Those could have been some very expensive fireworks

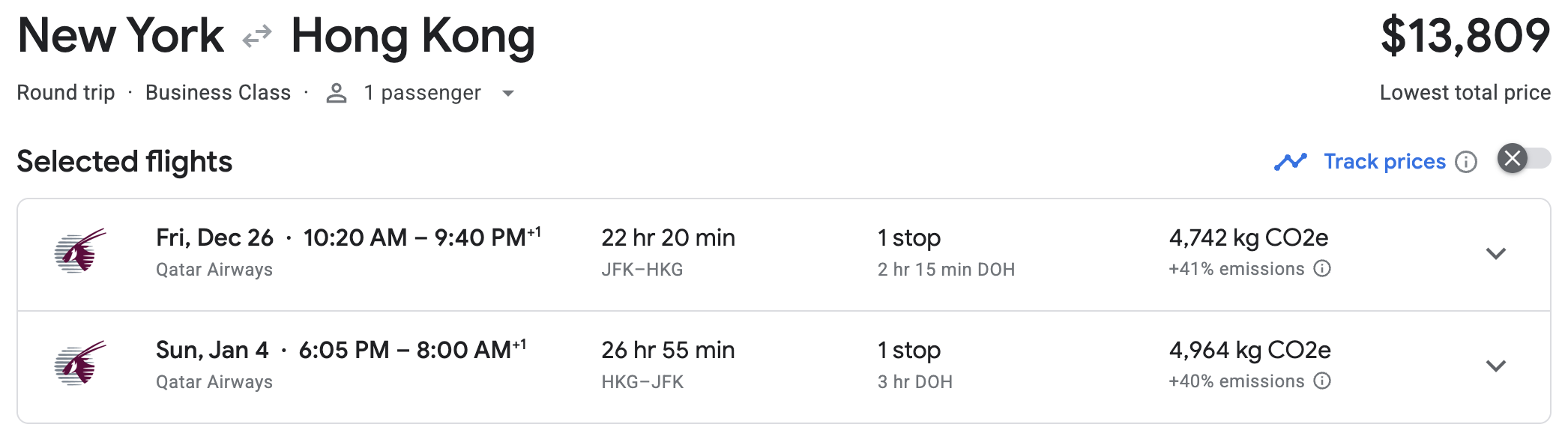

New Year's Eve Fireworks over Hong Kong Island: How a Small Business Turned $42,769 of Everyday Spend into $27,618 of Qatar Business Class

If You Only Had 60 Seconds to Read This Article (Click Here 🤏🏻 )

A seven-person design studio turned routine expenses into a luxury Hong Kong New Year’s trip by ditching a flat 2% cash-back card and adopting a 3.25× points strategy. Instead of $8,400 a year in rebates, their $420K annual spend now earns about 1.36 million transferable points.

They transferred 139K Chase Ultimate Rewards to Avios during a 30% bonus, instantly receiving 190K Avios - enough for two Qatar airways business-class roundtrips priced at $13,816 each. Out-of-pocket cost: just $380 in taxes and fees.

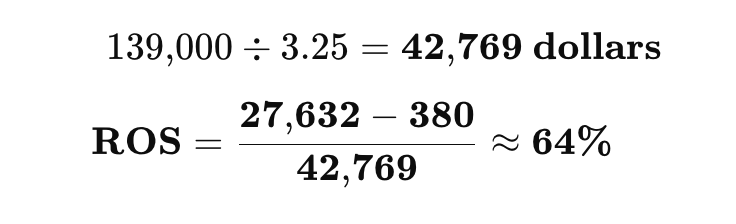

The underlying spend to earn those points was $42,769. Using the formula (cash price minus fees ÷ spend), their Return-on-Spend hit 64% - more than thirty times the return of their old 2 % cash-back setup, which would have required $1.38 million in spend for the same travel value.

Beyond free flights, the strategy fueled growth: a Hong Kong client shoot landed a six-figure retainer, executive perks helped hire top talent, and tighter payment timing improved cash flow. Routine invoices became an asset class - proof that measuring and maximizing Return-on-Spend can turn overhead into a profit engine.

Everything else you need to know is just below 👇🏻

🎞️: Powered by NotebookLM @ UpNonStop

The Scene: Champagne, Fireworks, and a Balance Sheet That Laughs Back

Picture it: New Years Eve, Hong Kong.

Victoria Harbour is a sheet of black glass, the skyline wired in neon. A winter breeze carries salt and the faint burn of firecrackers.

The owner of a seven-person design studio and his partner arrive by water taxi, coats sharp against the chill, still rested from their Qatar Airways flight out of JFK. From the open deck of a low-slung cruiser, they watch the first rockets streak upward - white arcs bending into red blossoms that light the harbor like a voltage surge.

Price of admission? $13,809 per ticket - a cool $27,618 roundtrip for the pair.

Price they actually paid? $380 in taxes and fees.

The rest was covered by 180,000 British Airways Avios, acquired with a simple transfer of 139,000 Chase Ultimate Rewards® points during a 30% transfer bonus.

That is not a typo. That is the modern definition of financial leverage. And it all traces back to a single metric most business owners have never calculated: Return-on-Spend (ROS).

Return-on-Spend: The Metric That Rewrites Business Travel

ROS = (Cash Value of Redemption – Taxes/Fees) ÷ Underlying Business Spend

While everyone else brags about “points per dollar,” ROS measures the real profit your spend creates. It answers the question: If I have to pay this vendor anyway, what’s the cash-equivalent upside?

For this trip:

- Cash fare saved: $27,618

- Taxes/fees paid: $380

- Underlying spend to earn 139K Chase points at

Sixty-four percent. Not annualized. Not hypothetical. A single transaction.

Before UpNonStop: The Comfort Blanket of 2% Cash Back

Six months earlier this studio ran every expense (software subscriptions, client dinners, ad buys) through a 2% cash-back card.

- Annual spend: $420,000

- Annual “reward”: $8,400 cash

Safe. Predictable. Mediocre. They treated rewards like coupons, not capital.

What they didn’t realize: that “easy” 2% return required $1.38 million in spend to net the same $27,618 of value they ultimately captured with one optimized redemption. They were leaving an extra six figures of potential travel value on the table every year.

The Wallet Makeover

Enter UpNonStop. We rebuilt their strategy around transferable currency and category multipliers:

- Chase Ink Business Preferred - 3× on advertising, shipping, and telecom

- Amex Business Gold - 4× on the two highest monthly categories (for them, dining + marketing)

- Capital One Venture X Business - 2× everywhere for floor coverage and extra transfer options

Weighted across their real spend, the studio now earns an effective 3.25× multiplier. That turns their fixed $420K annual spend into roughly 1.36 million transferable points - year after year.

From Points to Avios: Timing the Jump

Points are potential. Value comes from transfer bonuses. When British Airways offered a 30% bonus on Chase → Avios transfers, we pounced.

- 139K Chase → 180K Avios (instantly)

- Booked two Qatar Airways business-class roundtrips SFO-HKG during peak New Year’s space.

No hunting unicorns. Seats were wide open because we knew to target partner award space - Qatar's long-haul premium cabin bookable with Avios.

Business Impact: More Than a Free Trip

A fireworks cruise is nice. The business effects were better:

Client Development: They scheduled a Hong Kong case-study shoot with an Asia-based client that directly led to a six-figure retainer. The “vacation” became a revenue-generating trip.

Talent Magnet: Prospective hires suddenly saw international business-class travel as a perk, not a rumor. Their new creative director literally signed after seeing the lounge photos.

Cash-Flow Discipline: Because we planned spend around transfer-bonus windows, accounts payable got sharper. Vendors were happy to be paid early for small discounts; the studio captured the reward windfall.

Points became not just a perk but a strategic asset class.

Scaling the Strategy

One redemption is proof of concept. The real play is repetition.

- With $420K annual spend × 3.25× earn rate, they can recreate this exact itinerary seven times a year - or diversify into other high-value redemptions.

- Conservatively valuing each at $13,000, that’s ~$95,000+ of annual premium travel for a cost of routine operating expenses.

No market risk, no extra capital. Just routing the same spend through smarter channels.

Why Most Owners Miss It

- Complexity Fear. Multiple cards and transfer charts sound like admin headaches. (Solution: systems + automation.)

- Cash-Back Complacency. Flat 2% is easy and feels “responsible,” but it’s lazy capital allocation.

- Redemption Blindness. Without a target trip or partner knowledge, points expire or get cashed out at a penny apiece - financial malpractice.

UpNonStop’s job is to erase that learning curve so business owners can treat points the way CFOs treat assets.

Alternative Assets, Business Edition

Think of your spend as a bond throwing off 50%+ yield every time you redirect an invoice. There’s no hedge fund on earth offering that risk-adjusted return. Yet most business owners shrug and settle for 2% cash back.

If you believe in optimizing supply chains and cutting unit costs, why would you ignore the ROI on your credit-card strategy?

The Playbook in Short

- Audit Every Dollar. Identify which categories can safely shift to 3-4× cards.

- Bank Transferable Currency. Chase, Amex, Capital One, Citi. Flexibility is the moat.

- Track Transfer Bonuses. That 30% window is where the magic compounds.

- Redeem for Premium. Flights and luxury hotels are the highest-value use cases... period.

- Measure ROS Quarterly. Treat it like a KPI. Report it to the team.

The Final Ledger

💳 Underlying Spend: $42,769

💸 Cash Fare Avoided: $27,618

🧾 Taxes/Fees: $380

📈 Return on Spend: 64%

One fireworks-filled night in Hong Kong. Infinite ripple effects in the business.

This isn’t travel hacking. It’s financial engineering - accessible to any owner willing to move past “good enough” cash back and start running their spend like a profit center.

When you're ready to Maximize Your Business Spending

Get Started with a Free Earn-Optimization Assessment

Find out how much you could be earning and saving with UpNonStop.

Book your free Earn-Optimization Assessment and find your own Hong Kong - whether it’s Maldives overwater villas, Emirates First to Dubai, or a client-winning European roadshow.

P.S. Your invoices are already paid for. It’s time they started paying you back.

Schedule Your Free Assessment Now 👇🏻