How a Chicago Nurse Turned $4,000/Month Into $12,800 in Business Class Flights

Sara M., a 31-year-old nurse in Chicago, traded 12-hour shifts for lie-flat seats—flying round-trip to Bangkok on ANA and gliding home from Paris in Air France business class. Her secret? Smart points hacking. Her total out-of-pocket cost for the luxe travel: just $320.

If you only had 60 seconds to read this article 🔗✨ (Click here)

Sara M.’s $320 upgrade to $12.8 K of business-class travel isn’t magic—it’s a case study in conversion efficiency, ecosystem arbitrage, and behavioral automation:

- Conversion Efficiency – She funneled every dollar of fixed spend into cards whose points transfer (Amex MR, Chase UR, Bilt) rather than lock her into a single airline. Transferability is the currency-killer feature: 100 K MR → ANA = 95,000 Round Trip Asia biz (4–6 cpp), vs. 1 cpp cash back. Most households unknowingly accept a 75–85 % haircut by redeeming the “easy” way.

- Ecosystem Arbitrage – Cards are simply faucets; the pipes matter more. Sara pairs ANA’s distance-based chart (ultra-cheap long-haul) with Flying Blue’s promo pricing (cheap West-bound legs) and Hyatt’s low-tier Asia footprint. Each program has a sweet-spot the issuer hasn’t priced in. The insight: Treat loyalty charts like foreign-exchange tables—move points where the purchase power is highest today, not where you collect them.

- Behavioral Automation – Her tech stack (Seats.Aero alerts, AwardWallet counters, Calendar reminders for 30 % transfer bonuses) externalizes discipline. Humans break budgets; software doesn’t. Automation rescues the strategy from “too busy” fatigue that sinks most earn-and-burn plans.

- Risk Mitigation – She keeps annual fees under $400, offsets them with dining/hotel credits, and always carries a cash-equivalent emergency fund. Points are not assets; they’re vouchers—liable to overnight devaluations. Her rule: hold only what she’ll redeem within 12 months.

- Scalability – The model back-tests on $3–6K monthly spend and 670+ credit scores. Income merely determines velocity, not viability. The real moat is knowledge and timing.

TL;DR: Redirect routine expenses, exploit partner sweet-spots, automate the grind, de-risk with tight redemption windows—luxury travel follows as a mathematical certainty, not a lifestyle fluke.

Everything else you need to know is just below 👇🏻

Introduction: Why Ordinary Spend Can Unlock Extraordinary Travel

Sara is not a Wall Street banker or a Silicon Valley founder—she’s a 31-year-old registered nurse in Chicago with a rotating schedule, a love-hate relationship with 12-hour shifts, and a modest salary that has to stretch across rent, groceries, and the occasional night out. In other words, she looks a lot like the rest of us.

Yet in a single year she catapulted herself from cramped economy cabins to champagne-poured business-class pods, flying round-trip to Bangkok on ANA and gliding home from Paris in Air France’s lie-flat seats. Her total out-of-pocket cost? $320.

This is not a story about loopholes that will vanish tomorrow or six-figure spending that 90 percent of households can’t replicate. It’s a story of strategy—of funneling dollars you already spend into the right reward ecosystems, of setting concrete goals before you ever fill out a card application, and of letting modern tech do the tedious tracking for you.

By the end of this guide you’ll know exactly how Sara structured her finances, why her approach works for budgets as low as $3–6K per month, and how you can duplicate—and customize—her playbook for your own dream itinerary.

Before the Breakthrough: Life on Autopilot

For years Sara treated money the way many busy professionals do: auto-pay the bills, swipe the debit card at Whole Foods, and assume that fancy rewards programs were designed for frequent-flyer elites and corporate rainmakers. She had one “travel” credit card—the Chase Sapphire Preferred (CSP)—but never scratched the surface of its potential.

Like millions of cardholders, she would occasionally log in, shrug at the 40 000 Ultimate Rewards sitting there, and cash out a $400 Amazon gift card. Useful? Sure. Optimized? Not even close.

The TikTok Spark: A Two-Minute Video That Changed Everything

One rainy Sunday Sara fell into the infinite scroll of TikTok and landed on a live Q&A where a creator mapped out how a single grocery card plus a rent rewards card could net a round-trip business class ticket every 12–15 months. The demo looked almost too good to be true—but the math checked out.

The key insight: You don’t earn premium travel through extraordinary spending; you earn it through ordinary spending placed on the right tracks, multiplied by the right categories, and redeemed through the right partners.

That night she grabbed a notepad and began reverse-engineering her own spending:

- Rent: $1,600

- Groceries: ≈ $600

- Dining/Takeout: ≈ $500

- Travel/Transit: ≈ $400

- Utilities & Subscriptions: ≈ $300

- General Shopping: ≈ $600

Total: ≈ $4,000 per month.

Building a Smarter Spending & Points Earning System

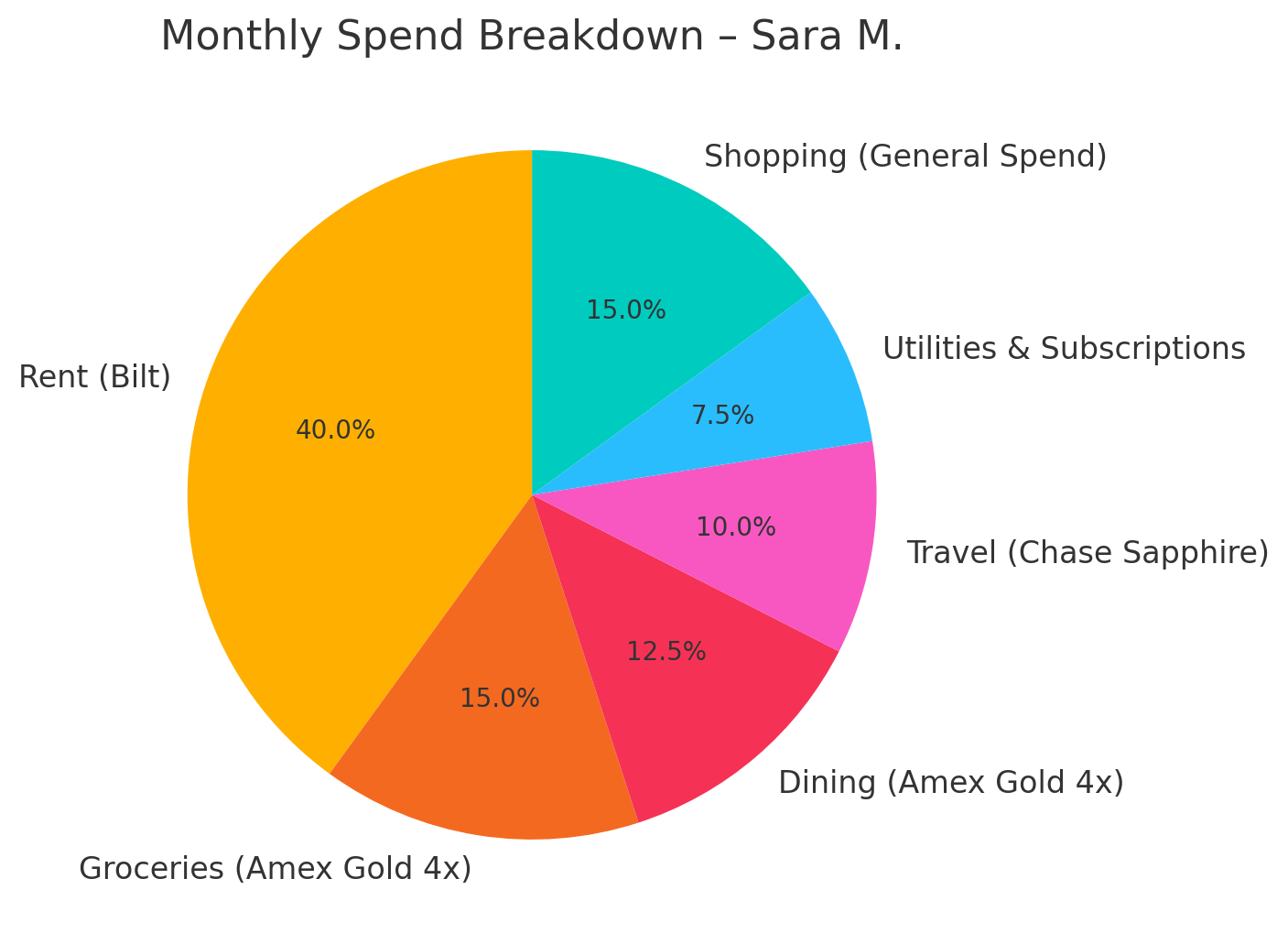

Mapping Her Monthly Spend

First, Sara assigned each dollar to a category with a clear points multiplier. She didn’t chase “magic” new expenses; she simply redirected existing ones.

- Rent → Bilt Mastercard (1× points, no fee for rent payments).

- Groceries & Dining → Amex Gold (4× points).

- Travel & Transit → Chase Sapphire Preferred (2× points).

- Everything Else → Whichever of the above earned at least 1× with the strongest ecosystem value.

| Category | Monthly Spend | Points Multiplier | Points Earned |

|---|---|---|---|

| Rent (Bilt) | $1,600 | 1× | 1,600 |

| Groceries (Amex Gold) | $600 | 4× | 2,400 |

| Dining (Amex Gold) | $500 | 4× | 2,000 |

| Travel (Chase Sapphire) | $400 | 2× | 800 |

| Utilities & Subscriptions | $300 | 1× | 300 |

| General Shopping | $600 | 1× | 600 |

| Total | $4,000 | 7,700 pts |

The Multiplier Magic

With that alignment, her $4,000 in monthly expenses began generating ≈ 7,700 transferable points, or ≈ 92,400 points per year—before factoring in sign-up bonuses, retention offers, or occasional transfer bonuses. That alone was enough for a one-way business-class redemption to Asia or Europe.

From Scattered Points to Focused Goals

The 1-Cent-Per-Point Trap

Sara’s biggest early mistake—and one many beginners share—was redeeming at a flat 1 cpp (cent per point): gift cards, Pay Yourself Back, or Expedia’s portal. Those redemptions work in a pinch, but they squander the 2–6 cpp potential embedded in airline and hotel transfer partners.

Calculating True Redemption Value

A Delta One seat Chicago → Paris regularly prices at $2,500–$3,000. Via Virgin Atlantic’s partnership with Delta, off-peak awards can run 50,000–55,000 points. That single transaction yields ≈ 5 cpp of value—five times what a statement credit would provide. Multiply that margin across two or three long-haul trips per year, and you unlock thousands of dollars of “free” luxury.

The Card Combo That Changed Everything

Amex Gold – The Culinary Cash Cow

- 4× Membership Rewards at U.S. supermarkets (up to $25K per year) and on worldwide dining.

- 25+ airline partners, including ANA, Singapore KrisFlyer, and Virgin Atlantic.

- Monthly dining credits and an annual hotel credit that can offset most of the $250 annual fee.

Bilt Mastercard – Turning Rent into Rewards

- 1× points on rent (up to 100,000 points per year).

- 3× on dining every “Rent Day” (the 1st of the month).

- Built-in transfer partners like American Airlines and World of Hyatt—rare for a $0-fee card.

- No third-party processing fees, protecting both tenant and landlord from penalties.

Chase Sapphire Preferred – The Flexible Fighter

- 2× Ultimate Rewards on travel (everything from Uber to airfare).

- 3× on dining since the 2024 refresh.

- 25% redemption bonus in the Chase portal or 1:1 transfers to United, Air Canada Aeroplan, Hyatt, and more.

- Modest $95 annual fee, often waived in year one.

Together, these three cards blanket nearly every household expense category while keeping annual fees manageable ($345 net, since Bilt is free and Amex credits offset much of its fee).

Engineering the Dream Redemption

Booking ANA Business Class to Bangkok

Sara’s first target was Thailand during shoulder season—cheap on the ground, but pricey in the air. Booking directly with ANA Mileage Club yields a jaw-dropping 95,000 miles round-trip in business class between the U.S. & Asia. Because ANA is an Amex partner, Sara funneled a full year’s Membership Rewards plus a 30% transfer bonus (it happens 1–2 times per year) to reach the 95K mark faster.

Leveraging Flying Blue Promo Rewards

Instead of returning on ANA, Sara used an “open-jaw” ticket: fly SFO → BKK on ANA, but return CDG → ORD on Air France. Flying Blue’s monthly Promo Rewards frequently slash 20–50% off select routes. One lucky February, Chicago appeared at 25% off—pricing business class at 55,000 Flying Blue miles plus modest surcharges.

Chase Ultimate Rewards transfer 1:1 to Flying Blue, so Sara drained 55K points from her CSP stash. She paid roughly $320 in fuel surcharges across both tickets, versus $12,800 retail.

Mixing and Matching One-Ways for Maximum Flexibility

Flying “A to B” on one carrier and “B to C” on another isn’t just a luxury trick; it:

- Doubles seat availability. If ANA isn’t open on your preferred return date, another alliance might be.

- Lets you build stopovers. Sara spent 48 hours in Paris, essentially scoring a free Euro-trip.

- Optimizes partner sweet spots. Each program has distance-based bands. A one-way may slot into a cheaper band than the full round-trip.

The Tech Stack: Dashboards, Alerts, and Automation

Sara did not spend nights refreshing ExpertFlyer. She employed:

- Award-availability alerts (PointsYeah, Seats.Aero) for ANA business seats out of West Coast hubs.

- Transfer-bonus trackers (like AwardWallet’s blog notifications).

- A simple Google Sheet that auto-pulled balances via API so she knew, down to the day, when she’d hit 95K + 55K points.

Automation meant she could ignore minutiae until her phone pinged “Transfer bonus live!” or “ANA seat 355 days out—book now!”

The Luxury Surprise: More Than a Seat Upgrade

Walking onto the ANA 777, Sara expected a comfier seat. She did not expect:

- Pre-departure Krug in real glassware.

- PJs and an amenity kit rivaling five-star hotels.

- A seasonal kaiseki tasting menu that made her forget she was at 35 000 ft.

On arrival she redeemed 15,000 Chase points for two nights at a Category 4 Hyatt in Bangkok (avg. cash price $600 during peak). She even tapped 20,000 Amex points for a private Mercedes transfer—a splurge, yes, but still cheaper than paying cash.

Could You Replicate Sara’s Success?

If you can check three boxes, the answer is a resounding yes:

- Monthly spend ≥ $3,000–$6,000.

- Credit score 670 + (to qualify for mid-tier rewards cards).

- Willingness to plan 6–12 months ahead.

Remember, points are not a rich person’s game—they’re a strategic person’s game. A teacher earning $50K but channeling expenses through optimized cards can out-luxury a $200K earner who swipes a debit card.

Beyond the Flights: Hotels, Transfers, and Experiences

Many beginners blow the entire balance on premium cabins and forget ground costs. Yet Hyatt, Marriott, and Hilton all offer off-peak sweet spots:

- Hyatt Category 1 off-peak (3,500 pts): Southeast Asia and Turkey have Park Hyatt-level service for Holiday-Inn-level prices.

- Hilton fifth-night-free: Book five reward nights and pay four.

- Marriott 35K certificates: Great for an airport hotel the night before an early flight.

Use points where cash prices spike (luxury, peak season) and pay cash when airlines or hotels are running fire sales.

Next Horizons: Sakura Season in Japan

Targeted Redemptions

- JAL business class via Alaska Mileage Plan (only 60,000 miles West Coast → Tokyo).

- Park Hyatt Tokyo (35,000–45,000 Hyatt points per night, far below its $850 cash rate).

- A side-trip to Seoul booked via Virgin Atlantic’s partnership with Korean Air (economy awards often 12–15K).

By mapping these in advance, Sara can assign future expenses to the programs that feed each goal.

Mindset Shift: Earning Travel as a By-Product of Life

The pivotal change wasn’t a new card or a flashy transfer—it was seeing every swipe as a tiny deposit toward the next adventure. Groceries become museum days. Rent morphs into rooftop cocktails overlooking the Seine. Utility bills flow into cherry-blossom selfies.

Travel stops being a once-a-year splurge and starts feeling like an automatic dividend paid for living responsibly.

Getting Started: A Practical Playbook

1. Define the Destination First

Write exactly where, when, and how you want to travel—“Business class to Tokyo next April”—and reverse-engineer points needs.

2. Audit Your Spend

Pull three months of bank statements. Sort by category. Highlight recurring payments that can safely migrate to credit cards.

3. Pick 2–3 Core Cards

- A high-multiplier grocery/dining card (Amex Gold, Citi Premier, etc.).

- A flexible travel card (CSP, Capital One Venture X).

- Optional: a rent card (Bilt) if you’re a tenant.

4. Track Balances & Goals

Use a spreadsheet, AwardWallet, or a subscription-based dashboard. Automate alerts for:

- Partner transfer bonuses

- Award seat releases (355 days out for many carriers)

- Credit-card retention offers (call annually)

5. Redeem for Maximum Cents-Per-Point

Aim for ≥ 2 cpp on flights and ≥ 1.5 cpp on hotels. If the math falls short, pay cash and keep stacking points.

6. Rinse, Review, Refine

Every six months reassess: Did a multiplier change? Did a partner devalue its chart? Swap cards or strategies accordingly.

Final Thoughts: Your Everyday Life Is a Boarding Pass

Sara M.’s story proves that luxury travel isn’t gated behind six-figure salaries or an alphabet soup of elite statuses. It’s about disciplined channeling of existing spend, clarity in goal-setting, and the patience to let tech handle the heavy lifting.

The next time you tap your phone at the grocery checkout or schedule an auto-pay for rent, pause and picture the business-class cabin, the five-star suite, the late-night ramen joint in Shibuya that those dollars could unlock. Then make sure they’re flowing through the right points pipeline.

Because the only thing better than scrolling past someone else’s champagne-and-lie-flat TikTok is recording your own. Your boarding pass is already in your wallet—you just need to know how to swipe it.