Citi "ThankYou" in Q4-2025: When "Strata" Tries to Reforge Loyalty

Citi didn’t just rename a rewards card in 2025. It relaunched an entire worldview: "ThankYou" points are no longer a backwater alternative to Chase or Amex. With the Strata family, it’s trying to make its points behave like a modern currency - flexible, timed, and fiercely contested.

If You Only Had 60 Seconds to Read This Article

| Click Here 🤏🏻

For years, Citi’s points were polite, predictable, and painfully under-optimized. Then came 2025 - and the Strata cards. The bank that once lagged behind Chase and Amex quietly rebuilt its engine, turning ThankYou points from a passive rebate system into a liquidity network for people who treat their spending like a portfolio.

Citi’s 2025 relaunch of its rewards ecosystem under the Strata banner was more than cosmetic. It unified the lineup, re-tuned the ThankYou points engine, and introduced a modern architecture for earning, redeeming, and moving points.

Welcome to Q4-2025: Citi’s currency behaves less like a coupon book and more like capital. The old world of flat multipliers and sleepy partners is gone. In its place: high-octane portal bonuses, calibrated category weighting, and a refined transfer roster built for yield, not noise.

The Strata Premier and Elite cards have turned ThankYou into a dual-core system: one bank for stability, one for speculation. Your cash-equivalent portal bookings keep your travel life frictionless; your speculative bank of transferable points sits ready for the right opening - an Emirates first-class window, an off-peak Asia fare, or a hotel partner that finally justifies its math.

In this market, liquidity wins. You don’t worship points. You rotate them, protect them, and treat them like any other volatile asset. That’s the new ThankYou - an operator’s currency in a world where timing, not loyalty, determines value.

Everything else you need to know is just below 👇🏻

🎞️: Powered by NotebookLM @ UpNonStop

Part 1: The Reinvention of Citi's ThankYou Points

Citi’s biggest move of 2025 wasn’t a bonus category or a splashy commercial. It was an identity swap. The Rewards+, Prestige, and Premier families dissolved into a single line: Strata - simple on the surface, strategically layered beneath.

- Strata (no-fee): the entry layer, built for breadth - groceries, gas, transit, and digital services.

- Strata Premier ($95 / year): the core operator’s card - 5× on Citi Travel portal bookings, 3× on dining, 3× on groceries, and 1× baseline everywhere else.

- Strata Elite ($495 / year): the executive tier - airport lounge access, transfer bonuses, concierge perks, and periodic 10% redemption rebates when you play through the portal.

The point wasn’t to clone Chase Sapphire or Amex Platinum. It was to build a chassis that rewarded intentional behavior. Citi’s research showed that the most profitable customers weren’t the biggest spenders - they were the ones who actively managed their balances and chased asymmetry. So they built a system that rewarded motion, not inertia.

ThankYou 2025 is therefore not about points accumulation. It’s about choreography: earning where multipliers flow, parking where protection exists, and striking when redemption math turns favorable.

Part 2: The Two-Engine Model

Citi’s rebirth brought a structural clarity missing for a decade. In practice, you now manage two banks of ThankYou points inside one ecosystem.

- Your conservative bank: points you earn through the Citi Travel portal or flat categories - these are your liquid assets. They’re backed by predictable value, redeemable for cash or portal travel at fixed rates.

- Your speculative bank: points you earmark for transfer to partners - volatile, leveraged, capable of doubling their worth or erasing it if mis-timed.

The split matters because Citi finally built guardrails for both. Portal bookings through Citi Travel (now powered by Booking.com’s engine) routinely earn 5× and redeem at 1.25–1.5¢ per point, depending on card tier. It’s the stablecoin side of the house.

The speculative bank is where the art lives. Citi’s partner grid - retooled and pruned in 2025 - focuses on quality over quantity:

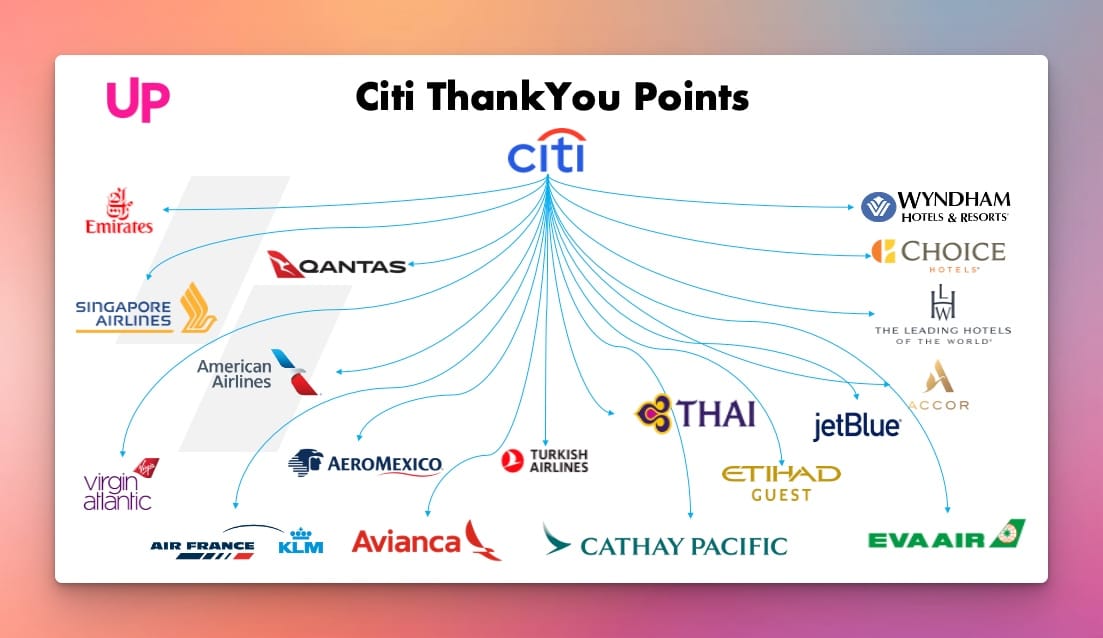

Emirates, Singapore, Turkish, Flying Blue, Virgin Atlantic, Qatar, and niche Asia-Pacific carriers on one side; Choice Privileges and Accor Live Limitless on the other. Each carries distinct leverage. The goal isn’t breadth - it’s calibrated reach.

The worst sin, Citi learned from Chase’s over-diversification, is redundancy. The best loyalty currency doesn’t have thirty partners - it has ten that matter.

Part 3: The Strata Multipliers and the Liquidity Ladder

The backbone of Citi’s earning power is now a laddered multiplier system that rewards behavior by sophistication.

1. Portal Loyalty

When you book flights, hotels, or rentals through Citi Travel, you’re effectively trading friction for yield. The portal runs on dynamic pricing but offers predictable earn rates - 5× on Premier, 10× on Elite. For high-volume travelers who value simplicity, it’s an alternative to chasing transfer inventory.

2. Category Precision

Citi kept the classics (3× on dining and groceries) but added modern life: EV charging, rideshare, digital subscriptions, and fitness memberships. Strata Elite layers an uncapped 3× on entertainment, creating a subtle nudge toward lifestyle spend that Amex once monopolized.

3. Tactical Bonuses

Quarterly challenges - hit $1,500 in travel spend, get 10,000 bonus points - are now standard. Citi learned from Bilt’s Rent Day: a calendar-driven dopamine loop sustains engagement better than passive multipliers.

Together, these tiers create a liquidity ladder: fast earn in the portal, steady drip in lifestyle categories, periodic bursts through bonuses. You’re never fully idle.

Part 4: Transfer Partners and the Speculative Game

Citi’s partner roster defines its speculative DNA. The banks learned that customers don’t need fifty alliances - they need optionality where scarcity lives.

A. Emirates Skywards: The Prestige Play

Citi remains one of the few currencies that still converts cleanly to Emirates. Business class DXB-Europe or U.S.–Dubai redemptions remain some of the last bookable luxuries under 100K points each way when timed correctly. Devaluations elsewhere have made this corridor one of the last bastions of aspirational efficiency.

B. Turkish Miles & Smiles: The Utility Engine

Despite quirks, Turkish remains Citi’s hidden gem. Domestic U.S. routes on United metal at fixed 7.5K each way or Europe redemptions around 45K in business make it the workhorse for those who plan precisely.

C. Flying Blue and Virgin Atlantic: The Volatility Twins

These dynamic programs swing between brilliance and absurdity. But Citi’s periodic 25–30% transfer bonuses in 2025 make them worth monitoring. When paired with Elite’s quarterly transfer rebates, they can outperform Chase transfers on raw yield.

D. Hotels: Choice & Accor

Citi’s 2025 hotel play isn’t luxury - it’s arbitrage. Choice’s partnership with Preferred Hotels and Accor’s frequent flash sales mean that a carefully timed redemption can hit 1.4–1.8¢ effective value, rivaling Hyatt’s economics.

The through-line: timing beats loyalty. Citi’s greatest gift in 2025 is volatility itself. Every partner’s pricing rhythm is slightly off from the others, creating windows of misalignment. If you can read those windows, you can mint margin.

Part 5: The Portal Illusion (and Its Truth)

Every program has its mirage. For Chase, it’s the belief that the portal is a safety net. For Citi, it’s the myth that the portal is punishment.

The truth sits in between. The Citi Travel portal in Q4-2025 is effectively a live marketplace, not a static catalogue. It runs on Booking.com’s inventory feed with Citi-specific overrides for bonuses, cash-back offers, and rebate cycles. That means prices mirror public rates, but the earn-and-burn math can swing your ROI by 30–40%.

The rule is simple: price every major booking twice - once through the portal, once through a transfer partner. If the delta after taxes is under 10%, use the portal and bank the liquidity. If it’s above 20%, pivot to a partner. Between 10–20%, evaluate time vs. flexibility.

This “10–20 rule” is becoming gospel among seasoned Citi users. It transforms the portal from a trap into a quote engine. You’re not pledging allegiance - you’re running arbitrage in real time.

Part 6: The Strata Playbooks

Citi’s ecosystem works best when you match strategy to temperament. Here are four archetypes - each valid, each demanding different discipline.

The Portfolio Pilot

You treat ThankYou points as an asset class. You split your balance 60/40 between portal and transfer banks, redeem quarterly, and chase the best risk-adjusted yield. You care about cents-per-point averages and maintain spreadsheets. Your goal: 1.6¢ blended value across 12 months.

The Weekend Industrialist

You’re chasing leisure arbitrage - short-haul premium flights, mid-tier hotels, entertainment redemptions. Your world revolves around quick cash rates and portal bonuses. You’ll book a concert trip through Citi Travel at 1.3¢ value and never feel guilt. You trade liquidity for simplicity.

The Long-Haul Hunter

You watch partner calendars like a day trader watches earnings reports. When Turkish or Flying Blue release premium space, you strike. You transfer only when availability is live and never mourn missed windows. Your ROI swings wildly - but you play for the outliers.

The Hybrid Entrepreneur

You mix client travel and personal trips. Portal for reimbursable work bookings (easy expensing, 5× earn), partners for family vacations. You see Citi’s portal not as a convenience but as a hedge against corporate unpredictability.

All four paths work because Citi built elasticity into its program. The architecture rewards management, not mythology.

Part 7: Mistakes That Still Kill Value

The new ThankYou points are efficient but unforgiving. The same volatility that creates opportunity also amplifies mistakes.

Mistake 1: Hoarding for Ego

A giant balance feels safe but bleeds quietly. Airline charts devalue; portals adjust; partners vanish. If your balance isn’t moving, it’s losing. Set a redemption cadence - quarterly, semi-annual, whatever - just move it.

Mistake 2: Ignoring the Calendar

Citi’s bonuses follow a rhythm. Transfer events often drop around Rent Day competitors or end-of-quarter campaigns. Missing one can cost 20–30% in yield. Build alerts, or at least skim the monthly Strata email - they’re coded clues.

Mistake 3: Mispricing the Portal

Too many users assume “portal = fixed rate = bad.” That’s outdated. Elite-tier users with 10% redemption rebates and 1.5¢ valuations can beat many transfer redemptions. Learn the math; stop acting on 2018 wisdom.

Mistake 4: Category Drift

Forgetting where your multipliers live is silent sabotage. If your grocery spend isn’t on Premier or your travel on Elite, you’re lighting margin on fire. The Strata ladder rewards precision, not volume.

Mistake 5: Over-optimizing for Cents

Chasing the highest numerical value at the cost of sanity is the oldest trap in the game. A 2.4¢ redemption that burns three nights of sleep is negative yield. Value is outcome aligned with intention, not decimals.

Part 8: Top 5 Tactical ProTips

Start from your biggest planned redemption - summer Europe, Asia holiday, annual conference. Work backward six months. Earn strategically in the categories that align with that target. The path defines the spend, not the reverse.

When you find award space, you have three days to act. If it doesn’t align, stand down. Chasing phantom seats leads to stranded points.

Set a personal minimum value - say, 1.25¢. If an option falls below that, pay cash and keep your points liquid. The discipline alone raises long-term ROI.

The 2025 portal is a dynamic market. If the difference versus public fare is minimal, use it. The 5× earn plus 10% redemption rebate on Elite can turn a “lazy” redemption into a professional one.

Every 90 days, evaluate your balance split between conservative and speculative banks. If one exceeds 70%, rebalance by spending or transferring. Hoarding is a liquidity risk.

Part 9: The Case Studies

Case Study 1: The Strategic Spender

A Los Angeles consultant funnels $4,000 monthly through Strata Premier - groceries, dining, portal travel. Over nine months, she accrues 120,000+ points.

In October’s 25% Flying Blue transfer bonus, she converts 100K for two business-class seats LAX-AMS, normally $3,800 each.

Her effective return: 3.8¢ per point. Her secret? Treating Strata like a side fund - steady inflow, surgical outflow.

Case Study 2: The Liquidity Minimalist

A Long Island (NY) tech founder started using the Strata Elite solely for travel spend - roughly $50K annually.

Instead of hoarding, he redeems quarterly via Citi Travel at 1.5¢ per point with a 10% rebate.

His ROI stabilizes at 1.65¢, consistent, frictionless, time-efficient. For him, predictability beats thrill. Citi built the portal exactly for this temperament.

Part 10: The Verdict | Citi’s Long Game

Citi spent a decade lagging behind Chase’s polish and Amex’s prestige. The Strata overhaul changed that equation. By late 2025, Citi’s ThankYou ecosystem feels less like an underdog and more like a platform.

Its true product isn’t points - it’s control. Portal or partner, conservative or speculative, Strata lets you choose your battlefield. It rewards awareness, timing, and decisiveness - traits of an operator, not a hobbyist.

The irony: Citi’s greatest strength in 2025 is humility. It didn’t reinvent loyalty; it re-engineered discipline. By building a currency that demands intention, Citi forced its users to evolve - or be left behind.

Think of ThankYou points as the stealth currency of this cycle: quieter than Chase, humbler than Amex, but sharper in its calibration. It’s the points equivalent of a precision instrument - best in the hands of those who know exactly what they’re doing.

The loyalty wars will rage on - Amex selling aspiration, Chase selling liquidity, Bilt selling belonging. But Citi? Citi is selling mastery. And mastery, in Q4 2025, might just be the rarest reward of all.