The $6,580 Lie-Flat Lesson: How UpNonStop Turns a “Normal” Transatlantic Ticket into a Masterclass in Smart Redemption Strategy

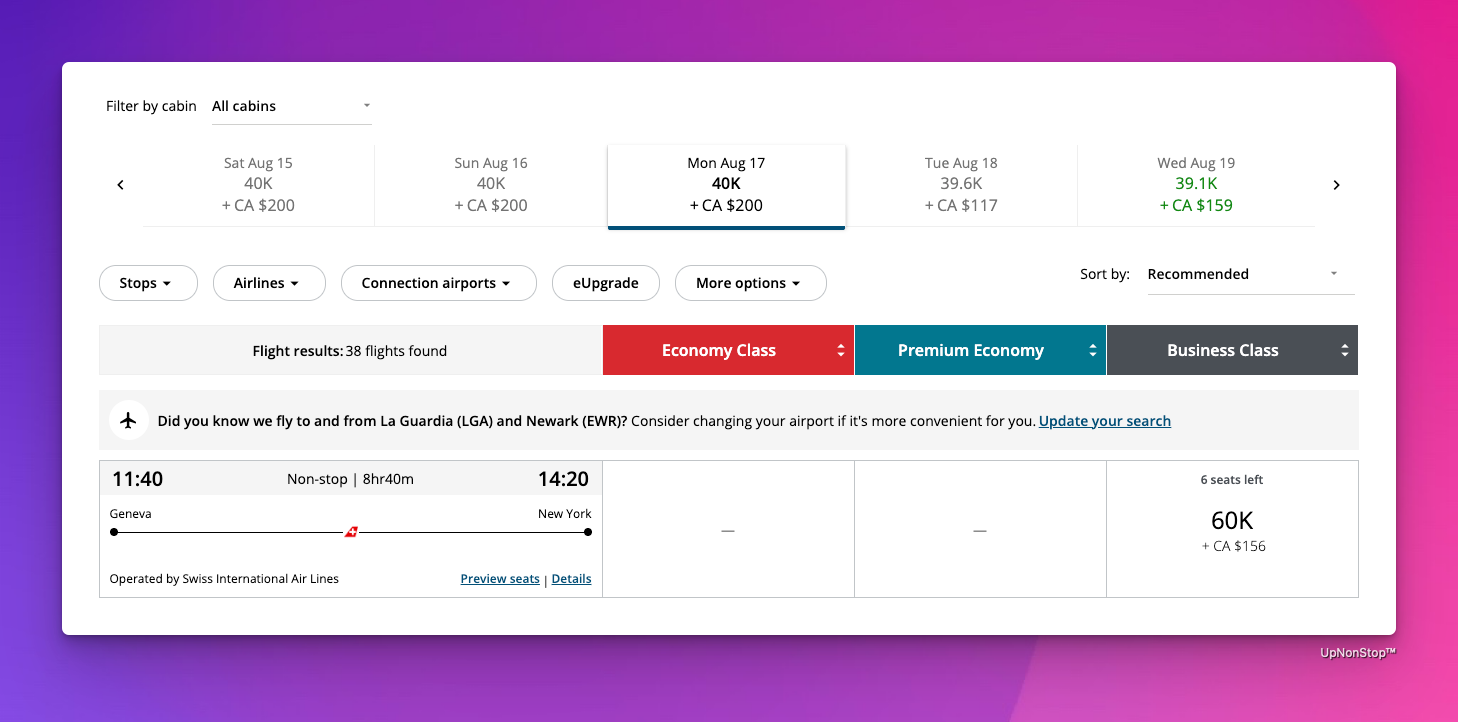

Same flight. Same seat. Three wildly different prices: the portal wants 657K points, United wants 88K, and Aeroplan quietly wins at 60K. This is why UpNonStop exists - to turn chaos into strategy and make every redemption a high-ROI financial decision, not a blind click.

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

Smart redemptions aren’t about booking a flight - they’re about refusing to let banks, portals, and “default” redemptions steal value you’ve already earned. This GVA–JFK business-class case study is the cleanest illustration: same seat, same plane, same 11:40 departure out of Geneva. Three prices. Three realities. Only one makes mathematical sense.

Your travel portal wants 657,953 points for a $6,580 seat - a redemption rate so bad it should come with a safety warning. United wants 88,000 miles + €51.64, which finally begins to look sane. And Aeroplan quietly slides in with 60,000 points + CAD 155.30, delivering the single best ROI by a mile - literally cents-on-the-dollar efficiency that portals don’t want you to know exists.

Now add a real UpNonStop client earning 3.125% back in points. For them, every redemption is an ROI event. Redeeming 60K Aeroplan isn’t just cheaper - it’s a financial strategy. Instead of torching almost 660K points for the same seat, they deploy 60K, save over $6,300 in cash, and convert everyday business spend into travel leverage that beats every “premium travel card” ad on earth.

This is the magic: same itinerary, three radically different outcomes - and UpNonStop is the difference between “I paid whatever the portal told me” and “I engineered the smartest seat on the plane.”

This isn’t travel hacking. It’s disciplined redemption strategy. And this article shows exactly why it works.

Everything else you need to know is just below 👇🏻

🎞️: Powered by NotebookLM @ UpNonStop

There are two kinds of travelers in this world:

- People who open a travel portal, see a five-figure number in points, shrug, and click redeem because “it’s free anyway,” and

- People who understand that every point is a financial instrument (an asset class) and know precisely when and where to deploy it for maximum ROI.

UpNonStop only works with the second category.

And if someone isn’t in that category yet… they join it the moment they see a real case study like this one.

Because nothing converts a casual traveler into a points strategist faster than watching the exact same seat price at:

- 657,953 portal points

- 88,000 United miles

- 60,000 Aeroplan points

The same seat. The same cabin. The same date. The same aircraft.

Three wildly different prices.

Welcome to the inside of the UpNonStop machine.

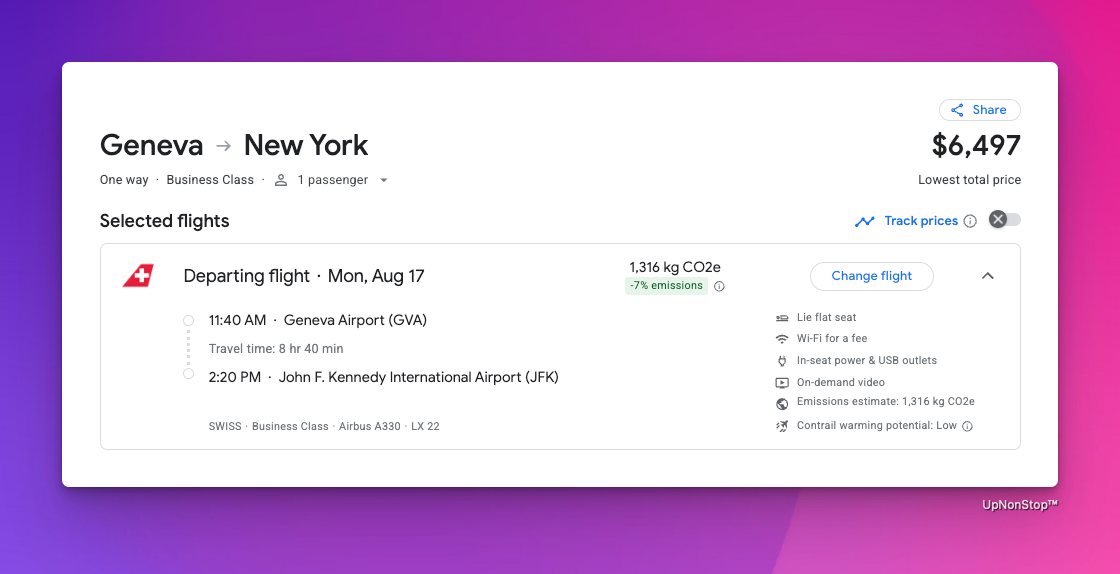

The Itinerary: A Serious Business Seat on a Serious Business Carrier

Geneva (GVA) → New York (JFK)

11:40 departure → 14:20 arrival

Airbus A330-300 Business Class (true lie-flat)

Distance: 3,857 miles

Flight Time: 8hr:40min

A polished European business product. Clean hardware. Predictable service. A seat that lets you sleep like a human being instead of a tax write-off.

If you fly transatlantic regularly, you already know Swiss is one of the safest plays for consistency. No surprise cabin roulette. No “angled lie-flat” museum relics. No performance art from the crew.

So far, so good.

Then comes the price.

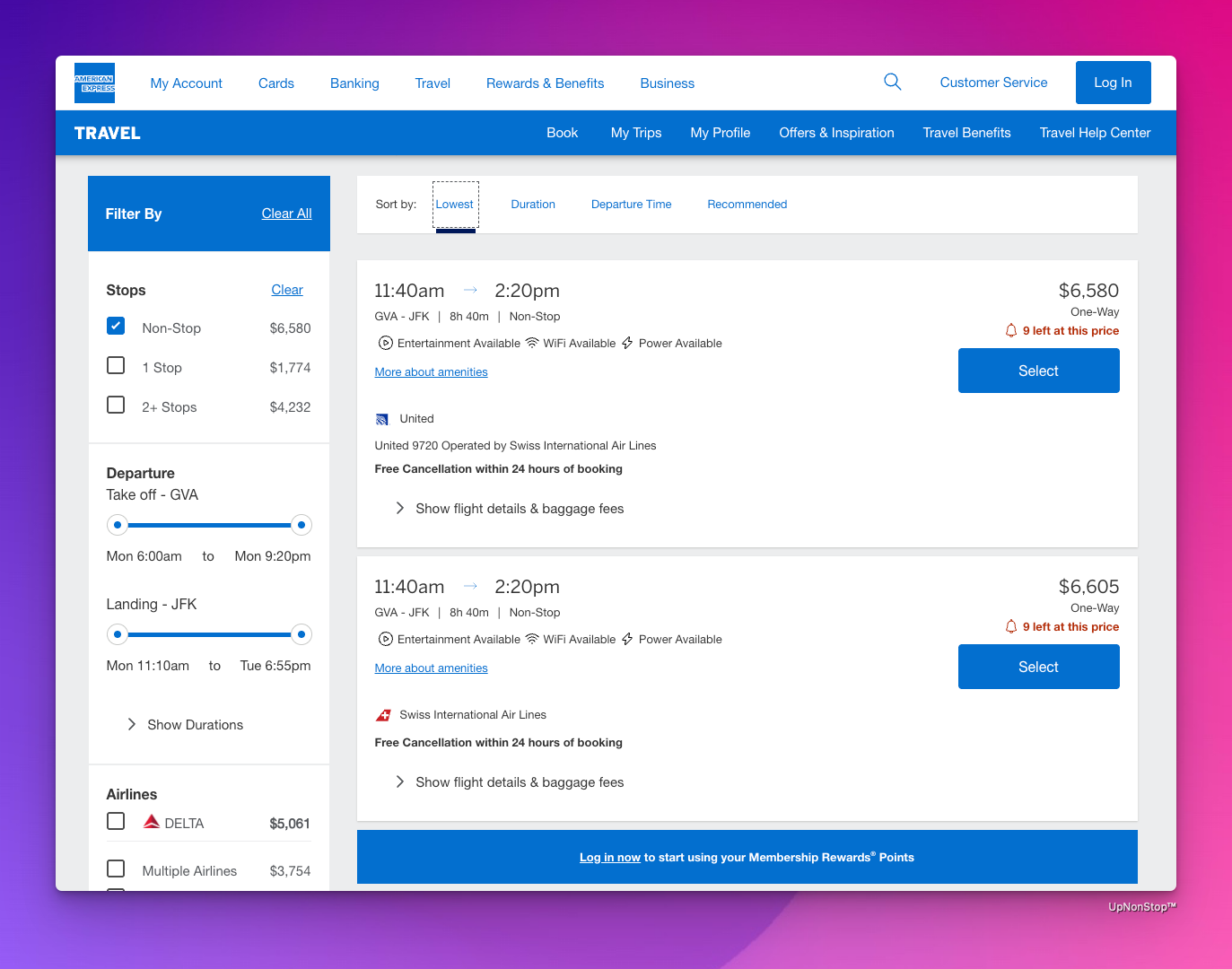

Price #1: The Travel Portal Scam (AKA The Great Points Evaporator)

Let’s start with the standard consumer trap: The portal.

The travel portal proudly displays:

- Cash price: $6,580

- Or pay with points: 657,953 points

This is the quiet part nobody says out loud:

When a travel portal offers a points price, it is not offering you a deal.

It is liquidating your points at exactly 1 cent per point.

$6,580 ÷ 657,953 = $0.0100 exactly.

It’s not a coincidence.

It’s not a special valuation.

It’s a fixed-rate cash-out disguised as “travel.”

This seat isn’t 657,953 points because it’s premium.

It’s 657,953 points because the backend math says:

Portal points = cash, at 1¢ per point.

And when a client tells me, “I used 650k points for my flight,” my jaw doesn’t drop because of the price. It drops because I immediately know:

They used one of the lowest-value redemption paths in the industry.

Portal redemptions are where points go to die.

But we can do better.

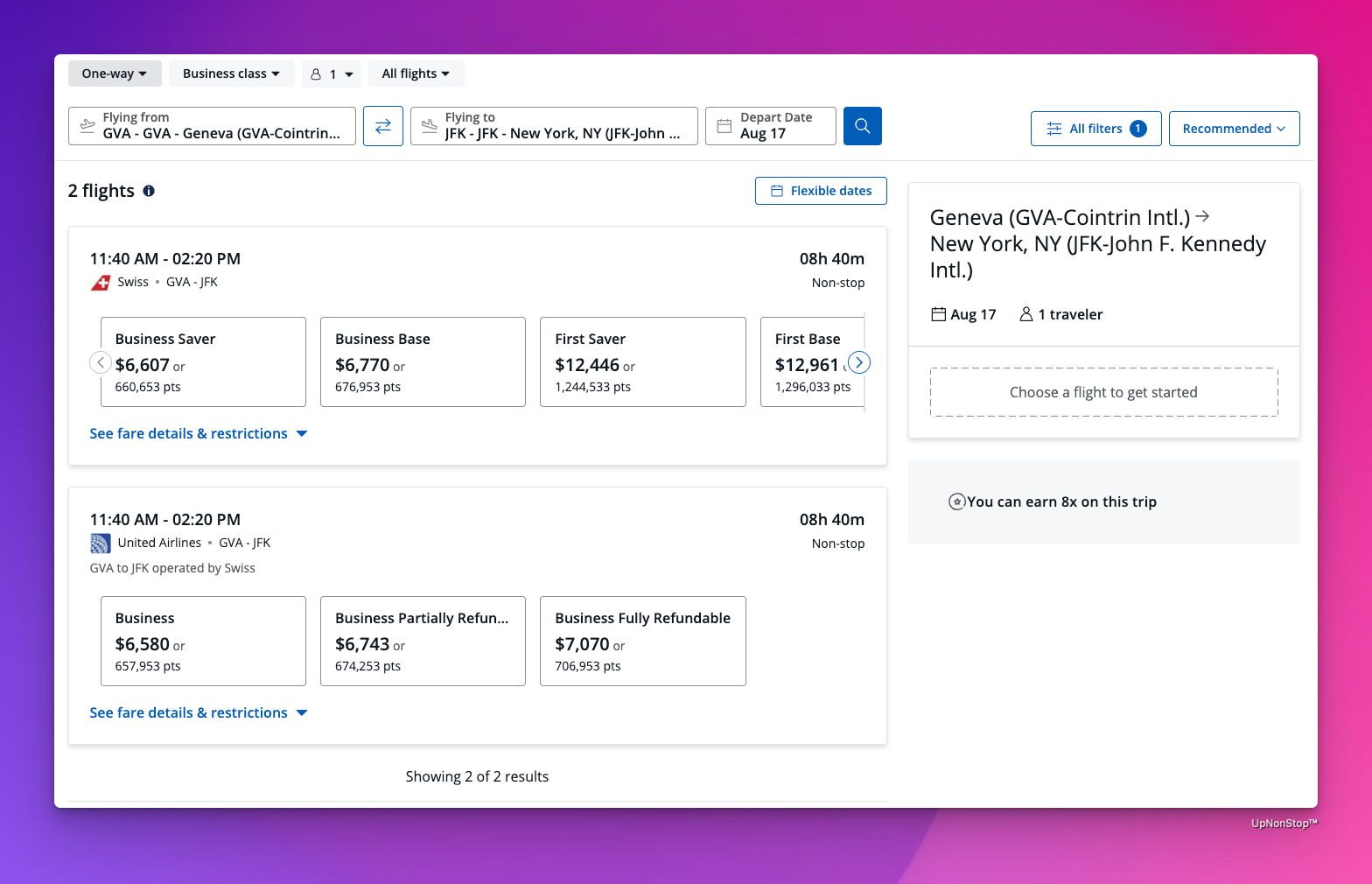

Price #2: United MileagePlus (Good, Not Great, But Occasionally Strategic)

Let’s rerun the same flight directly through United’s MileagePlus program:

- United award price: 88,000 miles

- Plus €51.64 in taxes/fees

Converted using a recent EUR→USD rate (1.1531):

€51.64 → $59.56

Total out-of-pocket: $59.56

Total miles: 88,000

Value calculation:

- Cash equivalent saved: $6,580 − $59.56 = $6,520.44

- Implied value per mile: $6,520.44 ÷ 88,000 = 7.41¢ per mile

That is 7.41x the portal value.

Read that again.

The exact same seat yields:

- Portal: 1.0¢ value per point

- United: 7.41¢ value per mile

Why would anyone willingly redeem at 1 cent when 7.4 cents is available?

Because most people never look beyond the portal.

Because most businesses never document their redemption strategy.

Because most card points earners have no idea what their points are capable of.

But you do.

Because you’re reading this.

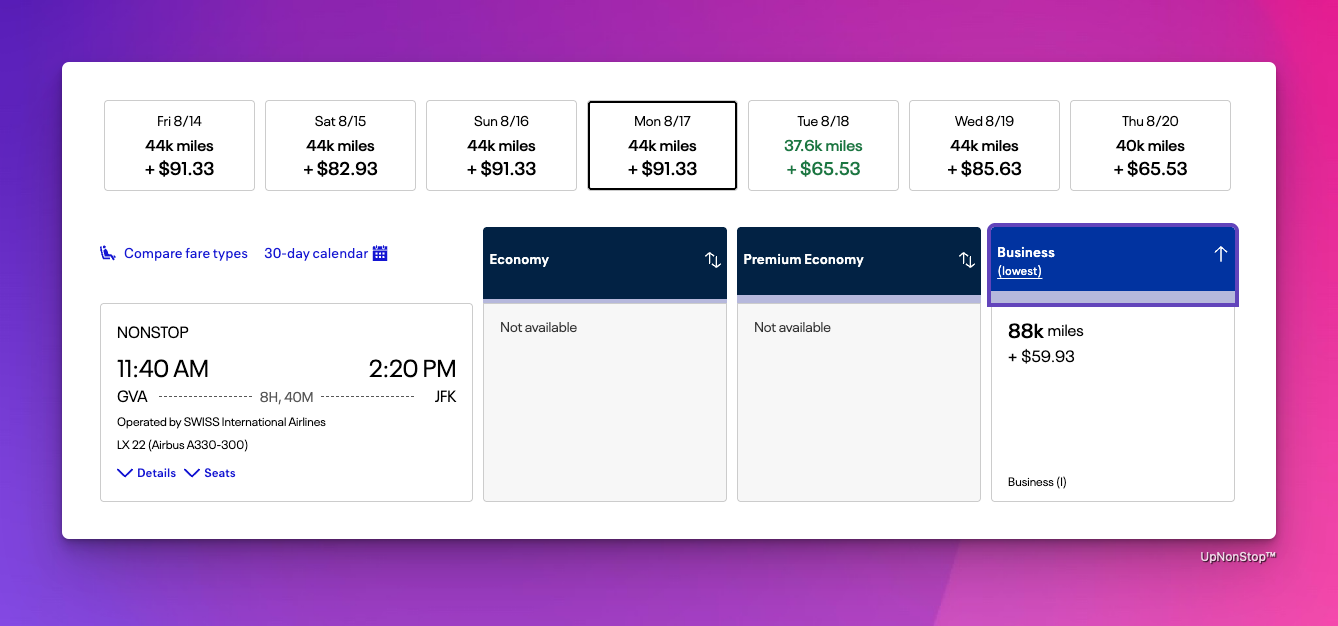

Price #3: Air Canada Aeroplan (This Is What We Call “Criminally Underpriced”)

Same seat. Same date. Same everything.

Through Aeroplan:

- Award price: 60,000 Aeroplan points

- Taxes/fees: CAD 155.30 → USD $110.58

Cash saved:

$6,580 - $110.58 = $6,469.42

Value per point:

$6,469.42 ÷ 60,000 = 10.78¢ per point

This is where your jaw should drop.

Aeroplan is giving you nearly 11 cents per point on a long-haul business class seat.

Compare all three paths:

| Program | Points Required | Fees | Value/Point | Relative ROI |

|---|---|---|---|---|

| Portal | 657,953 | $0 | 1.00¢ | Baseline (terrible) |

| United | 88,000 | $59.56 | 7.41¢ | 7.4× better |

| Aeroplan | 60,000 | $110.58 | 10.78¢ | 10.8× better |

This is not a game of “save a little here, save a little there.”

This is a game where:

One program multiplies your points’ value by over 10x—on the same seat.

This is why UpNonStop exists.

Why These Discrepancies Exist (The Part Most Travelers Don’t Know)

A portal redemption is priced off cash.

An airline program redemption is priced off a chart, zone, or dynamic award inventory that only loosely correlates with the cash price.

Air Canada uses a structured distance-based award chart with partner pricing that hasn’t caught up to the cash market on premium transatlantic fares.

Translation:

The portal charges you based on what the flight actually costs.

Aeroplan charges you based on a chart that has nothing to do with reality.

And you, the knowledgeable traveler, get to exploit that gap.

The UpNonStop Magic: Knowing When These Arbitrage Windows Appear

This isn’t luck.

It’s not random.

It’s not a glitch.

It’s predictable.

UpNonStop analyzes:

- Partner award charts

- Saver inventory

- Zone sweet spots

- Transfer partner alignment

- Cabin class quirks

- Historical price bands

- Fuel surcharge structures

- Dynamic pricing anomalies

And then we identify which program offers the highest cents-per-point today for any given itinerary.

For this flight:

- Aeroplan beats United

- United beats portal

- Portal comes dead last

This is not unusual.

In fact, it’s typical.

But this next part is where the real business value comes in.

The Business owner angle: What This Redemption Means for a Business Owner

Let’s bring in your sample client:

Average earn rate: 3.125%

Meaning every dollar of business spend earns 3.125 cents in usable point value.

To “earn” the points (in value terms) required for this redemption, we calculate:

Required Spend = Value Saved ÷ Earn Rate

Earn rate = 0.03125

Portal-equivalent spend:

$6,580 ÷ 0.03125 = $210,560 required business spend

United-equivalent spend:

$6,520.44 ÷ 0.03125 = $208,654 required spend

Aeroplan-equivalent spend:

$6,469.42 ÷ 0.03125 = $207,022 required spend

Notice something beautiful?

The Aeroplan redemption requires fewer points but generates nearly the same net dollar savings—so its implied ROI is absurdly high.

A business doing $300k+ in annual card spend can replicate this type of redemption multiple times per year.

A business doing $1M+ in card spend can industrialize it.

This is where UpNonStop’s model shines:

predictable, repeatable, scalable redemption arbitrage.

Now Let’s Talk About the Soft Stuff: The Experience, Service, and Comfort

Because numbers matter, but you know what’s even more meaningful?

How it feels to sit in the seat you just mathematically dominated.

Seat (Lie-flat on A330)

Swiss business on the A330 is a known quantity:

- 1-2-1 and 2-2-1 alternating, maximizing window privacy

- Fully lie-flat, decent width, angled footwell but manageable

- 9/10 for ergonomics

- 8.5/10 for privacy (solo seats rule)

Service

Swiss runs their cabin crew like a Swiss watch:

- Not overly warm, but always professional

- Quick meal pacing

- Efficient refills

- Zero chaos

9/10

Food & Beverage

Swiss uses consistent, relatively high-end catering:

- Reliable appetizers

- Solid mains

- Good wine list

- Great coffee

8/10

Ground Services

GVA and ZRH offer clean, fast, predictable lounge operations.

No circus. No hour-long queues.

8/10

Overall product rating: 8.5/10

This is a product built for actual business travel—not Instagram.

And that matters.

Because your points should buy you something that works.

The Real Lesson: “Value” Isn’t About Paying Less. It’s About Getting More for What You Already Spend.

Let’s zoom out. If a client spends:

- $500k/year

- $1M/year

- $3M/year

- $10M/year

They’re already earning redemption power.

The tragedy is that:

Most companies redeem points

the way consumers do.

They:

- See a portal price

- Assume the points price is “the best”

- Redeem at 1 cent per point

- Think they’re saving money

- Celebrate a “free” flight

- Never realize they just vaporized $4,000–$6,000 of potential value

This isn’t just inefficient.

It’s wasteful.

It’s leaving money on the table every single year.

UpNonStop’s entire model is based on one principle:

Your business is already earning the points.

Your job is to make sure those points behave like assets, not coupons.

And assets get optimized.

Putting It All Together: The Case Study in One Sentence

For the same Swiss business-class seat from Geneva to New York, your real options were:

- 657,953 portal points

vs. - 88,000 United miles

vs. - 60,000 Aeroplan points

One is a ripoff.

One is solid.

One is a masterstroke.

UpNonStop ensures you never choose the first, always know when to take the second, and consistently access the third.

So What Should You Do Next?

- Stop redeeming through portals.

They’re dead last in value. - Start centralizing spend to earn transferable currencies

(Amex, Chase, Capital One). - Use UpNonStop’s earning and burning strategy

to match your spend mix with the programs that consistently undervalue partner premium inventory. - Let us do the route shopping, the partner hunting, the transfer timing, and the seat-finding.

That’s the work.

And we already do it. - Repeat.

Again and again.

Because this is a play you can run every single year.

Final Word: Clients Love Savings, But They Stay for Predictability

A single $6,580 redemption saved at 10.78¢ per point is impressive.

But what CFOs, controllers, and owner-operators really want is predictability:

- predictable point accumulation

- predictable redemption opportunities

- predictable premium-cabin travel

- predictable returns on spend

- predictable financial efficiency

That’s what UpNonStop delivers.

Anyone can find a deal once.

We build systems that find deals forever.