What 100,000 Citi Points Can Really Buy: First Class Seats, 5-Star Resorts, and Travel Flex You Didn’t Know You Had

100,000 Citi ThankYou points unlock premium travel: think round-trip business to Europe, first class to Tokyo, or $1,000+ in hotel stays. Whether you want one luxury blowout or stretch your points across multiple trips, our guide shows how to turn your stash into $5K-$10K of real-world value.

If You Only Had 60 Seconds to Read This Article (Click Here)

A 100,000-point balance unlocks travel options that go far beyond the basic $1,000 cash value through Citi’s portal.

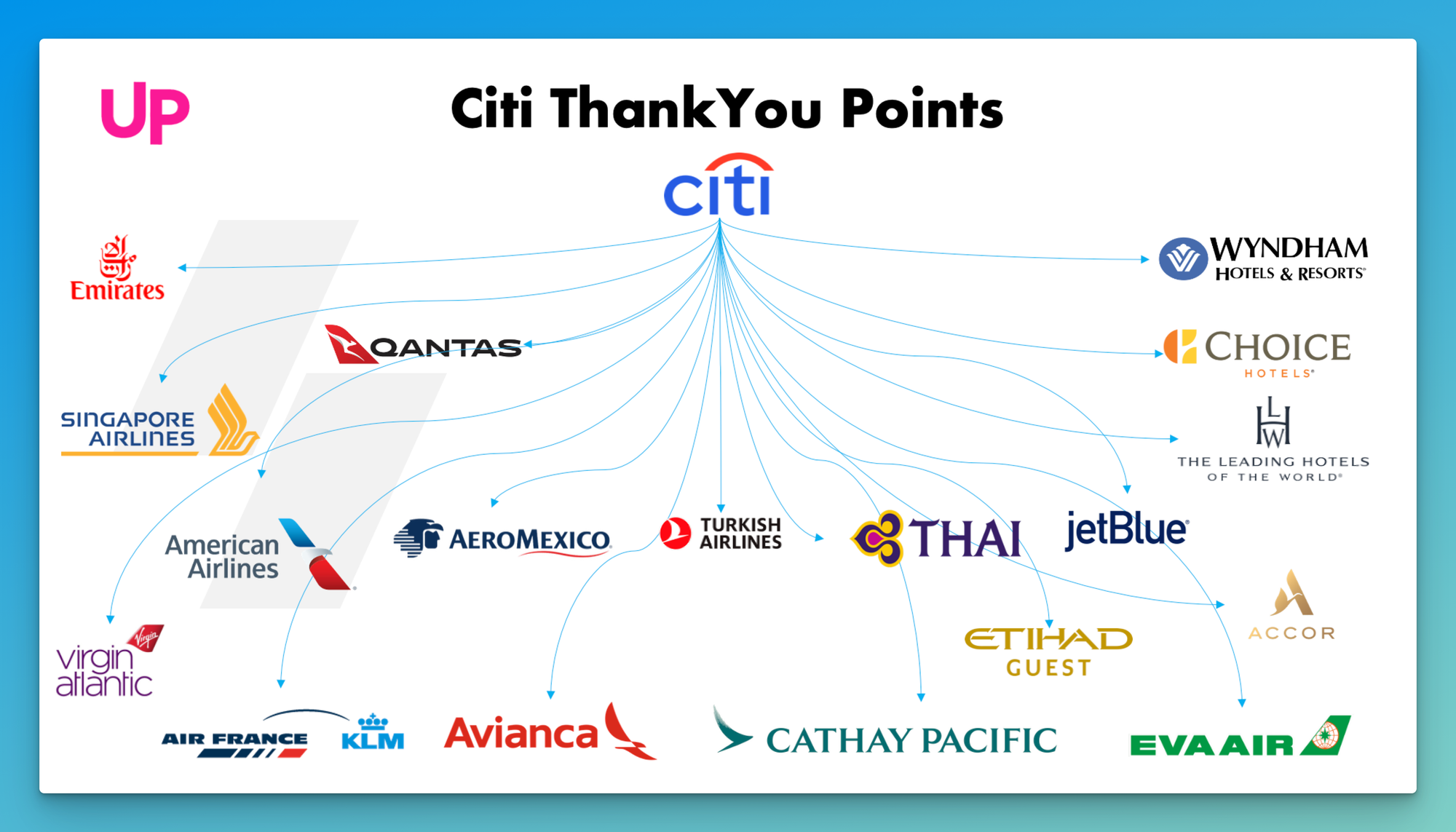

With transfer partners like Avianca, Virgin Atlantic, and Turkish Airlines, you can fly round-trip business class to Europe or Asia - often for 90k–110k points - saving $4,000–$6,000 in retail airfare. Lufthansa First Class via LifeMiles runs just 87k one-way, while ANA First via Virgin Atlantic can go for 110k–120k round-trip, with cash values exceeding $15,000. These aren’t gimmicks - these are top-tier airline products you can access for pennies on the point-dollar.

Rather spread the value out? 100k points can cover two long-haul one-way flights in business class (like NYC–Paris for 50k and Miami–Buenos Aires for 50k), or even two roundtrips in economy (Turkish to Europe at 45k RT per person). That means you can fund a couple’s vacation, a family reunion, or two solo getaways. Bonus: programs like Flying Blue and Turkish offer rotating deals and off-peak pricing that bring round-trip awards as low as 35k–50k. You can stretch 100k into 3–4 total flights if you strategize across routes, regions, and transfer bonuses.

Hotels? That 100k opens the door to €1,000 in value via Accor (e.g., Fairmont or Sofitel), 4–5 nights at all-inclusive Wyndham resorts (usually 30k/night for 2 guests), or a 10-night Scandinavia tour with Choice’s 2:1 transfer ratio. Think $2,000–$3,000 in hotel value depending on where you go. Especially during peak dates or luxury stays, hotel redemptions can eclipse airfare in savings potential - so aligning redemptions with cash price spikes maximizes return. Consider Vacasa vacation rentals via Wyndham for upscale cabins, homes, or beachfront villas using ~15k per bedroom per night.

If you want a true “wow” moment, your 100k can buy a one-way Emirates First Class seat from New York to Milan (85k + ~$500 in fees), complete with a private suite and in-flight shower. Or string together a DIY around-the-world trip in business class using 2–3 redemptions across alliances. The cash value of these redemptions can top $10,000, making it one of the most powerful six-figure point balances in the game.

Your 100k isn’t just a number - it’s a passport to experiences you’d likely never pay for in cash.

Everything else you need to know is just below 👇🏻

Welcome to the six-figure points club!

Accumulating 100,000 Citi ThankYou points is no small feat - it likely took careful spending, multiple credit card bonuses, or perhaps significant business expenses. But now you’ve got 100k in your arsenal, and the possibilities have multiplied exponentially. If 50k points opened the door to business class and international trips, 100k points kicks it wide open. We’re talking round-trip business class flights, multiple vacations, or one ultra-luxurious experience in first class that you’ll be bragging about for years.

This article will help you navigate the exciting world of six-figure point redemptions. We’ll build on concepts from the earlier parts of this series but tailor strategies to a larger balance - ensuring we don’t just repeat the same moves. With 100,000 points, you can mix and match rewards in creative ways: perhaps one big splashy redemption or several high-value uses. It’s like having a currency of its own, dedicated to fulfilling your travel dreams.

Strap in as we explore how to turn 100k ThankYou points into unforgettable journeys. From flying in lie-flat comfort on long-hauls to pampering yourself at luxury resorts, get ready for some serious point-powered inspiration.

What 100,000 Points Signify

First, let’s grasp the magnitude of what you have:

- Baseline Monetary Value: In the Citi Travel Portal, 100,000 points = $1,000 in travel. That alone could buy a pretty nice vacation if used judiciously. But we’re aiming higher…

- Premium Cabin Galore: With 100k, you’re squarely in range of round-trip business class flights to many parts of the world. Europe, Asia, South America - business or even first class (one-way or possibly round-trip in some cases) are achievable.

- Entire Trips on Points: You can feasibly cover flights and hotels for a full trip for two people using 100k, if you play your cards (or rather, points) right.

- Safety Buffer: Having more points gives you a cushion. You can pay those odd award fees or unexpected extra points costs without derailing your main redemption. It’s like a points “budget” with wiggle room, which is liberating.

Flying High: Best Flight Redemptions for 100k

This is where the fun really begins. With 100k points to spend, you can eye some of the best seats in the sky or multiple flight awards. Here are standout ways to deploy 100k:

- Round-Trip Business Class to Asia (Various Programs): Asia typically requires more miles than Europe, but 100k puts it within reach. For example, Avianca LifeMiles charges around 78k miles one-way for business class from the U.S. to East Asia on Star Alliance partners. So ~156k round-trip - a bit over 100k, but maybe you pay one way with miles, one way with cash or another program. However, consider Turkish Airlines Miles&Smiles: It has had promo award rates of 55k miles one-way in business from the U.S. to Europe (on Turkish Airlines via Istanbul) - 110k round-trip. If you’re flexible to connect in Istanbul, 110k gets you all the way to Europe in business round-trip. Another example: Etihad Guest for ANA (All Nippon Airways) - you can book ANA flights via Etihad miles for 54k one-way business from US to Tokyo (108k round-trip). Yes, you read that right - fly a top-rated Japanese airline in business class round-trip for ~108k. That’s nearly exactly your 100k (with a little extra from ongoing spending or a transfer bonus, you’re there). Those flights could cost $5,000+ in cash total, so this is immense value.

- Lufthansa First Class to Europe (Avianca LifeMiles): Time to talk first class. With 100k, you’re now within striking distance of one of the most aspirational awards: Lufthansa First Class. Avianca LifeMiles (1:1 from Citi) charges 87,000 miles for a one-way First Class ticket from the U.S. to Europe on Lufthansa. So for 87k of your points, you can fly in the nose of a 747 or A380, sipping champagne and enjoying a Michelin-quality meal. On arrival in Frankfurt, you get access to the exclusive Lufthansa First Class Terminal (where you literally take a bubble bath and get chauffeured to your plane in a Porsche). The cash price of that ticket? Often $8,000 one-way. Getting it for 87k points + maybe ~$100 in fees is phenomenal. With 100k, you could do that one-way and still have 13k left for a domestic hop or a hotel night. Or, if you’re traveling with a partner, 100k could almost get two people a one-way in Lufthansa business (which is ~63k each via LifeMiles, total 126k - okay, bit short, but one person in First, one in Business could be a fun combo if you’re feeling generous vs greedy!).

- Virgin Atlantic + ANA First Class Bonanza: Earlier we alluded to a legendary deal: Virgin Atlantic Flying Club lets you book ANA (All Nippon Airways) First Class round-trip for as low as 110,000 miles (from West Coast USA to Tokyo) or 120,000 miles (from East Coast). That’s round-trip First Class, with the new ANA “The Suite” possibly, one of the world’s best first class products. Now, Virgin is 1:1 transfer from Citi. If you have 100k, you’re just shy of these amounts, but perhaps you and a spouse each have 100k? Then each of you could redeem 110k and fly together. Or if it’s just you, earn another 10-20k (through a bit more spending or say using the Citi Rewards+ 10% rebate to get some back on a redemption) and you’re there. Considering that ticket can cost $20,000+ for one person, this is a “turn left on the plane” kind of experience for (nearly) free. It’s hard to top that value for ~120k points. It’s literally like turning points into a small car and then flying that car through the sky… okay, maybe that analogy is weird, but you get it - it’s big.

- Multiple Business Class One-Ways (Spread the Love): Another approach: Instead of one round-trip, you could book several one-way tickets in business class to sample different airlines or for different trips:

- For example, spend ~50k on a one-way to Europe in business (Flying Blue or Virgin Atlantic on Delta, etc.), then spend ~50k on a one-way to South America in business (Aeromexico Club Premier might charge around 50-60k one-way to, say, Argentina on Delta or Aerolineas).

- This way, you cover two separate vacations’ long-haul flights in a lie-flat seat for one points balance. Perhaps one trip to Europe this year (one-way covered with points, you pay return in economy or with other points), and next year a trip to South America (again one-way covered). Flexibility is key - you don’t have to use all 100k at once or on one itinerary.

Two Trips or One? Maximizing 100k for Travel Goals

With 100,000 points, a key question arises: should you blow them all on one epic trip, or spread them out for multiple travels? The answer depends on your travel style, but here are two scenarios:

- One Epic Trip (All-In): You decide to go all-out on a dream vacation. Example: 100k to Flying Blue for ~96k round-trip business class tickets for you and your spouse to Europe (Flying Blue has promo awards sometimes: I’ve seen NYC to Paris round-trip business for ~48k per person during a sale, which is incredible - so two people = ~96k). Then use cash for hotels, or maybe a few leftover points for a hotel night. You experience a luxurious flight together, making the journey as memorable as the destination. Alternatively, 100k could cover both of you round-trip in economy to, say, Asia (maybe 35k each way per person via a Star Alliance partner - 140k total needed, okay maybe economy to Asia might be more like 40k each way on average, which is 160k total, so not quite; but certainly to Europe 100k can cover two round-trip economy tickets easily). The point is, you use the points to remove the biggest cost barrier of a big trip (the flights) in a high-comfort way.

- Multiple Trips (Balanced Use): You could instead aim for two or three trips in economy or mixed cabin. For instance, spend ~60k for two round-trip economy tickets to Hawaii for a family vacation (20k each RT via Turkish for 3 people = 60k, leaving 40k), then use the remaining 40k for a solo trip in business class to Europe for yourself (maybe one-way business 55k via Turkish and pay cash to return in economy, or find a deal). Or do a 40k spend on a domestic U.S. trip (family visits, etc.) and 60k on an international one. By segmenting your points, you could have something to look forward to now and still keep points for another trip later.

One approach isn’t inherently better - it’s personal preference. Big splash vs. steady stream of free travel. Many enthusiasts lean towards the splashy since it’s hard to otherwise justify paying for first/business class out-of-pocket, whereas economy trips can often be saved up for in cash. Points let you experience things that would be extravagances otherwise.

High-End Hotels and Unique Stays with 100k Points

We’ve talked a lot about flights, but what about using 100k for hotels? After all, if flights are cheap and hotels are expensive at your destination, shifting point usage to lodging can be smart. Here are some killer uses on the hotel front:

- €1,000 at Accor Hotels: As noted, transferring 100k to Accor yields 50k ALL points, worth €1,000 in hotel credit. Think of what €1000 can cover - maybe 2 nights at the Fairmont Maldives Sirru Fen Fushi (one of Accor’s luxe properties) which might go for around €500 a night. Or perhaps 4-5 nights at a high-end Sofitel in Europe at €200/night. Essentially, you have a grand to spend across Accor’s entire portfolio, from Raffles to ibis. If you’re a fan of luxury city hotels or fancy resorts under the Accor umbrella, this is a straightforward and very valuable redemption. (Keep in mind, you usually have to book through the Accor site and apply points as credit at check-out in chunks of 2k points for €40 off each time - a minor hassle, but totally worth it).

- All-Inclusive Resort for a Week (Wyndham/Choice): 100k ThankYou -> 100k Wyndham. Many Wyndham all-inclusive resorts (like Viva Wyndham in Dominican Republic, or some Margaritaville All-Inclusive resorts) cost 30k points per night for two people. With 100k, you have enough for 3 nights (90k) all-inclusive for two, with 10k leftover. If you have any Wyndham elite status or their credit card, you could potentially get a 4th night free on award stays, stretching to 4 nights. Meanwhile, Choice Privileges has all-inclusives like some in the Curio Collection/Ascend in the Caribbean accessible via points (and Choice transfers yield 200k points from your 100k). Some of those can be as low as 40k-50k points a night per person all-inclusive. It gets complicated with how they charge per guest, but you could feasibly cover a 3-5 night all-inclusive stay with 100k worth of points. That’s food, drinks, activities - everything - covered by points. For a family or couple, the value can be tremendous (those stays could easily cost $300-500 per night out of pocket, so you’re looking at $1,500-$2,500 value).

- Luxury Boutique Hotels (Choice Ascend Collection): Choice’s point prices for high-end Ascend properties in expensive cities can be great. For example, hotels in Scandinavia (Choice partners with Nordic Choice Hotels) can be 16k-20k points a night even if cash rates are $300+. 100k (->200k Choice) could fund a 10-12 night Scandinavian adventure hotel-wise, potentially worth $3,000. Or an upscale Parisian boutique hotel for 5 nights at 40k/night (200k total). You pay for flights with perhaps separate points or cash, but your entire hotel bill - often the biggest expense - is wiped clean by points.

- Vacation Rentals Upgrade: We talked about Vacasa via Wyndham earlier. With 100k Wyndham, you could book something like a 5-night stay in a 2-bedroom mountain cabin (15k per bedroom, per night: 2 bedrooms = 30k/night, so 5 nights = 150k; you’d need a bit more, but maybe a smaller unit or 4 nights). If you ever wanted to take your extended family or a couple of friends on a getaway, covering the lodging in a cozy Airbnb-style home via points is a very cool use.

Creating “Wow” Moments with 100k

At this point, you might be wondering what’s the single most impressive thing you could do with 100k ThankYou points. While “impressive” is subjective, here are a couple of scenarios that would make any points enthusiast’s jaw drop:

- Around the World (in Business Class) - While the classic “Round The World” award ticket is largely a thing of the past in the U.S. programs, you can DIY your own with alliances. Imagine this: use 100k to book multiple one-ways on separate tickets, creating a round-the-world itinerary. For instance, 50k to fly USA to Europe in business (via Virgin Atlantic on Delta or Flying Blue on KLM), 45k to fly Europe to Asia in business (maybe Asia Miles with Cathay Pacific if you have some Amex/CapOne points to supplement, or Flying Blue via the Middle East), then 55k to fly Asia back to USA in business (perhaps via Turkish or United’s Star Alliance partners, topping up with a few extra points). Yes, this exceeds 100k by a bit and uses multiple programs, but the concept is using points in chunks to encircle the globe. Even if you do part in economy to save points, you could literally visit 3 or 4 continents on one big trip powered by points. For a single person, 100k can go a long way in piecing this together if you hunt down sweet spots and maybe leverage a transfer bonus or two.

- Emirates First Class Shower Experience - Emirates is famed for its A380 first class, complete with a shower spa at 40,000 feet. Citi points can transfer to Emirates Skywards (currently 1:1 if you have Premier, though note: an upcoming change is reducing that to 1:0.8 for some cardholders, so use while it’s good). Emirates first from the U.S. to Europe (like New York to Milan, a fifth freedom route) runs about 85,000 Skywards miles one-way. With 100k, you can cover that. Yes, you’ll pay some fuel surcharges ($500-ish possibly), but you’ll get to experience one of the most over-the-top products in aviation: a private suite, caviar service, and a shower in the sky. Alternatively, 100k Skywards could get you close to a one-way from U.S. to Middle East in first (~136k needed from NYC to Dubai). Not enough for full, but perhaps from nearer (like Europe to Dubai is ~85k). But that New York-Milan flight for 85k is a “short” 7-hour jaunt that is perfect to enjoy all the goodies without breaking the bank points-wise. Imagine telling your friends you used points to fly in a $7,000 first class seat and took a shower above the clouds - that’s a wow!

ProTip: When going for these super high-end redemptions, don’t forget to document and enjoy the experience! You earned these points through responsible financial habits - you deserve to relish the fruits. Take the selfies in the lounge, savor the seven-course meal on bone china, pocket the amenity kit. These “bucket list” flights or stays are more than just transportation, they’re events in and of themselves. If you leveraged Citi ThankYou points to make it happen, that’s a double win: you’re living large and you stayed within your budget.

Final Thoughts: 100k Points - Your Ticket to the Extraordinary

Reaching 100,000 ThankYou points is a turning point. It elevates you from dabbling in points to truly unlocking premium travel. We’ve explored how 100k can fly you in style, put you up in luxury, or simply allow you to travel more often without financial strain. It’s a travel currency that, when used wisely, can easily deliver $2,000, $3,000, or even $10,000+ worth of value.

If you earned these points through Citi’s cards (perhaps a combo of a Premier bonus and steady Double Cash earnings), give yourself credit - you played the game well. If you’re still building toward 100k, hopefully this gives you motivation to get there, because the reward is sweet.

One piece of advice as you deploy this balance: have a plan. It’s easy to get overwhelmed by options at 100k. Create a short list of top goals (e.g., “biz class to Europe for anniversary” or “family Disney trip flights and hotel”). Then figure out which redemptions align and go after them. Points are meant to be used, and there’s no time like the present.

In our series, we’ve now covered 20k, 50k, and 100k. But what if you go even bigger?

Stay tuned for our next installment: 250,000 ThankYou points. At a quarter-million, we enter the realm of round-the-world possibilities and nearly unlimited flexibility. The excitement only grows from here.

Until then, enjoy dreaming up ways to spend your 100k - and then make it happen. Because the only thing better than planning a trip on points is actually taking that trip. Bon voyage!