How to Turn 20,000 Citi Points Into $500 Flights, 4 Hotel Nights, or a Tropical Escape

Think 20,000 Citi ThankYou points can’t take you far? Think again. With the right strategy, that “small” stash can unlock $500+ in flights, free hotel stays, or a Caribbean getaway. Don’t waste it on gift cards - here’s how to squeeze every drop of value from your Citi points...

If You Only Had 60 Seconds to Read This Article (Click Here)

Don’t underestimate 20,000 Citi ThankYou points-it might sound modest, but with the right moves, it can be worth far more than $200. While the Citi Travel Portal gives you a fixed 1¢ per point value ($200 total), that’s just the floor. With a premium card like the Citi Strata Premier, you unlock access to 21 transfer partners, allowing you to extract up to 2–3¢ per point in value. That means your 20k points could translate to $400–$600+ in real travel when redeemed smartly. The portal works great for simplicity - book any flight, hotel, or rental car directly - but you’re leaving serious value on the table if you stop there. Think of the portal as your backup plan, not your endgame.

Transferring to airline partners is where the real magic happens. Turkish Airlines Miles&Smiles lets you book any round-trip United flight in the U.S. - even cross-country or to Hawaii - for just 20k miles. That same itinerary could cost $500+ in cash. With Flying Blue, you might snag a one-way to Hawaii or the Caribbean for just 15k miles, turning your 20k stash into tropical sun and surf. Avianca LifeMiles offers U.S. domestic one-ways from ~7.5k miles, meaning two full flights are within reach. These transfers can double or even triple the value of your points - so long as you confirm award space before moving them (points are irreversible once transferred). Always start your search on United, Delta, or Air France’s sites depending on your target route.

Hotel redemptions through Citi’s partners also pack a punch. Choice Privileges offers 2:1 transfer rates from ThankYou points, meaning your 20k becomes 40k Choice points - enough for two nights at an upscale Ascend Collection hotel or even four nights at a lower-tier property. Wyndham Rewards lets you score two nights at a 7.5k property with 5k leftover or a night at a 15k-per-night resort. Even Accor’s ALL program gives you €200 (~$220) off a Fairmont or Sofitel bill. That’s equivalent to the portal’s fixed value - but with more flexibility in luxury markets. Look for fifth-night-free deals or bonus night promos that stretch your balance further.

As a last resort, you can redeem for cash back, gift cards, or Amazon shopping - but you’re capping out around 0.8–1¢ per point in value. That’s $160–$200, a clear downgrade from the potential $500+ flights or multi-night hotel stays mentioned above. Still, if your points are about to expire or you’re closing a Citi card without a backup, cashing out is better than losing them. If you're strategic and combine tools - like the 10% rebate from Citi Rewards+ or point pooling with a partner - you can further stretch the value of this relatively small balance. Done right, 20,000 points isn’t small - it’s a plane ticket, a getaway, or a budget-saver waiting to be unlocked.

Everything else you need to know is just below 👇🏻

What to Do With 20,000 Citi ThankYou Points

Twenty thousand points might not sound like a life-changing windfall at first. After all, if you use Citi’s own travel portal, 20,000 ThankYou points equates to roughly $200 in travel value. But don’t let that baseline fool you - with a bit of savvy, those 20k points can unlock experiences worth far more than a couple hundred bucks. The key is knowing how to maximize Citi ThankYou points through the right redemption strategies. In fact, even a relatively modest stash of 20,000 points can be parlayed into a free flight or a few hotel nights that might surprise you. Curious how? Keep reading - we’ll explore how to squeeze every last drop of value from 20k Citi points, from clever point transfers to strategic bookings. Even with a smaller balance, you’re closer to your next adventure than you think!

Understanding the Value of 20,000 Points

Before diving into specific redemptions, it’s important to understand what 20,000 Citi ThankYou points represent in the broader context of travel rewards. Think of ThankYou points as a flexible currency:

- Baseline Value: If you book travel through Citi’s Travel Portal, your points are generally worth 1 cent each. That means 20k points = $200 in flights, hotels, or car rentals. Not bad, but we can do better.

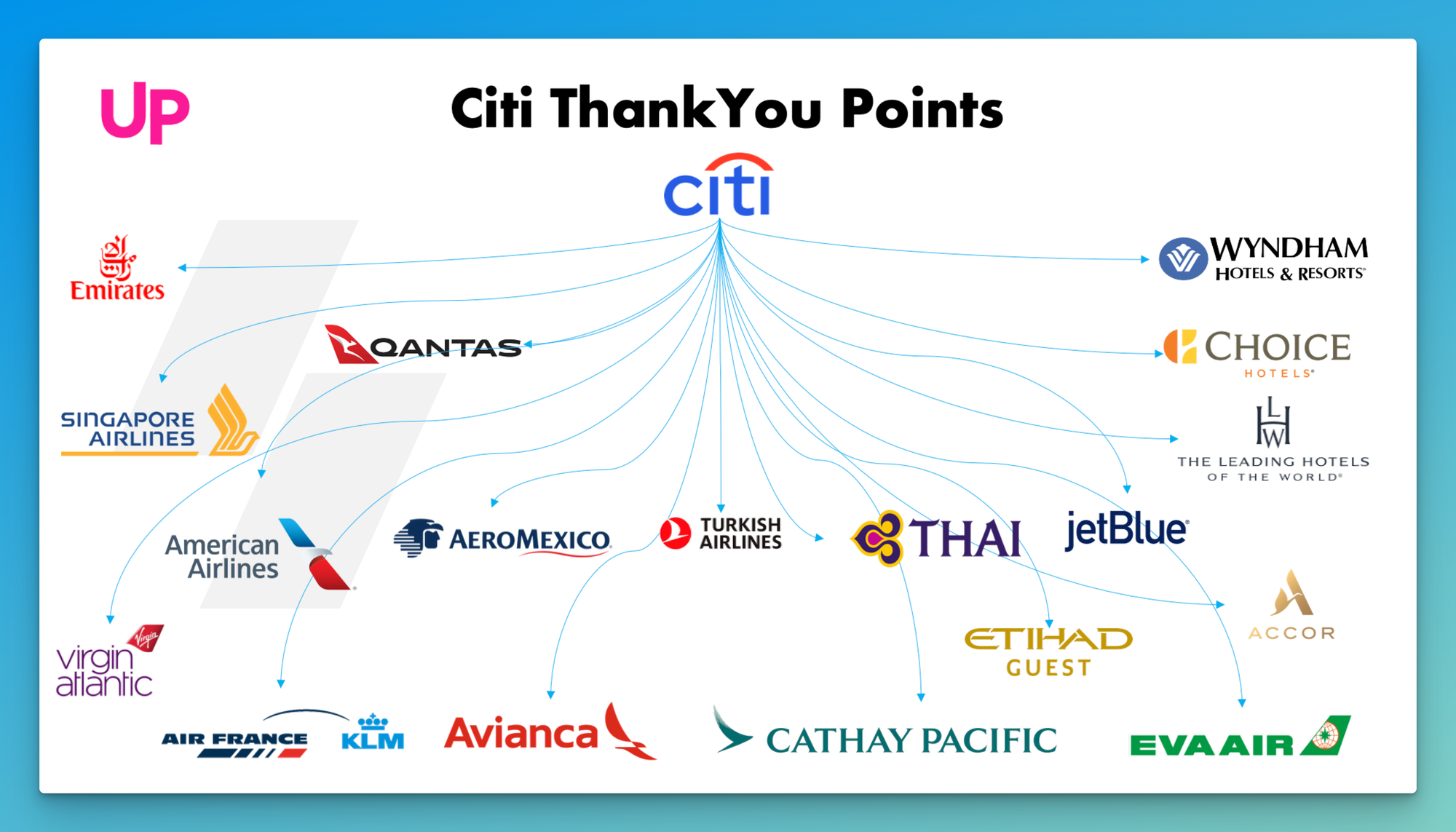

- Transfer Potential: Citi has a roster of 21 transfer partners (airlines and hotels) to which you can convert ThankYou points. By moving your points into these programs, you can often get 2 cents or more per point in value. This is where 20k points can punch above their weight.

- Important: To unlock all transfer partners, you’ll need a premium Citi card like the Citi Strata Premier. With only a no-annual-fee card (like Citi Rewards+ or Citi Double Cash), your transfer options are limited to a few partners (Choice Hotels, Wyndham, JetBlue) at adjusted ratios. So having the right card boosts your points’ power.

Option 1: Book Travel Through the Citi Travel Portal

Let’s start with the simplest route: using the Citi Travel Portal. This is Citi’s online booking platform (accessible via ThankYou.com) where you can spend points just like cash for flights, hotels, rental cars, and more. At 20,000 points, you have about $200 of travel credit here.

What can $200 get you in travel? Actually, (potentially) quite a lot:

- Domestic Economy Flight: $200 might cover a round-trip airfare for a short-haul flight or an advance-purchase ticket on many U.S. routes. For example, you could snag a round-trip from New York to Miami or Chicago to Dallas using your points.

- Hotel Stay: Through the portal, you could book a night (or even two) at a mid-range hotel. Think a night at a Marriott Courtyard or Hilton Garden Inn in many cities, or two nights at a lower-cost property. Your 20k points can turn into a free weekend getaway.

- Car Rental: Need wheels for a road trip? $200 worth of points can cover a couple of days’ car rental in many locations - perfect for that spontaneous weekend escape.

The upside of using the portal is simplicity - no worrying about reward seat availability or blackout dates. If there’s a seat for sale or a hotel room open, you can book it with points. Plus, you’ll still earn airline miles or hotel points on these bookings since the travel is treated like a cash purchase.

However, the portal’s downside is the fixed value. You’re locked into ~1¢ per point. That’s fine as a floor, but savvy travelers know our goal is to exceed that value via other methods…

Option 2: Transfer to Airline Partners for Outsized Value

This is where 20,000 ThankYou points can truly shine. By transferring your points to Citi’s airline partners, you unlock award charts and sweet spots that can turn a modest points balance into a fantastic trip. Here are some of the best ways to use 20k points via transfers:

- Fly Round-Trip Anywhere in the U.S. (Turkish Miles&Smiles): Believe it or not, you can book a round-trip domestic flight on United Airlines for 20k points by leveraging Turkish Airlines’ Miles&Smiles program. Turkish is a Citi partner (1:1 transfer). They charge 10,000 miles each way for any United domestic economy flight, even coast-to-coast or to Hawaii! That means your 20k ThankYou points (once transferred to Turkish) could get you a ticket that might cost $500+ in cash. For example, fly New York to Hawaii round-trip (usually a pricey trip) for just 20k points. Talk about punching above your weight!

- Island Getaway to Hawaii (Flying Blue or Singapore KrisFlyer): Hawaii is a dream trip for many, and 20k points can make it happen. Air France/KLM’s Flying Blue program (another 1:1 transfer partner) often has promo awards to Hawaii for as low as 15,000 miles one-way in economy on Delta flights from the West Coast. With a bit of flexibility, you could do Los Angeles to Honolulu for 15k, leaving you 5k points to spare. Alternatively, Singapore Airlines KrisFlyer (1:1 transfer) allows booking United flights to Hawaii for 19,500 miles one-way in economy. That’s 39k round-trip, which is a bit above 20k - but you could cover one direction (20k for one-way for two people, for instance). If you’re just shy on points, remember you can always pay one way with cash and the other with points.

- Quick Escape to Mexico or the Caribbean (Flying Blue): Flying Blue has a generous definition of “North America.” For example, Mexico and the Caribbean are often just 12,500-15,000 Flying Blue miles one-wayfrom the U.S. mainland. That means 20k ThankYou points could become a one-way ticket for two people to Cancun or the Bahamas (or a round-trip for one person with a bit more points). Sun, sand, and turquoise waters for minimal out-of-pocket cost - yes please!

- Short-Haul Bargains (Avianca LifeMiles): Another transfer partner, Avianca LifeMiles, has a region-based award chart with some short-haul gems. For instance, certain U.S. domestic routes or flights from the U.S. to nearby regions (like northern South America) can cost under 12,500 LifeMiles one-way in economy. With 20k, you could do a one-way flight to Colombia or Peru (around 17.5k in some cases) or cover a couple of shorter domestic hops (perhaps two one-ways at ~7.5k each). LifeMiles can be quirky, but the deals are there if you hunt.

As you can see, 20,000 points can go further via strategic transfers than through the fixed-value portal. A $500 flight to Hawaii or a $400 domestic round-trip is a much better deal than a flat $200 value.

Option 3: Hotel Stays via Transfer Partners

Citi ThankYou points also have a couple of hotel loyalty partners. With 20k points, you’re not going to be staying a week in the Maldives, but you can get solid value for hotel nights, especially in mid-range properties or off-peak times.

- Choice Privileges Hotels: Citi lets you transfer to Choice Privileges at excellent rates if you hold the Strata Premier or Prestige card - in fact, 1 ThankYou point = 2 Choice points. That means 20,000 Citi points becomes 40,000 Choice points. What can that get? Choice has a huge network (Comfort Inn, Quality Inn, Sleep Inn, Clarion, as well as the upscale Ascend Collection and all-inclusive resorts in the Caribbean). Many mid-tier Choice hotels cost between 16k and 20k points per night. So your 40k points could cover two free nights at a nice Ascend Collection boutique hotel, or even four nights at a lower-category property that’s 10k a night. For instance, imagine a long weekend in Nashville or Charleston - hotel covered by points!

- Wyndham Rewards: Another hotel partner is Wyndham. With a premium Citi card, the transfer is 1:1 (20k ThankYou = 20k Wyndham). Wyndham’s award chart has flat tiers: properties cost 7,500, 15,000, or 30,000 points per night (go free awards). With 20k, you could get two nights at a 7.5k-per-night hotel (common for budget-friendly hotels in the Wyndham portfolio like Days Inn, Super 8, etc.) and still have 5k left, or one night at a nicer 15k property (think Wyndham Grand or certain All-Inclusive resorts at off-peak rates) with some points left over. While one night isn’t a full vacation, it could save you $150-$200 at a resort - again, beating the value of the portal.

- Accor Live Limitless (ALL): This one’s a bit different. Citi transfers to Accor (the parent of Fairmont, Sofitel, Novotel, etc.) at a 2:1 ratio. So 20k ThankYou becomes 10k Accor points. Accor uses points as roughly cash credits: 2,000 ALL points = €40 off. So 10k ALL points = €200 (~$220) credit. This essentially equates to the same 1¢ per point value, but if you’re planning a stay at a fancy Fairmont or Raffles hotel, it’s worth noting you can effectively get ~$220 off your bill using this method. It’s straightforward and might come in handy for a luxury stay where standard points rooms aren’t available.

Other Uses: Cash, Gift Cards, and Shopping (If You Must)

Citi ThankYou points have a myriad of redemption options beyond travel. You can redeem for statement credits or cash back (usually at $0.01 per point, so 20k = $200). You can also get gift cards to various retailers (often at the same 1¢ rate; occasionally Citi runs sales like a $25 gift card for 2,200 points, slightly improving value). And there’s Shop With Points on Amazon or Best Buy, where you pay for purchases with points (usually around 0.8¢ per point value - not great).

For the sake of comprehensiveness:

- $200 Cash Back: 20,000 points could simply wipe $200 off your credit card bill or be deposited in your bank. Straightforward, but you’re capping yourself at the bare minimum value of your points.

- Gift Cards: If you catch a promotion, you might redeem 20k for maybe $220 worth of gift cards to stores you love - that’s effectively a 1.1¢ value. Without a promo, it’s $200 in gift cards. If you have an immediate need (say you need new appliances at Home Depot and you can snag a Home Depot gift card with points), it’s not the worst use. Just not the best.

- Shopping Portals: Using points on Amazon or Apple’s site, etc., tends to yield subpar value (~0.8 cents/point typically). We’d advise against it unless you have more points than you know what to do with (in which case, 20k probably isn’t your endpoint!).

Making the Most of a Small Stash

When dealing with 20,000 points, a smart strategy is to target redemptions that fully use (or just slightly exceed) your balance. You want to walk away feeling like “Wow, I got [flight/hotel] for free with my points,” rather than redeeming for $50 here and $50 there with no memorable result. For instance:

- Booking a round-trip flight that uses ~20k points is ideal - it’s a complete free trip.

- If you need a few thousand extra points to reach an award, consider topping up by earning more (maybe put a bit more spending on your Citi Double Cash card to earn the difference, rather than settling for a lesser redemption).

Also, consider combining your ThankYou points with a partner or family member. Citi lets you transfer ThankYou points to another person’s ThankYou account (up to 100k per year). If your spouse or friend also has some points, you could pool 20k + 20k to get 40k in one account and really open up your options (just note: transferred points to another person expire after 90 days, so use them quickly).

Final Thoughts: Big Memories from “Just” 20,000 Points

Don’t underestimate the travel you can unlock with 20,000 ThankYou points. By leveraging transfer partners, you can turn this humble sum into a mainland-to-Hawaii flight, a weekend hotel stay, or multiple shorter hops that would otherwise dent your wallet. The key is being strategic: transferring to high-value airline partners whenever possible, and using the Citi Travel Portal when you find a particularly good deal that points can cover.

Perhaps the best part of having 20k Citi points is that it’s often within reach through a single credit card sign-up bonus or a few months of rewards. For example, the Citi Strata Premier Card often has a welcome bonus (say, 60k points), and even the no-fee Citi Rewards+ might net ~20k in a bonus - so getting this stash is doable. And once you have it, you’re equipped to save a few hundred dollars on your next trip or indulge in a travel treat you might’ve otherwise skipped.

Ready for more? This article is just the start. We’ve seen how 20k can get you a nice taste of award travel. In our next installment, we’ll crank it up a notch.

Stay tuned for the 50,000 points strategy - with three times the points, the possibilities really start to expand!

And remember, even if the world of points feels a bit overwhelming, there are resources and experts (like UpNonStop services) that can help you plan the perfect redemption.

But for now, pat yourself on the back - 20,000 points can indeed take you places. Happy travels!