$8,785 Business-Class Redemption from 287,000 Points: How a NYC Restaurant Owner Turned $100K+ Spend into Luxury Travel (Hint: 11.8% Return)

$100K+ in corporate spend, 287K Amex points, $8,785 Singapore Airlines Business Class roundtrip for one, and $58 in fees. From 1.5% cashback to 3.8% earn rate - here’s how our client - a NYC restaurant CEO turned everyday spend into predictable, premium travel wins.

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

Our NYC restaurant owner, CEO of a growing East Coast chain, came to UpNonStop with scattered corporate card spend and a 1.5% cashback average. Over nine months, we centralized and optimized his cards (Amex, Chase, and Capital One) turning routine expenses into a predictable, high-yield points engine. His average earn rate climbed to 3.8%, producing 287,000 Amex points ready for redemption.

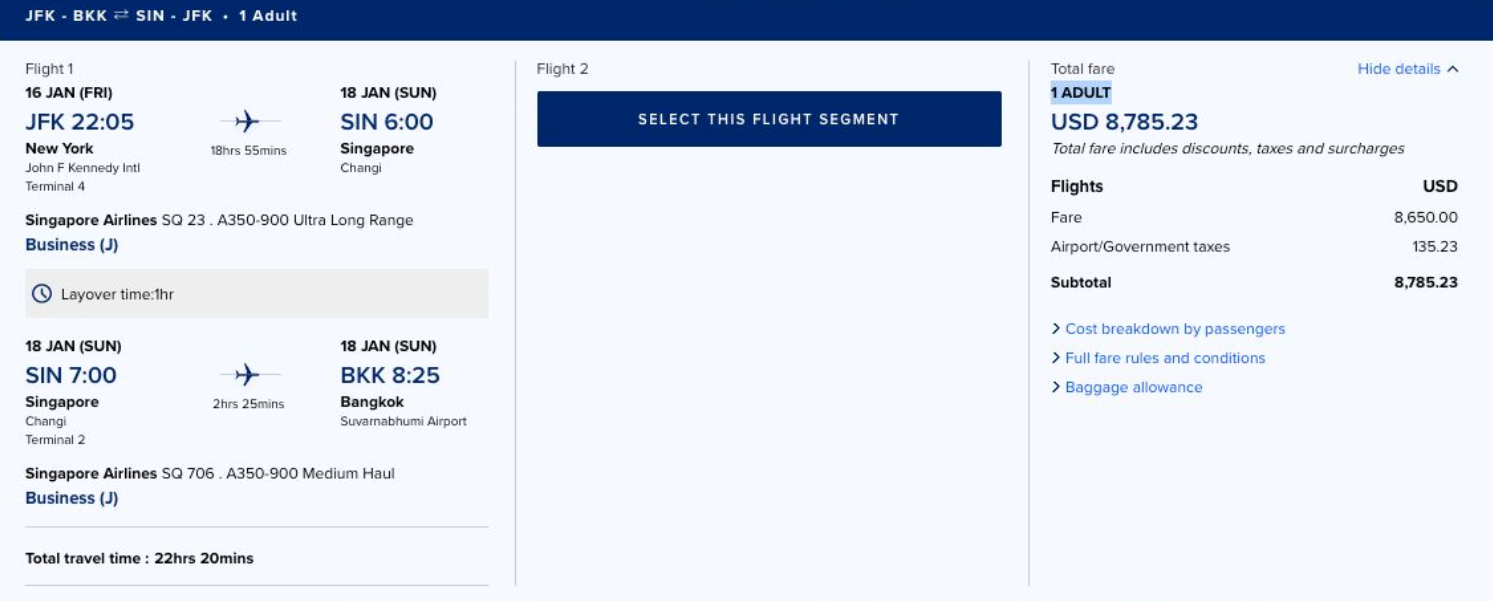

We deployed those points for a Singapore Airlines Business Class roundtrip for one, outbound JFK → Singapore → Bangkok, return Phuket → Singapore → JFK. Total out-of-pocket fees? $58.30. Cash-equivalent value of the tickets: $8,785.23, translating into a Return-on-Spend of ~11.8%. Every dollar he now spends contributes measurably to premium travel.

The experience itself exemplifies the payoff: lie-flat beds, Michelin-level dining, SilverKris lounges, and personalized service. Every connection, every seat, every meal is optimized for comfort and efficiency. Points here aren’t just currency... they’re a tool for luxury, productivity, and time savings.

The key takeaway: Business owners spend can be systematically optimized to generate predictable points, strategic redemption, and tangible Return-on-Spend. For this NYC restaurant owner, daily business spend became a repeatable, high-value asset, showing how we turn routine expenses into life-enhancing wins.

Everything else you need to know is just below 👇🏻

Name/Role: NYC-based restaurant owner, CEO of growing East Coast chain

Time with UpNonStop: 9 months

Pre-UpNonStop Spend Efficiency: 1.5% cashback, scattered across multiple cards

Average Monthly Spend: $100K+ on corporate credit cards

Cards Optimized: Amex Business Platinum / Gold, Chase Ink, Capital One Spark Target: Maximize points accumulation, stabilize earn rate, enable high-value redemptions

Average Earn Rate: 3.8% across all corporate spend

Total Points Accumulated: 287,000 Amex points

Today's Redemption: Singapore Airlines Business Class roundtrip for one

Total Fees Paid: $58.30

Cash Value of Tickets: $8,785.23

Return-on-Spend (RoS): ~11.8%

Experience Delivered: Lie-flat beds, Michelin-level meals, SilverKris lounges, personalized service

System Built: Predictable, repeatable points engine leveraging everyday business spend

Over nine months, we transformed his corporate spend from a low-yield ledger exercise into a high-performing points engine, enabling tangible, high-value travel rewards without changing day-to-day behavior.

The Earn: Turning $100K+ Spend into 287,000 Points

Optimized points strategy isn’t luck, it’s science, precision, and active management. For our NYC restaurant owner, the process unfolded in four key steps:

Step 1: Assess & Consolidate

- Before UpNonStop: Multiple cards, inconsistent category use, scattered points.

- After: Spend mapped into high-value earning categories, with each dollar directed to the optimal card.

- Goal: Create a predictable, measurable points flow that grows every month.

Step 2: Card Optimization

- Amex Business Platinum / Gold: Maximized for flights (x5 points), dining, and business services (x4 points).

- Chase Ink Business: Focused on high-volume vendor payments and F&B expenses (2x-3x points).

- Capital One Spark: Covered miscellaneous recurring spend, creating a floor for earn rate.

Step 3: Stabilize Monthly Flow

- Spend volume distributed to avoid credit limits or loss of category bonuses.

- Points tracked and adjusted dynamically to maintain 3.8% average earn rate, up from 1.5%.

Step 4: Total Points Accumulated

- Result after nine months: 287,000 Amex Membership Rewards points ready for transfer to Singapore Airlines KrisFlyer.

- This isn’t theoretical - points were real, liquid, and ready to redeem.

Takeaway: Every dollar spent now works harder without adding complexity to the CEO’s daily workflow. Optimization plus oversight = predictable, repeatable points accumulation.

The Burn: Crafting a High-Value Redemption

Accumulating points is just step one. The real impact comes from strategic redemption - turning points into premium experiences at optimal value.

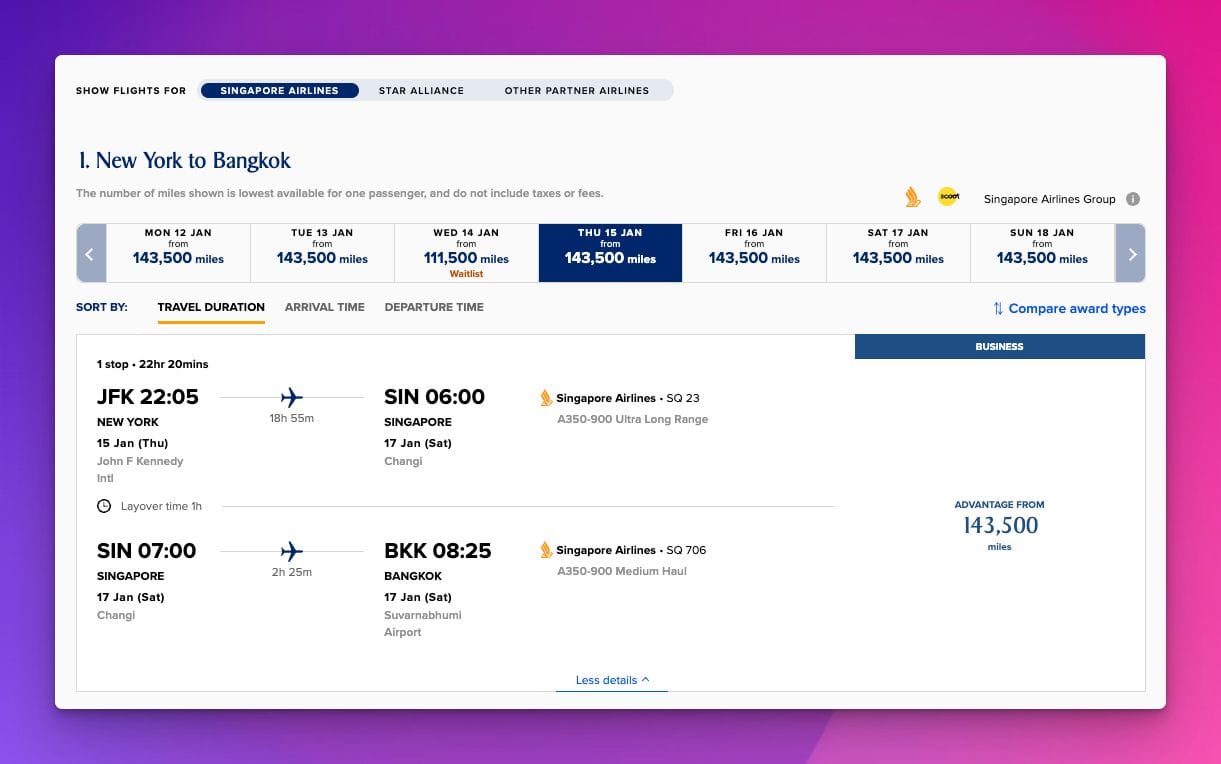

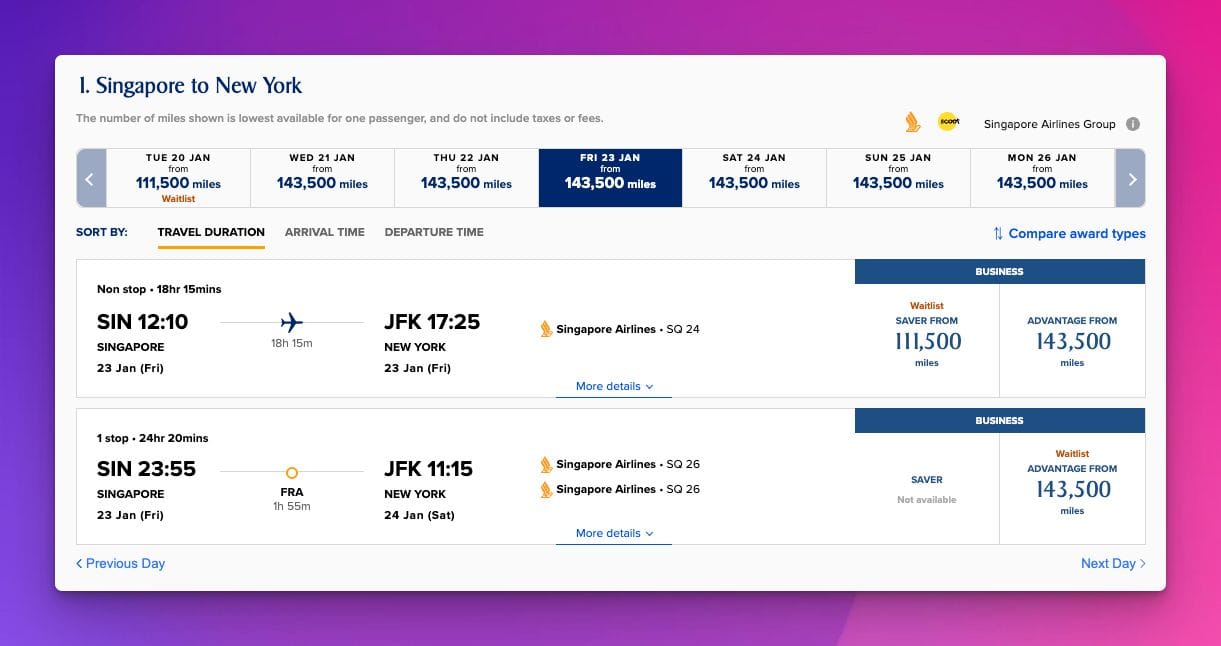

Route Selection & Redemption

- Outbound: JFK → Singapore → Bangkok

- Inbound: Phuket → Singapore → JFK

- Points Required: 143,500 SQ points per leg, roundtrip total: 287,000 points

- Total Fees: $58.30

- Cash Equivalent Value: $8,785.23

Why this redemption?

- Efficiency: Singapore Airlines is one of the most redemption-efficient carriers for Business Class.

- Value Maximization: Transferring Amex points ensured optimal point-to-dollar conversion.

- Experience: Lie-flat beds, top-tier lounges, and uninterrupted comfort throughout the journey.

Pro Strategy: Each leg chosen to maximize cost-per-point efficiency and deliver the best onboard and lounge experience while avoiding low-product flights.

The Return-on-Spend: Numbers That Matter

Here’s the hard data for executives who want results:

| Metric | Value |

|---|---|

| Average earn rate | 3.8% |

| Total points redeemed | 287,000 Amex points |

| Total cash equivalent | $8,785.23 |

| Fees | $58.30 |

| Return-on-Spend (RoS) | ~11.8% |

Why it matters:

- The RoS is real, tangible, and repeatable.

- Compared to 1.5% cashback, it would have required over $585,000 in spend to achieve equivalent value.

- Points accumulation is predictable and trackable, creating a repeatable system.

- Additional benefits:

- Time saved: No hunting for cash fare deals

- Flexibility: Easy schedule changes with minimal fees

- Tax-free leverage: Points redeemed for travel are not taxable

The Learn: Experiencing Singapore Airlines Business Class

Points are currency - but experience is the real reward.

Here’s what our client will encounter:

Cabin & Seating

- Lie-flat beds in 1-2-1 configuration

- Privacy dividers and ample personal storage

- Ergonomic seat controls for work, relaxation, or sleep

Dining

- Multi-course meals designed by Michelin-level chefs

- Wine pairings and fresh ingredients

- Pre-order options for full customization

Lounges

- SilverKris Lounges in Phuket and Singapore.

- Chase Sapphire Reserve Lounge in JFK (using his own personal CC)

- Spa showers, curated drinks, quiet and work-friendly spaces

- Seamless boarding and transfers

Crew & Service

- Personalized attention without intrusion

- Anticipation of individual needs: hot towels, beverages, small amenities

- Professional, unobtrusive, and efficient

Travel Efficiency

- Smooth connections at SIN to Bangkok and Phuket

- Minimal ground hassle, allowing arrival ready for work or leisure

Lessons Learned: What This Case Shows

For our NYC Restaurant Owner:

- Optimized points strategy produces predictable accumulation

- Strategic redemption maximizes Return-on-Spend while delivering world-class experience

- Routine business spend becomes a repeatable, high-value asset

- Systematic, data-driven points management matters

- Stabilizing spend across multiple cards exponentially increases RoS

- Points aren’t just currency - they’re experiential leverage

For Business Owners in General:

- Don’t settle for generic cashback or scattered points

- Optimized accumulation + tactical redemption transforms everyday spend into luxury travel

- Tax-free Return-on-Spend from points can dramatically outperform cash back

Final Approach:

From 1.5% cashback to a 3.8% average earn rate, culminating in $8,785 Singapore Airlines Business Class roundtrip, our NYC restaurant owner illustrates the power of strategic points management.

This is repeatable, measurable, and scalable. Every dollar spent now contributes directly to experience and value.

With 287,000 Amex points turned into premium business-class travel, our restaurant owner doesn’t just fly - he travels smart, efficiently, and luxuriously. Our work demonstrates how business owners can leverage everyday spend into tangible, life-enhancing wins.