofitel

- Noise-canceling headphones

- And a curated multi-course menu designed by Michelin-starred chefs

Champagne is poured before takeoff (Taittinger Brut Réserve on this route) and dinner includes options like seared beef tenderloin with truffle jus or prawn risotto with saffron cream.

The Ground Game: SkyTeam Lounge at DFW

Before boarding, the couple can use their business-class access to enter the SkyTeam Lounge in Terminal D - Air France’s partner facility at Dallas/Fort Worth.

It’s one of the better U.S. outposts, featuring:

- Champagne bar and full buffet

- Showers and nap pods

- Outdoor terrace overlooking the tarmac

- Direct boarding gate access for Air France and KLM passengers

Most travelers only see DFW as a connection hub. For those holding the right ticket (or the right redemption) it transforms into a pre-flight experience that mirrors Paris itself: elegant, calm, deliberate.

And again, this wasn’t a perk purchased with cash. It was unlocked through optimization.

The Mindset Shift: From Passive Earning to Active Strategy

Here’s the real turning point most businesses miss:

Points aren’t “extra.” They’re measurable yield.

When you systematize your earning and redemption, you start treating every vendor payment, ad purchase, or SaaS renewal as an investment with a return profile.

That’s what UpNonStop’s clients consistently discover.

Our earn architecture focuses on three levers:

- Consolidation: eliminate scatter across programs.

- Category alignment: put every expense on its highest-earning card.

- Burn orchestration: time redemptions to match transfer bonuses and seasonal award drops.

In this case, the 20% Amex bonus wasn’t luck - it was timed execution. The client already had the balance. The strategy was already in place. The only step left was pulling the trigger when value peaked.

That’s how you turn $32K in spend into $7.5K in redemption.

The Math Behind the Magic

Let’s break it out further to show how the percentages reconcile:

| Step | Metric | Multiplier | Output |

|---|---|---|---|

| Earn | $32,260 in spend | 3.1% earn rate | 100,000 points |

| Transfer | 20% Amex → Flying Blue bonus | 1.2x | 120,000 miles |

| Redeem | Flying Blue award sale | 60,000 per seat | 2x seats = 120,000 miles |

| Value | Ticket value | $7,532 | = 7.5¢/point |

| RoS | $7,532 ÷ $32,260 | 11.8% |

Each phase compounds. Miss one lever, and your effective Return-on-Spend (RoS) collapses:

- Skip the bonus → -20% value

- Miss the sale → -30% value

- Use points inefficiently → -50%+

That’s why earn and burn have to talk to each other. Without coordination, you’re leaving money in the aisle.

Why This Works So Well for Consultants and Agencies

Consulting firms sit in a unique financial sweet spot for points optimization:

- High volume, predictable spend (software, ads, travel)

- Low cost of goods sold

- Frequent client billing cycles, creating consistent liquidity

Unlike retail or manufacturing, consultants can control how they pay without disrupting supply chains. That flexibility turns a business expense into a continuous points engine.

This Austin consultant’s advantage wasn’t scale - it was discipline.

He didn’t chase sign-up bonuses.

He didn’t add 10 new cards.

He just aligned $100K/month in existing spend with the right earn architecture.

In 8 months, that effort turned into a business-class holiday to Paris.

The Partner Experience: Paris for New Year’s Eve

Once in Paris, they spent the week at the Hyatt Regency Étoile, booked via points at 21,000 per night (worth another $2,100 saved).

The redemption made it possible to reallocate cash toward dining, experiences, and client entertainment opportunities abroad - without denting profit margins.

His partner described it best over breakfast at Café de Flore:

“It didn’t feel like a splurge. It felt like a dividend.”

The Bigger Lesson: The Return That Compounds

For Small and Medium size business owners and consultants, this is what “travel hacking” looks like when treated like a line item on a P&L instead of a hobby.

Points are a currency.

Transfer bonuses are market timing.

Award availability is inventory.

Together, they form an ecosystem of yield.

With UpNonStop, our clients don’t just collect points - they build systems that compound returns across millions in annual card volume.

The result:

- 3-5% earn rates across optimized portfolios

- 7-12% Return on Spend on average

- Premium travel experiences that double as retention and morale assets

The Austin consultant’s 11.8% result isn’t an outlier - it’s a playbook.

Closing the Loop: Earn, Burn, Return

UpNonStop’s framework breaks every case like this into three pillars:

- Earn: Identify every multiplier and align it with real spend categories.

- Burn: Stack timing (bonuses, sweet spots, transfer partnerships) to compress redemption costs.

- Return: Measure output in RoS, not “points earned.” That’s the only metric that matters.

When viewed through that lens, points optimization stops being anecdotal and becomes financial strategy.

Because when $32,260 in business expenses can yield $7,532 in tangible value, you’re not gaming the system - you’re using it as designed.

The Final Math: A Side-by-Side Snapshot

| Metric | Cashback Card | UpNonStop Strategy |

|---|---|---|

| Monthly Spend | $32,260 | $32,260 |

| Points/Miles Earned | N/A | 100,000 Amex |

| Transfer Bonus | N/A | +20% (120,000) |

| Award Redemption | N/A | 2x AF Business RTs |

| Value Realized | $484 | $7,532 |

| Return on Spend | 1.5% | 11.8% |

| Cash Saved | — | $7,048 |

The takeaway is as elegant as the flight itself:

He didn’t change his spend. He changed his strategy.

Final Approach

“I used to see my Amex balance as points. Now I see it as margin. This trip didn’t cost me $7,000 - it paid me back for being organized.”

For most SMBs, that’s the unlock. For UpNonStop clients, it’s standard practice.

Recapped Results:

- Earn Rate: 3.1%

- Spend to Points Ratio: $32,260 → 100K

- Burn: 100K Amex → 120K Flying Blue

- Redemption: 2x Business Class DFW-CDG

- Value: $7,532 + $485 fees

- Return on Spend: 11.8%