BILT Handed You a Brick 🧱 —Now Let’s Build you the Penthouse 🏗️🏙️✨

Imagine turning your largest monthly expense—rent—into a gateway for travel, dining, and even student loan repayments. The BILT Mastercard, issued by Wells Fargo, offers this unique opportunity. More than just a credit card, it's a tool designed to transform routine payments into valuable rewards.

Rent is the check you write every month and then forget. The Bilt World Elite Mastercard issued by WellsFargo flips that script. Each dollar of rent becomes a brick in a skyscraper of travel, status and long-term wealth. This guide is your construction manual—six floors, seven ProTips, zero fluff.

The Problem: Rent That Builds Nothing

Most people treat rent like a sunk cost. They pay by ACH or check, collect a polite “thank you,” and walk away with nothing but a lighter wallet. That’s the equivalent of stacking bricks on an empty lot and leaving them in the rain.

With Bilt, every rent dollar can become a reward point—up to 100,000 points per year—with no transaction fee for your landlord and no annual fee for you. But bricks scattered on the ground still aren’t a building. You need a plan.

The Blueprint: Know Your Materials

Bilt Points—A Flexible, Tier-One Currency

Bilt points transfer 1:1 to a wide roster of airline and hotel partners (see Floor 4), can wipe out student loans, can book travel through the Bilt portal at 1.25 cents each, and can even fund a future down payment on a home. That puts them in the same league—some analysts argue a higher league—than Chase Ultimate Rewards or Amex Membership Rewards.

Earning Rates (the Load-Bearing Walls)

| Purchase Type | Normal Day | Rent Day (1st of the month*) |

|---|---|---|

| Dining | 3× | 6× |

| Travel | 2× | 4× |

| Other spend | 1× | 2× (up to 1 k bonus pts) |

| Rent | 1× (to 100 k/yr) | 1× |

*Activate Rent Day in-app; must make 5 transactions per statement cycle to earn points.

Floor 1: Turn Monthly Rent Into Rapid Capital

How It Works

- Enter your landlord’s details in the Bilt app.

- If the property accepts cards, Bilt pays them directly.

- If not, Bilt mails a check—still counts as a card transaction for you.

That means studio apartment or walk-up sublease, you’re earning rewards without the 3% processing fee typical of other cards.

Schedule rent on autopay but set a calendar alert for the 28th of each month. Check your statement for five posted transactions. If you’re short, buy a morning coffee or an online micro-purchase to lock in point eligibility before the cycle closes.

Floor 2: Stack Status and Side Perks

Insurance & Protections

- Cell-phone protection up to $800 when you pay your bill with the card.

- Trip delay/cancellation coverage on eligible travel.

- Primary rental-car CDW when you use Bilt for the reservation.

Lifestyle Tie-Ins

- Up to 5× points on Lyft rides when you link Bilt to Lyft Rewards.

- Rotating fitness studio credits through partners like SoulCycle and Rumble.

- DoorDash DashPass trial plus quarterly dining credits (targeted).

Charge a delayed flight on Bilt to trigger trip-delay coverage. File the claim for cash, then also request compensation or miles from the airline. Two payouts, one headache.

Floor 3: Master Rent Day Like a Maestro

On the first of each month Bilt flips the rewards dial to ludicrous speed—6× dining, 4× travel, 2× everything else (rent still 1×). Plan large expenses—yearly insurance premiums, quarterly tax estimates, even gift-card reselling—around that 24-hour window.

Rent Day also delivers rotating extras: status challenges with Hyatt, concert ticket drops, or 150-point trivia bonuses inside the Bilt app. These micro-earnings compound faster than you think.

When the month has 31 days, the 1st falls five weeks after the prior 1st. Push discretionary purchases from the 30th/31st onto Rent Day to milk an extra statement’s worth of bonus points each year.

Floor 4: Transfer Partners—The Elevator Shafts to the Sky

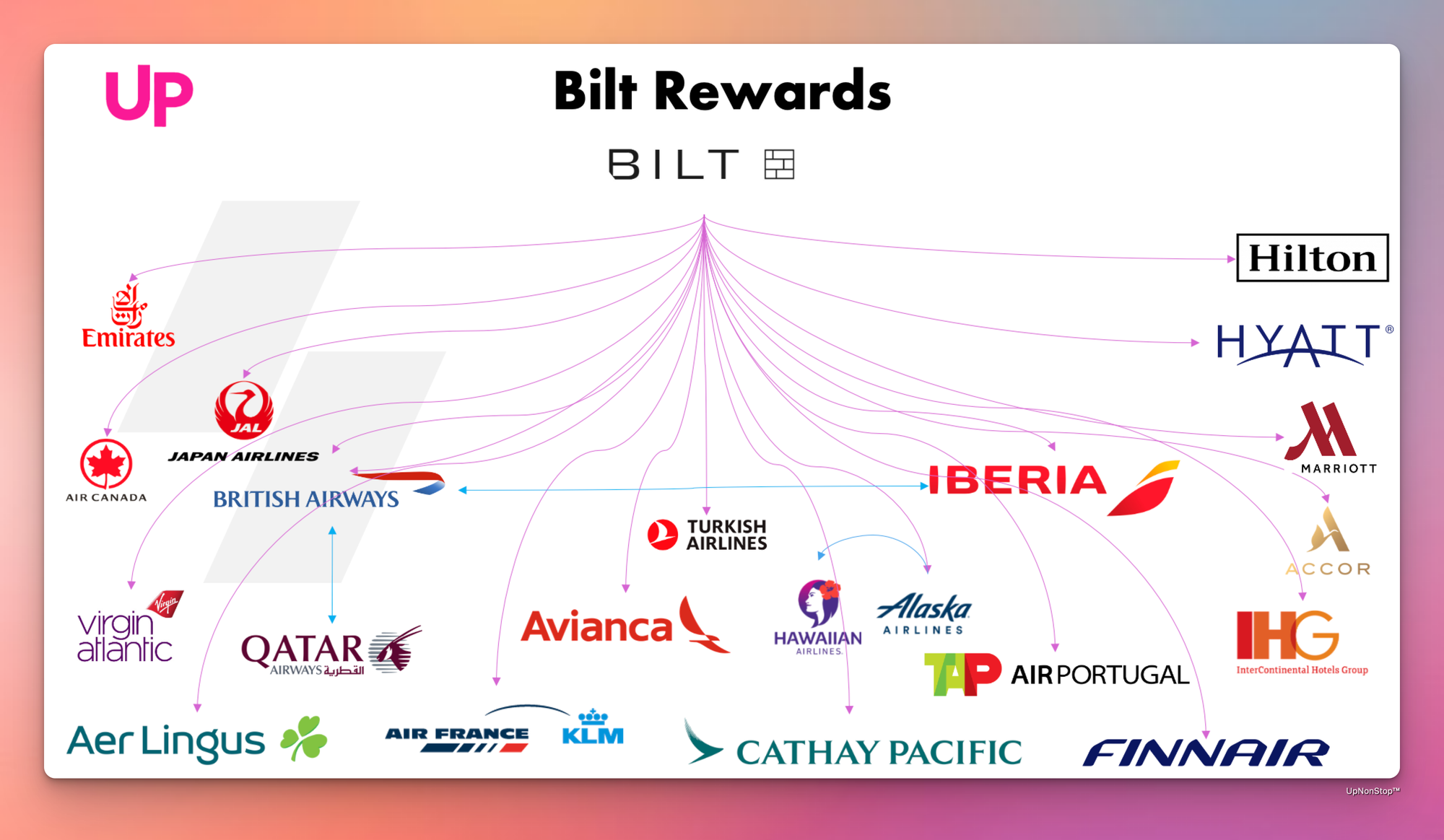

As of spring 2025 Bilt points move 1:1 to 13 airlines and 5 hotel chains:

Airlines

Alaska Mileage Plan, Avianca LifeMiles, United MileagePlus, Air France–KLM Flying Blue, Virgin Red, Emirates Skywards, British Airways Avios, Cathay Pacific Asia Miles, Turkish Miles&Smiles, Aer Lingus AerClub, Iberia Plus, Air Canada Aeroplan, TAP Miles&Go, Southwest Rapid Rewards.

Hotels

World of Hyatt, IHG One Rewards, Marriott Bonvoy, Hilton Honors, Accor Live Limitless (3:2).

Sweet-Spot Examples

- 120 k points → World of Hyatt Category 7 five-night stay valued at $4,000.

- 90 k points → Cathay Pacific business class JFK–HKG one-way ($6,500 cash).

- 7.5 k points → British Airways Avios intra-Europe economy hop that would cost $250.

All transfers are one-way. Always search award space on partners like Aeroplan or ExpertFlyer before moving your bricks; the cement sets instantly.

Floor 5: Build a Travel Calendar Six Months Out

Award availability is a game of timing. Most airlines load schedules 330–355 days in advance; premium cabins vanish quickly. Sketch the coming year—weddings, conferences, peak-season breaks—then back-date your booking reminders:

- 11 months out: Set alerts for transoceanic business class.

- 6 months out: Lock in Hyatt or Marriott resorts before cash rates soar.

- 2 months out: Use Bilt portal cash+points for domestic hops you can’t cover with transfers.

Spreadsheet it, share with travel companions, and treat points like a budget category, not a surprise windfall.

If the seat or suite isn’t available, join the waitlist, then tweet the airline or hotel politely. Agents often open up award space for engaged elite-status customers—especially if you reference a confirmation of flexible travel dates.

Floor 6: Mix Cash and Points for Maximum ROI

Bilt’s portal prices travel at 1.25 cents per point. That’s solid for cheap domestic fares or mid-tier hotel nights where transfer partners don’t provide leverage. Meanwhile, keep points for redemptions that top 2 cents per point—international premium cabins, aspirational resorts, or last-minute deals with LifeMiles.

Think like an investor: cash is bonds, points are options. You wouldn’t exercise every option; don’t redeem every flight.

Treat your monthly rent points as a laddered bond coupon. Allocate 50% to near-term travel goals, 30% to a strategic “dream trip” in two years, and 20% toward Bilt’s down-payment feature. Burn and earn simultaneously to dodge devaluations.

Penthouse Level: From Apartment Renter to Mileage Mogul

Let’s crunch a realistic scenario:

- Rent: $2,400/mo → 28,800 points/yr

- Dining: $800/mo → 28,800 (3×)

- Travel + rideshares: $600/mo → 14,400 (2×)

- Other spend: $1,200/mo → 14,400 (1×)

Add Rent Day doubles (~9,600 bonus points) and Lyft promos (≈4,000), and you’re at 100,000+ points with zero annual fee. Redeemed at a conservative 1.8 cpp, that’s $1,800—enough for two round-trip business-class tickets to Europe every year.

Bilt lets you commit points toward a future down payment at 1.5 cents each. Combine three years of disciplined earning (≈300,000 points) with a healthy cash reserve and you have $4,500 shaved off closing costs—effectively turning rent into equity.

Final Thoughts: Stop Paying Rent, Start Building

A brick alone is inert. Thousands, aligned with a blueprint, become a penthouse view. The Bilt Mastercard hands you a pallet of bricks every single month. Centralize your spend, exploit Rent Day, ride the elevator of transfer partners, and ladder your redemptions with the precision of an architect.

Your rent isn’t an expense. It’s raw material. Build something extraordinary.

If you’re looking to apply for the BILT Mastercard and want to support our work, consider using our affiliate link below 👇🏻