BILT Miles in 2025: A Strategic Traveler’s Guide

BILT isn’t just for rent anymore. In 2025, it’s becoming a full-blown lifestyle engine - rewarding mortgages, HOA dues, even your gym. With 1.25× earning on housing and insane transfer promos, smart users are stacking 100k+ points fast. The game’s changing - are you ready to play it right?

If You Only Had 60 Seconds to Read This Article (Click Here)

BILT is evolving fast in 2025, moving from a rent rewards platform into a broader housing and lifestyle ecosystem. The upcoming Cardless relaunch in February 2026 brings a tiered card system: a no-fee card, a $95 mid-tier (offering 5× categories), and a $495 premium card with 1.25× on rent/mortgages, lounge access, and wellness credits. This transition reflects BILT’s need to generate revenue as it moves away from Wells Fargo, whose $10M/month rent reward costs proved unsustainable.

The mortgage play is massive - BILT secured $250M in funding, including $100M from UWM, to build out mortgage reward capabilities. With average U.S. mortgages around $3,000/month, even a base 1× rate yields 36,000 points/year - and 1.25× on the premium card jumps to 45,000+. This is equivalent to a $500–$1,200 travel value annually. Rollout is expected late 2025 to early 2026, starting with UWM before expanding across brokers.

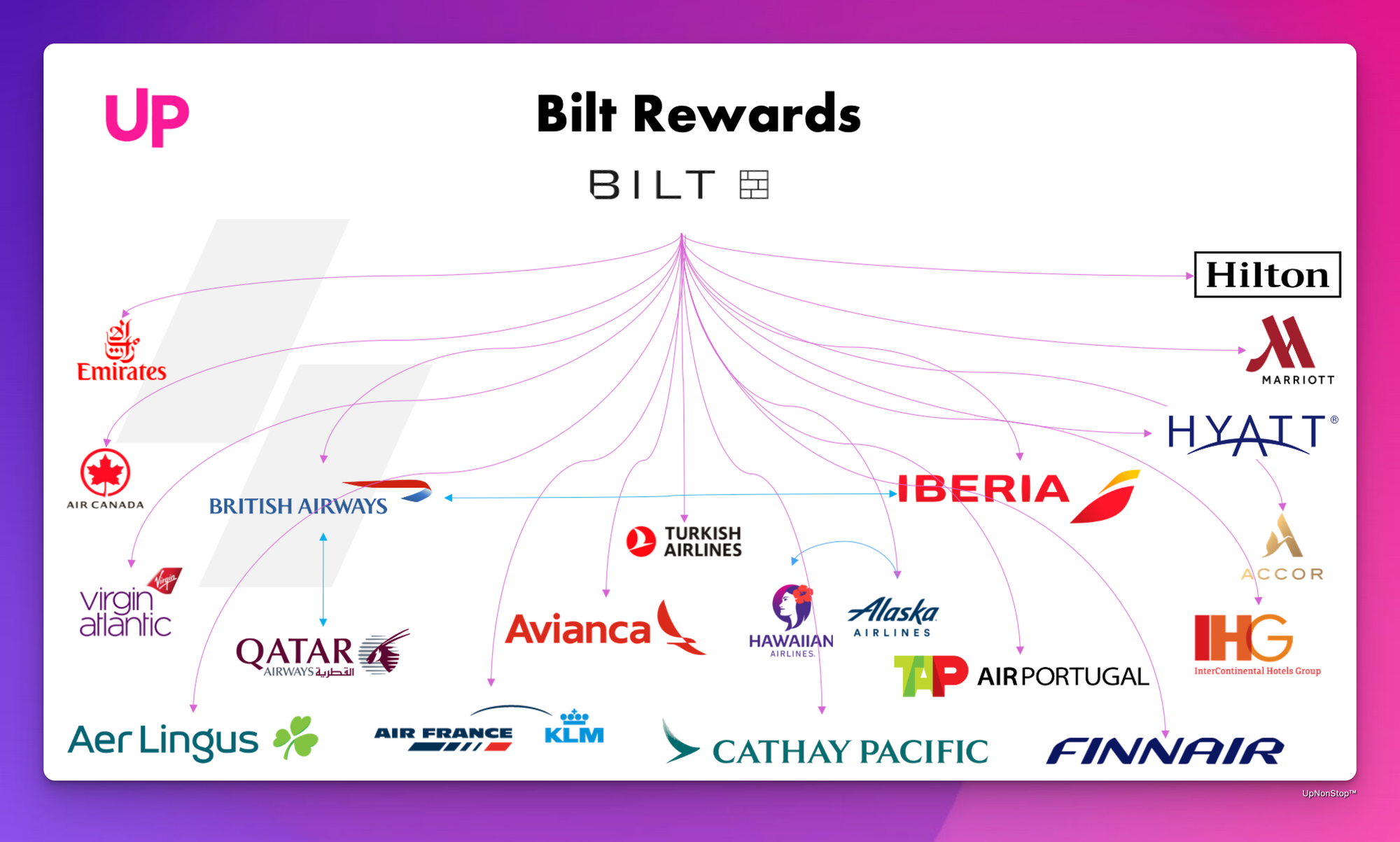

Travel redemptions remain a core strength, with 16 airline and 5 hotel partners, including recent additions like JAL, Qatar, and Southwest. Value sweet spots include 7.5k Turkish miles for domestic flights, 85k Virgin for ANA First, and 60k Flying Blue biz to Europe - often doubled via Rent Day 100% transfer promos. BILT Platinum members should watch for these to instantly double redemption value, effectively turning 100k BILT into 200k partner points.

BILT is also expanding its ecosystem with neighborhood commerce - earning rewards on HOA dues, student housing, Walgreens, fitness, and dining. With Banyan’s receipt-level data, users get hyper-personalized offers. To win in 2025: pay rent or mortgage through BILT, time spend around Rent Day, leverage partner multipliers, and prep for the Cardless migration. This isn’t just rent anymore - it’s a full-scale lifestyle rewards engine.

Everything else you need to know is just below 👇🏻

As we cruise into mid‑2025, BILT Rewards is quietly pivoting from “just rent points” to a full-fledged housing and finance powerhouse. Think mortgages, premium cards, deep travel integrations, and even neighborhood commerce. This Saturday Strategy breakdown unpacks four key shifts and how to position your BILT game accordingly.

BILT Card 2.0: Transition to Cardless + New Premium Tiers

BILT is ending its Wells Fargo co-brand relationship and launching BILT Card 2.0 with Cardless in February 2026.

The new lineup includes:

- No-annual-fee card – similar to today’s, but enhanced.

- $95 mid-tier card – higher bonuses (e.g., 5× on BILT Dining/Lyft/Walgreens, 3× on dining/travel) and extra credit.

- $495 premium card – tipping the scales with perks like 1.25× on rent/mortgage, 4×–5× bonus categories, travel credits, Priority Pass, and wellness credits.

Why it matters:

BILT is introducing paid cards to support enhanced benefits - a move to capture a traditional credit card revenue stream and justify the costly rent rewards (which Wells found unprofitable at ~$10M/month).

Strategic takeaways:

- Base card remains solid – no need to pay an annual fee for continued 1× rent, 3× dining, 2× travel.

- Consider the $95 card if you spend heavily in BILT Dining, Lyft, travel, and Walgreens - potentially worth the fee with consistent use.

- Premium card for power users – if you pay rent/mortgages via BILT, frequent travelers, and value lounge access or travel credits, the $495 could be legit - especially with 1.25× baseline and boosted earning tiers.

Entering Mortgages: A Huge Earning Boost

BILT secured $250M in funding (led by General Catalyst, GID, UWM) valued at ~$10.75–10.8B. A $100M investment from United Wholesale Mortgage signals a major push into mortgage payment rewards.

Why it’s transformative:

If rent payments were the hook, mortgage payments is the main product. Earning points on mortgages means hundreds of thousands in monthly payments potentially earning rewards - mostly at 1× (or higher for premium cardholders).

Key dynamics:

- Mortgage use begins late 2025 or early 2026 via UWM services - later expands to broker networks.

- A future mortgage payment could yield 1× rent vs 1.25× with premium card, adding 25% more points.

- Even modest add-ons - credit diversification, balance safety - suddenly amplify reward accrual.

How to play it:

- If applying for a mortgage soon, time it post-launch to pay mortgage via BILT - especially with reward multipliers.

- Decide whether to keep or upgrade card tier to maximize value.

Transfer Partners & Scaling Travel

As of July 2025, BILT's partner lineup includes 16 airlines and 5 hotels, all mostly at 1:1 transfer - and Hyatt, IHG, Hilton, Marriott, Accor.

Notable Additions:

- Southwest Rapid Rewards (added April 2025)

- Japan Airlines JAL Mileage Bank (May 2024), Qatar Privilege Club (May 2025)

Top partners to prioritize:

- Alaska Airlines Mileage Plan – 1:1 and only bank-level partner - book Cathay First, JAL First, QSuite, etc.

- Turkish Airlines Miles & Smiles – steal domestic flights 7,500 each way; business class to Europe on Turkish/United.

- Virgin Atlantic Flying Club – access Alaska’s sweet spot ANA First at 85k one-way; also Virgin transatlantic biz.

- Air France/KLM Flying Blue – Promo Rewards, 25k US→Europe economy, 60k business.

- Southwest – flexible U.S. flights + two free bags; 1:1 addition rounds out domestic utility.

- Hyatt World of Hyatt – 1:1 point transfer; high value stays at top-tier hotels.

Look for transfer bonuses:

Bilt Platinum holders often receive exclusive 100% bonus promos via Rent Day - e.g., double to Accor or Flying Blue.

BILT Beyond Rent: Neighborhood Commerce and Data Advantage

BILT is positioning itself as a complete housing ecosystem, not just a card.

New frontiers:

- Condos & HOAs: Earn points on fees and dues with real-estate partners like Douglas Elliman and Century Living.

- Student housing: American Campus Communities welcome earning on campus rent.

- Neighborhood commerce: Partnerships with Walgreens (extra points), dining networks, fitness studios (e.g., SoulCycle, Peloton privileges)

- Receipt-level data: Acquired Banyan for detailed merchant data - helping tailor merchant rewards and offers.

Strategic impact:

- BILT wants to own the full housing lifecycle: renter → homeowner → insurer → fitness → shopping → travel.

- They’re building a digital wallet ecosystem with data-driven offers and localized perks.

- As they partner across verticals, expect 5×, 10× point tiers on many everyday services.

The 2025 BILT Strategy Playbook

Here’s how to turbocharge your BILT approach this year:

| Strategy | Tactics | Why It Matters |

|---|---|---|

| 1. Earn rent & mortgage via BILT | Use BILT base now; plan mortgage pay once available | 100,000 /yr = 100k+ points + future 25% boost |

| 2. Prepare for Cardless/Cards launch | Wait for full details in fall before upgrading | Ensure you pick the tier that best matches spending |

| 3. Target transfers on Rent Day bonuses | Watch app; jump on 100%+ promos | Banks skyrocket point value instantly |

| 4. Optimize travel redemptions | Use partners like Alaska, Turkish, Virgin | Maximize utility via sweet spots |

| 5. Neighborhood deals = big pocket change | Chain Walgreens, dining, fitness | Free points for daily living |

| 6. Use data / app features | Check budgeting, Points.me, Neighbors offers | Be opportunistic with promotions |

7 ProTips (for Saturday Strategy)

- Test-run mortgage payments on BILT once eligible - but verify category tracking rolls to “rent/mortgage” vs. just “other.”

- Prepare your credit ahead of Cardless migration; expect a soft pull or account number change.

- Put large spend on Rent Day (1st of each month); if you have a $500 bike or $1,000 trip, time it right.

- Stack partner multipliers: e.g., BILT Dining + $9 Walgreens for prescriptions (bonus cash + points).

- Use Point.Me search within the app to spot real-time award availability before transferring.

- Diversify partners - split points across hotel and airline partners when high-value award sweet spots exist.

- Plan premium card ROI in scenarios: If you spend $36k in rent/mortgage & bonus categories, a $495 card with elevated earnings likely pays off.

- Monitor transfer-bonus calendars outside BILT (Amex, Chase) to compare and pivot when BILT isn’t running promos.

- Use neighborhood data to try new services (like fitness studios) that reward before full rollout; early users often benefit most.

Final Thoughts

BILT is scaling far beyond rent: from paying homeowners, serving student housing, and expanding into mortgages, to becoming a finely tuned lifestyle rewards hub by 2026. The three-card lineup lets you pick your plane - frequent local spender or travel splurger. With mortgage payments enabling massive earning, Rent Day promos offering one-hour windfalls, and deep travel transfers, the potential value per point is accelerating.

This Saturday, take inventory:

- Are you ready to pay mortgage via BILT (once live)?

- Will you stick with the free card or opt for $95 or $495 tiers?

- Which transfer partners align best with your travel goals?

- Have you fully tapped neighborhood offers - even small wins add up fast?

BILT may have started as rent rewards, but by summer 2025, it’s evolving into a formidable finance + travel platform - and you’re already on board. Use this strategy guide to plan and act before the next big shift hits.

Here’s to stacking points and unlocking richness in more ways than one - have a powerful #SaturdayStrategy session, and keep an eye out for fall 2025 updates when details of those premium cards and mortgage rollouts drop.

Review the BILT redemption series: