50,000 BILT Points: Stepping Up Your Travel Game

With 50K BILT points, you’ve unlocked serious travel potential - from lie-flat seats to luxury hotels or multiple round-trips in the U.S. Don’t waste them on cash redemptions. Transfer smart, plan ahead, and use Rent Day boosts to keep earning. (Spoiler Alert: This is where the fun really starts!)

If You Only Had 60 Seconds to Read This Article (Click Here)

Congratulations on hitting 50,000 BILT points - this is where travel gets serious. You’ve moved past casual redemptions and into the zone where international flights, business class seats, and multi-night luxury hotel stays are all realistic options. If you earned the points within a year, you’ve also unlocked BILT Silver status, which brings benefits like point interest and Rent Day transfer bonuses. This isn’t just a number milestone - it’s a strategic inflection point.

How You Got Here: and How to Keep Going

You likely earned those points through a combination of rent payments, Rent Day multipliers, referral bonuses, and smart spending in the BILT Neighborhood (dining, fitness, etc.). Don’t stop now. Keep maximizing Rent Day, eye new milestone bonuses, and hunt for Rent Day transfer promotions. Pay attention to partner offers like Walgreens, and don’t ignore the underrated value of paid bookings through the BILT portal if you’re already planning a trip.

Redemption Options: Quantity or Quality

With 50k BILT points, you can go wide or deep. Fly business class one-way to Europe or Asia for a taste of luxury, or squeeze in multiple domestic round-trips (Turkish Airlines via United is a sweet spot at just 15k per U.S. round-trip). Prefer hotels? That stash converts to two nights at a $700+ Hyatt resort or several nights at solid mid-tier properties. You can even pull off a Hawaii trip for two with flights and hotel covered - yes, really.

Smart Moves and Next Steps

Don’t waste your points on cash redemptions or merchandise - the opportunity cost is brutal. Focus on high-value transfer partners like Hyatt, Air France, or Alaska Airlines. Think in combinations: book a flight with one partner and a hotel with another. Most importantly, use the points while they’re valuable. BILT points replenish with rent and spend, so don’t fall into hoarding mode. You’ve mastered 50k - now start dreaming bigger. 100k is next.

Everything else you need to know is just below 👇🏻

So, you’ve leveled up to a 50,000 BILT point balance - nicely done! At this stage, you’re moving from a quick trip here or there to the realm of more ambitious travel plans. Fifty thousand points open the door to premium flights, longer vacations, and creative combinations of redemptions that weren’t possible with just 20k. Plus, if you earned those points within a year, congrats on reaching BILT Silver status - meaning you get some interest on your points and bigger bonuses on BILT Rent Day promotions (more on that shortly). Now let’s maximize those 50k points so you get the absolute most out of them.

From 20k to 50k: Maximizing Earning Strategies

Climbing from 20,000 to 50,000 BILT points likely meant doubling down on the strategies you used to get the first chunk - with a few new tricks:

- Keep paying rent (and maybe pay others’ rent!). Rent remains the single easiest way to rack up points. If you have roommates or a significant other, consider consolidating rent payments through your BILT card (they can pay you back). You’ll hit that 50k faster by earning on the whole rent check rather than just your portion. And remember, there’s a 100k/year cap on rent points, which you’re halfway to now.

- Supercharge your spending on Rent Day. Now that you’re a seasoned BILT user, you know the first of the month is party time. With 50k points banked, you might be eyeing an even bigger goal (like 100k for Gold status), so efficiency matters. Plan ahead to use the double points on Rent Day for any large expenses: maybe that new laptop, a semester’s tuition, or an annual insurance premium. Spread the purchases across Rent Days if you can, to repeatedly snag the extra +100% points (up to 1k bonus each time). It’s like a monthly turbo boost for your balance.

- Leverage BILT’s Promotions and Milestones. By 50k you’ve unlocked at least one BILT Milestone Reward (after earning 25k points). Perhaps you chose a 2x grocery or 2x gas bonus for a month. If so, hopefully you used it to stock up on essentials and bank some extra points. At 50k (Silver status), you won’t get another milestone choice until 75k, but stay alert for targeted offers. BILT has been known to email cardholders surprise challenges (like “spend $X this month for Y bonus points”). Take advantage if it aligns with your spending plans. Every boost counts toward that next big redemption.

- Explore the BILT Dining and Fitness networks more deeply. By now you might have a few favorite restaurants that quietly earn you BILT points when you pay with a linked card. With a 50k balance, you clearly value points - so maximize these “free point” opportunities. If two lunch spots near work earn 5x BILT points via the app and two don’t, you know where to eat! Similarly, if you have a fitness membership or class pack, see if booking through BILT’s app is an option. Ten SoulCycle classes at $30 each would normally earn just 300 points on a 1x card - but via BILT’s 10x Neighborhood perk, that’s 3,000 points. These partnerships can be a goldmine when used regularly.

- Consider the BILT travel portal for paid travel. Wait, use points for cash flights? No - here we’re talking about earning. If you’re booking paid travel anyway, you could book via the BILT travel portal (run by Expedia) to earn 2x points on flights, hotels, and cars. It’s not something to go out of your way for (since many other cards give 2x or more on travel), but if BILT is your primary card, it’s good to know. A $500 hotel stay will yield an extra 1,000 BILT points through the portal. Again, the idea is to squeeze every drop of earning potential.

- Capitalize on referrals and opportunities. At 50k, maybe you’ve already referred a friend or two (that’s 2,500 points each). Why stop now? If you know fellow renters or travel enthusiasts, share your referral code in the BILT app. Five successful referrals could net you 12,500 points (2,500 each plus a 10k bonus for the fifth referral) - pushing you to 62.5k. It’s one of the fastest ways to boost your balance without spending money. Also, keep an eye on new BILT partners; for example, they added Walgreens to the Neighborhood program (1x on purchases, 2x on Walgreens brands, plus 100 points per prescription). Little bonuses like these can collectively add thousands of points with minimal effort.

By employing these tactics, 50,000 points is an achievable milestone - many BILT users hit it within their first year. Now comes the fun part: spending those points for outsized rewards that dwarf what 20k could do.

Thinking Bigger: What Can 50,000 Points Get You?

With 50k in your account, you’ve officially moved into a new class of redemptions. Suddenly, business class flights enter the conversation, multi-stop itineraries become possible, and luxury hotels for multiple nights are on the table. The key is to diversify your uses and layer strategies. Here are some stellar ways to deploy 50,000 BILT points:

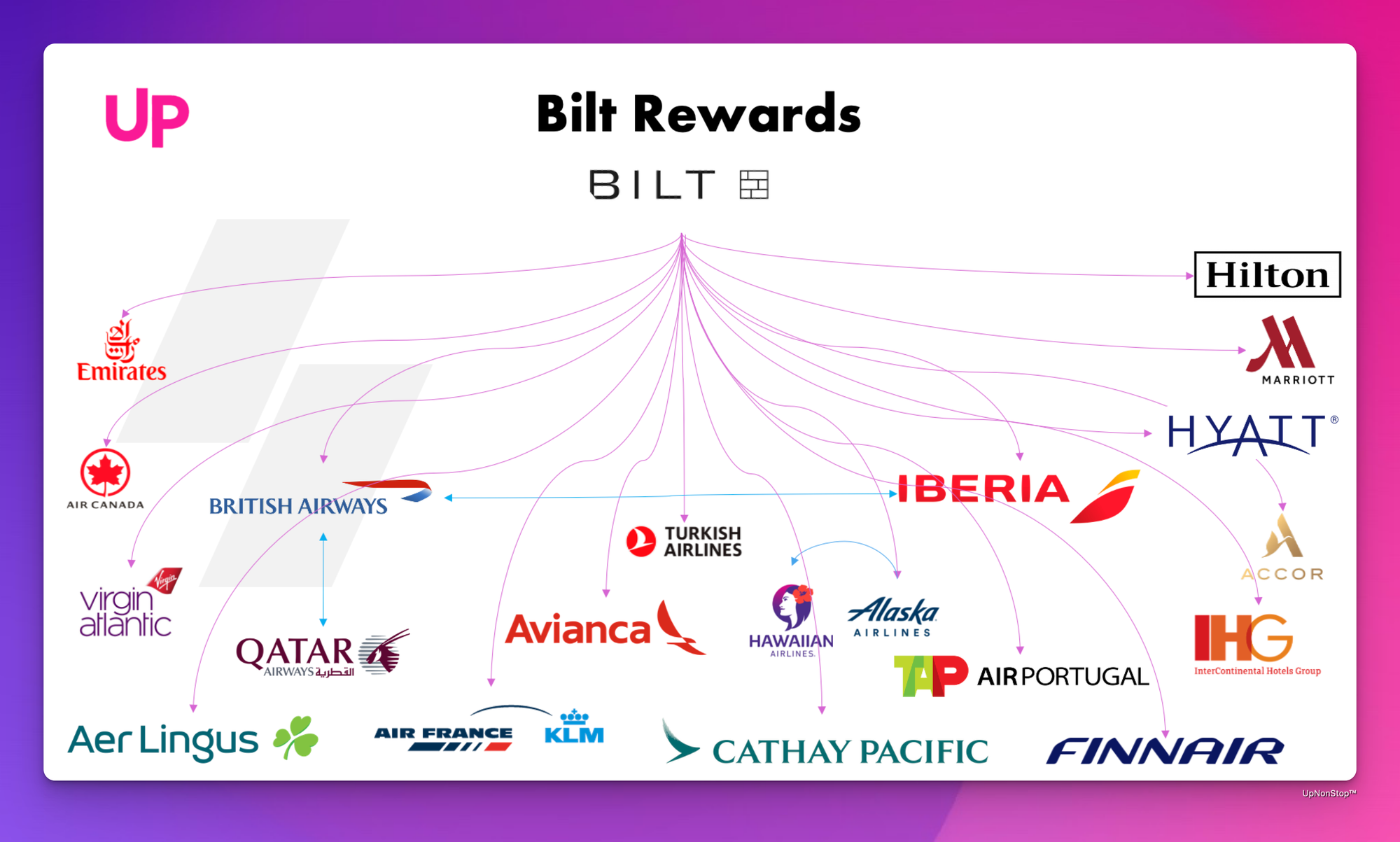

- Business Class, Here We Come - One of the most exciting uses of 50k points is dipping your toes into business class on an international flight. While 50k alone might not cover a round-trip in biz, it can often cover a one-way in business class to Europe or South America with certain programs. For instance, transfer ~48k points to Air France/KLM Flying Blue, and you could fly New York to Paris in business class one-way (that route often runs ~55k-60k Flying Blue miles on a good day). Or transfer 50k to Alaska Airlines Mileage Plan - BILT is the only bank program that can do this - and you can book Cathay Pacific business class from the US to Asia one-way (costs 50,000 Alaska miles from West Coast to Hong Kong). Imagine: you’re sipping champagne in a lie-flat seat on a long-haul flight that would’ve cost $4,000, and it only “cost” you half your BILT stash. That’s the magic of 50k.

- Two Economy Round-Trips in the U.S. - Your 50k can also be stretched for multiple trips in economy. For example, we discussed how 15k Turkish miles buys one round-trip in the U.S. via United. With 50k, you could book three separate domestic round-trips (3 × 15k = 45k) and still have 5k left. That’s three vacations or three visits to family across the country. You could fly NYC-LAX in spring, Chicago-Honolulu in summer, and Dallas-NYC in the fall, all for points. Similarly, 50k transferred to Southwest Rapid Rewards (yes, BILT now partners with Southwest!) could cover two to three round-trips on Southwest if you hunt for their famous low fares. The value per point might be ~1.3-1.5 cents (so 50k ~ $650-750 in flights), which isn’t earth-shattering, but the flexibility and free bags on Southwest are nice perks. If maximizing the number of trips is your goal, splitting 50k into multiple domestic jaunts is a satisfying strategy.

- Hawaii for Two (Flights + Hotel) - Let’s paint a picture: you and your partner want a Hawaii getaway. With 50k BILT points, you can fly two people round-trip to Hawaii and cover at least one night at a beach resort, all on points. Here’s how: Transfer 30k to Turkish Miles & Smiles - that gives you 30k miles, enough for two round-trip tickets on United (15k each). Yes, really - that’s 4 flight segments (two people, two flights each) for a total of 30k miles + about $22 in fees. Now you’ve got 20k BILT left. Transfer that to Hyatt for 20k Hyatt points. That could book you one night at the Hyatt Regency Waikiki Beach (Category 5, ~20k points), which often goes for $300+ per night. Or split into two nights at a lower-category Hawaii hotel (some nice Hyatt Place or Hyatt Regency properties in Honolulu are 8k-12k points/night, so 20k could be two nights). Effectively, your flights for two and a couple nights of lodging are covered by points. That’s hundreds of dollars saved - leaving you more budget for island activities, mai tais, and poke bowls.

- Multiple Nights of Luxury - 50k BILT -> 50k Hyatt can unlock some seriously upscale hotel stays. Perhaps you want a luxurious long weekend. Many top-tier Hyatt hotels (Category 6) cost 25,000 points/night (standard). With 50k, you get two nights at, say, the Andaz Maui at Wailea (25k/night off-peak, or 30k standard) - a resort that often runs $700+ a night. Two free nights in Maui could easily be worth $1,400 since this resort is pricey. Or you could do four nights at a Category 4 Hyatt (15k per night) like the Hyatt Regency Coconut Point mentioned earlier or the Thompson Washington D.C., where rooms often cost $300/night - you’re getting $1,200 in value for 60k points (a bit above 50k, but if you have a couple extra points or catch off-peak nights at 12k each, it fits). The point is, 50k points puts upscale accommodations firmly within reach, turning an indulgent trip that might have been too expensive into an affordable treat. And if your travel companion also has some BILT or other transferable points, you could combine forces to extend the stay to 3-4 nights of luxury.

- A Pair of International Economy Trips - If you’d rather travel farther in economy (and don’t mind coach), 50k can potentially cover two separate international round-trip flights. For instance, Aeroplan has competitive pricing to many destinations. About 40k-45k Aeroplan points can get you a round-trip economy ticket from the US to Europe on Star Alliance (depending on distance and whether it’s off-peak - some routes price at 60k, but deals exist around 40k). If you find the right flights, you could convert ~40k of your BILT to Aeroplan and go to Europe, and still have ~10k left. Later in the year, maybe transfer another chunk (once you earn it) to take a trip to the Caribbean or Central America (which might be ~20k-30k round-trip via Aeroplan or Avios). Essentially, with smart use of alliances (Star Alliance via Aeroplan, OneWorld via Avios), 50k can be stretched into two overseas trips in economy class. Each might cost you $50-$100 in taxes, but imagine flying to London in spring and Costa Rica in fall, all on points. Not too shabby for a no-annual-fee card’s rewards, right?

- Splurge on First Class (Once) - If you’re feeling extra fancy and want a taste of the high life, you could blow your 50k in one shot on a first class experience on a shorter route. For example, BILT transfers to British Airways Avios, which you can use to book Cathay Pacific First Class on a short flight like Hong Kong to Tokyo for around 50k Avios one-way (Cathay first is superb, though long-haul costs more). Or book Qatar Airways Qsuite Business (which many consider first-class-worthy) from the U.S. East Coast to Doha for ~70k Alaska miles (you’d need ~20k more points beyond 50k, or perhaps wait for a transfer bonus to Alaska to close the gap). While 50k alone doesn’t cover many true long-haul first class flights, you could be opportunistic: maybe a transfer bonus pops up (BILT occasionally offers 20-100% bonuses on Rent Day for select partners). If, say, a 50% transfer bonus to Flying Blue came along, your 50k could become 75k Flying Blue miles - suddenly enough for a one-way in Air France Business Class or even stretching toward First on certain routes (Air France first isn’t open to most partners, but a La Premiere treat requires status anyway). The general idea: 50k is on the cusp of some very swanky experiences if you play your cards (and points) right. Even if it only gets you one leg in first class, it can be a life-long memory. For instance, I once used roughly 45k points to fly in Lufthansa’s First Class on a flight from Europe back to the U.S. Stepping into their private terminal in Frankfurt and enjoying caviar at 30,000 feet was surreal - and it only whetted my appetite to earn more points for the next big trip!

Mix and Match for Maximum Joy

One of the beautiful things at the 50k level is that you can start combining redemptions to craft a bigger trip. You’re not limited to one outcome; you might use your points across multiple programs on the same vacation. Consider this scenario as a thought exercise:

- You transfer 20k to Hyatt for a hotel stay.

- You transfer 30k to Aeroplan for two one-way flights.

That 50k could manifest as a budget-friendly city break: say, you fly you and a partner to San Francisco using Aeroplan miles on United (perhaps ~12.5k each one-way, so ~25k total for two one-way tickets) and use Hyatt points to stay 2 nights at the Hyatt Regency San Francisco (Category 4, 15k per night = 30k for two nights). That’s ~55k worth of points (slightly dipping into another 5k if needed) to cover flights and a nice hotel for a weekend getaway that might have cost $1,000 out of pocket. Or flip it: use points for the flight there and pay cash back, or vice versa. The flexibility is yours.

The “Opportunity Cost” of 50k Points

At this stage, it’s worth reflecting on the value of what you’re spending. You’ve likely noticed that some redemptions give better value per point than others:

- Using 50k points for a $625 flight via the portal is okay, but transferring 50k to book a pair of business class tickets that would cost $3,000 is obviously a better deal (roughly $0.06 per point, vs $0.0125 via portal).

- If you’re ever tempted to use points for non-travel (like merchandise or rent payments), just remember you’d be getting maybe $350 from those 50k (at 0.7¢ each on a gift card). In travel terms, $350 is perhaps one domestic flight. But 50k points could be three or four flights or several hotel nights as we’ve shown. The difference is huge in experiential value.

One area to consider opportunity cost is transferring to Marriott Bonvoy. BILT’s 20k -> 25k Marriott bonus is tempting if you’re a Marriott loyalist. But think carefully: 50k BILT would become 62.5k Marriott points. Marriott’s dynamic pricing might charge 50k+ per night at a nice resort. So 62.5k might only secure you 1-2 nights in many cases (worth maybe $300-500). Meanwhile, that same 50k to Hyatt can often get $800-$1000 in hotel stay value, or to airlines can save you $2,000 in flights. Use Marriott if you have a specific high-value redemption in mind (like a five-night stay where the 5th night is free, squeezing extra value). Otherwise, the opportunity cost is too high compared to other options.

New Strategies Building on Old Ones

Each tier of points unlocks new strategies, but it also builds on the previous ones. With 50k, you can of course still do everything we mentioned for 20k:

- Book multiple domestic trips (now you can do more of them, or fly friends/family too).

- Transfer small chunks to top off other accounts (maybe you already had 30k United miles - add 20k BILT to book an award).

- Take advantage of Rent Day transfer bonuses: this becomes even juicier now. For example, BILT ran a Rent Day promo with Avianca LifeMiles where members got a bonus up to 100% based on status (Platinum got 100%, Gold 50%, Silver 40%, Blue 25%). If you, as a Silver, had transferred your points that day, 50k BILT would have become 70k LifeMiles. 70k LifeMiles can sometimes book a round-trip business class ticket on Star Alliance to, say, Colombia or Peru (LifeMiles has some quirky sweet spots). That’s leveraging a promo to leap into a higher class of award for the same points - always keep an eye on those Rent Day announcements on the BILT app.

Bottom Line: 50k - A World of Options

Fifty thousand BILT points can be a turning point in your travel journey. It’s enough points to seriously elevate your travel comfort (hello, lie-flat seats) or drastically extend your travel quantity (multiple free trips). Whether you choose to splurge on one amazing experience or sprinkle the points across several adventures, you’re in a position of strength.

The best part is that none of these points came from buying miles or paying fees - they’re a reward for living your life (paying rent, going out to eat, riding in Lyfts). That’s something to feel good about. Now your job is to turn those points into memories.

Maybe you’ll celebrate reaching 50k with a special trip, like a business class flight to Europe for an anniversary, or a couple of domestic getaways to scratch that travel itch. Whatever you do, do it with the confidence that you’re getting great value and enjoying the fruits of your strategy.

Now, onward and upward - literally. Up next, we’ll tackle the six-figure territory: 100,000 BILT points. If you think 50k opened doors, just wait to see what 100k can do. Spoiler: it’s a game-changer for luxury travel. See you in the next installment, and until then, happy travels!