500,000 Citi Points: Unlock $20,000+ in Luxury Travel: First Class Flights, 6-Month Global Adventures, and Premium Stays (Galore!)

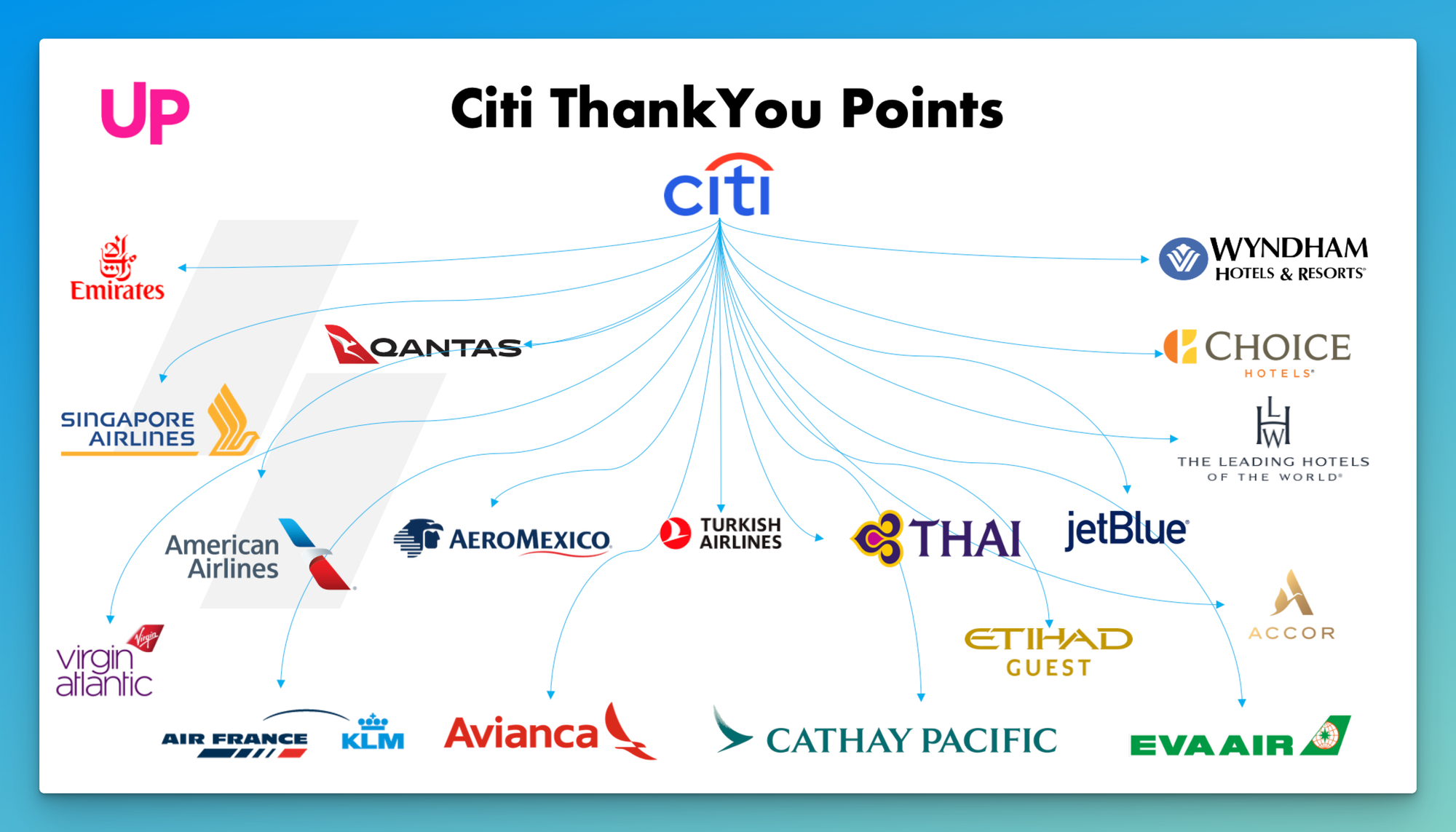

Half-a-million Citi ThankYou points unlock $5,000 to $20,000+ in travel value. Think first-class flights, overwater villas, and multi-continent adventures. Learn how to maximize luxury, plan epic family trips, and diversify redemptions for unforgettable experiences beyond saving cents-per-point.

If You Only Had 60 Seconds to Read This Article (Click Here)

Half a million Citi ThankYou points represent a rare and powerful travel currency stash, unlocking opportunities far beyond typical redemptions. At a base valuation of 1¢ per point, 500,000 points equate to $5,000 in travel spending power - but savvy use can easily double or quadruple that value, reaching $10,000 to $20,000 or more. Whether it’s booking first-class flights, luxurious overwater villas, or multi-continent adventures, this balance offers virtually unlimited flexibility for crafting extraordinary experiences. The main challenge is shifting from accumulation to strategic utilization, balancing maximum value with memorable splurges, and spreading redemptions across trips, guests, and moments that truly matter.

With 500k points, your dream travel options expand dramatically. Consider an around-the-world first class itinerary with Emirates, Singapore Suites, and Qantas first class segments - a journey valued more than $50,000 cash and involving multiple continents and iconic premium cabins. Alternatively, fund six months of nomadic exploration across South America, Europe, Asia, Australia, and Africa by carefully allocating roughly 320k points to flights and using the remainder for selective high-end hotel stays. Family travel becomes attainable too: business or first-class round-trip tickets for four, plus luxury hotel stays, are possible with smart transfer and redemption strategies. Breaking large redemptions into smaller, flexible segments also mitigates availability risk and adds peace of mind.

Beyond flights, 500k points open the door to unparalleled ground experiences. High-end hotels in major cities, overwater bungalows in the Maldives, and all-inclusive resorts for large family gatherings become within reach, often through transfers to Citi’s hotel partners like Accor and Choice Privileges. Cruises and unique experiences - from private tours to Michelin-starred dining - can be partially or fully covered by points, freeing up cash for indulgences. Avoid low-value redemptions (like Shop Your Way conversions) and instead use points as a “scalpel” to tackle the most expensive parts of travel, maximizing your overall return. Always consider mixing cash and points strategically to stretch your balance further.

Finally, 500,000 points offer philanthropic and practical benefits beyond personal indulgence. Donating points to charity, gifting travel to loved ones, or holding a point “rainy day fund” for emergencies adds meaningful dimensions to your balance. Security is also key: diversify points transfers to multiple programs to hedge against devaluations or account issues and aim to redeem large portions within 1-2 years to avoid point erosion. Keep earning steadily to replenish your stash and engage with the travel community for fresh ideas.

Ultimately, your half-million points are a passport to world-class experiences, letting you say “yes” to life’s best moments without hesitation - turning your points into priceless memories.

Everything else you need to know is just below 👇🏻

Welcome to the grand finale of our points journey

500,000 Citi ThankYou points - half a million! - is an astounding reserve of travel currency.

It’s the kind of balance that frequent flyer fantasies are made of. At this level, you aren’t just planning a trip; you can orchestrate year-long travel agendas, multi-country expeditions, or ultra-luxury experiences that most people only ever read about in magazines.

Think about it: even at the basic 1¢ per point value, that’s $5,000 in travel. But in reality, with smart redemptions, you might extract $10,000, $20,000 or more in value. You have virtually unlimited flexibility: First class flights on a whim? Sure. Two weeks in an overwater villa? Doable. Fly the whole family in business class to New Zealand and back with a stop in Fiji? Why not.

The key challenge with 500k points is how to use them optimally without getting overwhelmed. It’s a good problem to have! In this article, we’ll explore strategies to deploy this mountain of points in ways that maximize joy, not just cents-per-point. We’ll look at crafting once-in-a-lifetime journeys, spreading the wealth over time, and even some philanthropic or creative uses. By the end, you should have a clear vision (and probably a daydream-induced smile) of what to do with your 500k ThankYou points.

Grab a cup of coffee (or champagne, you point-mogul, you) - we’re about to go on a world tour of ideas.

Mindset at 500k: From Accumulation to Utilization

Before diving into redemptions, let’s address the mindset. With 500k points, you’ve likely been in accumulation modefor a while - opening cards, maximizing bonus categories, etc. Now it’s time to switch to utilization mode. Points are not like a retirement fund; hoarding them indefinitely isn’t the goal (due to potential devaluation and missed experiences). At this level:

- Set Travel Goals: Make a bucket list of places and experiences. Match your points to these goals.

- Diversify Redemptions: You have enough points to do a lot, so consider using them across multiple trip types- some for luxury, some for family, some for exploring new places.

- Share the Love: 500k can also allow you to be generous - treat friends or family to flights or hotels, gift an experience, or even donate points (though generally redeeming for charity through Citi is at lower value, some prefer to use the travel savings to donate cash).

- Don’t Fear Splurges: This is important. At 500k, you can afford some “poor value” redemptions if they fulfill a personal wish. Example: If you want to take your elderly parents on a cruise and the only way to use points is via a less efficient route (like maybe converting to a cruise certificate at 0.8¢ value), it might still be worth it to create that memory with them “for free.” Not every point has to squeeze out 2¢ - balance max value with maximum happiness.

The Ultimate Dream Trip (or Trips)

Half a million points unlocks the ability to plan an ultimate dream trip that most could only imagine. Here are a few epic ideas:

- Around the World in First Class (The Royal Treatment): We’ve touched on RTW in business class, now let’s crank it up. 500k can feasibly get you around the globe almost entirely in first class:

- Fly New York to Dubai on Emirates First Class (136k Skywards miles one-way).

- Then Dubai to London on Emirates First (85k Skywards, if you want to stop in Europe).

- Then London to Singapore on Singapore Airlines Suites (around 125k KrisFlyer miles one-way).

- Then Singapore to Sydney on Singapore First (maybe ~95k miles).

- Then Sydney back to Los Angeles on Qantas or American First via Asia Miles or AAdvantage (let’s say ~110k, perhaps you’d need to use some partner miles or Asia Miles around 105k one-way).

- This is conceptual, and in reality you’d need to juggle programs, availability and possibly partner with one or two other bank point currencies for the full spectrum. But purely in terms of points, that string of first class flights sums up around 550k. With some transfer bonuses or slight tweaks (maybe a couple legs in business instead), 500k covers it.

- You’d literally experience multiple top-tier first class products: Emirates’ shower and bar, Singapore’s double bed in the sky, maybe ANA’s new “The Suite” or Cathay Pacific’s first class if you route differently. It’s the kind of trip that cost in cash would likely be well over $50,000 collectively. And you’d see multiple continents in extreme comfort.

- Between flights, of course, you’d enjoy stopovers at destinations (and with 500k, you can also cover hotels - but we’ll get to that).

- 6 Months of Travel, Nomad Style: Perhaps you’re more into extended slow travel. 500k points can support a six-month round-the-world backpacking (but make it chic) journey. For instance:

- Start in South America: redeem 30k for a one-way to Peru. Spend a month there (cheap on cash).

- 30k to fly to Europe.

- 50k to get to Asia.

- 30k within Asia hops (e.g., Bangkok to Tokyo 22k on ANA via Virgin, etc.).

- 40k to go down to Australia/New Zealand.

- 60k to head up to Africa (maybe via Middle East).

- 80k to fly home from South Africa via Qatar Qsuites (one-way business ~75k Avios).

- That’s about 320k in flights. You could use remaining ~180k for lodging intermittently: perhaps splurge every couple of weeks on a fancy hotel to refresh (20k Choice points here, 40k Accor there). Meanwhile, use cheaper accommodations other nights. 500k could essentially underwrite half a year of exploring across 5-6 continents - flights and key accommodations paid. You’d return with countless stories and maybe still some points left!

- Family First Class Trip to Anywhere: Many parents dream of taking their kids or extended family on a truly special vacation, all in first or business class together. 500k makes this plausible:

- Example: Family of four to Japan in business class. ANA round-trip business via Virgin Atlantic = 90k * 4 = 360k (assuming you can book round-trip awards, Virgin requires round-trip on ANA). You have 140k left for hotels. Transfer 100k to Hilton via Virgin (actually Virgin to Hilton is 2:3, so 100k yields 150k Hilton, which can get maybe 3 nights at a top Hilton or more at moderate ones), or use 140k for 5 nights at a Hyatt by transferring via Bilt (oops, Citi doesn’t do Hyatt, scratch that unless you convert Citi->Choice and Choice->Hyatt which is inefficient). Alternatively, use 140k via Accor (70k ALL) for €1400 of hotel credit - that’s perhaps 4 nights at a luxury hotel in Tokyo or Kyoto.

- Or family of four in first class to Europe: might be ~170k per person round-trip on Lufthansa First via LifeMiles (87k one-way *2). That’s 680k, a bit beyond our budget. But maybe one-way in first (for the experience) and one-way in business coming back: around 520k total, still above. Maybe find a cheaper first like Etihad first apartment via AA miles (62.5k one-way) if they open awards, etc. It can be done creatively.

- The point: 500k can let you share luxury travel with your loved ones, not just yourself. There’s something incredibly rewarding about seeing your partner or parents or kids wide-eyed in an airplane suite or relaxing in an incredible resort that they never imagined experiencing.

Luxury Ground Game: Hotels, Cruises, and Experiences

We’ve emphasized flights, but at 500k, let’s focus on ground and sea:

- High-End Hotels: With 500k, you can stay in places that are destinations unto themselves.

- Overwater Bungalows: As previously mentioned, some Maldives resorts can be booked via points. If not direct, use points as cash. $5k in portal value could be 5 nights at $1,000/night. There are resorts like St. Regis Maldives (Marriott, not directly Citi transferrable), or you could transfer to Turkish Miles&Smiles to book Marriott hotels (yes, Turkish has a bizarre hotel booking option with points, but probably poor value). Perhaps easier: Accor’s Raffles Maldives Meradhoo runs around $1,200/night; use €2000 of Accor points (100k ThankYou -> 50k Accor) and pay rest cash for two nights - basically 2-for-1 deal. Alternatively, use Citi’s Luxury Hotel Collection or transfer to ThankYou’s partner Choice Privileges which now includes some Preferred Hotels & Resorts properties (some of which are super high-end independent hotels).

- City Luxury: Enjoy a week in a Parisian palace hotel or Tokyo’s Aman? Many top cities have hotels in the $800-1000/night range for suites or club level rooms. 500k points via portal (or via a mix of transfer to hotel points) can cover multiple nights. For example, 500k -> 250k Accor = €5000, that could get 5 nights at the Plaza Athenee in Paris (part of Dorchester collection which partners with Accor for points) which is a palace hotel. Or even more nights if you choose slightly less pricey 5-stars.

- All-Inclusive for the Whole Clan: Transfer a big chunk to Wyndham or Choice and book multiple rooms at an all-inclusive for an extended family gathering. 500k ThankYou = 500k Wyndham; at 30k per room per night, that’s about 16 room-nights. You could get 4 rooms for 4 nights for a family reunion at a Viva Wyndham resort in the Caribbean, all food and drink included - covered entirely by points. Imagine inviting your siblings, their kids, etc., and saying “don’t worry about the hotel or meals, I’ve got it covered with points.” Hero status!

- Cruises: If you love cruising, points can indirectly help. Citi’s travel portal does allow cruise bookings in some cases. $5,000 can certainly get you a very nice cruise for two. Or, some cruise lines have gift card arrangements; you might redeem ThankYou points for Carnival or Royal Caribbean gift cards when available. Another angle: use points to fly business class to the cruise port (e.g., Mediterranean cruise starting in Rome - use points to get there in comfort and back).

- Unique Experiences: Citi sometimes has the ability to redeem for concerts, sporting events, etc., via their rewards portal (often not great value, but hey). Alternatively, use points to free up cash for experiences: e.g., pay hotels and flights with points, then use the cash you saved to perhaps rent a sports car for a day in Monaco, or take a private guided tour of the Pyramids, or dine at Michelin 3-star restaurants without guilt.

- Transfer to Shop Your Way (10:1): This is usually an awful value (1 ThankYou = 10 Shop Your Way points = basically 10 cents). So 500k would be $50 in Sears/Kmart points… skip. But I mention to emphasize: even with so many points, avoid truly wasteful redemptions like that. Instead, if you need cash-like uses, consider Pay Yourself Back if you have Citi Custom Cash (they sometimes allow mortgage/student loan payments at 1¢). Or even statement credit at 1¢ (Citi has been known to do 1¢ with some card combos). Worst case, $5k cash back is the floor - but you likely didn’t accumulate transferable points to cash them out, you want aspirational travel!

Philanthropy and Pay-It-Forward

One often overlooked use of points - especially a large sum - is to do good or help others:

- Donate Points: Citi ThankYou allows donation of points to charities like the Red Cross. The rate is typically 1¢ per point (so 500k = $5,000 donation). It’s not travel, but it’s a noble consideration if you’re in a position where travel is already abundant in your life and you want to give back.

- Gift Travel: Use your points to book tickets or hotel stays for friends/family who might not otherwise afford it. For example, surprise your parents with a business class trip for their anniversary, or send a friend and their spouse on a weekend getaway. You can usually book tickets in anyone’s name using your miles. With hotel points, some programs allow you to book in someone else’s name easily (Choice lets you add an authorized user name at booking, etc.). There’s immense joy in not just enjoying points for yourself but enabling loved ones to have experiences.

- Help in Emergencies: Having a stash of points is like an insurance policy. If a family member needs last-minute travel for an emergency, you can dip into points and get them there with less financial stress. Or if there’s a natural disaster and flights are disrupted or expensive, points seats might still be available. 500k ensures you have a cushion for the unexpected - which is a form of philanthropy too, towards people you care about.

Safeguarding 500k Points - A Quick Note

We touched on protecting a 250k balance, but at half a million, even more so:

- Maybe Don’t Keep All Eggs in One Basket: You might intentionally transfer out some points to different programs ahead of time as a hedge. For instance, if you have favorite airlines, you could keep 100k in Flying Blue, 100k in LifeMiles, etc. Downside is risk of those miles expiring or devaluing, but it diversifies against Citi making any unfavorable changes or if (worst case) your Citi account gets hacked/frozen. Only do this if you have a planned use or the program has stable value.

- Use ‘Em: If you have 500k now, consider using a large portion within the next 1-2 years. Earning them may have taken long; spending should be faster. Points are not appreciating assets - quite the opposite, programs devalue regularly.

- Keep Earning (Lightly): It might sound odd, but still earn as you spend. If you blow 400k on a dream trip, you’ll still want a cushion for future travel. So keep using those Citi cards for great multipliers (Premier 3x on groceries/gas, etc., Custom Cash 5x on category, Double Cash for uncapped 2x). You likely have a strong points earning system; don’t fully turn it off or you might find yourself with zero faster than you think. 500k is a lot, but you can burn through it with ambitious plans (as we’ve shown!). The good news: you have the skills to earn it, so you can build back up for the next adventure.

Final Thoughts: Writing Your Own Travel Legend

500,000 Citi ThankYou points is more than just a number - it’s a passport to virtually anywhere, in any style. You have the means to craft memories that will last a lifetime, whether it’s jet-setting around the globe in first class, treating your family to dream vacations, or exploring every corner of the map on your terms.

As you embark on using these points, remember that the end goal isn’t to simply “get good value” - it’s to enrich your life (and perhaps others’ lives) through travel. The points are a medium to that end. So yes, do the research, find the sweet spots, but also relish the freedom that this abundance of points gives you. If an opportunity arises - a festival in Brazil, a friend’s wedding in Tuscany, an aurora borealis sighting in Norway - you can say yes without worrying about cost. That’s powerful.

Over the past five articles, we’ve journeyed from 20k to 500k ThankYou points. Each level unlocks new potentials, and you might find yourself somewhere along this spectrum, or moving up it as you continue earning. Wherever you stand, the ethos remains: maximize, strategize, and then utilize.

We’ll close with this thought: Travel is one of the most enriching things you can spend “currency” on, and thanks to points, you’ve essentially gotten yourself a treasure chest of free travel. So go forth and spend it! Fly in the fancy seats, stay in the bucket-list hotels, eat the exotic foods, take the epic road trips. Your Citi ThankYou points are your invitation to the world - RSVP to that invitation with a big, bold YES.

Happy travels, and may your journeys be as rewarding as the process of earning and redeeming these points has been. Bon voyage!