2026 Predictions: The 7 Quiet Devaluations Coming (and How You Can Still Win Big)

If you think 2024 and 2025 were chaotic in points land, buckle up. The next 12-18 months are shaping up to be the most consequential era for business travel value since the first bank slapped a bonus category on a metal card and called it innovation.

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

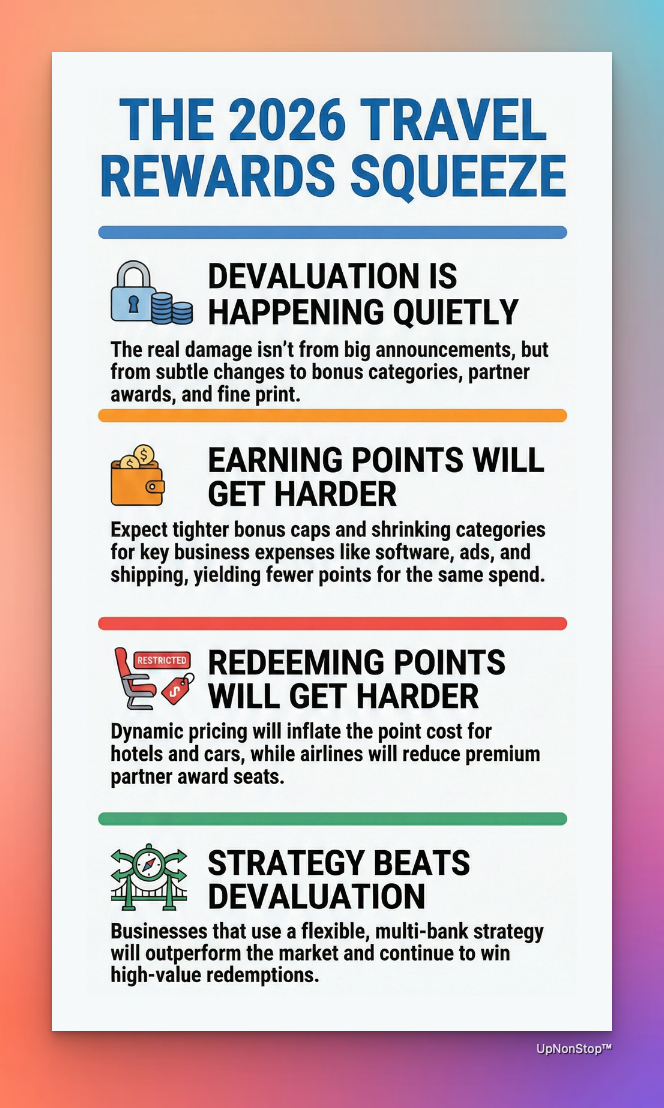

You probably think devaluations are big, loud announcements. They’re not.

In 2026, the real damage happens quietly: shrinking bonus categories, partner award tightening, dynamic pricing creep, and business-card fine print that trims earn potential without most businesses noticing. None of these moves make headlines - but every one of them reduces the value of an uninformed company’s points balance.

Co-branded cards will get more restrictive, bonus caps will tighten, and transfer bonuses will become shorter, narrower, and less lucrative. Hotels and car rental programs will fully embrace dynamic pricing, inflating the cost of redemptions that used to be predictable. And the golden era of easy signup bonuses is effectively over for businesses.

The result: the same spend now yields fewer real-world travel outcomes unless you’re operating with intention.

But this is not doom-and-gloom. It’s a widening gap. When banks make earning harder and burning less predictable, the business who rely on a single card, a single airline, or a single bonus category get squeezed - while the businesses with a flexible, multi-bank earn structure actually outperform the market. Devaluations don’t hurt operators who know how to shift spend, leverage flexible points, time transfers, and map redemption opportunities to seasonality and availability.

The UpNonStop view is simple: you only lose when you don’t know the game is changing. 2026 won’t reward the biggest spenders - it will reward the most strategic ones. The companies using real earn-to-burn systems, diversified card stacks, and flexible currencies will continue to get lie-flat seats for pennies on the dollar. Everyone else will start wondering why their points “don’t go as far anymore.”

Everything else you need to know is just below 👇🏻

🎞️: Powered by NotebookLM @ UpNonStop

This is not fear-mongering.

This is forecasting.

The kind institutional consultancies charge $40,000 for - except they don’t care about small and medium-sized businesses, and they don’t understand points as a financial asset class. They track interchange. I track earn mechanics and redemption leverage across real-world business spend.

2026 will be the year banks quietly make their boldest moves in a decade: trimming, tightening, restructuring, and shifting the rewards landscape in ways consumers won’t fully grasp until their points are suddenly worth… less.

But here’s the twist most people miss:

Devaluations don’t hurt informed operators.

They magnify the gap between the ones who strategize and the ones who wing it.

Business owners spending $100K to $10M on cards every year have more leverage than they realize. And when banks create friction, strategic players squeeze even more ROI out of the cracks.

Today, we’re walking through the 7 quiet devaluations coming in 2026 - the ones nobody else will warn you about - and the counter-strategies that put you on offense, not defense.

Let’s dig into it...

1. Category Shrinking: The Silent Killer of Earn Rates

For 10 years, banks expanded categories: dining, gas, office supply, shipping, software subscriptions, social media ads… everything got its “multiplier moment.”

That era is over.

Our Prediction: 2026 ushers in category contraction, not expansion.

Banks won’t remove categories outright - too obvious. They’ll redefine them subtly:

- “Software” becomes “U.S.-based SaaS only.”

- “Travel” quietly excludes OTAs or certain carriers.

- “Advertising” excludes boosted posts or niche platforms.

- “Dining” applies only to restaurants, not food delivery intermediaries.

These moves don’t make press releases. They appear in updated T&Cs and ambiguous category mapping charts most users never see.

Why it matters for businesses:

When categories shrink, you’re suddenly earning 1x on spend that used to generate 3-5x. And if you’re running $50K/month through software and ads?

Your annual points yield quietly collapses.

UpNonStop Strategy:

You don’t defend against category shrinkage - you diversify around it.

You need:

- A primary earn engine tied to flexible transferable currencies

- A secondary card optimized for “hard to kill” categories (shipping, office supply, telecom)

- A tertiary card with strong baseline value regardless of category drift

This is the difference between getting 1% back on half your operating expenses… and 10-20% ROI through strategic allocation.

If categories disappear, strategy becomes the category.

2. Cobranded Turbulence: When Airlines Rewrite the Playbook

The airline - bank marriage is healthy… until it’s not.

Right now, airlines are frustrated. Too much liability from outstanding miles. Too much reliance on banks. Too much breakage uncertainty. And too many people in premium cabins who paid nothing except points.

Our Prediction:

2026 sees multiple airlines tighten partner award space (especially for U.S. carriers) reducing the best-value redemptions.

We’ll see:

- Fewer partner premium seats

- More dynamic pricing creep into previously charted programs

- More peak-season “close-in penalty pricing”

- More award tiers that function like opaque cash fares

And banks will respond by pushing their premium cobranded cards harder, promising more “guaranteed availability” if you’re inside their ecosystem.

Why it matters for Businesses:

If 80% of a business redemptions rely on a single carrier (common for regional operators), any turbulence hits them disproportionately.

Your employees’ ability to fly business class depends on a negotiation between banks and airlines you’re not privy to.

UpNonStop Strategy:

Cobranded is no longer the backbone of the business strategy - it’s the edge case tool you use when the math works.

Your backbone must be flexible currencies:

- Amex Membership Rewards

- Chase Ultimate Rewards

- Capital One Miles

- Bilt (for niche high-value transfers)

Flexibility is future-proofing.

Dependence is devaluation’s playground.

3. Bonus Caps Tightening: The Era of “We Love You Until You Spend Too Much”

For years, banks tolerated huge Small and Medium-Sized businesses spend because the economics worked out - high interchange, high lifetime value, predictable behavior.

Then business owners got smarter.

Tools like UpNonStop showed them how to turn spend into outsized ROI.

Banks noticed.

Our Prediction:

2026 introduces tighter bonus caps on key business categories.

Not elimination - just ceilings:

- $150K annual cap on 4x earn

- $25K quarterly cap on elevated multipliers

- Lower caps for “complex” categories like shipping and digital ads

A company spending $2M/year on a category?

Their return collapses once the cap hits - and most don’t even know the cap exists.

Why it matters for the business:

The biggest winners of 2024–2025 were heavy spenders running $500K–$1.5M/year through a 4x or 5x category.

These were the companies getting 15%–20% ROI.

Once caps shrink, the top 5% of SMBs get squeezed hardest.

UpNonStop Strategy:

We don’t care about bonus caps.

We care about maximizing your blended earn rate across the entire spend spectrum.

That means:

- spreading spend intentionally across multiple banks

- mapping your spend curve to category ceilings

- using your highest-ROI category first

- redirecting overflow to your strategic secondary engine

This is where SMBs using UpNonStop consistently hit 10%-20.59% returns.

Because we engineer for efficiency, not blind loyalty.

"Banks cap categories. We cap nothing."

--Ohad Sternberg

4. Business Cards Adding “Gotchas”: The 2026 Fine Print Revolution

Personal cards used to be the testing ground for changes.

Not anymore.

Business cards are the new sandbox for “quiet gotchas,” because compliance reviews are lighter and SMB owners don’t have time to read 17-page T&C updates.

Our Prediction:

We’ll see...

- higher minimum redemption thresholds

- fewer transfer partners accessible at 1:1

- “enterprise controls” that actually hinder multipliers

- certain benefits tied behind spend requirements

- foreign transaction fee creep on sub-premium business tiers

Each change is small.

Together, they erode value.

Why it matters for SMBs:

Business owners rely on predictability.

Gotchas reduce predictability - which reduces your ability to plan award redemptions for company travel.

Devaluation isn’t always a gut punch.

Sometimes it’s a thousand paper cuts.

UpNonStop Strategy:

We treat card portfolios like software stacks.

Every piece has a job, and we monitor when something breaks or degrades.

If Amex loosens one screw, Chase tightens another.

If Capital One changes an earn map, Bilt or Citi fills the gap.

And when banks add friction?

We route around it.

Your spend always has a home.

Your ROI always has a strategy.

5. Transfer Bonuses Becoming More Restrictive

2024-2025 were transfer bonus heaven.

20%, 30%, 40%… sometimes multiple stacked windows.

Businesses used these to liquidate balances into premium cabins at stupidly good value.

Banks loved it at first.

Then they realized: Too many people were gaming the calendar.

Our Prediction:

In 2026...

- bonuses become narrower

- windows become shorter

- partner-specific bonuses favor weaker programs

- stacking becomes a relic

- some transfer bonuses require minimum point transfers

The short version:

Banks will make it harder for you to convert flexible points into first/business class redemptions at the values you’re used to.

Why it matters for Businesses:

A 30% transfer bonus can be the difference between:

- 150K points for a seat

- 195K points for the same seat

- or 250K if dynamic pricing hits

On a 5-person team flying once a year?

That’s a 250K–500K point swing.

UpNonStop Strategy:

We architect redemption calendars based on:

- historical bonus cycles

- partner award availability

- seasonal premium cabin dumps

- route-specific sweet spots

- partner devaluation likelihood

You don’t chase bonuses.

You plan around them.

This is how we routinely get business owners lie-flat seats worth $4,000–$7,000 each for effective “costs” of $150–$350.

Bonuses restrict?

We adapt the earn-to-burn pipeline.

6. Dynamic Pricing Spreading Beyond Airfare to Hotels and Car Rentals

Dynamic pricing is the virus of the industry.

Once one provider catches it, the neighbors start coughing.

Hotels were slow to adopt it.

Car rentals even slower.

But 2026 is the year both sectors fully embrace airline-style demand-based pricing.

Our Prediction:

Hotel programs will...

- drastically widen their dynamic pricing bands

- offer fewer “standard room” redemptions

- push people into premium rooms at inflated point costs

Car rental programs will...

- tie redemption rates to real-time fleet availability

- eliminate flat-rate awards

- charge more miles for “premium vehicle classes” that used to be included

Why it matters for Businesses:

Hotels and ground transport make up 40%–60% of many companies’ redemption mix.

When pricing becomes unpredictable, your points yield becomes volatile.

UpNonStop Strategy:

We don’t fight dynamic pricing - we weaponize it.

Strategy includes:

- shifting hotel redemptions to underrated chains with stable pricing

- using points for airfare and cash for lodging when math dictates

- locking in high-value fixed-price partners

- leveraging luxury-centric programs where dynamic swings work in your favor

You don’t lose to dynamic pricing.

You reallocate around it.

7. The Death of Signup Bonus Chasing: 2026 Ends the Era of “Free Points for Everyone”

Let’s be blunt:

Signup bonuses (“SUBs”) are not going away, but they’re no longer a viable strategy for SMBs.

They’re bait - and the economics are collapsing.

Our Prediction:

2026 brings...

- lower SUBs for business cards (Sign-Up-Bonuses)

- higher spend requirements

- issuer cooling-off periods

- increased denials for high-velocity applicants

- shrinking referral bonuses

- stricter EIN vs. SSN enforcement

For Businesses spending $500K-$2M per year, SUBs represented less than 3% of their total yearly points haul anyway.

They were a dopamine hit, not a strategy.

UpNonStop Strategy:

Earn strategy > Sign-on-Bonus strategy.

Always.

You maximize:

- category multipliers

- overlapping bonus categories

- strategic card pairings

- redemption sweet spots

- calendar-timed earn-to-burn flows

- partner route arbitrage

- operational spend consolidation

This is how you turn a $1M/year spend into:

- 100,000 points if you’re doing it wrong

- 1,000,000–2,000,000+ points if you’re doing it correctly

Sign-on-Bonuses don’t move the needle. Systems do.

So… Who Wins in 2026?

Not the biggest spenders.

Not the savviest deal chasers.

Not the “I read a Reddit post and now I’m an expert” people.

The winners in 2026 will be:

SMBs who treat points like a financial instrument… not a hobby.

- The ones who know where every dollar goes.

- The ones who engineer earn pipelines aligned with their spend.

- The ones who burn their points at 6-20% ROI, consistently.

- The ones with flexible, dynamic, multi-bank strategies.

- The ones who position themselves ahead of change, not reacting to it.

UpNonStop isn’t in the business of protecting you from devaluations.

We’re in the business of turning devaluations into leverage.

The UpNonStop POV: You Only Lose When You Don’t Know the Game Is Changing

Devaluations aren’t disasters. They’re signals.

Signals that the ecosystem is tightening, evolving, recalibrating.

And every signal creates opportunity for the player who understands the rules better than the issuer.

That’s what Strategy Saturday is about:

Not panicking - positioning.

2026 will be the year where:

- casual players feel squeezed

- Businesses without strategy lose ROI

- banks reclaim value

- airlines tighten partner space

- hotels go fully dynamic

But strategic SMBs (especially those optimizing through UpNonStop) will outperform the market.

Because when the game gets harder, the gap widens.

And you’re not competing against the banks.

You’re competing against the other SMB owners trying to get the same premium seats you want.

Strategy wins.

Real math wins.

Spend intelligence wins.

Flexible systems win.