What 50,000 Citi Points Can Really Buy: From Lie-Flat Luxury to a Full Vacation for Two

50,000 Citi ThankYou Points can unlock serious travel. Fly business class to Europe, book two round-trips to Hawaii, or cover hotel stays at all-inclusive resorts. With smart transfers and timing, your 50k points can be worth $1,000+ far beyond the $500 baseline. Don’t spend them small - think BIG!

If You Only Had 60 Seconds to Read This Article (Click Here)

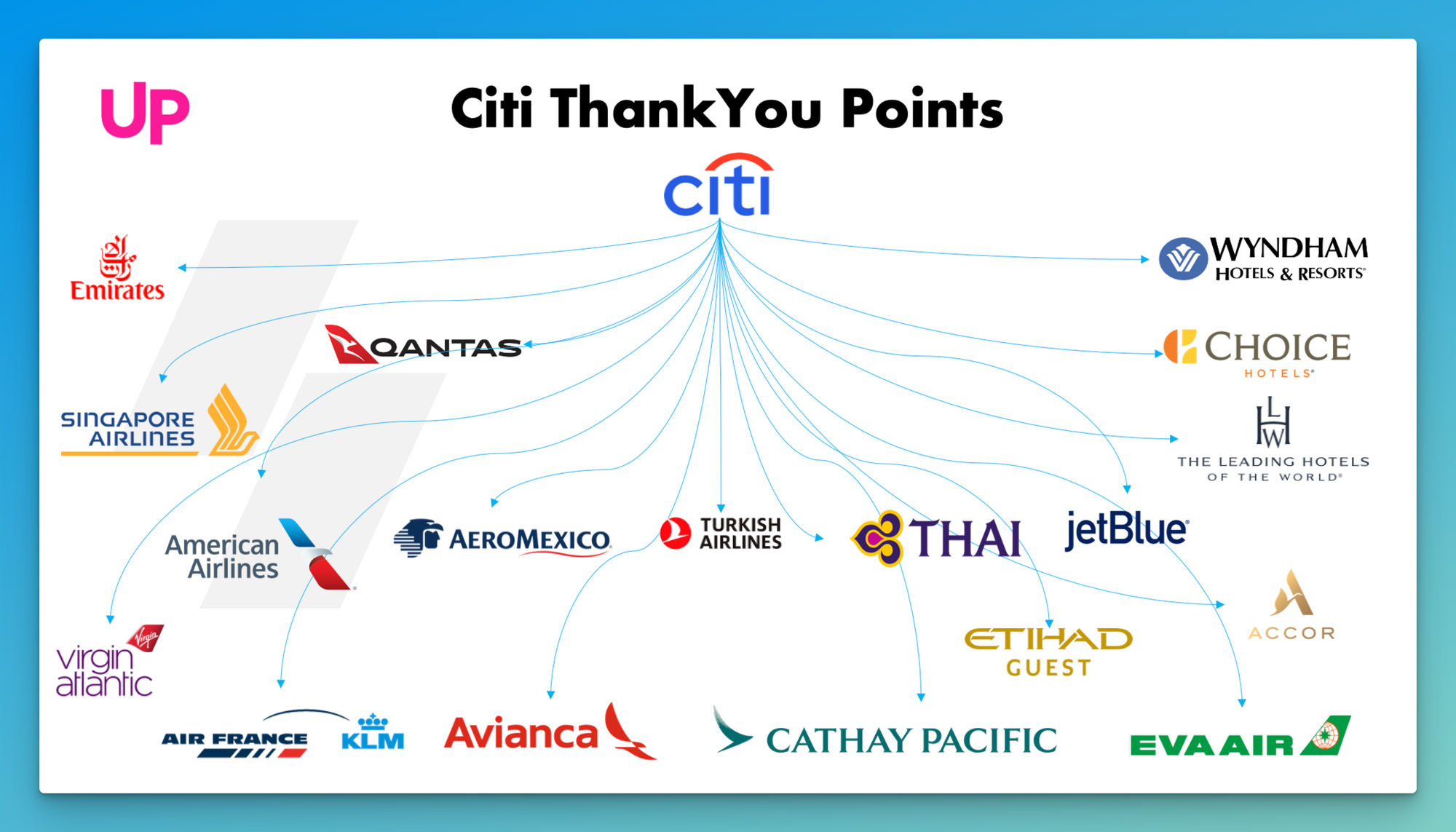

With 50,000 Citi ThankYou points, you're sitting on a flexible travel asset that can be stretched far beyond its baseline value of $500 through the Citi Travel Portal. When used strategically, those same points can unlock redemptions worth $1,000 or more - especially when transferred to one of Citi’s airline partners. For instance, transferring 50k points to Etihad Guest unlocks American Airlines business class flights to Europe, a seat that can retail for $2,000+.

Similarly, Turkish Miles&Smiles can turn 50k points into two round-trip economy flights to Hawaii, a redemption worth at least $1,200 if booked with cash. Citi’s partners - like Avianca LifeMiles, Flying Blue, and Virgin Atlantic - offer several sweet spots where 50k is enough to fly in business or economy across the Atlantic, Caribbean, or Central America.

For travelers seeking quantity over luxury, 50k points can stretch into multiple round-trip flights within the U.S. or to nearby international destinations. Using Singapore KrisFlyer miles or Turkish Miles&Smiles to book domestic United flights can yield up to 4 one-way tickets. In Flying Blue’s dynamic pricing model, 50k points can also cover two roundtrips to the Caribbean or one round-trip to Europe in economy - especially if paired with a timely transfer bonus (Citi often runs 15–30% promos to partners like Air France/KLM). These deals place the effective value of your points between 2 and 4 cents each, depending on route and timing.

But flights aren’t the only way to cash in. Citi’s 1:2 transfer ratio to Choice Privileges can turn 50k into 100k Choice points - enough for 2 nights at an all-inclusive Caribbean resort or 3–4 nights at upscale city hotels. Wyndham is another solid option, especially through its partnership with Vacasa vacation rentals: 50k points can cover 3 nights in a one-bedroom condo near the beach or slopes, potentially worth $900+ in cash. If you prefer flexibility, using a mix of 30k points for flights and 20k for hotels can create a nearly free full vacation experience. You can also use Citi’s portal for one component and transfer points for another, optimizing value while reducing booking friction.

Finally, for business owners or high spenders, 50,000 points can reduce operating costs or enhance client-facing travel. Whether it’s flying in business class to a conference, covering employee flights with portal redemptions, or redeeming gift cards for office supplies, 50k points represents real cash-equivalent utility. If you’re savvy with bonuses and redemptions, that one signup bonus or sustained spend can unlock a $1,000–$2,000 return in real-world travel and experiences.

The takeaway? With Citi ThankYou points, scale matters - and at 50k, you’ve entered the tier where strategic decisions turn points into power.

Everything else you need to know is just below 👇🏻

So you’ve accumulated 50,000 Citi ThankYou points - fantastic!

Whether it’s from a hefty sign-up bonus (hello, Citi Strata Premier’s welcome offer) or steady spending on your Citi Double Cash, now you’ve got a serious chunk of points to play with. To put it in perspective: 50k points are worth at least $500 in travel through Citi’s portal, but in the right hands, they can unlock travel experiences worth $1,000 or more. This is the sweet spot where your points can take you from economy to business class, from domestic to international travel, and from standard hotel rooms to upscale stays.

In this article, we’ll explore how to maximize 50,000 ThankYou points without repeating the same strategies we’d use for smaller balances. We’ll scale up the ambition: think bigger trips, fancier flights, and more complete vacation packages. By the end, you might be shocked at just how far 50k points can go - and itching to start planning your next getaway.

Ready to turn those points into a wow-worthy trip? Let’s dive in and build on what you already know, upping the ante with 50,000 points.

The Significance of 50,000 Points

Fifty thousand points is a common benchmark in the points world - many credit card bonuses are around this amount, and it’s a level where premium redemptions become possible. Here’s what 50k ThankYou points represent:

- $500+ in Baseline Value: If used in the Citi Travel Portal, you’ve got about a $500 travel budget. That might cover a domestic round-trip for two, or a nice weekend hotel plus a rental car.

- Access to Premium Cabins: At ~50k, you can start booking business class flights one-way on some international routes, or even round-trip on select shorter international routes. This is the ticket to lie-flat seats and airport lounge champagne on a reasonable points budget.

- Multiple Economy Trips: Alternatively, 50k points could fund several economy class flights. We’re talking perhaps 2-4 round-trip tickets in the U.S., or one round-trip to Europe in economy.

- Combination Strategies: You might choose to split your 50k points across flights and hotels, creating a whole trip itinerary on points alone (e.g., flight + 2 nights hotel). With more points, mixed-use strategies become appealing.

Jet-Setting with 50k: Best Flight Redemptions

Here’s where we start unlocking bigger adventures. With 50k ThankYou points transferred to airline partners, you can reach farther destinations and even sample business class comfort. Let’s look at some star redemption options:

- Business Class to Europe on American Airlines (Etihad Guest): One of the standout deals in the points world: 50,000 Etihad Guest miles for a one-way Business Class seat on American Airlines from the U.S. to Europe. Etihad is a 1:1 Citi transfer partner, and they have a partner award chart for American that beats AA’s own rates. With your 50k points transferred, you could fly in AA’s Flagship Business class - lie-flat seat, fancy meals, lounge access - from, say, New York to London or Chicago to Paris. That ticket often costs $2,000+ one-way, which means you’d be getting almost 4¢ per point in value. Feeling extra fancy? Etihad also allows AA First Class to Europe for 62,500 miles - a bit above our 50k budget, but it shows how far these points stretch. If Europe isn’t your thing, the same 50k Etihad miles can fly AA business to many parts of Asia (Japan/Korea are “Asia 1” for 50k; deeper Asia like Singapore is 55k). In short, 50k = business class abroad if you leverage the right partner.

- Round-Trip to Hawaii for Two (Turkish Miles&Smiles): We mentioned Turkish’s domestic United deal earlier for 20k round-trip in economy. With 50k, you can expand on that: how about taking a companion to Hawaii with you? For 45k Turkish miles, you can get two round-trip tickets from anywhere in the continental US to Hawaii (15k each, round-trip, since it’s 7.5k each way per person - note: Turkish did increase some rates to 10k each way in 2024, but even at 10k it’s 20k round-trip). So 40k covers two round-trips, and you’ll even have 10k points left over. That leftover could go towards a short hotel stay or be saved for your next trip. This is an incredible deal: imagine two people flying to Maui or Oahu and back, costing potentially $1,000+ each cash, all covered by your points. It’s the kind of redemption that turns heads.

- Multiple Trips in Economy (various partners): If your goal is to maximize the number of flights, 50k can do wonders:

- Domestic Hops: Using Turkish (United) or even Singapore KrisFlyer for United flights (they charge 12k one-way within continental US), you could get several one-way tickets. For instance, 50k via Singapore could fund four one-way flights at 12k each (48k total). That’s two round-trips within the U.S. for one person, or perhaps one round-trip for you and one for your spouse.

- Mexico and Caribbean: As noted, Flying Blue has 15k one-ways to the Caribbean. With 50k, you have enough for a pair of round-trip tickets to the islands (15k each way x 2 ways x 2 people = 60k, slightly short) or at least two round-trips for one person with points left over. Alternatively, use 50k to send two people one-way and pay the return cash if flights are cheap - flexibility is key.

- Transatlantic Economy: 50k can cover a round-trip economy to Europe with the right program. For example, Avianca LifeMiles often prices US-Europe economy around 60k round-trip (30k each way). You might need a few more points or catch a transfer bonus, but you’re in range. Flying Blue’s dynamic pricing might give you a round-trip off-peak for around 50k-55k as well. If you can secure that, you’ve just flown to Europe and back for basically free.

- One-Way in Style - Sampling First Class (Virgin Atlantic): While 50k isn’t enough for a round-trip in first class, it can get your foot in the door for a one-way ultra-premium experience. For instance, Virgin Atlantic is a Citi partner (1:1). Virgin Atlantic Flying Club has famous sweet spots like ANA First Class for 110k round-trip (which requires saving up more) - but what about Virgin Atlantic’s own Upper Class? Actually, you can use Virgin points for Delta One business class flights: specifically, 50k Virgin points is often enough for a one-way Delta One Suite from the U.S. to Europe (excluding UK). If you’ve dreamed of that sleek Delta One Suite seat, 50k points can make it happen one-way. Then maybe use cash or other points to get back, or just do one direction in luxury and economy back. It’s a great way to treat yourself on a long flight without committing a fortune in points.

Crafting a Vacation: Combining Flights & Hotels

With 50,000 points, you don’t necessarily have to burn them all on flights. You could plan a more balanced trip by allocating some points to airfare and some to lodging. Here’s an example of a mix-and-match strategy:

- Flights: Transfer 30,000 points to an airline for a round-trip flight in economy. For instance, 30k to Avianca LifeMiles could likely get you a round-trip from the U.S. to, say, Costa Rica or Colombia in economy (LifeMiles has ~15k each way fares to Northern South America). Value: maybe ~$600.

- Hotels: Use the remaining 20,000 points for hotels. As we saw earlier, 20k can become 40k Choice points (2-3 nights in a decent hotel) or 20k Wyndham (perhaps a night or two at a resort). If going to an area with Choice hotels, transferring to Choice could get you a few free nights at a Comfort Suites or even a night at an upscale Ascend hotel by the beach.

- End result: You’ve covered both airfare and lodging for a vacation with points alone - perhaps a four-night getaway to Central America or a long weekend in the Caribbean, nearly free.

Alternatively, consider using the Citi Travel Portal for one component and transfers for another. For example:

- Book a $250 airfare via the portal using 25k points (maybe a domestic flight or a deal to Canada/Mexico), and then transfer the other 25k to Choice to cover hotels for that trip. This way, you sidestep some complexity of award flights (just pay with points directly for a good cash fare), and still maximize hotel value via transfers.

Elevated Hotel Experiences with 50k Points

Let’s talk more about hotels. 50,000 points can significantly defray accommodation costs, which are often the biggest expense on a trip after flights.

- Upscale Options with Choice Privileges: Converting 50k ThankYou to 100,000 Choice Privileges points (at the 1:2 transfer for Premier cardholders) opens up higher-end hotel possibilities. Choice’s portfolio includes some Ascend Collection boutique hotels and all-inclusive resorts (in places like the Caribbean or Central America). These can cost 25k-50k points a night. So 100k Choice points might get you two nights at an all-inclusive resort in the Dominican Republic, for example - that’s food, drinks, stay, all covered for two people! Or perhaps 3-4 nights at a nice hotel in a European city where Choice has a presence. Considering those stays might run $200-$300 per night, you’re getting good value.

- Vacation Rentals with Wyndham: Wyndham’s sweet spot is actually their partnership with Vacasa vacation rentals. Every Wyndham point is worth 1 Vacasa point, and you can book Vacasa managed homes at a rate of 15,000 points per bedroom per night. With 50k (which becomes 50k Wyndham), you could book a one-bedroom condo for 3 nights (45k points). For instance, a ski condo in Colorado or a beach cottage in Oregon - many of these go for hundreds per night in cash, so using points is a steal. If you travel with family or friends, this can be a cozy and cost-effective option.

- Combining Hotel Nights: Maybe you don’t have enough points for all nights of a trip, but you can split. Use points for a couple of nights and pay cash for the rest. For example, on a week-long trip, cover the Friday and Saturday night (often most expensive) with points, and pay for the cheaper weekday nights. 50k points could likely cover the high-cost nights at a resort via transfer points, saving you money where it counts most.

Considerations for Business Owners and Big Spenders

The prompt mentioned “both consumer and business” angles - so if you’re a small business owner or just have high expenses, you might be eyeing 50k points from a different perspective. Perhaps you amassed these points by putting business spend on a Citi card. If so, you might also be interested in:

- CitiBusiness ThankYou Card: (If you have one of these legacy cards) - it could be another source of points. Combine points from business and personal accounts to boost your balance.

- Using points for business travel: 50k points could save your business $500 on airfare for a conference or hotel for a client meeting. The same leisure strategies apply - you can transfer to an airline to fly to that meeting in style, or use the portal to book last-minute travel without dipping into company cash.

- Gift Cards for Business Expenses: Redeeming points for gift cards (office supply stores, Amazon, etc.) at full value can effectively reduce business operating costs. While we usually push travel, sometimes the best use is what improves your bottom line. $500 in Staples or Amazon cards could buy a new office printer “for free.”

The “Wow” Examples at 50k Points

Let’s close this out with a little inspiration. What are some “wow, I can’t believe points covered this” scenarios around the 50k mark? Here are two:

- Example 1: Luxurious Long-Haul for One - You’ve always wanted to try a true international business class with lie-flat seats. You transfer 50k ThankYou points to Qatar Airways Privilege Club (Avios). Qatar’s Qsuite business class is often hailed as the best in the world. For 70k Avios you can fly one-way from the U.S. to Doha in Qsuites. 50k won’t cover it all, but suppose you wait for a Citi transfer bonus to British/Qatar Avios (say 30%, which happens occasionally) - your 50k would become 65k Avios, getting you within reach after a bit of additional points from spending. You book a one-way in Qsuites from New York to Doha, retail cost perhaps $4,000, for essentially your points. You sip champagne at 35,000 feet in a private suite, dine on chef-curated meals, and think: those dining-out purchases on my Double Cash that earned me these points were totally worth it.

- Example 2: Vacation for Two in Paradise - You and your partner have 50k points. You transfer 20k to Turkish for two round-trip tickets to Honolulu (40k total, 20k each). With flights sorted, you transfer the remaining 30k to Choice Privileges (becoming 60k Choice). You use those to book 3 nights at the Kaimana Beach Hotel in Honolulu (just as an example, it’s an Ascend Collection boutique property at ~20k points a night). The cash rate for those 3 nights plus flights could easily have been $1,800 or more, but you paid almost nothing. You’re watching the sunset on Waikiki Beach knowing that your credit card points covered this romantic getaway. That’s a wow moment courtesy of points.

Final Thoughts: 50k is a Gateway to Bigger Adventures

At 50,000 points, you’ve moved into the big leagues of award travel. There’s so much you can do, from flying business class internationally to treating a loved one to a special vacation, or stringing together multiple trips. The strategies at this level revolve around leveraging the diversity of Citi’s transfer partners to maximize value, and sometimes splitting points among multiple uses to craft an end-to-end travel experience.

For many, 50k points is achievable with one good credit card bonus (the Citi Strata Premier often dangles offers of 60k or even 75k points). If you haven’t yet reached this balance, that’s one route. If you already have the points, pat yourself on the back - you’re sitting on a treasure trove of travel.

One more thing: as your points balances grow, so does the complexity (and opportunity) of using them. If you ever feel a bit overwhelmed by award charts or finding availability, remember you can lean on experts. Award travel planning services (like a subtle mention of UpNonStop, which specializes in maximizing points for dream trips) can handle the nitty-gritty and let you enjoy the ride.

Now, we’ve tackled 20k and 50k in our series. Coming up next: 100,000 ThankYou points - the six-figure club!

This is where first class flights enter the chat and entire vacations can be paid for in points. Stay tuned, and start daydreaming about how you’ll use those 50k points - because as you’ve seen, the only limit is your imagination.

#HappyTravels!