Quarter Million, Infinite Miles: How to Turn 250,000 Citi Points Into First-Class Flights, Family Vacations, and Once-in-a-Lifetime Adventures

With 250,000 Citi ThankYou points, you can unlock first-class flights, family getaways, or round-the-world adventures. Our guide reveals how to maximize your stash for $5,000+ in travel value - turning your points into unforgettable trips without leaving value on the table.

If You Only Had 60 Seconds to Read This Article (Click Here)

With 250,000 Citi ThankYou points, you're sitting on a travel fund worth at least $2,500 through the Citi portal - but strategic transfers can easily push that to $5,000 - $10,000+ in value. Think 2 round-trip business class flights to Europe with points to spare, or multiple family vacations in economy with enough left over for premium hotel stays. This balance gives you rare flexibility: the option to prioritize convenience (like nonstop flights or ideal dates) over squeezing every last cent-per-point. But discipline still matters - aiming for a floor of 2 cents per point ensures you're extracting $5,000+ in travel value, without wasteful redemptions.

If you're tactical, 250k can stretch into 4-5 major trips. Consider: 120k for two lie-flat business class seats to Paris with another 50k - 70k on upscale lodging via Choice or Wyndham; 60k for four economy tickets to the Caribbean; 85k for a solo Emirates First Class ticket to Dubai; or even 22k transferred to Choice for Tokyo hotel nights. Want to go all in? One mega luxury trip with first-class flights and top-tier hotels can burn the entire stash in one go - but on your terms. The real takeaway is that you don’t need to choose between indulgence and efficiency - you can have both, if you map your redemptions wisely.

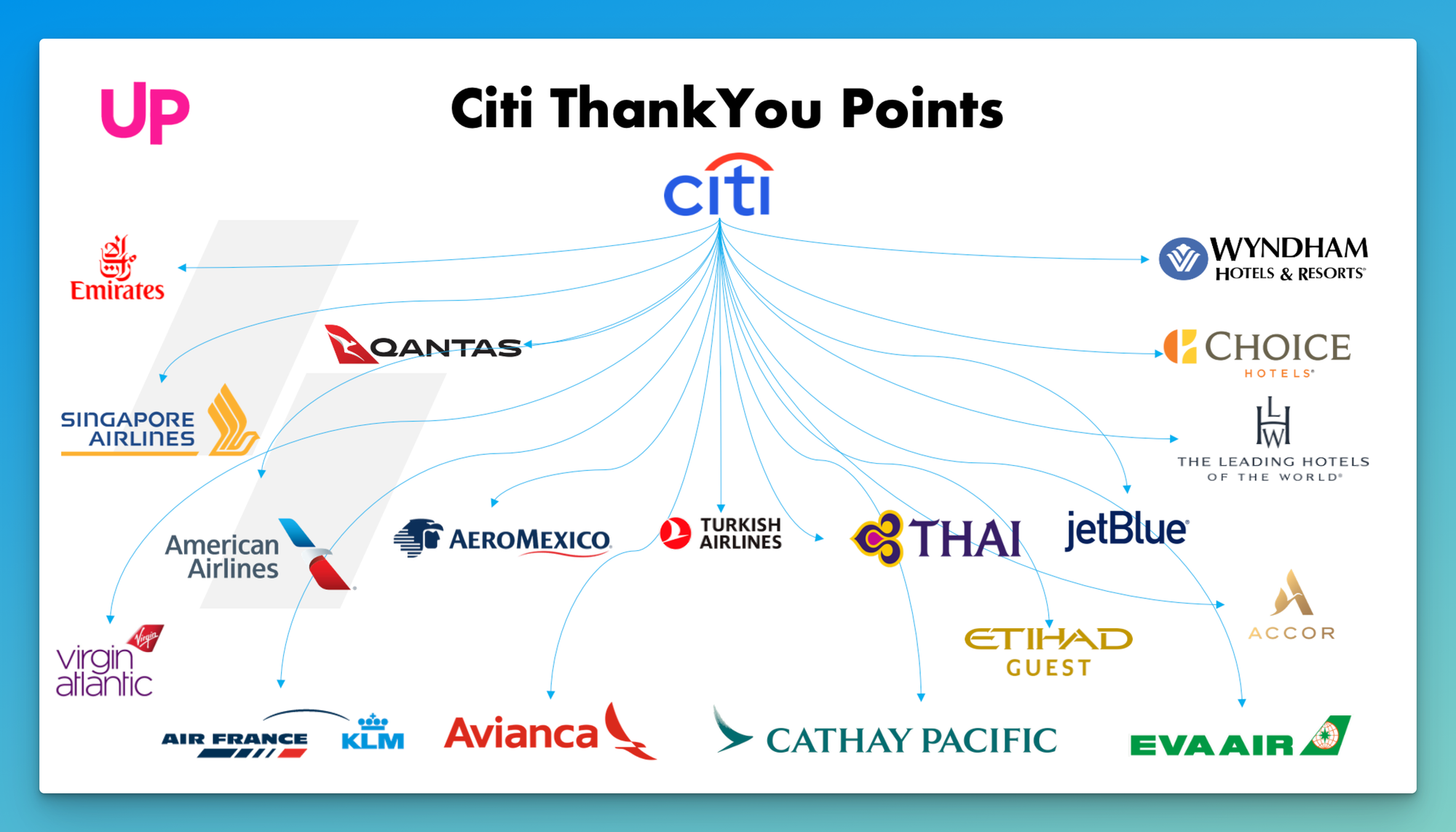

You could even go global. Stitch together a round-the-world trip by transferring points to Citi’s broad network of partners: 30k to Virgin Atlantic for NYC - London, 25k to Qatar for Europe - Doha, 35k to Asia Miles for Middle East to Asia, 25k to Singapore KrisFlyer for Asia - Australia, and 55k to Cathay for Australia - USA. It’s complex - but feasible - and often totals under 200k if optimized across cabins. Pro tip: stick to one alliance like Star Alliance and use Avianca LifeMiles or Turkish Miles&Smiles to simplify logistics and get stopover perks.

Planning something this intricate? It’s a perfect moment to call in an expert award booker and turn fantasy into itinerary.

For families, 250k is a serious cost eliminator. Four round-trip tickets to Disney, 3 - 5 nights at a resort via Wyndham, and even lift tickets or an Airbnb for ski season can all fit under budget. Want to take teens to Europe? 180k gets four economy seats round-trip with Turkish Airlines, leaving 70k for hotels or trains. Or split the cabin: 2 business class seats for the parents, 2 economy for the kids. Remember to pool ThankYou points among household members, and use the Citi Rewards+ card to score a 10% redemption rebate - redeem 200k, get 20k back.

Whether you're building memories at a national park or flying international in style, this balance lets you pick the experiences that matter most.

Everything else you need to know is just below 👇🏻

Quarter of a million points...

Take a moment to let that sink in. 250,000 Citi ThankYou points - whether you’ve earned them through business expenses, strategic sign-ups, or years of savvy spending, this is a truly impressive stockpile. At this level, you’re basically your own travel agency, with a bank of points to customize virtually any trip. If 100k points got you a taste of luxury and multiple options, 250k is a buffet of first-class flights, five-star hotels, and far-flung adventures. You have the means to cover entire vacations for a family, or orchestrate an around-the-world journey in premium cabins for yourself.

This article will guide you through making the most of a 250k balance. We’ll aim to avoid retreading ground from previous installments; instead, focusing on strategies unique to handling such a large sum. We’ll explore complex itineraries, high-value redemptions at scale, and how to ensure you diversify (or concentrate) your points for maximum effect. There’s also an underlying theme we’ll emphasize: with great points come great responsibility - you’ll want to redeem wisely to avoid leaving value on the table.

Buckle up, because at 250,000 points, the travel world is truly your oyster. Let’s crack it open and find some pearls of wisdom (and awesome trips)!

The Power of 250k: Big Picture

First, consider what 250,000 points represent:

- Monetary Baseline: At the bare minimum, through Citi’s portal, you have $2,500 in travel credit. That alone could pay for a very nice vacation or two. But of course, we’re aiming to double, triple, or even quadruple that value via strategic use.

- Multiple Premium Trips: You could fly business class not just once, but on several trips. For instance, 250k could cover business class round-trips to Europe for two people (approx 125k each), and still have points to spare for hotels.

- Around-the-World Potential: This is enough points to potentially circle the globe in stages. For example, a series of one-way awards hopping continent to continent, as we’ll discuss.

- Family Travel in Comfort: If you have a family, 250k might mean you can take the whole crew somewhere special in economy or premium economy, or a couple of people in business. The burden of big family travel expenses can be wiped away by this stash.

- No Compromises: With smaller balances, we often optimize every point. At 250k, you have some freedom to pick convenience over absolute max value at times. You can, for example, book a direct flight that costs a bit more in miles rather than an inconvenient connecting award - and it won’t break your bank. That’s a nice perk of a large balance: flexibility.

Strategy 1: The Multi-Trip Master Plan

Rather than focus on one trip, let’s outline how 250k could fuel an entire year (or two) of travel. Breaking it down into trips can be very effective.

Imagine the following travel calendar using 250k points:

- Spring: Romantic Europe Getaway - 2 round-trip tickets to Paris in business class on Air France using Flying Blue miles. Rough cost: ~120k points (if you catch a promo or off-peak, maybe 55-60k each). Use another 50k (->100k Choice) for 5 nights at an Ascend Collection hotel in Paris or the French countryside. Total: ~170k. You’ve just enjoyed lie-flat beds across the Atlantic and a lovely French holiday at minimal cost.

- Summer: Family Beach Vacation - 4 round-trip tickets to the Caribbean in economy (maybe 15k each via Flying Blue or AA partner awards). That’s 60k for flights for four people. Transfer another 20k to Wyndham (1:1) for 2-3 nights in an all-inclusive resort (15k/night per room, two rooms maybe for the family for a couple nights = ~60k Wyndham, a bit beyond 20k TY, so maybe adjust to one room or shorter stay, or use Choice points left from earlier). Or use the Citi portal to book a large Airbnb by the beach for $800 (80k points) for a week and pay cash for some meals. Total: ~60k-80k for a family of four’s flights + some lodging. Not too shabby.

- Fall: Solo Trip to Asia - Treat yourself to a solo adventure. Use 85k to fly one-way in Emirates First Classfrom USA to Dubai (shower time!). Then 50k to fly Dubai to Tokyo in business (maybe via JAL using American miles, but since we need Citi partner, you could do Qatar Qsuites via Avios 70k - maybe too high - or transfer to Etihad for 54k business on ANA from Europe to Tokyo… a bit complex). Let’s say 85k for Emirates 1st, and perhaps you pay cash or use other points for Tokyo back to US, or use another ~35k to come home in economy via United or similar. In Tokyo, use 22k ThankYou -> 44k Choice points for 3 nights at the Comfort Hotel Tokyo (just an example) or transfer 30k to ALL Accor for €600 value and splurge at the Park Hyatt Tokyo for a night (Lost in Translation vibes!). Total: ~130k for a globe-trotting, first-class sampling, multi-stop trip.

Add those up: 170k + 70k + 130k = 370k, which is beyond 250k. So maybe you wouldn’t do all in one year, or you trim each a bit (economy to Europe instead of biz would save a lot, but you have points, so why not live a little?). The point is: 250k can cover numerous trips. You could easily split it into, say, five 50k-point trips: each 50k could cover a flight and hotel for a long weekend somewhere for two people (with economy flights, like domestic or nearby international). That’s five vacations paid for.

Alternatively, it could cover two huge trips (125k each) with all the trimmings, or one mega trip (250k) with ultra-luxury at every step.

Strategy 2: The Round-the-World (RTW) Adventure

With 250k, you can seriously consider an around-the-world trip in terms of flights. While no U.S. credit card directly offers a RTW ticket, you can chain together awards. Here’s a hypothetical RTW routing using Citi transfer partners:

- Leg 1: USA to Europe - Transfer 30k to Virgin Atlantic for one-way Virgin Atlantic Upper Class (business) from NYC to London (often around 47.5k, but if you have any Amex or extra points, or catch a transfer bonus, that helps). Or go economy for ~20k on Flying Blue to save points.

- Leg 2: Europe to Middle East - Transfer 25k to Qatar Avios for a Qatar Airways business class flight from, say, Paris to Doha (typically 43k Avios one-way in biz, need some extra or a bonus, but maybe economy for 21k Avios).

- Leg 3: Middle East to Asia - Transfer 35k to Asia Miles (Cathay Pacific) to fly Doha to Hong Kong to Tokyo in business (Cathay might charge ~50k one-way biz from ME to Asia; you could also use Qatar Avios again: Doha to Maldives 40k biz or Doha to Bangkok ~50k).

- Leg 4: Asia to Oceania - Transfer 25k to Singapore KrisFlyer for a Singapore Airlines flight Tokyo to Sydney (Saver biz might be ~65k, so maybe economy 25k). Or use Qantas via Asia Miles from HK to Sydney (~30k economy).

- Leg 5: Australia to USA - Now the grand finale: transfer ~100k to Virgin Atlantic to book the famous ANA First Class from Sydney to USA via Tokyo (it’s two awards actually: Sydney to Tokyo first class on ANA, Tokyo to USA first class; not sure Virgin can do a connecting award like that easily, likely need separate awards; but ANA first Tokyo to US is 110k round-trip or 55k one-way first if allowed which historically Virgin required round-trip for ANA… perhaps scrap that). Alternatively, transfer 40k to Qantas (but Qantas program miles are hard to get via Citi unless via Wyndham->Qantas trick or something, skip). Or transfer 55k to Cathay Pacific Asia Miles for a one-way business from Sydney to Los Angeles on Cathay (via Hong Kong) - that’s plausible.

This RTW (round the world) is complicated, admittedly. The concept is to use different programs for each segment, aligning with their sweet spots in each region. It might total something like 200k if done mostly in business class and some economy. You’d visit 5-6 regions.

If that made your head spin, know that there are professionals who love planning these - and yes, this is a prime case for tapping an award booking service (again, hint hint - UpNonStop or similar). Hand them 250k worth of various bank points and say “I want to go around the world hitting these cities in business class,” and see the magic happen.

Strategy 3: Family Travel Made Easy

Let’s shift from the solo globetrotter to those with families. 250k points can be a godsend for family travel, which often is cost-prohibitive.

Some family-friendly redemptions:

- Disney World Trip: Use points for flights to Orlando - domestic US, maybe 4 x 25k round-trips via JetBlue TrueBlue (also a Citi partner; 1:1 transfer - 25k JetBlue might equal ~$300 ticket, so 4 tickets ~$1200 value for 100k points). Then hotels: transfer 80k to Wyndham (for 4 nights at Wyndham Bonnet Creek resort, a condo-style property near Disney at 15k/night for a suite = 60k, you have extra). Or use the Citi portal to book an on-site Disney hotel for $1500 (150k points) for a week. You could cover flights and lodging entirely with <250k. Considering a Disney vacation for 4 can easily run $5k including park tickets, being able to remove a big chunk of that cost is huge.

- Ski Trip for the Family: Fly to Denver or Salt Lake City using points (again maybe 4 tickets * 25k = 100k). Use ThankYou points on the portal for lift tickets or equipment rentals (some portals sell these or you could redeem for Airbnb near a ski resort). Or use Wyndham points to book a Vacasa cabin near the slopes (15k per bedroom). 250k could likely cover a significant portion of a ski holiday for a family of 4, which otherwise can be very pricey.

- International Journey: Maybe you want to take the kids to Europe or Asia to broaden their horizons. 250k could fly all four of you round-trip in economy to Europe (say 4 * 45k via Turkish = 180k round-trip total, since Turkish charges 45k per person round-trip US->Europe in economy). You’d have 70k left for hotels or trains, etc. Or if kids are older and you want comfort, maybe 2 business class seats for the parents (100k each RT = 200k) and put the teens in economy (50k total both RT) - that’s 250k and everyone’s on the same plane, parents up front enjoying champagne while the kids are fine in coach with their iPads. (Is that a little cheeky? Possibly. But hey, maybe alternate who gets the fancy seats on each flight leg!)

Strategy 4: Splurge on Unforgettable Luxury

With 250k, you might decide to check off one of those bucket list, once-in-a-lifetime experiences. We’ve already touched on first class flights like Emirates, Lufthansa, ANA… But what about on the ground or at sea?

- Overwater Bungalow in the Maldives: Citi doesn’t transfer to Marriott or Hilton, but you can use points creatively. For example, transfer to Choice Privileges - they have some partnership resorts like in the Maldives (Sun Aqua Vilu Reef was bookable via Choice at one point for 50k/night). With 250k (->500k Choice), you could potentially get 10 nights in a beach bungalow in the Maldives. Or transfer to Accor - use the €1,000 credit to offset a couple of nights at the all-villa Fairmont Maldives Sirru Fen Fushi (though it’s pricey, likely more than €500 a night). Alternatively, use the Citi portal to book any hotel and pay with points - $2,500 could get 5 nights at a $500/night luxury resort if available through their travel site.

- First Class Extravaganza Around the World: We talked about piecing it yourself, but you could go all-out: Use a big chunk (say 170k) for a one-way Emirates First Class from USA to Dubai to Singapore (you can do multi-city with Emirates miles: e.g., New York->Dubai stopover->Singapore, all in first, for maybe ~165k and lots of fees, but possible). Then another chunk (say 120k) for Singapore Suites from Singapore back to NY(it’s 132k KrisFlyer miles one-way in suites from SIN to JFK via FRA). That totals more than 250k, but maybe you catch a transfer bonus or use cash/other points for one segment’s fees. Essentially, you could fashion a round-the-world all-first-class: New York - Dubai - Singapore - Frankfurt - New York on two of the world’s top first classes (Emirates and Singapore). It would be the trip of a lifetime, covering literal circumnavigation in style.

- Charter a Yacht or Private Island: Did you know points can even do this? Citi’s portal or concierge might allow weird redemptions. Alternatively, 250k points (if cash-out at 1¢ each) is $2,500 - which in some places can rent a small yacht for a day or two or a private island stay for a night. It’s not typically the best use, but the point is you have options. For example, Richard Branson’s Necker Island can be booked via Virgin points (not Citi directly, but showing idea) - crazy expensive though. The more realistic: maybe use points to cover an upscale cruise. Citi has a cruise booking portal - $2,500 could book a very nice cruise cabin. Or you could transfer to Club Premier (Aeromexico) which has a partnership with Cruise Privileges points (not sure if still active, but historically one could use Aeromexico points for cruises). These out-of-the-box uses might not maximize value cent-wise, but they maximize experience.

Managing and Protecting a Large Balance

One aspect to note: 250k is a lot of points to have sitting around. A few tips on managing:

- Keep Your Cards Active: If you earned these across multiple Citi cards, ensure you keep at least one premium ThankYou card active (like the Strata Premier) so you don’t lose transfer privileges. If you need to cancel one card, combine points into another account first.

- Watch Transfer Ratios: As seen in recent updates, banks can change transfer ratios (e.g., Emirates dropping to 0.8:1). With 250k, small ratio changes can cost thousands of points. So stay informed on any planned devaluations or ratio shifts and transfer before they hit if needed.

- Beware of Devaluations: Airlines and hotels can increase award prices anytime. Consider using a good chunk of your points sooner rather than later, because 250k today might not go as far in 3 years. Diversifying across programs (don’t keep all points in one airline after transfer, only move when ready to book) helps mitigate the risk.

- Leverage Multiple Programs: With so many points, you might spread them among several loyalty programs for specific uses. Create a spreadsheet to track where you transfer points, account logins, and point expirations (e.g., Flying Blue miles expire after 2 years of inactivity, Singapore after 3 years hard expiration). With big balances, you want to make sure not a single point goes to waste due to expiration or forgetting an account.

- Security: Your ThankYou account is valuable; use strong passwords and possibly two-factor authentication. There have been (rare) cases of points theft. Don’t share your account details widely. When using an award booking service, ensure they are reputable and ideally they book by having you generate a transfer or booking yourself via a secure method (some services will handle everything, but just be mindful).

Final Thoughts: 250k - Your Passport to Infinite Possibilities

At 250,000 ThankYou points, you’ve achieved something exceptional. It puts you in a class of travelers who can all but eliminate cost considerations when planning travel, focusing instead on what you want to do. Want to fly around the world in first class? You can. Want to take your extended family on a vacation and pick up the tab? Done. Want to immerse yourself in luxury that would normally be out of reach? Here’s your ticket (literally).

We’ve outlined multiple strategies - from scattering points across many trips to concentrating them for grand journeys. You might even mix these approaches: save 100k for a huge trip, and use 150k for assorted smaller ones. The key is to redeem in ways that make you happiest, because points are a tool to enhance your life experiences.

One thing we haven’t directly mentioned yet: the role of professional help at this level. If you ever felt a need for guidance, it’s when dealing with tons of points. Award booking experts (like UpNonStop services, which we’ve subtly hinted at) can take the stress off and craft complex itineraries, ensuring you get maximum bang for your 250k. Don’t hesitate to use them for tricky bookings or even just inspiration - sometimes seeing a proposed itinerary opens your eyes to possibilities you hadn’t considered.

As we conclude the 250k chapter, there’s one more frontier to explore: the half-million mark. Stay tuned for the finale of our series, where we tackle 500,000 Citi ThankYou points - the realm of true high-rollers and dreamers.

Spoiler: if you thought 250k could do a lot, 500k will blow your mind. Until then, keep strategizing, keep exploring, and most importantly, enjoy the journey that your points make possible. Safe travels and happy swiping!