From 1.5% Cash Back to a 37.64% Return / Or: How Every Dollar Became a Lever

Most business owners think they’re maximizing rewards with a cash-back card • They aren’t • Here’s a concrete example of how simple strategic moves can multiply your return without increasing spend

If You Only Had 60 Seconds to Read This Article (Click Here🤏🏻)

Flat cash-back cards feel safe, but 1.5% on everyday business spend is leaving tens of thousands on the table. For a business spending $15k -$20k per month, that’s just $2,700 - $3,600 a year... far below the potential return if spend were optimized. Points, not cash back, turn operational dollars into leverage.

By upgrading to flexible points (Capital One Venture X Business, Chase Ink, and Amex Gold for Business) the effective earn rate jumped to 3.62%. Same vendors, same invoices, zero extra effort. Everyday business spend now works harder, generating points that can be redeemed strategically instead of static cash.

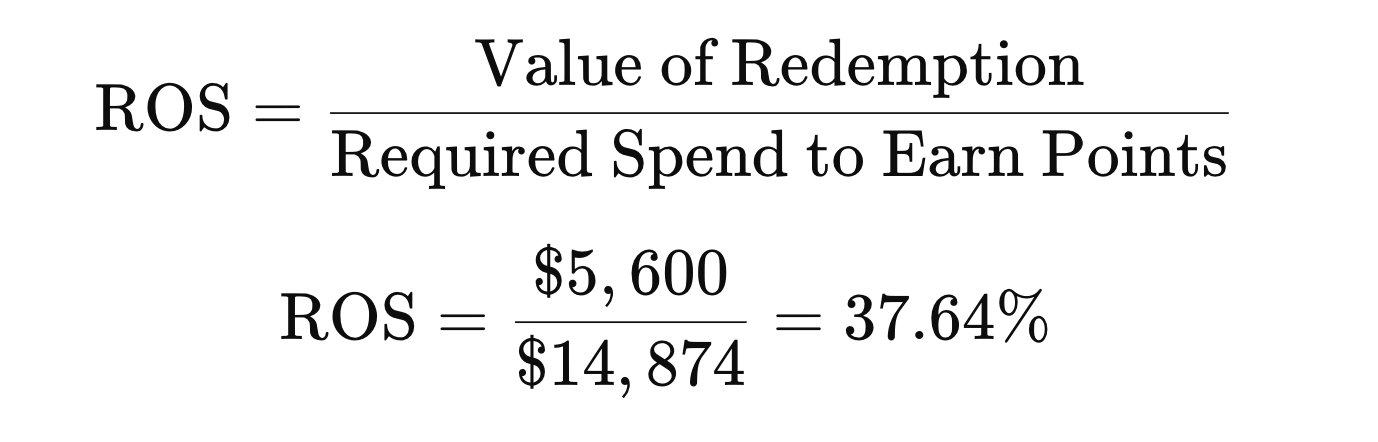

Strategic redemption is where the real value compounds. A $5,600 Virgin Atlantic business-class flight was booked for 53,846 points using a 30% transfer bonus, which required $14,874 in spend to earn - compared to $373,000 in spend needed at 1.5% cash back.

That’s a 37.64% return on spend, demonstrating how points, timing, and transfer bonuses multiply value.

This approach scales across any business with predictable spend. Optimizing earn, redeeming strategically, and leveraging transfer bonuses turns operational spend into a measurable profit center. Flat cash back leaves money on the table. Flexible points with a smart strategy convert routine spend into high-value returns - without spending a single extra dollar.

🎞️: Powered by NotebookLM @ UpNonStop

The Flat Cash-Back Trap

The starting point: Amex Plum Card at 1.5% cash back.

On paper, it looks fine: 1.5% on every dollar spent. Safe. Predictable. No fuss.

Reality check:

- Monthly spend: ~$15,000-$20,000.

- Annual spend: ~$180,000-$240,000.

- Return at 1.5%: $2,700-$3,600 per year.

Not nothing, but for businesses that move large sums, this is negligible. At scale, 1.5% cash back leaves tens of thousands on the table - money that could be leveraged to fund premium travel, upgrades, and luxury perks.

Cash back is static. Points are leverage. That’s the difference.

Step 1: Optimizing the Earn Rate

The first step was upgrading the earning potential without changing business operations.

- Swap the flat 1.5% cash-back card for 2% Capital One Venture X Business for flexible points.

- Complement with a Chase Ink card to maximize the business uqniue bonus categories.

- Update an Amex Gold for Business for Top-Category 4x points earn.

Result: effective 3.62% earn rate on all business spend.

This wasn't incremental. It was more than double the return of the Plum card. And it’s earned on the same invoices, same vendors, same operational spend - no extra payments, no extra tracking.

At this point, the business everyday spend was already working harder. Each dollar now contributes toward points that can be redeemed for high-value travel - rather than a fraction of cash.

Step 2: Redeeming Strategically

Earn rates are only valuable if points are redeemed efficiently. That’s where most businesses fail. Points sit idle. Or they’re redeemed for low-value options like gift cards, hotel nights at inflated rates, or minor airline tickets.

UpNonStop focuses on maximizing point value through smart airline redemptions and transfer bonuses. Here’s how it worked in this example:

- Goal: $5,600 Virgin Atlantic business-class ticket.

- Strategy: Transfer Capital One points to Virgin Atlantic during a 30% transfer bonus.

- Points required: 53,846 Virgin Atlantic miles, equivalent to 41,420 Capital One points pre-bonus.

Step 3: Calculating Effective Spend

At a 3.62% earn rate, the spend required to generate 41,420 points was $14,874.

Compare that to the old setup:

- 1.5% cash back to “buy” the same $5,600 ticket: $373,000 in spend required.

Same result. Vastly different efficiency.

- Old method: $373,000 → $5,600 → 1.5% return

- Optimized method: $14,874 → $5,600 → 37.64% return

This is the kind of leverage that changes the way a business views spend.

Step 4: Understanding the Math

Return on Spend (ROS) is the metric that matters:

That’s not marketing fluff. That’s real-world, verifiable ROI.

Here’s why it works:

- Flexible Points: Capital One points can transfer to multiple airline partners. Flexibility unlocks the sweet spots.

- Transfer Bonuses: A 30% bonus increases effective point value instantly. Timing is everything.

- Earn Optimization: Smart card and spend combinations increase effective return to 3-4% on routine spend.

Every operational dollar becomes a lever for high-value redemptions.

Step 5: Why Most Businesses Fail

Most Business owners stick to flat cash-back cards for three reasons:

- Simplicity over optimization: One card feels easier than managing multiple cards and transfers.

- Fear of complexity: Transfers, award charts, and promotions seem intimidating.

- Lack of strategy: Businesses don’t track effective return on spend; they track statements.

The result: leaving tens of thousands, sometimes hundreds of thousands, on the table each year.

With the same effort, point strategy compounds exponentially versus flat cash back.

Scaling the Approach

This isn’t a one-off. Any business with predictable spend can apply the same approach:

- We optimize earn by pairing the right cards with the right categories.

- We redeem points strategically, focusing on transfer partners and high-value redemptions.

- We leverage transfer bonuses whenever available.

Example applications:

| Business Spend | Old Cash Back | Effective Upgrade |

|---|---|---|

| $150,000 | $2,250 | $5,600 flight booked for $14,874 spend |

| $200,000 | $3,000 | Multiple international tickets |

| $500,000 | $7,500 | Premium cabins, first-class stays, hotel packages |

At scale, ROI multiplies quickly. What was a minor cash-back trick becomes a strategic revenue lever.

Beyond Airline Tickets

Points aren’t just for flights. Flexible points can also fund:

- Premium hotel stays at global chains

- Business-class upgrades for clients or executives

- Experiential travel for incentive programs or team retreats

The key is aligning earn strategy with redemption opportunities. Points should amplify business spend, not sit idle.

Final Thoughts

Flat cash-back cards feel safe. But for any business serious about efficiency and return, flexible points with strategic redemption is the only way to scale rewards.

- 1.5% cash back → 3.62% earn rate

- $14,874 spend → $5,600 flight

- 37.64% return on spend

The difference is not incremental. It’s game-changing.

Business owners often assume “good enough” is enough. It isn’t. Spend optimization plus points strategy creates measurable, high-value returns - without adding a single dollar of new spend.

That’s the UpNonStop approach.

- Focus on the earn side first: optimize every dollar of operational spend.

- Redeem strategically: transfers, bonuses, and award charts are tools, not hurdles.

- Measure return on spend, not points accumulated.

When done correctly, business spend stops being a cost center and becomes a profit center in disguise.

Flat cash back leaves money on the table. UpNonStop turns spend into leverage, instantly.

When you're ready to Maximize Your Business Spending

Get Started with a Free Earn-Optimization Assessment

Find out how much you could be earning and saving with UpNonStop.

Schedule your free assessment today to learn how we turn business spending into premium travel with better value, and more time for what matters most.

Schedule Your Free Assessment Now 👇🏻