100,000 BILT Points: The Gateway to Luxury Travel

Hitting 100K BILT points unlocks premium travel options like Business & First-Class flights, Luxury Hotels. Perks from BILT Gold status and smart transfer strategies can turn these points into unforgettable experiences!

If You Only Had 60 Seconds to Read This Article (Click Here)

Hitting 100,000 BILT points is a major milestone that unlocks premium travel opportunities and shifts your mindset from budget trips to luxury experiences. With this balance, you can consider flying business or first class, staying at five-star hotels, or spreading your points across multiple trips. This level of points opens a world of high-value redemption strategies far beyond the basics covered at 20k or 50k points.

Getting to 100k usually involves consistent rent payments, maximizing bonus categories on the BILT card, leveraging Rent Day promotions, and possibly referral bonuses or special offers. At this stage, you may have reached BILT Gold status, which adds perks like better bonuses and exclusive experiences. While the earning pace may slow, there are occasional promos and small bonuses that help top off your balance for even greater redemptions.

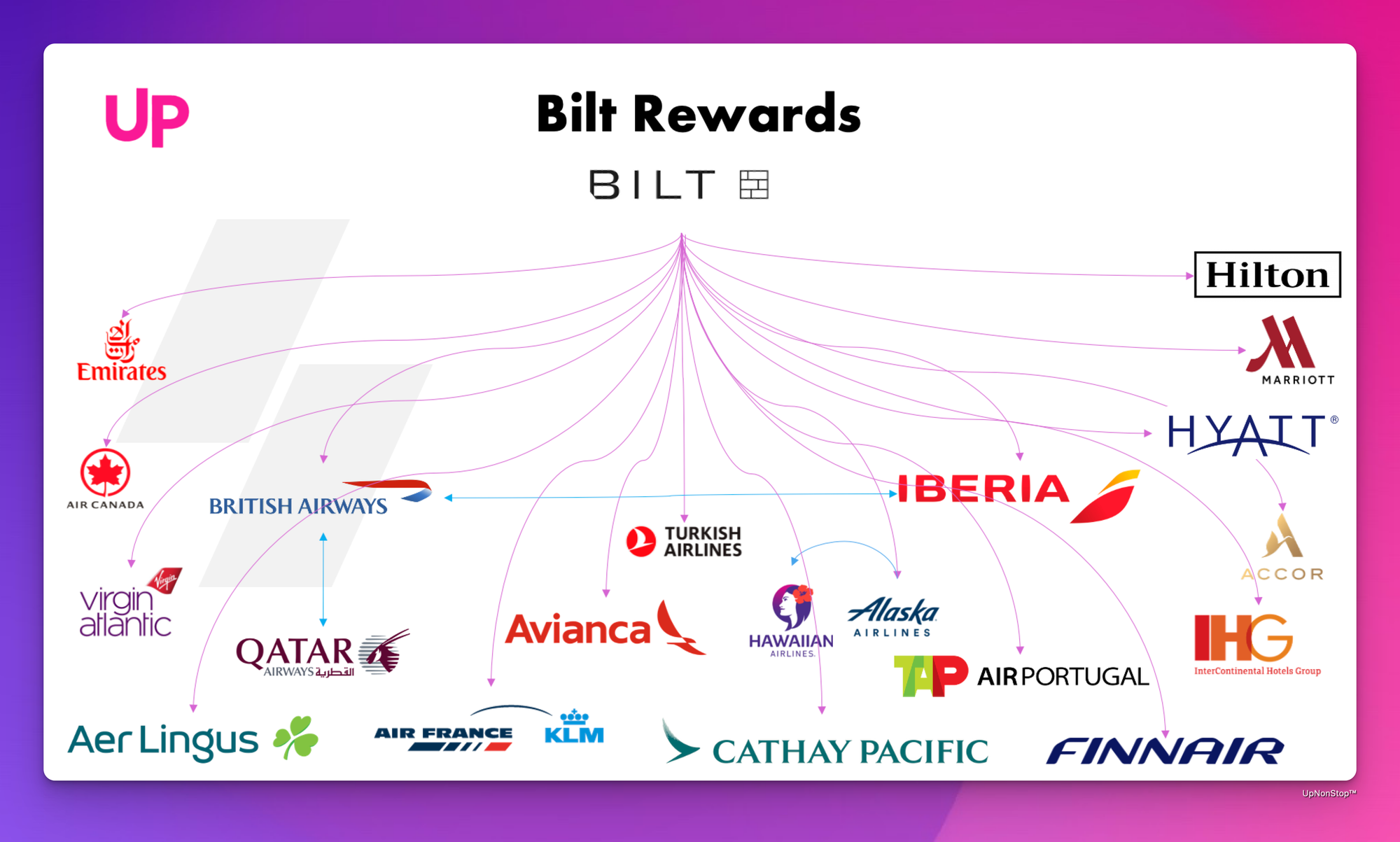

With 100k points, some standout redemptions include round-trip business class flights to Europe or Asia, one-way international first class seats on carriers like ANA, Emirates, or Cathay Pacific, and luxury hotel stays at top-tier Hyatt or Marriott properties. You can also mix flights and hotels on the same trip, optimizing your points to cover the biggest costs. Alternatively, 100k points can fund multiple economy tickets for family travel or several moderate trips.

At this level, the key is deciding whether to concentrate points on a single luxurious experience or diversify across many trips. The flexibility of BILT’s transfer partners lets you customize redemptions to your goals. Staying on top of transfer partner changes and award availability is crucial. Looking ahead, 100k is a great base to build on as you aim for even bigger rewards at higher balances. For now, enjoy the freedom to plan memorable, aspirational trips with your hard-earned points.

Everything else you need to know is just below 👇🏻

Reaching 100,000 BILT points is a milestone that deserves a victory lap. You’re now in the elite six-figure club of rewards, and your patience (and spending savvy) is about to pay off big time. With 100k points, the conversation shifts from “can I afford to go there?” to “how do I want to go there - economy, business, or first class?” and “should I splurge on a five-star hotel or stretch it across multiple trips?” It’s a good problem to have. In this article, we’ll explore how to best use a stash of 100k BILT points, drawing on new strategies that build upon what we learned at 20k and 50k. Buckle up - we’re entering the realm of high-end redemptions and creative combos that can unlock bucket-list experiences.

Earning 100k: A Quick Recap of How You Got Here

First, let’s acknowledge the journey. Accumulating 100k points is no small feat - you likely:

- Paid a ton of rent (maybe $2-3k a month over a couple of years, or an insane $100k rent in one year if you’re in a NYC penthouse - hey, it happens).

- Maxed out those 3x dining and 2x travel categories, making the BILT card your go-to for dinners, ride shares, flights, hotels, and more.

- Exploited Rent Day promotions religiously - doubling points on the 1st of the month, grabbing those free point quizzes or games BILT sometimes runs in the app, and hopping on any transfer bonuses.

- Possibly snagged referral bonuses or special offers (like some users get an email after sign-up offering 5x points on all non-rent spend for 5 days, up to 50k points - if you were lucky enough to get that, and timed some big purchases, you could have scored a heap of points in one go).

- Kept your BILT status climbing. By now, if 100k was earned within a calendar year, you’re at least BILT Gold (Gold requires 125k in a year or $25k spend - you might be just shy or have hit it). Gold gets you larger Rent Day bonuses and some perks like a home ownership concierge and Blade helicopter lounge access in NYC. More importantly, you’re on the doorstep of Platinum (200k), which offers the biggest promos and even some unique gifts (like a free annual ride with Blade and status with a travel partner or two). But we’re getting ahead of ourselves - 100k is our focus, and Gold/near-Gold is already a great place to be.

At 100k points, you might find your earning rate naturally slowing - the first 100k often includes initial excitement, maybe a big welcome push of spend or referrals. Don’t worry; even if the next 100k takes longer, you’ve now got enough to do something incredible. And you can always top up gradually.

Alright, and on to the main event: What can we do with 100,000 points?

The 100k Point Menu: First Class Flights, Five-Star Nights & More

With a six-figure stash, the world (literally) is yours. Many of the very best award redemptions in points and miles land in the ~100k range for one person. Let’s break down some of the top ways to deploy 100k BILT points:

- Round-Trip Business Class to Far-Flung Destinations - This is a headline redemption for 100k. For example, Air Canada Aeroplan might charge around 110,000 points round-trip for business class from the US to Europe on Star Alliance (exact pricing can vary with Aeroplan’s distance bands, but 110k is a solid estimate for East Coast to Western Europe RT in biz). Transfer your 100k (maybe supplement with another 10k you’ll earn soon, or catch a 10% transfer bonus to Aeroplan if one pops up) and you could be flying lie-flat across the Atlantic and back, with all the champagne and multi-course meals that entails. Similarly, Turkish Miles & Smiles has incredible business class deals: think 45k each way to Europe in business on United or other Star partners (90k RT). Yes, you read that right - Turkish’s award chart is that generous if you can snag the seats. If you find availability, 90k miles could take you round-trip NYC to Paris in business class, leaving you 10k for positioning flights or a fancy meal on your trip. Even if your route or dates require more (some programs charge ~60k each way, or 120k RT for Europe), you’re within striking distance - maybe you use 100k points and $500 cash for one ticket, still a huge savings over the usual $3-5k biz fare. And don’t forget Asia: programs like Aeroplan or Cathay Pacific Asia Miles might charge ~70k-75k one-way in business to parts of Asia (140k-150k RT), which is just beyond 100k but perhaps you only go one-way in business and come back in economy or use another stash for the return. For example, fly to Tokyo in business for 75k, return in economy for 35k = 110k total. Or use 100k for one person’s biz ticket and pay for your companion’s economy if needed. With 100k, these mix-and-match premium trips become very doable.

- One Way in International First Class (The “Holy Grail” Seats) - Some of the world’s most over-the-top first class products can be had for around 100k one-way. Always wanted to shower onboard Emirates or sip Krug in Singapore Suites? BILT points can help:

- Emirates First Class: Costs around 136,000 Emirates Skywards miles one-way from the US East Coast to Dubai (and even more from West Coast). 100k BILT won’t cover that alone, but Emirates occasionally runs transfer bonuses (e.g., 20% extra) which could make 100k -> 120k, closer but still a bit short. However, they have “fifth freedom” routes like New York-Milan or Newark-Athens, which run about 85k miles one-way in First. That’s within 100k! Transfer ~85k to Emirates and indulge in the blingy cabin, on-board shower, and cocktail bar on your way to Europe. Note: taxes run ~$300+ and only Emirates Skywards members with status can book first on certain routes now (they added a restriction that first class awards require Silver status or higher for long-haul). But short routes like NYC-Milan remain bookable for anyone.

- ANA (All Nippon Airways) First Class: One of the best uses of points, period, is booking ANA’s “The Suite” first class via Virgin Atlantic Flying Club. Currently, you can redeem 85,000 Virgin points for ANA first class one-way from the US East Coast to Tokyo (~60k in business if you prefer). From the West Coast it’s even less, 72.5k. So 100k BILT transferred to Virgin gets you an ~85k first class ticket (JFK to Tokyo) + ~$170 in fees, leaving 15k points. That seat retails for $15-20k! With remaining points you could cover a domestic flight or hotel night. Or, if you have a partner, 85k + 85k = 170k for two one-ways in ANA First - that’s a bit beyond 100k of course, but shows how far 100k per person can go. (Virgin Atlantic is a partner of BILT, so this one’s very much within reach).

- Cathay Pacific First Class: BILT -> Alaska Mileage Plan is unique. For 70,000 Alaska miles, you can fly Cathay Pacific First Class one-way from the US to Hong Kong (when Cathay releases space - it’s scarce nowadays but not impossible). 100k BILT covers that with 30k to spare. Cathay first is legendary for its pampering service and caviar and champagne. You could then use the remaining 30k for perhaps a connecting flight in Asia or a nice hotel night. Alternatively, Japan Airlines (JAL) First is also 70k Alaska miles from US to Tokyo - so similarly, 100k could book JAL first for one way (70k) and you’d have 30k left to maybe get an economy flight home or a short-haul first class on JAL within Asia (they charge as low as 20k Alaska miles for JAL business intra-Asia).

- Lufthansa First Class: Bookable via Aeroplan or United, albeit expensive. Aeroplan might charge 90k points one-way from Europe to US in Lufthansa first (they only release to partners ~2 weeks before departure). 100k covers that. Many consider Lufthansa F a must-try for the First Class Terminal experience on the ground in Frankfurt (who doesn’t want a rubber duck souvenir?). With 100k, you could plan to return from Europe in Lufthansa First, and maybe go there using business class (55k or so). That would be a lavish way to cap off a trip.

First class redemptions are largely one-way treats given the points involved, but if you have a companion with their own points or you’re okay mixing cabins, 100k can get you there one way and you can fly back in business/economy.

- Two Round-Trip Economy Tickets to Almost Anywhere - 100k could also simply cover two people flying economy nearly anywhere in the world (at least one-way in many cases, and round-trip in some):

- To Europe: Many programs charge ~60k per person round-trip in economy to Europe. 120k for two, slightly over 100k, but if you catch off-peak awards (Flying Blue has 35k RT deals in fall from some East Coast cities, for example, or Avios via Aer Lingus can be ~26k RT Boston-Dublin off-peak), two could go for ~100k total. You might transfer 50k to one program for one ticket and 50k to another for the second person’s ticket depending on availability. Or use 100k for both tickets one-way in economy and pay cash for the return if you find a flight deal. There’s flexibility when you have cash and points to play with.

- To Asia: Similar story, albeit economy awards to Asia often run 70k-80k round-trip per person. 100k likely covers two one-ways or one RT and one one-way. For instance, 100k Aeroplan could get two tickets from West Coast to Japan one-way (~40k each, 80k) and you pay the return or use another program. Or use 100k to fly both of you in economy to Hawaii (which, while domestic technically, feels like an exotic trip!) and still have points left.

- The point is, if premium cabins aren’t a priority, 100k can take two people far, in comfort and with minimal out-of-pocket costs. And if you take advantage of stopovers (some programs allow a free stop on a round-trip), you can even see two destinations for the price of one.

- Family travel: 100k could also be used to take the kids to Disney or grandparents on a vacation. For example, 100k Southwest points might cover four round-trip tickets if booked at good rates (Southwest points are roughly worth 1.3¢ and fares can be cheap). Or 100k Avios could fund several short hops for a family trip in Europe/Asia where flights are shorter. Sometimes the biggest joy is using points to enable family members to join a trip they otherwise couldn’t. Keep this option in mind as your balance grows.

- Hyatt Heaven: 100k Worth of Hotel Stays - Now let’s talk hotels, because 100k here is a ton of fun:

- Ultra-Luxury Vacations: 100k Hyatt points could get you 4 nights at a top-tier Category 7 Hyatt (30k/night standard - 120k for 4 nights, you might use a bit more beyond 100k or hope for off-peak at 25k to squeeze 4 in). Think Park Hyatt Paris, Andaz Maui, Alila Napa Valley - these often cost $800+ per night. So 100k (plus a little extra) gets you a ~$3,000 stay free. Or consider new Category 8 properties (like some SLH hotels) at 40k/night - 100k covers 2 nights (value easily $2000 at places like Ventana Big Sur or Maldives resorts). It’s a huge splurge, but if you’ve never stayed in a $1000-a-night bungalow, points let you do that without draining your savings.

- Stretching for More Nights: Alternatively, go for quantity. 100k could get you 20 nights at Hyatt Category 1 hotels (5k/night). More realistically, mix tiers: maybe a week (7 nights) in mid-range Hyatt Regencies or Hyatt Place in expensive cities at 12-15k/night (roughly 90k for 7 nights). Imagine a 7-night European city tour with all hotels on points - that’s easily $1500 saved right there. Or five nights in a Category 4 (15k each) for 75k and you still have 25k for two weekend getaways at Category 2/3. The combinations are endless.

- Stay at Multiple Brands: 100k transferred to Marriott yields 125k Bonvoy points. While Marriott points are less potent, 125k could cover 5 nights at a 25k/night resort (with 5th night free) - maybe a Caribbean all-inclusive that’s 25k per night (you’d actually only pay 100k for 5 nights with the promo, which is neat). Or it could get 2-3 nights at iconic properties like a St. Regis where rates are $1000/night (if you find standard rooms at ~85k points/night and top off a bit). Again, Marriott is variable - some redemptions give 0.7c per point, others 1.5c. Focus on the latter if using BILT there.

- Other partners: BILT can also transfer to IHG (100k BILT = 100k IHG). That could be 4 nights at a nice Kimpton or InterContinental (25k each if you catch a deal) or a huge slew of nights at Holiday Inns if that’s your thing. And BILT’s one unique hotel partner is Accor Live Limitless (ALL) at 3:2. 100k BILT = 66.6k Accor points. Accor points have a fixed value (2000 pts = €40). So 66.6k = €1332 of credit at Sofitel, Fairmont, etc. It’s like a gift card. You could have a fancy €300/night French Riviera hotel for 4 nights on that credit. Keep in mind Accor points have no award chart - they just reduce your bill. So if you find cash rates high, that credit goes further in terms of money saved.

- Whether you choose one blow-out stay or multiple, 100k in lodging can drastically reduce your trip costs. And there’s something liberating about checking out of a 5-star hotel knowing the bill is covered by points.

- Mixing Premium Flights and Hotels in One Trip -

- With 100k, you don’t necessarily have to choose between flying well or staying well - you might do a bit of both on the same vacation by allocating points accordingly. For example, let’s say you have a romantic anniversary trip in mind:

- Use ~75k points to fly business class one-way to Europe for two (e.g., 55k for one person, 20k for the other in economy if you only have 75k among you - one gets pampered, maybe swap on the way back).

- Then use 25k points for 2 free nights at a luxury hotel in your destination (perhaps at 12.5k/night off-peak in a lovely Hyatt).

Combined, that’s 100k. You’ve greatly enhanced both the journey and the destination stay. You might still pay for the flight home or other nights, but you’ve elevated the overall experience.

Or another scenario: - Use 50k for flights (maybe economy round-trip for two to the Caribbean) and 50k for the hotel (four nights at a beachfront Hyatt Zilara all-inclusive for 20k each).

That’s flights and hotel covered for a full vacation with points alone. The only spending money you need is for excursions and souvenirs.

When you have 100k, think about the pain points of a trip. If airfare is pricey but hotel is cheap, spend points on the flights. If lodging is the budget buster but flights are on sale, cover hotels with points. You have the flexibility to attack the biggest costs.

Opportunities and Trade-Offs at 100k

At this level, an important concept comes into play: diversification vs. concentration of points. You have enough points to either:

- Do one extremely luxurious thing (like a round-trip in first class for one, or a week in an overwater villa for two).

- Do multiple moderately luxurious things (maybe two business class one-ways and a nice hotel stay, or three separate economy-class trips with good hotels).

- Do many economy/basic things (lots of domestic flights and mid-range hotels, spreading the joy across the year).

None of these is “wrong.” It depends on your travel goals. Some save 100k for a single blowout experience that they’ll remember forever (like flying First Class on Emirates to the Maldives for a honeymoon). Others prefer to get a year’s worth of trips out of 100k, maximizing the number of vacations.

The beauty of BILT points is their versatility. You aren’t stuck with one airline or one hotel chain; you can pick and choose where to allocate. One strategy I often use: allocate points to the experience that would be hardest to get otherwise. For example, points can easily cover a $500 domestic flight, but maybe you’d have found a budget fare or driven instead - not life changing. Covering a $5,000 business class seat, however, might be impossible without points. So I’d lean towards using points for the “aspirational” splurge that I wouldn’t buy with cash. The exception is if an aspirational thing is available for cheap cash occasionally but something mundane is super expensive due to peak season - then I’d use points for the expensive mundane thing. It’s all about leveraging points where cash fails you.

Also, at 100k, watch out for program changes. Keep an eye on BILT’s transfer partners for any rumors of devaluation. If you hear Hyatt might raise award prices or an airline might revamp its chart, you might fast-track plans to use points at the old rates. BILT points themselves are fairly stable (pegged to the 1.25¢ portal value and partner transfers), but partner currencies can fluctuate in value.

Looking Ahead: 100k and Beyond

Reaching 100k might have felt like the mountaintop when you started at zero, but as any points enthusiast knows, there’s always another peak. You might be eyeing BILT Platinum status at 200k, which brings the maximum Rent Day transfer bonuses (often 100% on certain promos) and even one-time perks like gift status in a hotel program. If you’re inclined to keep saving, just ensure you’re also using points along the way. Programs devalue and life circumstances change - better to have enjoyed some of your hard-earned points than to never spend them and regret missed experiences.

The joy of 100k is that you can now realistically plan trips that once felt out of reach. That Europe business class trip, that week at the Maldives water villa, that ski vacation in Aspen - they’re all on the table. Think about what excites you most and use the points to make it happen.

In the next article, we’ll venture further into the stratosphere of point balances: 250,000 BILT points. It sounds mind-boggling now, but as you’ve seen, the snowball can grow - and with it, the scale of opportunities (think multi-country adventures and first class galore). Until then, give yourself a pat on the back for hitting 100k. Plan something amazing, and enjoy the feeling of turning those points into memories. Happy travels, and see you at the quarter-million mark!