20,000 BILT Points: Small Stash, Big Possibilities

20K BILT points can unlock big travel wins - like a round-trip to Hawaii, a night at a luxury Hyatt, or flights to Europe. Earn them fast with rent, dining, and Rent Day promos. Skip the low-value redemptions and use transfers for outsized value and unforgettable trips.

If You Only Had 60 Seconds to Read This Article (Click Here)

Don’t underestimate 20,000 BILT Rewards points. Even if it doesn’t sound like much, that balance can unlock serious travel when you earn smart and redeem strategically. You can rack up 20k quickly by paying rent with the BILT Mastercard, using the card for dining and travel, taking advantage of Rent Day promos, linking Lyft, and referring friends. Just paying $1,500 in rent monthly gets you 18k points a year - add in some dining and partner boosts, and you're there fast.

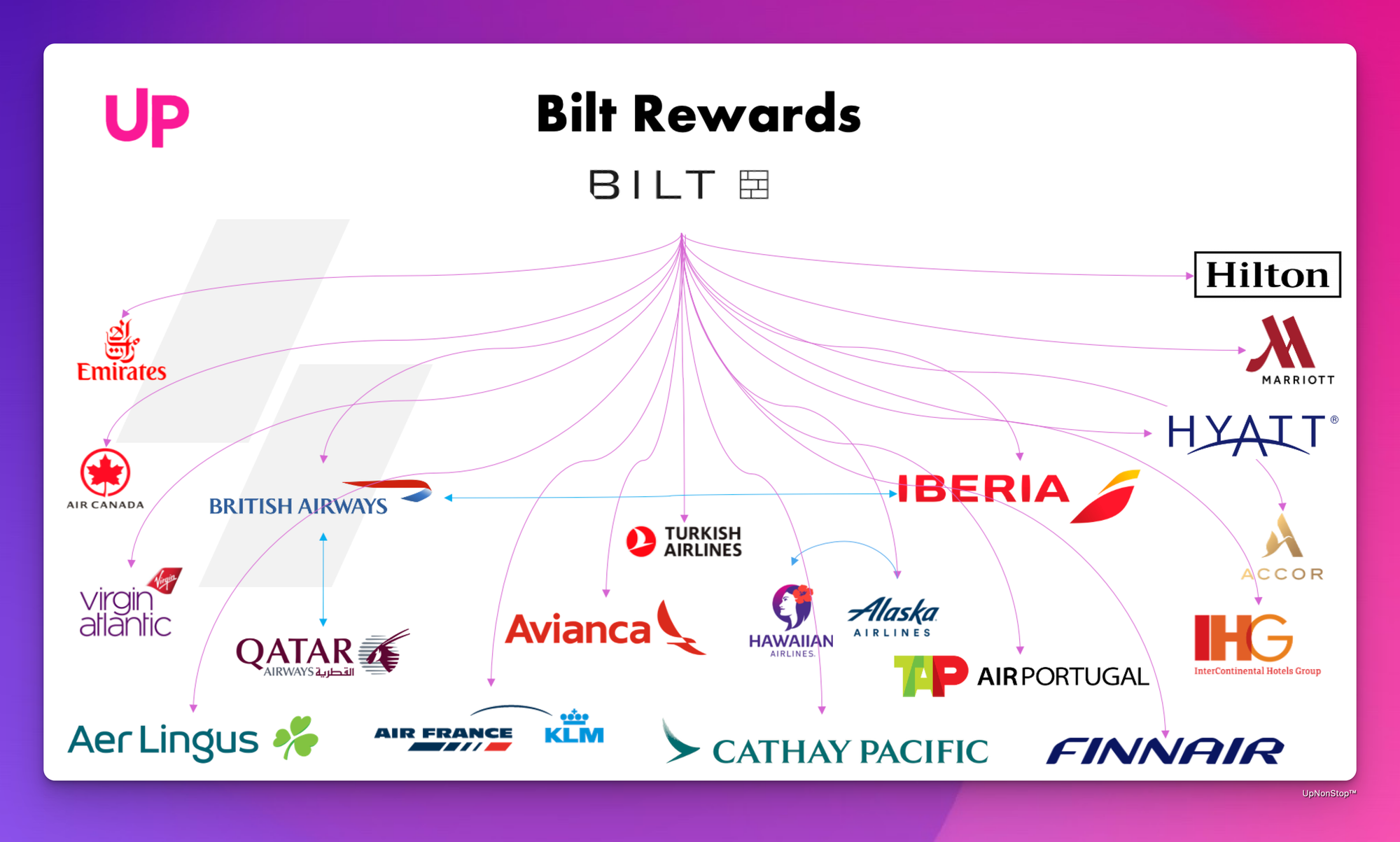

Once you’ve got the points, the key is using them wisely. While you can redeem 20,000 BILT points for $250 through the BILT Travel portal, you’ll often get far more value by transferring to airline and hotel partners. Steer clear of redemptions like rent payments or Amazon shopping, which cut the value to just 0.5-0.7 cents per point. Instead, aim for 2-5 cents per point by booking award travel with programs like Turkish Airlines, Virgin Atlantic, or World of Hyatt.

Even with “just” 20k, your options are impressive. Fly round-trip to Hawaii for 15k points via Turkish, or book a one-way to London from Boston for 10k points via Virgin Atlantic. Fancy a beach trip? Use 18k to fly to the Caribbean with Avios. Prefer hotels? Transfer to Hyatt and cover two nights at resorts that would cost $600+ out of pocket. You can even mix and match—use 15k for a flight and the rest for a free hotel night.

Ultimately, 20,000 points won’t fly you around the world in luxury, but it can give you an unforgettable trip for nearly nothing. Travel opportunities this good don’t last forever - award charts change, and availability isn’t guaranteed. So don’t hoard your points. Use them to turn everyday spending into extraordinary memories. And when you’re ready for the next level, 50,000 points opens even more doors.

Everything else you need to know is just below 👇🏻

So you’ve got 20,000 BILT Rewards points burning a hole in your pocket. It might not sound like a sky-high balance, but even 20k points can unlock some truly exciting travel experiences. In fact, with a little strategy, those points can take you farther (and in more style) than you might expect. Let’s dive into how to earn 20,000 BILT points quickly, and more importantly, all the sweet spots you can redeem them for in the real world.

Earning 20,000 BILT Points (Without Breaking a Sweat)

If you’re new to BILT Rewards, accumulating 20,000 points is a realistic early goal. How do you get there? Start with the basics:

- Pay your rent with the BILT Mastercard. This is BILT’s killer feature - you earn 1 point per dollar on rent (up to 100k points a year) with no fees. If your rent is $1,500 a month, that’s an easy 1,500 points just for paying the bill. Do that for a year and you’re already at 18,000 points, nearly hitting our 20k target.

- Use the card for everyday spending. BILT gives 3x points on dining and 2x on travel, plus 1x on everything else (just remember to make at least 5 transactions a month or you earn nothing!). Grabbing coffee, groceries, or booking a flight on your BILT card can easily add a few thousand points over a year. For example, spend $200 a month dining out and you’ll net 7,200 points in a year from dining alone.

- Take advantage of Rent Day promos. On the first of each month (dubbed BILT Rent Day), BILT often offers double points on non-rent purchases (up to 1,000 bonus points). That’s 6x on dining, 4x on travel, etc., for one day. If you know you’ll make a big purchase, timing it on Rent Day can be a quick boost.

- Explore BILT’s extra earning partners. Link your BILT account to Lyft to earn 5x points on Lyft rides (2x just for linking, plus 3x if you pay with the BILT card). Dine at restaurants in the BILT Dining network and earn up to 5-10x points (on top of your credit card points!). And if you’re into fitness, booking classes through the BILT app at studios like SoulCycle or PureBarre gives 10x points. These are fun ways to pad your balance doing things you’d do anyway.

By mixing rent payments, daily swipes, and special promos, reaching 20,000 points might only take a few months of focused spending. And remember, American Airlines is no longer a BILT transfer partner, so if you were eyeing AA miles, you’ll have to use a workaround (don’t worry, we’ll get to that). Now that you’ve got the points, let’s talk about the fun part: spending them.

What Are 20,000 Points Worth?

To appreciate the value of 20k BILT points, consider the alternatives:

- Cash value through BILT: If you’re not ready to navigate airline programs, you can use points in the BILT Travel Portal at 1.25¢ per point. That makes 20,000 points equal $250 toward flights, hotels or rental cars. Not bad, but we can do better.

- Worst-case uses: BILT lets you pay rent or loans with points, but at a depressingly low ~0.55¢ each. That same 20k would be only about $110 off your rent - hardly a thrill. Similarly, Amazon or gift cards give around 0.7¢ (about $140).

- Travel redemptions (sweet spot range): Used smartly, 20k points can unlock travel worth $400, $600, sometimes even $1000+. That’s like getting 4-5 cents per point. This is where BILT points shine - by transferring to airline and hotel partners for outsized value. Let’s check out some real examples.

Sweet Spot Redemptions for ~20,000 Points

Even with a “modest” 20k balance, you have a buffet of travel options. Here are some of the best ways to put those points to work right now:

- Round-Trip Domestic Flights (even to Hawaii!) - One of the juiciest deals is transferring BILT points to Turkish Airlines Miles & Smiles. Why Turkish? Because they have an incredible flat award price on United flights: just 7,500 miles each way in economy anywhere within the continental US - and yes, that includes Hawaii! For 15,000 points round-trip, you can fly from New York to San Francisco, or Los Angeles to Maui. Think about it: a Hawaii round-trip that often costs $500+ can be yours for 15k points + ~$11 in fees. You’d still have 5,000 points left over. That’s enough for another one-way ticket in the US (7.5k out, pay cash back) or to top off a partner account for a future trip. It’s hard to beat the value here.

- Hop Across the Pond in Economy - Believe it or not, 20,000 points can take you to Europe. Transfer to Virgin Atlantic Flying Club and you can book a one-way economy flight on Virgin’s own planes from the US East Coast to London for as low as 10,000-15,000 points. For example, Boston to London can be just 10k points + ~$130 in taxes one-way on certain off-peak dates. From the West Coast, it’s around 15k. Round-trip would be ~20k-30k points + taxes (UK return flights have higher fees, so consider flying back from another city). Even factoring in $200-$300 in fees total, two transatlantic flights for ~20k points is a steal - many other programs charge 30k+ for one-way. With the money you save, you can indulge in some fish and chips or a West End show with a smile on your face.

- Caribbean Getaway - Dreaming of turquoise waters? BILT points can become British Airways Avios, which are fantastic for short-haul flights on American Airlines (even though you can’t transfer to AA directly, you can use AA flights via partners). For about 9,000-11,000 Avios each way, you can jet from Miami to spots like Cancun, Jamaica, or the Bahamas on American. With 20k points (becoming 20k Avios), you’ve got enough for a round-trip to the Caribbean from Miami or Dallas (or one-way from NYC, which runs closer to 11k-13k Avios). Avios are distance-based, so shorter flights = fewer points. For East Coasters, a quick escape to Bermuda or the islands is well within your budget. Just imagine: a round-trip to Nassau that might cost $400 can be yours for ~18k points + maybe $100 in fees. Not a bad trade at all.

- Two Nights at a Fancy Hyatt - BILT’s hotel gem is World of Hyatt transfers. 20,000 BILT points = 20,000 Hyatt points, and Hyatt points pack a punch. Many upscale hotels cost 12k-15k points a night (Hyatt’s award chart varies by category and peak/off-peak rates). For instance, 15k points could snag you a night at the Hyatt Regency Coconut Point in Florida (often $400/night), or the Andaz Savannah (boutique luxury in a prime historic district). With 20k, you could do two nights at a lovely resort or city boutique that would have cost $600-$800 total. Or stretch it further: Hyatt’s lower-tier properties are 5k-8k a night, meaning 20k could cover 3-4 nights at a Hyatt Place or similar - great for an extended weekend away. And remember, award nights aren’t charged resort fees or taxes, so it’s truly free. It’s an awesome feeling to check out owing $0.

- Multiple Nights at “Free” Hotels - If you’re more about quantity than five-star luxury, consider transferring those 20k points to Hilton or Marriott during a promotion. While their point values are lower (Hilton often charges 20k+ per night for a basic hotel), these chains occasionally run promos or you might have a specific use. As a rule, Hyatt will yield more value on average. However, if you have a Marriott stay in mind, note that BILT gives a 5,000-point bonus for every 20k transferred to Marriott. So your 20k BILT automatically becomes 25,000 Marriott Bonvoy points. That could cover a night in a mid-tier Marriott (maybe a Courtyard in an expensive city or an off-peak night at a nicer resort). Still, unless you need Marriott points to top off an award, you’re generally better off using BILT points elsewhere. Save Marriott for those unique situations or if you’re a few thousand short for a specific booking.

- Short International Adventures - Think beyond North America: BILT’s partner Air Canada Aeroplan has some interesting low-mileage awards for shorter flights abroad. For example, flying within Europe or within Asia can be very cheap on points. Aeroplan might charge as little as 6k-8k points for a one-way on a partner airline for a short hop (say, Paris to Rome or Tokyo to Seoul). If you’re traveling internationally, converting a chunk of your 20k to Aeroplan could save you cash on those intra-region flights you’d otherwise buy. It’s a niche use, but worth mentioning if you need to connect the dots on a larger trip.

- Combine for a Bigger Trip - You don’t have to use all 20k in one place. You could spend ~15k on that domestic round-trip flight and keep ~5k for a hotel night or a shorter flight later. For instance, 5k Hyatt points could get you a free night at a Category 1 Hyatt (there are some surprisingly nice ones, especially overseas). Or 5k Turkish miles (transferred from BILT) is enough for a one-way economy flight on United up to 600 miles - perhaps a short hop like Chicago to Toronto or LA to Vegas. Strategically splitting your points can maximize your travel. Do the math: 15k for the big flight, 5k for a local hop or a hotel, and boom - you’ve subsidized two trips with one small stash of points.

As you can see - 20,000 points can go a long way. In some cases, it’s enough for a complete trip (flights and a hotel night or two). And even when it’s not the whole shebang, it can take a major expense (like a $500 flight) and wipe it out for just taxes. The key is to use the right transfer partner for the job:

- Use Turkish Miles for any United domestic flights (especially pricey long routes like coast-to-coast or Hawaii).

- Use Virgin Atlantic or Avios for transatlantic hops and AA flights to the Caribbean.

- Use Hyatt for high-value hotel stays.

- Save cash portal bookings as a last resort when points flights or nights aren’t available - $250 value from 20k is the floor, not the ceiling, of what you should aim for.

Opportunity Cost: Spend Points or Save?

You might be wondering, “Should I burn all my 20k now or save up for something bigger?” It’s a fair question. While patience can unlock even more aspirational redemptions (like business class seats that cost 50k+ each), there’s also something to be said for using what you have now to get traveling sooner. Points don’t earn interest (aside from a tiny bit if you hit Silver status and get point interest), and programs can devalue over time. Today, 7,500 points gets you a flight anywhere in the US - if United/Turkish were to change that policy, the deal might not be as sweet next year. My advice: set aside any fear of “wasting” points and spend confidently on meaningful travel experiences. 20,000 points won’t take you on a round-the-world tour in first class, but it absolutely can give you a memorable vacation that you might otherwise have skipped due to cost.

The Bottom Line for 20k Points

20,000 BILT points is the start of something great. It’s proof that even modest rewards can unlock travel opportunities that feel “free” (or darn close to it). Whether you’re flying to a new city for a weekend adventure, relaxing on a beach you only dreamed of, or staying at a hotel that would normally be out of budget, your points are your ticket to experiences that enrich your life. And because you earned these points on things like rent and dinner dates - expenses you had anyway - it’s even sweeter.

So go ahead: take that trip. Feel the thrill of paying $5.60 for a flight that your coworkers paid $300 for. Treat yourself to a nice hotel and let BILT pick up the tab. You’ve earned it (literally). Use those 20k points wisely and you’ll come home with stories and memories worth far more than any “cash back” could ever buy.

And if this taste of practically-free travel motivates you, keep racking up those BILT points. In our next part of the UpNonStop series, we’ll explore the world of 50,000 BILT points and the even bigger opportunities they bring. But for now, celebrate what 20,000 points can do - and enjoy the journey!