From Dental Equipment to Deluxe Suites: How a Miami practice owner turned $80K/month spend into a Buenos Aires 4-night luxury stay for 120K points

$1,349/night stay at 30K-point rate: How a Miami dentist transformed his recurring business spend into a marquee hotel escape, RÜFÜS DU SOL concert access, and four nights at one of Buenos Aires’ most sumptuous addresses.

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

A Miami-based dentist will turn eight months of routine corporate spend into a four-night luxury escape at the Palacio Duhau - Park Hyatt Buenos Aires this February. Using 120,000 Hyatt points transferred from Chase Ultimate Rewards, the stay (otherwise ~$5,399) will include marble-floored rooms, manicured gardens, spa access, fine dining, and a live ROFUS concert.

His practice spends heavily each month on lab supplies, CE courses, software, marketing, and recurring fees, totaling over $100K.

Before UpNonStop, this overhead earned just 1.5% cashback. After optimizing cards and mapping spend categories across Amex, Chase, and Capital One, he now earns a blended 3.1% return, turning everyday expenses into a predictable points engine.

Timing and strategy were crucial: points were transferred at the optimal window to ensure peak-season availability. This approach delivers a 9.0% Return-on-Spend (RoS) - far above what generic cash-back could achieve - and provides a tax-free, experiential yield rather than a ledger number.

This case demonstrates the power of systematic points management for Business Owners. Routine spend becomes a repeatable, high-value asset, unlocking experiences that cash cannot buy, all without adding complexity to daily operations. Four nights in Buenos Aires are proof that strategy beats luck every time.

Everything else you need to know is just below 👇🏻

He drills. He bills. He spends $80,000 a month on a practice that hums like a machine. Supplies, lab work, digital scanners, marketing retainers - the cash flow of modern dentistry.

But this February, instead of another tax-deductible expense, that money will translate into something else entirely: 4 nights of marble, wine, and five-star service at the Palacio Duhau – Park Hyatt Buenos Aires.

All booked for 120,000 Hyatt points transferred from Chase Ultimate Rewards.

Cash rate? $5,399.

And yes - all from points earned while keeping molars healthy.

Name/Role: Miami-based dentist and practice owner

Time with UpNonStop: 8 months

Pre-UpNonStop Spend Efficiency: Standard ~1.5% equivalent cashback, credit cards unmanaged, points dormant

Average Monthly Corporate Spend: Six-figures consistently (>$100K/month)

Cards Optimized: Amex Business Platinum/Gold, Chase Ink Business, Capital One Venture

Target: Maximize point accumulation, stabilize earn rate, build high-value redemption capacity

Average Earn Rate: ~3.1% effective across all corporate spend (a significant improvement from 1.5%)

Points Accumulated: 120,000 Hyatt points (transferred from Chase Ultimate Rewards)

Redemption Executed: Palacio Duhau – Park Hyatt Buenos Aires, 4-night stay

Cash Value of Stay: ~$5,399

Fees Paid: Minimal taxes & service charges relative to cash price

Return-on-Spend (RoS): ~9.0% (see “Let’s Do the Math” below)

Experience Delivered: Historic luxury rooms, spa access, world-class dining, Recoleta gardens, and a live concert experience (which he didn't get with points ;)

This redemption isn’t just about the luxury hotel. It’s a demonstration of what happens when you treat routine corporate spend like a strategic asset, rather than a line item in your P&L.

The Earn: Turning Routine Dental Spend into Points

The dentist’s practice spends heavily each month:

- Lab Work & Supplies: $35,000/month

- CE Courses & Certifications: $7,500/month

- Marketing & Digital Advertising: $12,000/month

- Software Subscriptions & Practice Management: $10,000/month

- Equipment Financing & Leasing: $15,000/month

- Miscellaneous Overhead (utilities, insurance, payroll fees): $20,000/month

Totaling $100,000+ per month, or $1.2M per year.

Before UpNonStop, all of this earned 1.5% cashback, meaning about $18,000 per year in “rewards” - not bad, but taxable and far below the real potential.

Eight months ago, the dentist joined UpNonStop, and the game changed. His points strategy became methodical:

Step 1: Map & Consolidate Spend

- Lab suppliers → Chase Ink Business (3x points on recurring vendor payments)

- CE courses & advertising → Amex Business Gold/Platinum (4x points on select business categories)

- Miscellaneous recurring payments → Capital One Venture (optimized floor earn for non-category spend)

Mapping spend to the optimal card ensured that every dollar contributed to points accumulation, without adding friction to day-to-day operations.

Step 2: Stabilize Monthly Flow

- Spend volume was distributed to avoid hitting category caps or losing bonus points

- Dynamic tracking ensured points accumulation remained consistent each month

- Reconciliations prevented missed opportunities from unplanned vendor payments

After eight months, his blended earn rate stabilized at 3.1%, more than double the prior 1.5% return, setting him up for a meaningful, tax-free redemption.

Step 3: Transfer Timing

- 120,000 Chase Ultimate Rewards points were transferred to Hyatt once availability at Palacio Duhau was confirmed

- Timing ensured peak-season availability in mid-February (Argentina’s summer)

- Transfer strategy maximized liquid points availability, ensuring no risk of overpaying cash for rooms

Through systematic spend mapping, consistent monitoring, and strategic timing, routine overhead was converted into a predictable, repeatable points engine.

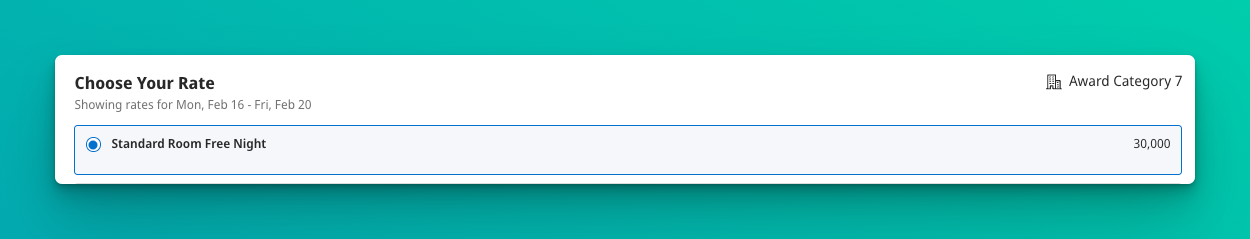

The Burn: Redeeming for Palacio Duhau

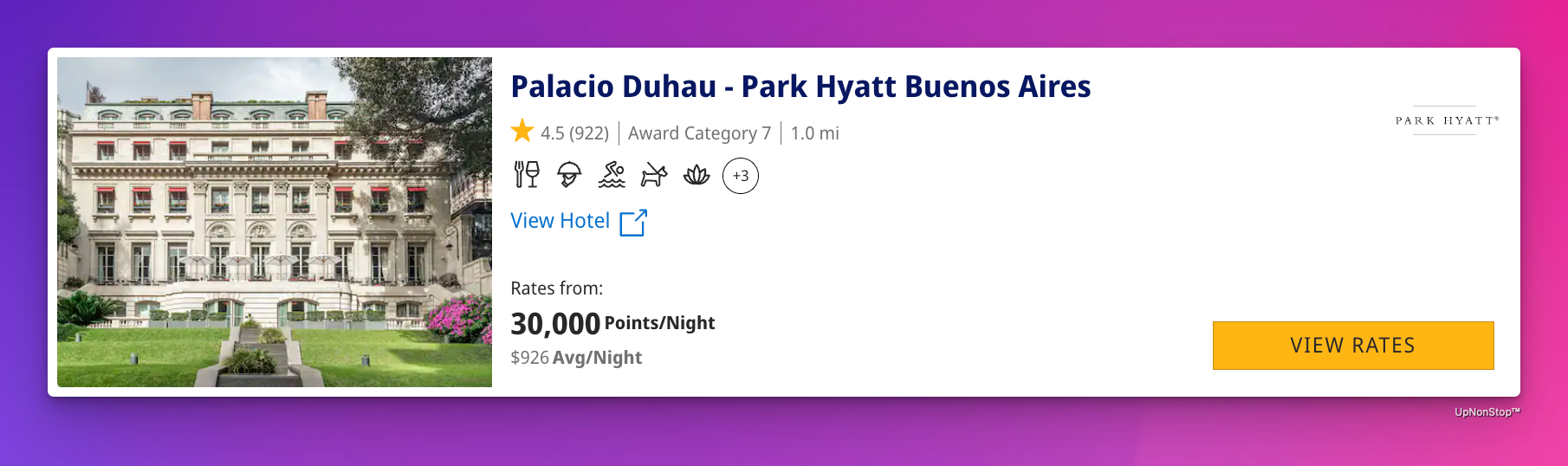

Property: Palacio Duhau – Park Hyatt Buenos Aires

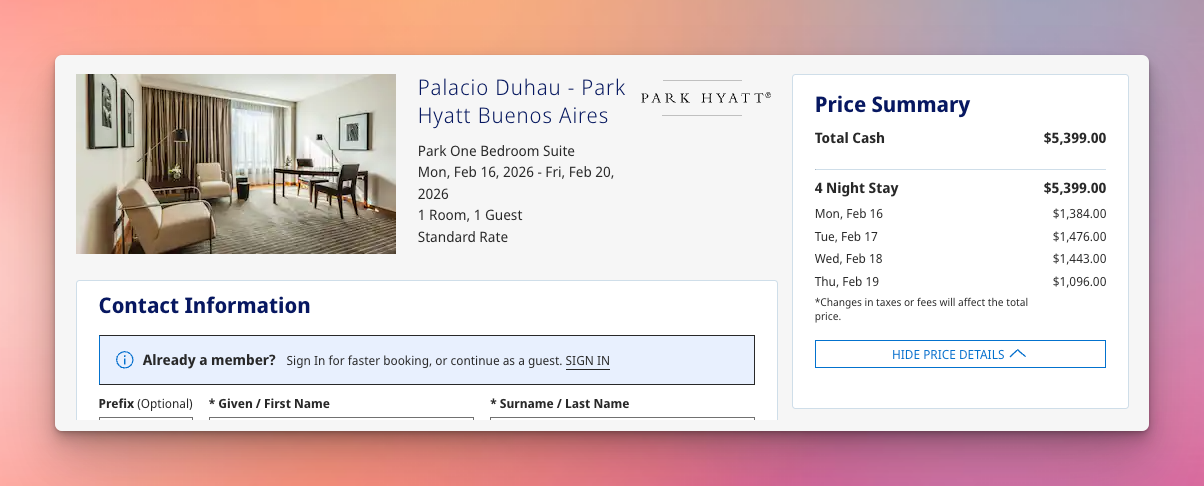

Dates: Mid-February, 4 nights

Points Required: 30,000 Hyatt points per night = 120,000 points total

Cash Equivalent: ~$5,399

Property Highlights

- Historic & Modern Luxury Combined: Italian marble floors, hand-crafted décor, and contemporary amenities

- Spa & Wellness Center: Sauna, treatment rooms, massage, and beauty services

- Outdoor Pool & Gardens: Recoleta’s manicured gardens for morning strolls or poolside relaxation

- Dining: Elena Restaurant, award-winning Argentine cuisine

- Rooms: 500+ sq. ft., marble bathrooms, plush bedding, city/garden views

- Entertainment: Proximity to live ROFUS concert scheduled during stay

Booking this stay with points transforms a routine expense into a curated experience, something cash-back alone could never deliver.

Let’s Do the Math

Points Used: 120,000 Chase Ultimate Rewards transferred to Hyatt Points

Cash Equivalent: $5,399

Value per Point: $5,399 ÷ 120,000 ≈ 4.5¢ per point

Earn Rate: 3.1%

Spend Required to Earn 120K Points: 120,000 ÷ 0.031 ≈ $387,000 in business spend

Return-on-Spend (RoS): $5,399 ÷ $387,000 ≈ 9.0% yield

Cash-back Comparison:

- 1.5% cashback would have returned ~$5,805 on the same spend

- Points strategy unlocks tax-free, experiential value, rather than a generic ledger return

The Experience Ahead

This February, Our practice owner and spouse will...

- Check in to a Palacio Duhau Park Deluxe Room (Suite Upgrade Pending)

- Enjoy garden views and serene marble interiors

- Spend afternoons poolside, unwind in the spa

- Dine at Elena Restaurant, sampling seasonal Argentine cuisine

- Attend the ROFUS concert (seamlessly integrated with the stay)

All of this stems from routine, predictable business spend, executed with precision.

Why It Matters

- Routine spend becomes tangible luxury: Ordinary lab fees and CE courses generate extraordinary experiences

- Points become tax-free yield: The value is realized without increasing taxable income

- Systematic, repeatable approach: Not a one-off reward - similar future spend will fund additional premium experiences

Takeaways

- Systemize Spend: Map expenses to the highest-yielding cards, stabilize flow

- Plan Redemptions: Transfer and book when availability and transfer bonuses align

- ROI Is Experiential: Cash-back cannot purchase curated, immersive experiences like Palacio Duhau

- Repeatable System: Points accumulate predictably and compound over time

In essence, it’s not about spending more. It’s about spending smarter. Every dollar spent is a dollar working harder - and the results speak for themselves: predictable points, maximum RoS, and experiences that elevate ordinary business spend into unforgettable memories.